Survey Reveals Global Leaders Struggle to Access and Effectively Use Data

December 12 2017 - 8:00AM

Business Wire

Organizations look to third-party vendors to

address data challenges

Pitney Bowes Inc. (NYSE:PBI), a technology provider of

innovative products, solutions and data which power commerce, today

announced the release of global research that reveals nearly half

(46 percent) of business professionals purchase third party data.

These industry leaders are using third party data to make business

decisions because they find it valuable (85 percent) and have

confidence that it is up to date (83 percent). Through the December

2017 study, Digital Is Driving The Next Generation Of Data

Marketplaces, commissioned by Pitney Bowes, and conducted by

Forrester Consulting, 800 senior-level advertising, marketing,

data, analytics and IT professionals with influence over data and

analytics decisions, were surveyed across the U.S., Canada, U.K.

and Australia.

“We’re seeing a shift in the type of data businesses are buying

today. While 83 percent of organizations still rely heavily on

first party, or owned data, third party data is gaining adoption

and recognized value,” says Bob Guidotti, EVP & President,

Pitney Bowes Software Solutions. “First party data allows

organizations to make internal business decisions, often without

complete consideration of their customer’s environment. Third party

data, however, provides an enormous opportunity to add depth of

information, enabling business leaders to make informed decisions

that go beyond the lens of their organization. As business leaders

begin to incorporate this data, it’s imperative that they work with

trusted vendors to access the most accurate and precise data to

achieve their business goals, and to avoid millions in lost revenue

from dirty data.”

Despite the growing confidence organizations have in third party

data, many are challenged to effectively use it. When asked what

the biggest challenges were to using the data, participants cited

improving the quality and accuracy of data (70 percent),

maintaining the quality of data as it changes (69 percent), and

improving the ability to detect and track changes in data (69

percent) as their top challenges.

“It can be the Achilles’ Heel if the

accuracy of the data is not great, or the accessibility of the data

is not great,” says participant VP of Customer Engagement Marketing

from a financial company. “Accuracy and accessibility are

critical.”

According to a VP of Marketing from a real

estate company, “Real-time data is the holy grail.”

Beyond the lack of confidence in third party data, 96 percent of

survey participants say they also find data difficult to acquire.

The high costs of licensing reliable data sets from third parties

(55 percent), along with the timeliness and reliability of open

data sets (54 percent), and finding the right data products in the

open market (50 percent) are the most common pain points for

organizations looking to acquire this data. Currently, the

preferred methods to access data are through APIs (81 percent) and

self-service interfaces (77 percent). In the future, 99 percent of

organizations say they will be open to purchasing data through

online data marketplaces, with 38 percent indicating they’d spend

more than $10,000 USD purchasing marketplace data.

The research shows that in all geographies, more organizations

are looking to easily access and purchase third party data, yet the

types of datasets vary by region. In the U.S., survey participants

are purchasing third party data primarily to obtain customer

behavior data (60 percent) and demographic or geo-demographic data

(60 percent). In Canada, participants indicated their interest in

digital data (51 percent), social media data (45 percent), and

customer behavior data (45 percent). In the U.K., digital data (58

percent) and social media data (59 percent) were among the most

licensed; and in Australia, participants were most interested in

transactional data (54 percent) and customer behavior data (43

percent).

In order to achieve their business priorities, survey

participants believe it’s important to maintain the quality of data

as it changes (82 percent), improve the quality and accuracy of

data (82 percent), and expand the ability to source external data

(81 percent). This is an opportunity for third party data providers

to improve their offerings, By improving these components, almost

80 percent of U.S. professionals believe they will see a notable

impact within their organization. U.K. professionals are more

skeptical though, with only 61 percent believing these improvements

will have a strong impact.

Methodology

This commissioned study was conducted by Forrester Consulting on

behalf of Pitney Bowes. Forrester Consulting surveyed 800

participants across the U.S., Canada, the U.K., and Australia.

Participants self-categorized themselves as manager-level or

higher, and work in roles across advertising, marketing, data,

analytics, and IT. Participants represent organizations within the

insurance, telecommunications, real estate and financial services

verticals that have 500 or more employees.

About Pitney Bowes

Pitney Bowes (NYSE:PBI) is a global technology and data company

powering billions of transactions – physical and digital – in the

connected and borderless world of commerce. Clients around the

world, including 90 percent of the Fortune 500, rely on products,

solutions, services and data from Pitney Bowes in the areas of

customer information management, location intelligence, customer

engagement, shipping, mailing, and global ecommerce. And with the

innovative Pitney Bowes Commerce Cloud, clients can access the

broad range of Pitney Bowes solutions, analytics, and APIs to drive

commerce. For additional information visit Pitney Bowes, the

Craftsmen of Commerce, at www.pitneybowes.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171212005108/en/

Pitney Bowes Inc.Emily Simmons, 843-467-1071Communications

DirectorEmily.simmons@pb.com

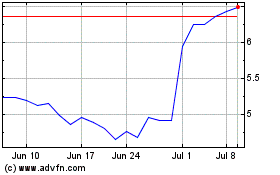

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

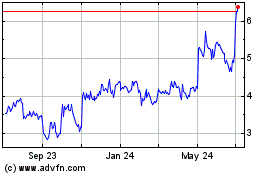

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Apr 2023 to Apr 2024