By Dan Strumpf and Riva Gold

Stocks pared their declines heading into the close Monday in a

volatile session that saw investors rush into haven assets.

After dropping as much as 401 points earlier, the Dow Jones

Industrial Average traded down 131 points, or 0.8%, to 16074 in

afternoon trading, while the S&P 500 lost 1% and the

technology-laden Nasdaq Composite declined 1.4%.

Losses were heaviest in the financial sector, where big banks in

both the U.S. and Europe sank amid persistent worries about the

pace of global economic growth. Shares of Deutsche Bank fell 9.5%

in Germany, while the country's DAX index fell 3.3% to close in

bear-market territory, down 21% from a late-November high.

Goldman Sachs Group shares declined 4.8%, while Morgan Stanley

fell 6.4%.

Heavy selling in beleaguered energy shares also intensified.

Chesapeake Energy Corp. fell by as much as half and was recently

down 34%. The natural-gas producer said it "has no plans to pursue

bankruptcy" after reports intensified such fears. Pipeline company

Williams Cos. lost 35%.

As investors sought safety, they rushed into government bonds,

boosting prices and pressuring yields. U.S. 10-year Treasury yields

fell to 1.736% from 1.846% on Friday as prices rose. Gold--another

haven--rose 3.4% to $1197.50 an ounce.

U.S. stocks have fallen sharply this year on the back of

tumbling oil prices and worries over decelerating global economic

growth. Investors have bid up government bonds as a haven, pushing

yields around the world sharply lower.

"The big picture thing is there's a lot more pain to go around,"

said Bill Costello, an energy analyst at investment manager

Westwood Holdings Group Inc., referring to the sharp declines in

energy producer shares. "The longer oil prices stay down, the

harder the slog these companies will go through."

Losses in the oil market accelerated, with U.S.-traded crude

futures down 3.9% to $29.69 a barrel.

Other forces were also weighing down stocks world-wide, some

traders said. Data over the weekend on China's foreign-exchange

reserves raised concerns about the country's ability to continue

its intervention in the currency markets.

The data showed that China's currency reserves fell to their

lowest level in more than three years, though many analysts had

expected an even larger drop.

Investors also continued to digest recent U.S. economic data.

Following Friday's U.S. jobs report, "there's a lot of uncertainty

weighing on markets," said Philippe Gijsels, chief strategist at

BNP Paribas Fortis. "People are starting to worry that the lower

oil price and situation in China are starting to impact the U.S.

and European economies," he added.

Junk bond prices fell. A proxy for junk, the $13.7 billion

iShares iBoxx USD High Yield Corporate Bond exchange-traded fund,

lost 1.4%.

In Europe, the Stoxx Europe 600 fell 3.5%, reversing an early

bounce. After five consecutive sessions of losses, the pan-European

index now sits at lows not seen since 2014.

While falling oil prices benefit consumers, a rise or

stabilization in oil prices "would alleviate strains from the

global financial system," said Mark Heppenstall, chief investment

officer at Penn Mutual Asset Management, which manages $20 billion

in assets.

"A lot of emerging market economies have revenues dependent on

oil and commodities and debt denominated in U.S. dollars--that mix

has proven pretty toxic," he added.

Monday's moves followed a rocky session on Wall Street Friday,

when a dive in technology shares and the mixed jobs report sent

U.S.-listed stocks lower across the board.

Job creation slowed in January after three consecutive months of

gains, data showed, but a slight fall in unemployment and a modest

uptick in wages left the prospect of further U.S. interest rate

increases this year on the table.

In Asian trade, Japan's Nikkei Stock Average gained 1.1% as the

yen fell against the dollar, while Australia's S&P ASX 200

ended flat.

Other markets in Asia were closed for the Lunar New Year

Holiday.

In currencies, the dollar fell 0.9% against the yen, while the

euro lost 0.2% against the dollar.

In commodities, three-month copper futures on the London Metal

Exchange were down 0.5% at $4592.50 a ton.

--Corrie Driebusch contributed to this article.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

February 08, 2016 16:07 ET (21:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

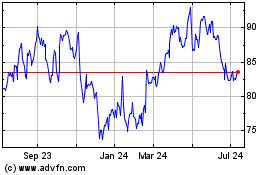

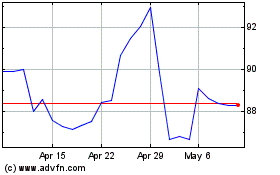

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024