Swiss Franc Rises Amid Risk Aversion

March 26 2015 - 7:15AM

RTTF2

The Swiss franc strengthened against the other major currencies

in the European session on Thursday, as weak U.S. data and a

deepening political crisis in Yemen sapped investors' appetite for

riskier assets.

The U.K.'s FTSE 100 index is currently down 1.36 percent or

94.94 points at 6,896, France's CAC 40 index is down 0.73 percent

or 36.62 points at 4,984 and Germany's DAX is down 1.98 percent or

234.44 points at 11,630.

Data from the Commerce Department showed Wednesday that U.S.

durable goods orders fell by 1.4 percent in February following a

downwardly revised 2.0 percent increase in January. Economists had

expected orders to climb by 0.7 percent compared to the 2.8 percent

jump that had been reported for the previous month.

Saudi Arabia and its allies began airstrikes against Houthi

fighters who have tightened their grip on the nearby port city of

Aden, where the country's president Abdu Rabu Mansour Hadi had

taken refuge.

Saudi ambassador in the US, Adel al-Jubeir said the military

action was aimed to defend the "legitimate government" of President

Abd rabbu Mansour Hadi, who has taken refuge in the southern port

city of Aden.

In Asian deals, the Swiss franc held steady against its major

rivals.

In the European session today, the Swiss franc rose to nearly a

4-week high of 0.9489 against the U.S. dollar and a 2-day high of

1.4210 against the pound, from early lows of 0.9605 and 1.4293,

respectively. If the Swiss franc extends its uptrend, it is likely

to find resistance around 0.93 against the greenback and 1.40

against the pound.

Moving away from an early 2-day low of 123.63 against the yen,

the Swiss franc edged up to 124.74. On the upside, 127.50 is seen

as the next resistance elevel for the Swiss franc.

Against the euro, the Swiss franc edged up to 1.0476 from an

early low of 1.0542. The Swiss franc may test resistance near the

1.03 region.

Looking ahead, U.S. weekly jobless claims for the week ended

March 21 and Markit's U.S. PMI reports for March are slated for

release in the New York session.

At 9:00 am ET, U.S. Federal Reserve Bank of Atlanta President

Dennis Lockhart will deliver a speech about the economic outlook

and monetary policy at the Engage International Investment

Education Symposium, in Detroit.

Subsequently, European Central Bank president Mario Draghi will

address the Italian parliament's finance and EU policy committees

in Rome at 9:15 am ET. After 15 minutes, Bank of Canada Governor

Stephen Poloz is expected to speak at the Canada-UK Chamber of

Commerce, in London.

At 1:30 pm ET, Bank of England Governor Mark Carney will hold a

press conference about his role as Chair of the Financial Stability

Board, in Frankfurt. After half-an-hour, Swiss National Bank member

Fritz Zurbrugg will deliver a speech about monetary policy after

the cap at the Money Market Event in Zurich.

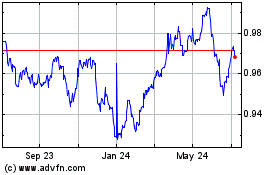

Euro vs CHF (FX:EURCHF)

Forex Chart

From Mar 2024 to Apr 2024

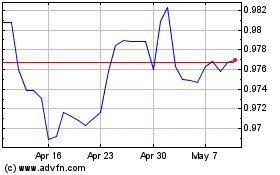

Euro vs CHF (FX:EURCHF)

Forex Chart

From Apr 2023 to Apr 2024