Swiss Franc Declines On Risk Appetite

July 30 2015 - 3:59AM

RTTF2

The Swiss franc weakened against its major rivals in European

morning deals on Thursday, as European stocks rose amid corporate

earning results and M&A activities, sapping demand for the

safe-haven assets.

Investors welcomed the Fed statement as it gave no hints that a

September rate hike is coming. The Fed struck a positive tone about

the world's largest economy, while sending no clear signal on when

a long-awaited rate rise might come.

The focus now shifts to the two monthly jobs reports scheduled

to be released before the next Fed meeting in September, with the

monthly employment report for July slated for release on August

7.

In economic front, survey results from the KOF Swiss Economic

Institute showed that a measure of future economic activity in the

swiss economy improved more-than-expected in June to reach its

highest level in almost one year.

The KOF Economic Barometer increased by 10 points to 99.8 in

July from 89.8 in June, which was revised up from 89.7. Economists

had expected the index to rise to 90.4.

The currency has been falling against its major rivals, except

the euro, in the Asian session.

In European deals, the Swiss franc fell to nearly a 5-month low

of 1.5150 against the pound and more than a 3-month low of 0.9711

against the greenback, from early highs of 1.5080 and 0.9667,

respectively. The franc ended yesterday's trading at 1.5092 versus

the pound and 0.9667 against the greenback. The franc is seen

finding support around 1.55 against the pound and 0.98 against the

greenback.

The franc pared gains to 127.96 against the yen, from an early

high of 128.19. The franc is heading to violate an early near

3-week low of 127.80. Continuation of the franc's downtrend may see

it finding support around the 126.00 mark.

The Swiss currency edged down to 1.0636 against the euro, after

having advanced to 1.0612 at 2:30 am ET. The next possible downside

target for the franc may be located around the 1.075 level.

Looking ahead, German unemployment rate and Eurozone economic

confidence index, all for July, are due to be released shortly.

In the New York session, preliminary German CPI for July,

advance second quarter U.S. GDP data and U.S. jobless claims for

the week ended July 25, are slated for release.

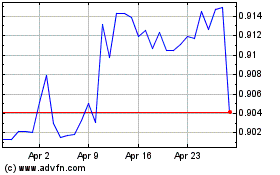

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024