Stocks Steady, French Bonds Recover as Election Fears Fade

February 23 2017 - 5:20AM

Dow Jones News

By Riva Gold and Ese Erheriene

Global stocks were largely steady Thursday while waning concerns

around the French election offered relief to the euro and French

government bonds.

The Stoxx Europe 600 was up 0.1% in morning trading, following

subdued sessions in Asia and on Wall Street.

Shares of Barclays PLC rose over 3%, leading gains in the

region, after the U.K. bank swung to a full year net profit and

said it was just months away from finishing a restructuring. Oil

and gas companies also climbed as Brent crude oil jumped 1.6% to

$56.94 a barrel.

A fall in metals prices weighed on the basic resources sector,

however, after iron-ore prices in China slid for a second day and

copper futures pulled back.

The euro and French government bonds continued to recover from a

recent selloff after centrist candidate François Bayrou announced

his offer of an alliance with independent centrist Emmanuel Macron

on Wednesday. Officials said Mr. Macron accepted Mr. Bayrou's

offer.

The news helped diminish some investors' fears of a victory for

anti-euro candidate Marine Le Pen. Recent polls had continued to

suggest Ms. Le Pen would likely be beaten in the second round of

the French election, but by a narrowing margin.

The euro was last up 0.1% at $1.0558 after snapping a

three-session losing streak on Wednesday. German 10-year yields

inched up to 0.279% from 0.272% previously and 2-year government

yields edged up from record lows, while French 10-year yields fell

to 0.998% from 1.025%. Yields move inversely to prices.

Investors had been avoiding French assets and the euro and

flocking to the safety of German stocks and bonds in recent

sessions. Germany's DAX index was unchanged Thursday after closing

at its highest since April 2015.

Global investors were also digesting the latest Federal Reserve

meeting minutes, where officials suggested that lifting U.S.

interest rates "fairly soon" may be appropriate in light of an

improving economy. Many officials continued to expect a gradual

pace of rate rises and only a modest risk of an inflation

overshoot.

The minutes did little to lift expectations for a rate rise in

March, with U.S. government bonds strengthening and the dollar

ending the day with modest declines. The WSJ Dollar Index was last

flat, while 10-year Treasury yields were unchanged at 2.416%.

Arthur Kwong, head of Asia Pacific equities at BNP Paribas

Investment Partners, said the firm is trying to stick with its

assumption that there will be three rate increases this year, "but

I think the feeling is getting more there may be only two."

Banks and financials mostly declined across Asia amid

disappointment there wasn't a clearer signal on rate rises, causing

Japan's Nikkei to end flat and Hong Kong's Hang Seng Index to shed

0.4%, after briefly rising to its highest level since September.

Higher interest rates tend to boost banks' profitability.

Shanghai shares pulled back on losses in infrastructure stocks,

as well as reports that the government plans to ban futures

companies from asset-management businesses--though analysts are

skeptical that it will carry out such drastic measures.

"The regulator must consider whether the market can absorb the

shocks from these tightening rules," says Xiao Shijun, an analyst

at Guodu Securities.

Futures pointed to small opening gains on Wall Street after a

decline in energy shares sent the S&P 500 narrowly lower on

Wednesday.

U.S. stocks continue to hover near record highs amid hopes that

stronger growth, higher inflation and tax cuts from the new

administration will lift corporate profits.

"It feels to me like the market is pricing in a lot more

optimism than it should be," said David Lafferty, chief strategist

at Natixis Global Asset Management.

"We have the most controversial president in history, the U.K.

is leaving the EU, there are existential risks in France, high

valuations...and volatility is low."

William Horobin

,

Yifan Xie

, David Harrison and Hiroyuki Kachi contributed to this

article.

Write to Riva Gold at riva.gold@wsj.com and Ese Erheriene at

ese.erheriene@wsj.com

(END) Dow Jones Newswires

February 23, 2017 05:05 ET (10:05 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

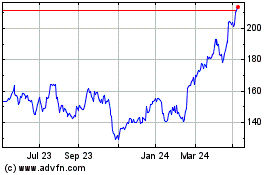

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

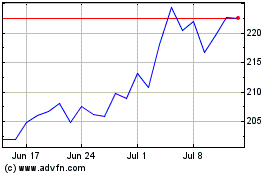

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024