Stress Test Pressure May See U.K. Banks Cut Dividends

November 27 2015 - 9:30AM

Dow Jones News

LONDON—Britain's largest banks could be forced to cut dividends

as the Bank of England steps up pressure on them to hold more

capital.

Analysts say U.K. regulators are making renewed efforts to get

banks to hold more capital through increasingly stringent stress

tests, even as the results of the most recent exam, due Tuesday,

are expected to show a perfect pass rate.

The latest test studied how seven major banks—HSBC Holdings PLC,

Barclays PLC, Lloyds Banking Group PLC, Standard Chartered PLC,

Royal Bank of Scotland Group PLC, Santander UK and Nationwide

Building Society—would fare in what have turned out to be real life

scenarios of an emerging markets downturn and low oil price.

The banks should all be strong enough to pass, but analysts say

the focus now is on the Bank of England's previously announced

plans to make the tests even harder from next year. Banks that

don't pass stress tests can be forced to raise additional capital

or postpone paying shareholder dividends.

"We don't expect outright capital deficits on Tuesday," said

Peter Richardson, a banking analyst at Berenberg. "What we do see

is a growing headwind of tougher tests and higher hurdle rates to

pass them. These will continue to erode expectations of dividends,"

he said.

Even before the stress tests, some banks have been revising

their dividend plans. Standard Chartered canceled paying a year-end

dividend and Barclays reversed plans to raise its payout. In both

cases, the moves marked an effort by the banks to conserve capital

as they undergo major restructurings. British banks, while widely

seen as healthier than many of their continental European rivals,

are still struggling to reshape their businesses to fit a tougher

economic and regulatory climate for banking.

From next year, the regulatory demands are set to get even

tougher, as the Bank of England raises the level of minimum capital

needed by the seven banks to pass its annual test. Each bank will

have a unique number of how much is enough, reflecting Bank of

England requirements and additional global buffers for the

country's four systemically important banks—Barclays, HSBC, RBS and

Standard Chartered.

The move ties in with a growing reliance on stress tests by the

Bank of England and regulators in the U.S. and elsewhere to predict

how their banking systems would cope in stressful conditions.

"Stress tests (are) increasingly the primary way banks are

regulated" in Britain, analysts at Morgan Stanley wrote in a report

Tuesday, calling the health checks "a gate on payouts". They said

higher capital levels than banks' current targets "could be needed

for major U.K. banks to give comfort that thresholds are not likely

to be breached during future stress tests".

Stress tests have become a key tool for the BOE and other

banking regulators to determine whether banks have enough capital

to withstand shocks and prevent a repeat of the financial crisis of

2008. The British tests assess the capital strength of individual

banks, as well as the overall stability of the country's financial

system. Banks that don't pass the tests can be forced to raise

additional capital or postpone paying shareholder dividends.

Banks also face the possibility on Tuesday of a new capital

buffer on their domestic lending, with signs that the Bank of

England's Financial Policy Committee may be poised to make its

first use of a so-called countercyclical buffer.

Bank of England Governor Mark Carney told lawmakers this week

that the central bank is concerned about how borrowing at low rates

over an extended period has fueled Britain's property market and

other lending, and that the extra buffer could help smooth out

problems.

At the core of officials' concern is a pickup in credit growth.

Overall lending to consumers rose at a 3% annual rate in September,

and growth in unsecured borrowing has accelerated to an annual 8%

rate, according to BOE data.

While still well below the 10% annual growth in overall consumer

lending that prevailed in the years before financial crisis struck

in 2008, economists say the central bank could act to prevent

credit growth accelerating further

"They are warming up to do it," said Richard Barwell, a senior

economist at BNP Paribas Investment Partners and a former BOE

official.

Jason Douglas contributed to this article.

Write to Margot Patrick at margot.patrick@wsj.com

Access Investor Kit for "Lloyds Banking Group"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB0008706128

Access Investor Kit for "Barclays Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB0031348658

Access Investor Kit for "Barclays Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US06738E2046

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 27, 2015 09:15 ET (14:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

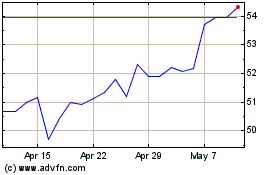

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024