Swiss Franc Declines Against Most Majors

July 06 2015 - 7:53AM

RTTF2

The Swiss franc drifted lower against most major counterparts in

European deals on Monday, as Switzerland's consumer prices

continued to decline in June, while the Swiss National Bank's sight

deposit rose last week, raising speculation of possible SNB

intervention to stem the currency's appreciation.

Figures from the Federal Statistical Office showed that the

consumer price index dropped 1.0 percent year-over-year in June,

slower than May's 1.2 percent decrease. Prices have been falling

since November last year.

Data from the central bank showed that total sight deposits rose

CHF 457.87 billion in the week ended July 3, up from CHF 456.58

billion a week earlier. An increase in sight deposits is seen as a

signal of central bank intervention in foreign exchange markets to

weaken the franc.

The upward pressure on the franc would intensify, as Greece's

rejection of austerity measures in a referendum on Sunday could

strengthen the appeal of the safe-haven assets, the Swiss economy

minister Johann Schneider-Ammann told Le Temps in an interview.

The SNB would decide independently about the conduct of

additional foreign interventions, he added.

Meanwhile, the European markets are trading in red, as Greek

people overwhelmingly rejected proposals by international creditors

in Sunday's referendum.

The franc has been trading higher in the Asian session, due to

Greek uncertainty.

After climbing to a 1-week high of 1.0351 against the euro at

the beginning of today's deals, the franc edged down to 1.0456 and

has stabilised shortly thereafter. The franc is likely to find

support around the 1.05 zone.

The franc fell to a 4-day low of 0.9465 against the greenback,

off its previous high of 0.9407. Next possible support for the

franc may be located around the 0.97 level.

The franc, which rose to 1.4646 against the pound at 6:00 pm ET,

weakened to 1.4725. Continuation of the franc's downtrend may lead

it to a support around the 1.50 area.

On the flip side, the franc has been steady against the yen in

European deals, trading at 129.93, off early 1-1/2-month low of

128.96.

Looking ahead, Markit's U.S. services PMI and ISM

non-manufacturing composite index for June are due in the New York

session.

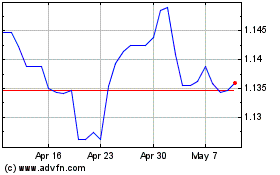

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024