TMO's Earnings Beat, LIFE Buyout on Track - Analyst Blog

April 24 2013 - 7:45AM

Zacks

Thermo Fisher Scientific (TMO) reported

adjusted earnings per share (“EPS”) of $1.37 in the first quarter

of fiscal 2013. This was 6.2% ahead of the Zacks Consensus Estimate

of $1.29 and surpassed the year-ago adjusted EPS by 17.1%. Amid a

challenging global economic environment, the company is encouraged

with this performance and expects to continue with this growth

momentum for the rest of 2013.

Revenues increased 4% year over year to reach $3.19 billion

during the quarter, higher than the Zacks Consensus Estimate of

$3.17 billion, based on 3% organic growth.

Thermo Fisher reports revenues under three segments – Analytical

Technologies, Specialty Diagnostics, and Laboratory Products and

Services. These three segments recorded revenues of $978 million

(0.2% annualized growth), $806 million (up 10%) and $1.54 billion

(up 5%), during the first quarter, respectively.

Gross margin contracted 36 basis points (bps) to 43.6% during

the quarter. However, Thermo Fisher witnessed a 7.7% increase in

adjusted operating income for the first quarter of 2013 to $600.6

million leading to an adjusted operating margin of 18.8%, up 58 bps

year over year. Adjusted figures exclude amortization of

acquisition-related intangible assets and restructuring costs and

related tax benefits.

The company exited the fiscal with cash and cash equivalents of

$1.0 billion compared with $851 million at the end of Dec 2012. A

strong cash balance helps the company pursue suitable acquisitions

or reward its shareholders through share buybacks. During the

reported quarter, the company deployed $90 million to repurchase

1.3 million shares.

Life Technologies Acquisition

Earlier this month, Thermo Fisher disclosed that it will acquire

Life Technologies (LIFE) for roughly $13.6 billion

(or $76 per share), plus the assumption of Life Technologies’ net

debt ($2.2 billion as of year-end 2012).

Life Technologies preferred Thermo Fisher as a potential buyer

against the consortium of private equity firms. Thermo Fisher was

not willing to lose its chance to become an unparalleled industry

leader to other potential buyers.

From the financial perspective, the buyout is expected to be

immediately accretive to Thermo Fisher’s adjusted earnings by 90

cents to $1.00 within the first full year of the takeover. Further,

the acquisition is expected to create significant cost and revenue

synergies for the company with adjusted operating income synergies

of $85 million in the first year.

Within three years of completion of the acquisition, Thermo

Fisher envisages adjusted operating income synergy of $275 million,

comprising $250 million and $25 million of cost and revenue

synergies, respectively. Apart from strong cash flow, the company

also expects adjusted return on invested capital (ROIC) to surpass

the cost of capital by the fourth year.

Thermo Fisher expects to close the acquisition in early 2014,

subject to standard closing conditions and Life shareholder vote.

The total price of the purchase of $13.6 billion includes cash and

debt of $9.5–$10.0 billion and as much as $4.0 billion in

equity.

Guidance

Accordingly, Thermo Fisher provided an update to its fiscal 2013

guidance. The company tightened its revenue guidance to

$12.84−$13.00 billion from the earlier $12.80−$13.00 billion

reflecting annualized growth rate of 3%−4%.

The company also expects adjusted EPS in the band of $5.27−$5.39

from earlier provided range of $5.32−$5.46 for 2013. This will

result in annualized growth rate of 7%−9% (earlier range being

8%−11%). The lowering of EPS guidance reflects its decision to

suspend share buybacks for the rest of the year and tighten its

revenue guidance range. The 2013 guidance does not include the

effect of the proposed acquisition of Life Technologies or the

impact of related financing activities.

The current Zacks Consensus Estimates for EPS $5.41 falls

outside the guided range. The current revenue estimate of $12.98

billion, however, is within the projected range.

Recommendation

For most of the last 7 years, Thermo Fisher has supported its

business momentum by acquiring several entities. Nevertheless, the

acquisition of Life Technologies is the biggest ever deal for

Thermo Fisher, since its inception in 2006. This acquisition has

helped the company prove its strength to continue with acquisitions

and grow further.

Given Life Technologies’ expansive line of consumables for

genomic, and molecular and cell biology, the buyout will complement

Thermo Fisher’s market-leading portfolio of analytical technologies

and specialty diagnostic. The takeover will seamlessly strengthen

Thermo Fisher’s global foothold and commercial reach.

The acquisition will create a kingpin in the research, specialty

diagnostics and applied markets. As per management at Thermo

Fisher, the acquisition supports its three-pronged growth strategy

of technological innovation, a unique customer value proposition

and expansion in emerging markets.

In addition, substantial expansion in the Asia-Pacific market,

mainly China, is in the cards for the company. Given the huge

potential in the region and high growth rate in China, Thermo

Fisher is likely to exceed its goal of garnering 25% revenues from

the high-growth Asia-Pacific region and emerging markets by

2016.

Thermo Fisher retains a Zacks Rank #3 (Hold). Medical devices

stocks such as Cyberonics Inc. (CYBX) and

Health Net Inc. (HNT), which carry a Zacks Rank #1

(Strong Buy) are worth considering.

CYBERONICS INC (CYBX): Free Stock Analysis Report

HEALTH NET INC (HNT): Free Stock Analysis Report

LIFE TECHNOLOGS (LIFE): Free Stock Analysis Report

THERMO FISHER (TMO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

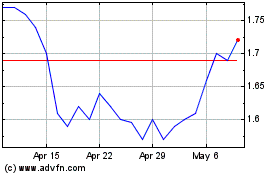

aTyr Pharma (NASDAQ:LIFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

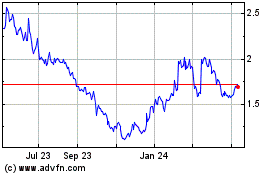

aTyr Pharma (NASDAQ:LIFE)

Historical Stock Chart

From Apr 2023 to Apr 2024