* China to Become Second Largest Export

Destination for American Goods by 2030 *

* Industrial Machinery, Transport Equipment,

and Information and Communications Technology Likely to Drive

Nearly Half of all U.S. Trade by 2030 *

* Trade Liberalization Expands Access to Faster

Growing Markets Vital to U.S. *

Trade expansion is expected to boost the American economy,

according to the latest HSBC Global Connections Trade

Forecast. Trade growth contributions to overall GDP are

projected to be driven by increased trade liberalisation and

growing demand to and from emerging and advanced Asian markets.

Trade agreements including the Trans-Pacific Partnership (TPP),

the Transatlantic Trade and Investment Partnership (TTIP), the

Regional Comprehensive Economic Partnership (RCEP) and the WTO

Trade Facilitation Agreement will open markets and have the

potential to eliminate barriers to trade. For businesses this could

mean opportunities for new product development and new trade

partners.

“The dismantling of trade tariffs and removal of other

restrictive barriers to free commerce creates an express lane for

businesses to reach faster-growing markets, underpinning the return

to a more moderate-to-high level growth environment for the U.S.

economy,” said Derrick Ragland, Executive Vice President and Head

of U.S. Middle Market Corporate Banking, HSBC Bank USA, N.A.

Expansion into high growth markets, including China, could mark

an economic boom for American trade. For example, the expansion of

the existing Information Technology Agreement (which includes 75

countries) is projected to increase the value of U.S. exports by

$2.8 billion. It is also expected to boost revenues of U.S.

information and communications technology firms by $10 billion and

support the creation of 60,000 new American jobs (1).

Asian Markets Expected to Dominate U.S Export Demand

In the past three years, exports as a share of U.S. GDP reached

13.5 percent, the highest share since at least 1947 (2). Even as

trade exports grow and liberalization continues, the report finds

that Canada is still expected to remain the top export trade market

for U.S. goods in the medium and long term, due in large part to

its proximity and size. The report projects that by 2030 China will

surpass Mexico as the second largest American export trading

partner, with Mexico dropping into third place. During the same

period Korea is expected to become the fourth largest market for

U.S. exports, followed by Brazil, pushing Japan out of the top

five. In addition, the fastest-growing export markets for American

goods are expected to include China, India, Malaysia and Vietnam,

with growth around nine percent annually.

“Strong economic growth in faster growing Asian economies

represents a major business opportunity for U.S. exporters,” said

Ragland. “It’s up to American businesses to capitalize on this

trend… and every indication is that they will. For example, 7 in 10

U.S. businesses have told HSBC they expect to buy or sell more

goods with China alone in the near-term (3).”

The report also finds that industrial machinery and transport

equipment are expected to remain the major American exports in the

foreseeable future and are expected to contribute about 40 percent

of the projected growth in total exports through 2030. Other

important drivers of exports will include high-value items such as

scientific apparatus, chemicals, and information and communications

technology (ICT) goods, as well as petroleum products and

plastics.

Canada and Mexico Remain the Top Two U.S. Trade Import

Partners

While imports into the U.S. closely mirror that of exports

(industrial machinery and transport equipment), these two

categories together with ICT will collectively account for almost

half of total import growth for the U.S. in the decade leading up

to 2030. Clothing and apparel and petroleum products are expected

to account for around 15 percent of total import growth in this

period. Overall, the strength in these sectors will mainly reflect

solid growth in domestic activity, maintaining the pull for

imports.

The top four largest trade corridors for American imports are

expected to remain unchanged, led by China, Canada, Mexico and

Japan, respectively. Interestingly, the report projects that India

will overtake Germany for the fifth position by 2030. The

fastest-growing countries for U.S. imports over the long term are

projected to be China and Vietnam – with growth at about 9 percent

annually for both countries – and India (up 8 percent) and Mexico

(up 7 percent).

Concluded Ragland, “America’s economic outlook remains firm as

solid job growth, low inflation and strong disposable income growth

all support American household spending. With our highly-educated

labor force, solid institutions, innovative technology and

efficient production processes, the U.S. is well-positioned to

benefit from rising world trade.”

Notes to editors:For updates from the HSBC Press Office,

follow us on Twitter: www.twitter.com/HSBC_Press

About the HSBC Trade Forecast - Modeled by Oxford

EconomicsOxford Economics has tailored a unique service for

HSBC which forecasts bilateral trade for total exports/imports of

goods, based on HSBC’s own analysis and forecasts of the world

economy, to generate a full bilateral set of trade flows for total

imports/exports of goods and balances between 180 pairs of

countries.

Oxford Economics employs a global modeling framework that

ensures full consistency between all economies, in part driven by

trade linkages. The forecasts take into account factors such as the

rate of demand growth in the destination market and the exporter's

competitiveness. Exports, imports and trade balances are

identified, with both historical estimates and forecasts for the

periods 2014-16, 2017-20 and 2021-30. Sectors are classified

according to the UN’s Standard International Trade Classifications

(SITC) and grouped into 30 sector headings. More information about

the sector modeling can be found on

www.globalconnections.hsbc.com

HSBC Commercial BankingFor nearly 150 years we have been

where the growth is, connecting customers to opportunities. Today,

HSBC Commercial Banking serves businesses ranging from small

enterprises to large multinationals in almost 60 developed and

faster-growing markets around the world. Whether it is working

capital, trade finance or payments and cash management solutions,

we provide the tools and expertise that businesses need to thrive.

With a network covering three quarters of global commerce, we make

HSBC the world’s leading international trade and business bank. For

more information see www.hsbc.com/1/2/business-and-commercial

About HSBC Bank USA, N.A.HSBC Bank USA, National

Association (HSBC Bank USA, N.A.), with total assets of US $178.7

billion as of 31 December 2014 (US GAAP), serves 2.4 million

customers through retail banking and wealth management, commercial

banking, private banking, asset management, and global banking and

markets segments. It operates more than 230 bank branches

throughout the United States. There are over 145 in New York as

well as branches in: California; Connecticut; Delaware; Washington,

D.C.; Florida; Maryland; New Jersey; Pennsylvania; Virginia; and

Washington. HSBC Bank USA, N.A. is the principal subsidiary of HSBC

USA Inc., an indirect, wholly-owned subsidiary of HSBC North

America Holdings Inc. HSBC Bank USA, N.A. is a member of the

FDIC.

Sources:(1) Information Technology and Innovation Fund,

http://www2.itif.org/2012-boosting-exports-jobs-expanding-ita.pdf?_ga=1.102254850.2068359215.1432158023(2)

HSBC Report: How America is Made for Trade,

http://cmbinsight.hsbc.com/americamadefortrade(3) HSBC Report: RMB

Internationalization Study 2015

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150528006086/en/

Media inquiries:HSBCNhan

Chiem, +1 212-525-7287nhan.chiem@us.hsbc.com

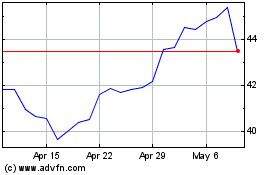

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

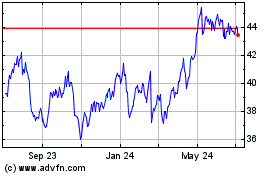

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024