Regulatory News:

TechnipFMC plc (Paris:FTI) (NYSE:FTI) (ISIN:GB00BDSFG982)

(“TechnipFMC”) and FMC Technologies, Inc. (“FMCTI”) today announced

the final results of the previously announced exchange offers (the

“Exchange Offers”) for any and all of the $800 million in aggregate

principal amount of outstanding senior notes issued by FMCTI (the

“Existing FMCTI Notes”) for (1) new senior notes issued by

TechnipFMC (the “New TechnipFMC Notes”) and (2) cash, and the

related consent solicitations (the “Consent Solicitations”) to

adopt certain amendments to the indentures governing the Existing

FMCTI Notes.

The Exchange Offers and Consent Solicitations expired at 11:59

p.m., New York City time, on March 27, 2017 (the “Expiration

Date”). As of the Expiration Date, the following principal amounts

of each series of Existing FMCTI Notes were validly tendered and

not validly withdrawn (and consents thereby validly given and not

validly revoked):

Aggregate Principal

CUSIP Amount Existing FMCTI Notes Tendered at

Title of Series Number Maturity Date

Outstanding Expiration Date

Principal Amount Percentage 2.00%

Senior 30249U October 1, Notes due 2017 AA9 2017 $300,000,000

$215,398,000 71.80% 3.45% Senior 30249U October 1, Notes due 2022

AB7 2022 $500,000,000 $459,862,000 91.97%

The Exchange Offers and Consent Solicitations were made pursuant

to the terms and subject to the conditions set forth in the

Offering Memorandum and Consent Solicitation Statement, dated

February 28, 2017 (the “Offering Memorandum and Consent

Solicitation Statement”).

Upon settlement of the Exchange Offers and Consent

Solicitations, which is currently expected to occur on Wednesday,

March 29, 2017, TechnipFMC will (i) issue to the holders of the

Existing FMCTI Notes who tendered in advance of the Early Tender

Date whose securities have been accepted for exchange New

TechnipFMC Notes in an equal principal amount to the principal

amount of the Existing FMCTI Notes that have been accepted for

exchange, (ii) issue to the holders of the Existing FMCTI Notes who

tendered after the Early Tender Date but before the Expiration Date

whose securities have been accepted for exchange $970 principal

amount of New TechnipFMC Notes for each $1,000 principal amount of

Existing FMCTI Notes that have been accepted for exchange and (iii)

pay to the holders of the Existing FMCTI Notes whose securities

have been accepted for exchange a total of $676,870 in cash as part

of the exchange consideration. Capitalized terms used in this

paragraph but not defined in this press release have the meaning

given to them in the Offering Memorandum and Consent Solicitation

Statement.

In addition, as previously disclosed, FMCTI received consents in

the Consent Solicitations sufficient to approve amendments to the

indenture governing the Existing FMCTI Notes. As a result, FMCTI

and the trustee for the Existing FMCTI Notes will promptly enter

into a supplemental indenture implementing those amendments to the

indenture governing the Existing FMCTI Notes.

The New TechnipFMC Notes will only be issued to eligible holders

of Existing FMCTI Notes who have completed and returned an

eligibility form confirming that they are either a “qualified

institutional buyer” under Rule 144A or not a “U.S. person” and

outside the United States under Regulation S for purposes of

applicable securities laws.

TechnipFMC will file a Current Report on Form 8-K after the

settlement of the Exchange Offers and Consent Solicitations

attaching, among other things, the indenture governing the New

TechnipFMC Notes. A copy of the Form 8-K will be available on the

SEC website (www.sec.gov) and on the TechnipFMC website

(www.technipfmc.com).

The New TechnipFMC Notes have not been and will not be

registered under the Securities Act of 1933, as amended (the

“Securities Act”), or any state securities laws. Therefore, the New

TechnipFMC Notes may not be offered or sold in the United States

absent registration or an applicable exemption from the

registration requirements of the Securities Act and any applicable

state securities laws.

