Stocks Edge Up With Focus on Upcoming U.S. Bank Earnings -- 3rd Update

January 13 2017 - 7:41AM

Dow Jones News

By Riva Gold

European stocks and S&P 500 futures advanced Friday as

investors waited to see whether the start of banks' earnings season

could help rekindle a postelection rally.

The Stoxx Europe 600 rose 0.5% midday, while London's FTSE 100

index added 0.3% after ending higher for 13 straight days, its

longest winning streak on record.

Futures pointed to a 0.1% opening gain for the S&P 500 on

Friday, as investors anticipated a report on U.S. retail sales and

focused on fourth-quarter earnings from major banks.

Shares of Bank of America Corp. rose 0.4% in premarket trading

after it kicked off banks' earnings season by beating expectations

on profit as its trading desk benefited from uncertainty around the

U.S. election. Shares of J.P. Morgan Chase & Co. and Wells

Fargo & Co. also advanced ahead of the release of their

results, while Morgan Stanley added 2.6%.

Shares of U.S. lenders have jumped since the November election

on expectations for higher U.S. interest rates and a rollback of

regulation, helping send major bourses to record highs. U.S. stocks

fell Thursday, however, as financial shares declined ahead of the

earnings reports.

"You've had quite a rally--you do need to see positive surprises

come through to drive that a lot further," said Simon Webber, a

global equities manager at Schroders. "I'll be looking for evidence

of improvement in net interest margins from the rate increase we've

seen," Mr. Webber said.

The Federal Reserve raised interest rates in December for the

first time in a year. Higher interest rates tend to boost lenders'

profitability, as the rates they charge on many loans are directly

tied to the Fed's target rate.

Some investors are hoping upbeat news from U.S. banks can help

rekindle a postelection rally driven by hopes the new

administration will help accelerate a rise in growth and

inflation.

After a steep climb, U.S. stocks have largely moved sideways for

the past month, keeping the Dow Jones Industrial Average just shy

of the 20000 milestone. Major global stock indexes are on track to

end the week slightly lower, while gold has gained over 2% and the

dollar has weakened, as popular postelection trades have moved into

reverse.

"I think the market had been giving President-elect Trump a lot

of the benefit of the doubt that his pro-business ideas or plans

are going to be ultimately enacted but that antibusiness things

such as border walls and trade wars will probably not happen," said

Randy Frederick, vice president of trading and derivatives at

Schwab.

Between now and the inauguration on Jan. 20, however, "the

market is in a wait-and-see mode," he said, with investors waiting

for clarity on the new president's top agenda items and the timing

of expected policy changes.

Elsewhere in markets, gains in Europe were led by banks and

health care companies, which had been among the worst performers

for most of the week.

Europe's auto sector pared gains midmorning after French

prosecutors said they opened a probe against Renault SA on

emissions, sending shares of the French car company down 2.7%.

Shares of Fiat Chrysler Automobiles gained nearly 4%, however,

after suffering a steep fall Thursday when regulators in the U.S.

accused the car maker of using illegal software to mask emissions.

Chief Executive Sergio Marchionne denied the auto maker subverted

emissions rules or violated any regulations.

Earlier Friday, shares were mixed during Asian trading hours

after data showed Chinese exports fell sharply last month amid weak

demand, adding to some investors' concerns about the health of the

world's second-largest economy. Hong Kong's Hang Seng Index

advanced 0.5% and Japan's Nikkei Stock Average added 0.8%, while

markets in Australia shed 0.8% and Shanghai declined 0.2%.

In currencies, the WSJ Dollar Index inched down 0.2%, with the

dollar last down 0.2% against the yen, 0.3% against the euro and

0.7% against the British pound. The Turkish lira fell over 1%

against the dollar, capping a volatile week.

In government bond markets, the yield on the 10-year U.S.

Treasury note was little changed at 2.355% from 2.358% Thursday,

while 10-year German bund yields were at 0.238% from 0.232%. Yields

move inversely to prices.

Nick Kostov, Christina Rexrode and Eric Sylvers contributed to

this article.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

January 13, 2017 07:26 ET (12:26 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

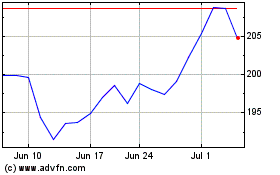

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024