Swiss Franc Climbs Amid Risk Aversion

August 25 2016 - 3:51AM

RTTF2

The Swiss franc strengthened against its most major opponents in

European deals on Thursday amid risk aversion, as oil prices fell

and investors became cautious ahead of the U.S. Federal Reserve's

annual symposium in Jackson Hole, Wyoming, that kicks off later in

the day.

Federal Reserve Chair Janet Yellen will speak on Friday at the

symposium and investors will keep a close eye on her remarks for

clues about the outlook for U.S. interest rates.

The death toll in the Italian earthquake has risen to 247

people, according to Italy's national civil protection agency. The

number of people killed are likely to rise further after several

towns were damaged by the quake.

In economic front, data from the Swiss Federal Statistical

Office showed that Swiss industrial production declined 1.2 percent

year-on-year in the second quarter.

This follows an increase of 1 percent annually in the first

quarter.

The franc showed mixed trading in the previous session. While

the currency rose against the pound, it held steady against the

greenback and the yen. Against the euro, it declined.

Reversing from an early low of 103.78 against the yen, the Swiss

franc advanced to 104.15. If the franc extends rise, 106.00 is

likely seen as its next resistance level.

Data from the Bank of Japan showed that Japan's producer prices

rose 0.4 percent on year in July.

That beat expectations for an increase of 0.1 percent following

the 0.2 percent gain in June.

The franc climbed to 0.9641 against the dollar, off its previous

low of 0.9677. The next possible resistance for the franc may be

found around the 0.95 zone.

The Swiss franc reached as high as 1.2724 against the pound,

after having fallen to 1.2818 at 8:45 pm ET. On the upside, the

franc may locate resistance around the 1.26 mark.

The Distributive Trades Survey from the Confederation of British

Industry showed that British retail sales volume increased in

August after declining in prior month.

The retail sales balance rose to +9 percent from -14 percent in

July. The score was above expectations of -12 percent.

On the flip side, the franc fell back to a 2-day low of 1.0899

versus the euro, compared to yesterday's closing value of 1.0889.

The franc is poised to test support around the 1.10 area.

Survey results from Ifo showed that German business confidence

dropped unexpectedly in August.

The business sentiment index dropped to 106.2 in August from

108.3 in July. The reading was expected to rise to 108.5.

Looking ahead, Markit's flash U.S. PMI for August, U.S. durable

goods orders for July and U.S. weekly jobless claims for the week

ended August 20 are slated for release in the New York session.

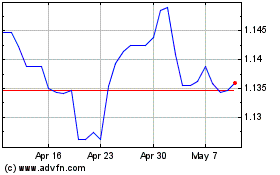

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024