Swiss Franc Advances Amid Risk Aversion

February 10 2016 - 11:59PM

RTTF2

The Swiss franc climbed against its major rivals in European

morning deals on Thursday, as European shares declined, with miners

and bankers under pressure, amid weak corporate earnings.

The outlook over global growth darkened after the Fed Chair

Yellen warned financial conditions in the U.S. and uncertainty in

China had become "less supportive" of growth. Yellen reaffirmed her

plan to increase rates gradually, but didn't close options for more

rate hikes.

Oil prices resumed sell-off after gasoline inventories hit a

record high for a second week and Goldman Sachs repeated its

warning that crude oil futures might fall below $20 per barrel in

2016.

Figures from the Federal Statistical Office showed that Swiss

consumer prices declined at a stable pace in January, in line with

expectations.

The consumer price index fell 1.3 percent year-over-year in

January, the same rate of decrease as in December.

The figure was also matched with consensus estimate. Prices have

been falling since November 2014.

The franc showed mixed performance in Asian deals. While the

franc held steady against the euro and the pound, it rose against

the greenback. Against the yen, the franc declined.

The Swiss franc appreciated to near a 4-month high of 0.9661

against the greenback, reversing from its prior low of 0.9742. If

the franc rises further, 0.95 is likely seen as its next resistance

level.

The franc, having declined to 1.4159 against the pound at 7:30

pm ET, reversed direction and advanced to a 9-month high of 1.3925.

On the upside, the franc may test resistance around the 1.38

mark.

The franc strengthened to more than a 2-week high of 1.0950

against the euro, off its early low of 1.0992. The franc is seen

finding resistance around the 1.08 area.

On the flip side, the franc depreciated to more than a 1-year

low of 114.75 against the yen, compared to 116.39 hit late New York

Wednesday. The next possible support for the franc-yen pair is seen

around the 114.00 zone.

Looking ahead, At 6:30 am ET, Bank of England deputy governors

Jon Cunliffe and Andrew Bailey will appear at the Lords committee

on euro zone financial system in London.

In the New York session, U.S. weekly jobless claims for the week

ended February 6 and Canada new housing price index for December

are due to be released.

At 10:00 am ET, Federal Reserve Chair Janet Yellen will testify

on the Semiannual Monetary Policy Report before the Senate Banking

Committee in Washington DC.

Eurozone finance ministers will meet in Brussels later in the

day.

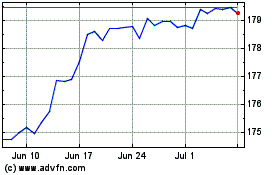

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024