Strong Dollar Batters Metal Investors

November 09 2015 - 4:40AM

Dow Jones News

Gold and base metal prices were trading close to multiyear lows

in Asia on Monday, as the U.S. dollar strengthened amid rising

expectations of a rate increase by the Federal Reserve next month

while concerns grew about weak demand from large commodity consumer

China.

Spot gold was trading at $1,093 per troy ounce during the Asian

afternoon, close to its 5½ -year low in late July. The precious

metal is marginally up from the opening price of $1,089.67 per troy

ounce, but well below the $1,100 per troy ounce that it had traded

above for more than three months.

"I expect gold prices to consolidate around this level as the

chance of a rate increase would have by now been taken into

account," says Jammy Chan, Hong Kong-based head of Greater China

for Gold Bullion International, an institutional precious metals

provider.

A firm U.S. labor market report issued late Friday has raised

market expectations the Fed will soon raise rates. "In fact, if the

positive tone to the data continues, the debate could quickly shift

from the timing of the first hike to the second and subsequent

ones," analysts at ANZ said in a note.

Any U.S. rate increase would further boost the dollar and weigh

on the price of gold and base metals as they are priced in U.S.

dollars.

The slide in gold prices could further support the pickup in

physical demand from top consumer China seen since late July

through the usually peak fourth quarter ending Dec. 31. That demand

may culminate by Lunar New Year on Feb. 8, analysts say.

Chinese demand has firmed up as investors have sought to

diversify their portfolios away from the country's volatile stock

markets, marking a turnaround from last year when gold purchases

tumbled because of anticorruption investigations and more lucrative

potential returns on offer from equities. China's retail gold

demand rose 7.8% in the nine months to September, Hong Kong-based

Argonaut Securities said in a report.

China has also boosted its official reserves by 65 metric tons

of gold in the past four months, Argonaut said. In October, China's

official gold holdings increased by 16 tons from September to 1,723

tons.

However, China's influence on gold prices this year has been

somewhat negated primarily by western investors withdrawing from

gold.

Physical demand from India, the other significant consumer apart

from China, has also been relatively muted during the current peak

season for festival-related demand, which will culminate with the

festival of lights, Diwali, on Nov. 11. Purchases by India's

farmers have been hit by scanty monsoon rains, which has left them

with less spare cash to spend on gold.

The impact of the dollar's rise extended to trading in base

metals Monday, with prices of aluminum, copper and zinc hovering

close to multiyear lows following weak October trade data from

China.

"A stronger U.S. dollar is typically a downside risk for

commodity prices, which helps to explain the selloff we have seen

in key base metal prices in recent days," said Paul Bloxham, HSBC's

chief economist for Australia and New Zealand.

Three-month aluminum inched up by $4 after a sharp fall in the

previous session and was last at $1,527 a ton, close to a six-year

low recorded at the end of October. China's aluminum and aluminum

product exports fell to 330,000 tons in October, the lowest level

since February 2014. China is the world's largest producer of

aluminum and has been forced to increase exports as domestic demand

has slowed. A fall in Chinese exports shows there are now fewer

takers globally, which may worsen a supply glut.

Copper rose $7 to $4,997 a ton, but remained close to a six-year

low reached in late August. China's copper imports in October fell

7.7% from the preceding month to 420,000 tons.

Write to Biman Mukherji at biman.mukherji@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 09, 2015 04:25 ET (09:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

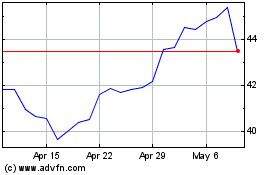

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

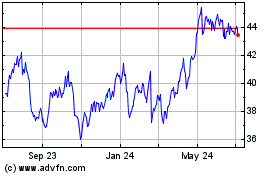

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024