Swiss Franc Eases After SNB Chairman Jordan Comments

February 11 2016 - 2:04AM

RTTF2

The Swiss franc retreated from its early highs against most

major rivals in European deals on Thursday, after the Swiss

National Bank President Thomas Jordan said that he cannot exclude

the possibility of cutting rates into further negative

territory.

Speaking to Swiss magazine Bilanz, Jordan asserted that the bank

went relatively far with negative interest rates and is ready to

intervene in the currency market.

"We went quite far to the negative interest. Now we monitor the

situation closely. We exclude nothing," he told.

The franc slipped to a 2-day low of 1.1000 against the euro, off

its early near 3-week high of 1.0950.

The franc eased to 1.4045 against the pound and 0.9710 against

the greenback, coming off from its more than 9-month high of 1.3925

and near a 4-month high of 0.9661, respectively.

The franc may find support around 1.12 against the euro, 0.98

against the greenback and 1.42 against the pound.

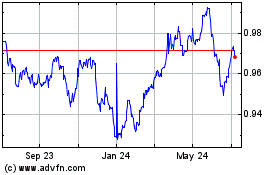

Euro vs CHF (FX:EURCHF)

Forex Chart

From Mar 2024 to Apr 2024

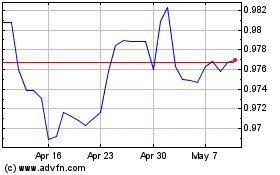

Euro vs CHF (FX:EURCHF)

Forex Chart

From Apr 2023 to Apr 2024