By Maureen Farrell, Aaron Kuriloff and Don Clark

A sharp dive in technology shares underscored investor worries

about uneven U.S. economic growth, as the latest lackluster

corporate outlook, this time from LinkedIn Corp., fueled a rush out

of stocks.

In the most jarring example of investor unease, LinkedIn's

shares tumbled 44% on Friday following a disappointing earnings

forecast. A weak reading on jobs growth added to the woes, helping

to push down the Dow Jones Industrial Average 211.61 points, or

1.3%, to 16204.97.

The tech-oriented Nasdaq Composite Index dropped 3.2% on its way

to a 5.4% drop for the week. The tech sector has been an investor

favorite in recent years, reflecting the strong growth and

popularity of big firms such as Facebook Inc., Amazon.com Inc.,

Netflix Inc. and Google parent Alphabet Inc.

But those firms all slumped at least 3% Friday, after LinkedIn

and another smaller technology firm, data-analysis software maker

Tableau Software Inc., posted softer-than-expected growth

projections for 2016.

Tableau's shares plummeted 49%, and other tech companies dropped

as well, including a 5.8% decline in Twitter Inc.

Analysts said the scale of the selling highlights the

vulnerability of the technology sector at a time when the U.S.

economy is expanding in fits and starts, corporate earnings are

under pressure, and investors are concerned that global economic

problems will spill over to the U.S.

While the prospects of firms such as Facebook and Google aren't

directly affected by poor results at smaller tech firms in

different fields, all the companies have been trading at high

valuations, a factor that makes them vulnerable to selling for

essentially any reason. And if any of tech's highflying companies

falter, analysts said, other stocks likely will be even more

vulnerable.

"It's the realization that the world is slowing," said Michael

Antonelli, an equity sales trader at brokerage Robert W. Baird

& Co.

He said poor earnings at LinkedIn and Tableau, together with

high earnings multiples and fears of slowing U.S. growth, are

causing investors to retreat from risk, for fear that earnings

growth will decline in coming months.

LinkedIn, an online professional network, late Thursday

projected revenue this year would increase roughly 22%, down from

35% in 2015, and far below analysts' expectations.

Chief Executive Officer Jeff Weiner said Thursday that LinkedIn

continues to make inroads with large corporate clients. The company

added more than 3,000 new corporate accounts in the fourth quarter.

Analysts said LinkedIn earned nearly $4,000 a month from each

corporate customer in the fourth quarter, roughly flat with the

year before.

"There has been increasing demand, in terms of large-scale

multinational enterprises. And again, it's going to take time to

continue to roll out the product, and ensure that companies are

ready to fully embrace social selling. It's a new practice, and

we're looking forward to continuing to educate the marketplace on

that front," he said.

The concerns were accentuated by comments late Thursday from

data-analysis software maker Tableau Software. Tableau said it

expects revenue this year of $830 million to $850 million, down

from its previous projection of $845 million to $865 million.

"We saw some softness in spending, especially in North America,"

Tableau CEO Thomas Walker told analysts. "We did see our customers

continue to expand their use of Tableau in the organizations, but

not at the same cadence we'd historically experienced."

Tableau's comments helped spark an exodus by investors from

other business-software makers.

Salesforce Inc., a maker of customer-relationship software with

annual revenue exceeding $6 billion, fell 13%. Smaller firms were

hit harder: Splunk Inc. fell 23%; New Relic Inc., 22%, Hortonworks

Inc., 17%; Workday Inc., 16%; and NetSuite Inc., 14%.

Atlassian Corp., which makes software used to run corporate

technology services, made more upbeat comments along with its first

quarterly results as a public company on Thursday. Quarterly

revenue rose 45% from a year earlier and the company said it added

2,600 customers. But its stock also was pummeled Friday, falling

16%.

Analysts questioned whether Tableau's comments should be

considered a sign of trouble ahead for others in the sector.

"We are not seeing across-the-board macro-related weakness in

the software sector," said Karl Keirstead, a Deutsche Bank analyst,

in a research note. He said greater competition in the company's

markets and internal issues with its sales force may be to

blame.

Others said they believe the largest tech firms remain solid

investments, given their dominance of their respective markets.

While stock markets have been declining and volatile this year,

they will rebound at some point, and these firms' prospects likely

will make them winning investments over time.

"In the short run, there's a valuation question, but it seems to

me that strategically, the growth path for these companies isn't

over," said David Kotok, chief investment officer at Sarasota,

Fla., money manager Cumberland Advisors.

Even after Friday's selling, Amazon traded at a 402 times its

earnings over the past 12 months. Netflix traded at 296 times,

Facebook traded at 81 times and Alphabet at 31 times. The S&P

500 average is 21.4, according to Birinyi Associates.

But others said the selling pointed to a confluence of concerns

about the U.S. economic outlook, with its negative implications for

corporate earnings, and high valuations that analysts said have

essentially meant investors were assuming that firms would keep

expanding faster than they are now expected to do.

According to Bespoke Investment Group, the 50 stocks with the

highest price/earnings ratios in the S&P 500 averaged a decline

of 3.1% as of midday Friday.

"Investors appear to be much less willing to pay up for growth

today than they were yesterday," Bespoke said in a research note.

"This looks like a case of "valuations don't matter...until they

do."

Deepa Seetharaman contributed to this article.

Write to Maureen Farrell at maureen.farrell@wsj.com, Aaron

Kuriloff at aaron.kuriloff@wsj.com and Don Clark at

don.clark@wsj.com

(END) Dow Jones Newswires

February 05, 2016 19:52 ET (00:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

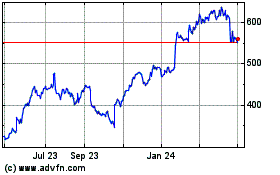

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

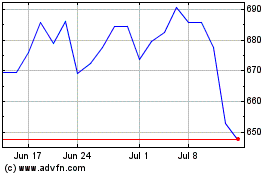

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024