T. Rowe Price Pushes Oracle to Boost NetSuite Bid

October 28 2016 - 10:57AM

Dow Jones News

By Jay Greene

T. Rowe Price Group Inc., which has stood in the way of Oracle

Corp.'s $9.3 billion acquisition of NetSuite Inc., said it would

tender its shares in favor of the deal if Oracle sweetens the offer

by $2 billion.

In a letter to a special committee of Oracle's board sent late

Thursday, T. Rowe Vice President Robert Sharps said that the

investment firm would support a deal at $133 a share, up from the

$109 a share that Oracle has proposed. T. Rowe said it came to that

price based on "the range of conclusions that the financial

advisors of the two boards' Special Committees reached in their

separate fairness opinions."

Oracle Chief Executive Mark Hurd told CNBC on Wednesday that the

company's $109 bid is its "best and final offer."

Last month, T. Rowe, NetSuite's largest independent investor,

notified the cloud-software provider that it would oppose the deal,

citing conflicts of interest in the deal among its concerns. That

led Oracle, earlier this month, to extend its tender offer by a

month after having received only about a quarter of the shares

necessary from NetSuite's stockholders. That tender offer expires

Nov. 4.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

October 28, 2016 10:42 ET (14:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

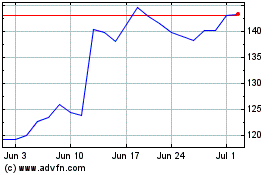

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024