###

About TechnipFMC

TechnipFMC is a global leader in subsea, onshore/offshore, and

surface projects. With our proprietary technologies and production

systems, integrated expertise, and comprehensive solutions, we are

transforming our clients’ project economics.

We are uniquely positioned to deliver greater efficiency across

project lifecycles from concept to project delivery and beyond.

Through innovative technologies and improved efficiencies, our

offering unlocks new possibilities for our clients in developing

their oil and gas resources.

Each of our 44,000 employees is driven by a steady commitment to

clients and a culture of purposeful innovation, challenging

industry conventions, and rethinking how the best results are

achieved.

To learn more about us and how we are enhancing the performance

of the world’s energy industry, go to TechnipFMC.com and follow us

on Twitter @TechnipFMC.

Important Information for Investors and

Securityholders

Forward-Looking Statement

This communication contains “forward-looking statements” as

defined in Section 27A of the United States Securities Act of 1933,

as amended, and Section 21E of the United States Securities

Exchange Act of 1934, as amended. The words such as “ believe,”

“expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,”

“would,” “could,” “may,” “estimate,” “outlook” and similar

expressions are intended to identify forward-looking statements,

which are generally not historical in nature. Such forward-looking

statements involve significant risks, uncertainties and assumptions

that could cause actual results to differ materially from our

historical experience and our present expectations or projections,

including the following known material factors:

- risks associated with tax liabilities,

or changes in U.S. federal or international tax laws or

interpretations to which they are subject;

- risks that the new businesses will not

be integrated successfully or that the combined company will not

realize estimated cost savings, value of certain tax assets,

synergies and growth or that such benefits may take longer to

realize than expected;

- unanticipated costs of

integration;

- reliance on and integration of

information technology systems;

- reductions in client spending or a

slowdown in client payments;

- unanticipated changes relating to

competitive factors in our industry;

- ability to hire and retain key

personnel;

- ability to attract new clients and

retain existing clients in the manner anticipated;

- changes in legislation or governmental

regulations affecting us;

- international, national or local

economic, social or political conditions that could adversely

affect us or our clients;

- conditions in the credit markets;

- risks associated with assumptions we

make in connection with our critical accounting estimates and legal

proceedings;

- the risks of currency fluctuations and

foreign exchange controls associated with our international

operations; and

- such other risk factors set forth in

our filings with the United States Securities and Exchange

Commission, which include our Registration Statement on Form S-4,

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K and in our filings with the Autorité

des marchés financiers or the Financial Conduct Authority.

We caution you not to place undue reliance on any

forward-looking statements, which speak only as of the date hereof.

We undertake no obligation to publicly update or revise any of our

forward-looking statements after the date they are made, whether as

a result of new information, future events or otherwise, except to

the extent required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170327006335/en/

TechnipFMC plcInvestor relationsMatt

SeinsheimerVice President Investor RelationsTel: +1 281 260

3665Email: Matt SeinsheimerorAurelia Baudey-VignaudSenior Manager

Investor RelationsTel: +33 1 85 67 43 81Email: Aurelia

Baudey-VignaudorJames DavisSenior Manager Investor RelationsTel: +1

281 260 3665Email: James DavisorMedia relationsChristophe

BelorgeotVice President Corporate CommunicationsTel: +33 1 47 78 39

92Email: Christophe BelorgeotorLaure MontcelSenior Manager Public

RelationsTel: +33 1 49 01 87 81Email: Laure MontcelorLisa

AdamsSenior Manager Digital CommunicationsTel: +1 281 405

4659Email: Lisa Adams

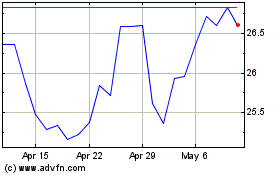

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

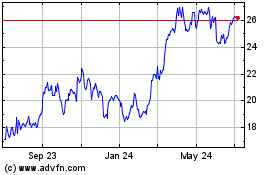

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Apr 2023 to Apr 2024