T. Rowe Price Pushes Oracle to Boost NetSuite Bid -- 2nd Update

October 28 2016 - 1:08PM

Dow Jones News

By Jay Greene

T. Rowe Price Group Inc., which has stood in the way of Oracle

Corp.'s $9.3 billion acquisition of NetSuite Inc., said it would

tender its shares in favor of the deal if Oracle sweetens the offer

by $2 billion.

In a letter to a special committee of Oracle's board, T. Rowe

Vice President Robert Sharps said the investment firm would support

a deal at $133 a share, up from the $109 a share that Oracle has

proposed.

T. Rowe said it came to that price based on "the range of

conclusions that the financial advisers of the two boards' Special

Committees reached in their separate fairness opinions."

CNBC reported the T. Rowe letter earlier Friday. Oracle Chief

Executive Mark Hurd had told CNBC on Wednesday that the company's

bid of $109 a share is its "best and final offer."

Last month, T. Rowe, NetSuite's largest independent investor,

notified the cloud-software provider that it would oppose the deal,

citing conflicts of interest in the deal among its concerns. That

led Oracle, earlier this month, to extend its tender offer by a

month after having received only about a quarter of the shares

necessary from NetSuite's stockholders. That tender offer expires

Nov. 4.

An Oracle spokeswoman declined to comment on the T. Rowe letter.

A NetSuite spokeswoman didn't immediately reply to a request for

comment.

T. Rowe portfolio manager Henry Ellenbogen said in an interview

that NetSuite engaged in "no real price discovery in the process."

T. Rowe used Oracle's own price analysis, disclosed in regulatory

documents regarding the deal, to conclude that NetSuite's shares

could be worth well above $109. He said his firm, which holds about

14.5 million shares, or roughly 18% of NetSuite's shares

outstanding, is seeking what it believes is a "fair price."

"We're not trying to stir up the pot here," Mr. We're not trying

to stir up the pot here," Mr. Ellenbogen said. "It's not in the

spirit of being an activist. It's in the spirit of being a

fiduciary.said. "It's not in the spirit of being an activist. It's

in the spirit of being a fiduciary."

He said Friday morning that Oracle hadn't replied to his

company's letter.

NetSuite shares fell 22 cents to $94.15 Friday morning.

Stifel Nicolaus & Co. analyst Brad Reback believes Oracle

will succeed in acquiring NetSuite, but it will need to raise its

offer to do so.

"While it is entirely possible that Oracle may pull the bid if

the tender expires at midnight next Friday, we continue to believe

that Oracle will ultimately acquire NetSuite in the next few

quarters and likely at a price higher than the $109 [per] share

price on the table today," Mr. Reback wrote in a research note.

Mr. Ellenbogen noted the challenge that NetSuite faces getting a

fair price because of Oracle executive chairman Larry Ellison's

substantial stake in NetSuite. In a September regulatory filing,

NetSuite said Mr. Ellison had an "indirect beneficial ownership of

approximately 39.5%" of NetSuite's common stock, making him the

company's largest investor.

To address that conflict of interest, Oracle appointed a

committee of independent directors to oversee its side of the deal.

Oracle and NetSuite also agreed that the transaction must be

approved by owners of a majority of NetSuite shares not held by Mr.

Ellison and his family, giving independent NetSuite shareholders

more clout in approving the deal.

Mr. Ellenbogen pointed to the recently disclosed list of

Salesforce.com Inc. acquisition targets, which included NetSuite,

reported by The Wall Street Journal. The list, which came from a

trove of thousands of former Secretary of State and Salesforce

director Colin Powell's stolen emails, noted Mr. Ellison's large

stake.

Mr. Ellenbogen took that to mean that "because of Ellison's

ownership, [an acquisition] was not even worth discussing." Lack of

a potential alternative bidder led NetSuite to accept an offer that

undervalued the company, Mr. Ellenbogen said.

He didn't call the $133-a-share price T. Rowe's best and final

offer. The firm holds its shares in multiple funds, and some

portfolio managers might be willing to accept a slightly lower

offer.

"If there is a price close to it, there is some majority of

shares that would listen to it," Mr. Ellenbogen said.

Mr. Ellenbogen said he recognized that, because of Mr. Ellison's

large stake, NetSuite is unlikely to attract bids from Oracle

rivals. But he said he believes shares in NetSuite, which helped

pioneer the business of delivering business applications via the

web, will ultimately trade above $133 if it remains

independent.

"Frankly, I hope if Oracle walks away, they walk away for good,"

Mr. Ellenbogen said.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

October 28, 2016 12:53 ET (16:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

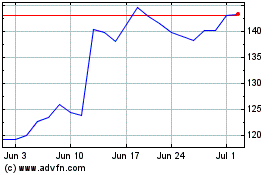

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024