Swiss Franc Falls As Swiss CPI Hits 56-year Low

September 04 2015 - 12:21AM

RTTF2

The Swiss franc weakened against the other major currencies in

the early European session on Friday, after data showed that Swiss

consumer prices declined for a tenth consecutive month in August

and at the fastest pace since 1959.

Data from the Federal Statistical Office showed that the

consumer price index dropped 1.4 percent year-on-year following a

1.3 percent decline in the previous month. The fall was in line

with economists' expectations.

Month-on-month, prices declined 0.2 percent in August after a

0.6 percent decrease. It was also in line with economists'

expectations. Prices fell for a second straight month.

Meanwhile, investors look ahead to the release of the U.S. Labor

Department's closely-watched monthly jobs report due out later in

the day. Economists expect the report to show an increase of about

220,000 jobs in August following the addition of 215,000 jobs in

July. The unemployment rate is expected to dip to 5.2 percent from

5.3 percent.

The Federal Reserve's September interest-rate decision hinges in

large part on this report, given the recent financial turbulence

and volatility caused by the China crisis.

In the Asian trading today, the Swiss franc showed mixed trading

against its major rivals. The Swiss franc rose against the euro,

the pound and the U.S. dollar. Meanwhile, it fell against the

yen.

In the Asian trading, the Swiss franc fell to nearly a 5-month

low of 122.29 against the yen, from an early high of 123.46. If the

franc extends its downtrend, it is likely to find support around

the 120.00 area.

Pulling away from an early 4-day high of 1.0800 against the

euro, the franc edged down to 1.0864. The franc may test support

near the 1.09 region.

Against the pound and the U.S. dollar, the Swiss franc edged

down to 1.4859 and 0.9755 from early highs of 1.4770 and 0.9698,

respectively. On the downside, 1.50 against the pound and 0.99

against the U.S. dollar are seen as the next support levels for the

franc.

Looking ahead, Canada unemployment data and Ivey's PMI, U.S.

non-farm payrolls report and unemployment data, all for August, are

set to be published in the New York session.

At 8:10 am ET, Federal Reserve Bank of Richmond President

Jeffrey Lacker will deliver a speech titled "The Case Against

Further Delay" at the Retail Merchants Association in Richmond.

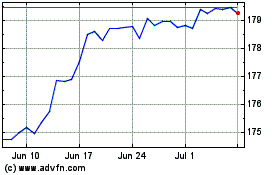

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024