Swiss Franc Slides As European Shares Rise Ahead Of ECB Decision

January 21 2016 - 1:47AM

RTTF2

The Swiss franc declined against its most major rivals in

European deals on Thursday amid risk appetite, as traders await the

outcome from the European Central Bank, due shortly, with

heightened volatility in financial markets and plunging oil prices

raising the prospect of further easing later this year.

The ECB is expected to keep all interest rates on hold, after

slashing deposit rate to minus 0.3 percent at the December meeting.

However, the ECB President Draghi may leave the door open to

further action in the coming months to achieve price stability, if

needed.

In economic news, figures from the Swiss National Bank showed

that Switzerland's money supply growth slowed in December, after

improving in the previous two months.

M3, the broad measure of money supply, rose at a slower pace of

1.6 percent year-over-year in December, following a 2.1 percent

spike in November. In October, the rate of increase was 1.4

percent.

The franc showed mixed trading in the Asian session. While the

currency rose against the pound and the greenback, it held steady

against the yen and the euro.

In European trading now, the franc dropped to 116.16 against the

yen and 1.0958 against the euro, off its early highs of 116.79 and

1.0929, respectively. The next possible support for the franc is

seen around 114.00 against the yen and 1.12 against the euro.

Reversing from an early high of 1.0013 against the greenback,

the franc weakened to a 2-day low of 1.0077. If the franc is likely

to find support around the 1.02 zone.

On the flip side, the franc that reversed from an early 2-day

low of 1.4289 against the pound advanced to 1.4174 at 2:30 am ET.

The currency showed no clear direction in European deals.

Looking ahead, U.S. weekly jobless claims for the week ended

January 16, Federal Reserve Bank of Philadelphia's manufacturing

index for January, weekly U.S. crude oil inventories data and

Eurozone consumer confidence index for January are due to be

released in the New York session.

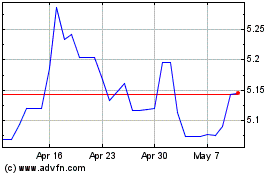

US Dollar vs BRL (FX:USDBRL)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs BRL (FX:USDBRL)

Forex Chart

From Apr 2023 to Apr 2024