By Christopher Alessi

FRANKFURT -- The boss of Thyssenkrupp AG is finally on the brink

of putting steel in the German company's past -- if he can sever

ties with its European steel legacy.

The storied industrial firm, which traces its roots to the early

19th century, took a big step away from its once-core steel

business when it unexpectedly announced late last month the sale of

the last of its beleaguered steel assets in the Americas, a

Brazilian plant. The deal, flagged by The Wall Street Journal in

October, is the most concrete sign to date that Chief Executive

Heinrich Hiesinger is driving forward the company's transformation

from staid steel giant into a lean capital-goods operation.

Investors are watching to see whether Mr. Hiesinger can deliver

on the next part of his strategy: separating Thyssenkrupp's

European steel business. That unit has been squeezed by a

protracted steel glut and inexpensive steel imports from China,

amid continuing consolidation in the industry.

Mr. Hiesinger has said he wants to remake Thyssenkrupp around

high-margin capital goods such as elevators, sophisticated car

components and submarines. But his efforts to get rid of the

Brazilian plant were long thwarted by challenging market conditions

in that region.

The company plans to sell the plant to Ternium SA, a

Luxembourg-based steel producer with a strong presence in Latin

America, for EUR1.26 billion ($1.33 billion). The transaction would

result in a EUR900 million write-down, but would also reduce the

company's roughly EUR3.5 billion in net debt by EUR1.5 billion.

"Folks in the market thought [the plant] would be an overhang

and realize very little value," said F. David Segal, a portfolio

manager at Franklin Mutual Series, a Thyssenkrupp shareholder.

"The fact that they were able to get what appears to be good

value earlier than anticipated allows all stakeholders to focus on

the future of Thyssenkrupp when it's out of the steel business,"

Mr. Segal said.

European steelmakers have shed thousands of jobs and closed

unprofitable plants in recent years. After hitting all-time lows in

early 2016, steel prices have since started to rally, helped in

part by moderating competition and plant closings, experts say.

"The steel industry is now a global industry and to [compete in]

that you need size," said Ben Orhan, a steel expert at IHS Markit

Ltd.

Thyssenkrupp has been in talks with India's Tata Steel Ltd. for

roughly two years to form a European flat-steel-products joint

venture that would allow the German firm to untangle steel from its

capital-goods operations. But the potential deal has stalled in

part over a dispute regarding pension obligations.

Mr. Orhan said a tie-up between Thyssenkrupp and Tata "makes

perfect sense," but the companies could lose their window of

opportunity.

"The longer it sits, the less likely it becomes," Mr. Orhan

said.

A spokesperson for Tata said the company continues to be

"engaged in constructive discussions" with Thyssenkrupp on a

tie-up.

Mr. Hiesinger declined to comment for this article. Thyssenkrupp

has said that consolidation in the European steel industry is

necessary, and that it is in talks with Tata and others.

If Thyssenkrupp is ever going to be seen by investors as a

lucrative capital-goods enterprise rather than a slow-growing steel

dinosaur, it would have to secure a deal with Tata soon, according

to investors.

Mr. Hiesinger would have to show he can "get that across the

finish line, " said Franklin Mutual's Mr. Segal.

A deal with Tata or a spinoff of the European steel business

would likely mean the gap with peers "should close and the market

should focus on Thyssenkrupp as a capital-goods company," Mr. Segal

said.

Thyssenkrupp posted total sales of EUR39.29 billion and net

profit of EUR296 million in fiscal 2016. Its elevator business --

the crown jewel of its capital-goods businesses -- delivered a

profit margin of 11%, compared with a margin of 5.7% at Steel

Europe and a loss at Steel Americas.

"We are now more independent from fluctuations in the steel

market," Mr. Hiesinger said following the announcement of the

Brazilian plant sale. After the deal, expected to close by October,

Thyssenkrupp will generate roughly 75% of sales from capital goods,

Mr. Hiesinger said.

Since Thyssenkrupp hired Mr. Hiesinger in 2011 following

corruption scandals and years of stagnation, the Siemens AG veteran

has steered the company back to a fragile profitability. One of his

initial moves was to sell Thyssenkrupp's troubled Alabama

steel-rolling and coating plant for $1.55 billion to a consortium

of ArcelorMittal SA and Nippon Steel Sumitomo Metal Corp.,

improving the balance sheet and shifting investment to capital

goods.

The expected sale of the Brazil plant "sets the stage for a

successful re-rating" of the company based on its capital-goods

businesses, said Seth Rosenfeld, an analyst at Jefferies LLC.

But it is unclear whether investors will value Thyssenkrupp on

par with profitable capital-goods firms such as German peer

Siemens.

"One of the big problems of Thyssenkrupp is that it doesn't

generate any free cash flow, and the last quarter was again a huge

disaster in terms of cash flow," said Joerg Schneider, a portfolio

manager at Thyssenkrupp shareholder Union Investment.

Free cash flow for the first quarter of fiscal 2017, ending Dec.

31, came in at a loss of EUR1.7 billion, which the company

attributed to a temporary increase in net working capital. "And

because of that I'm not willing to give them a multiple like a

traditional capital-goods company, " Mr. Schneider said.

Write to Christopher Alessi at christopher.alessi@wsj.com

(END) Dow Jones Newswires

March 26, 2017 15:00 ET (19:00 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

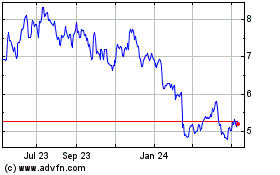

Thyssenkrupp (PK) (USOTC:TKAMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

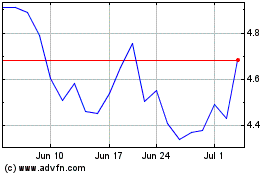

Thyssenkrupp (PK) (USOTC:TKAMY)

Historical Stock Chart

From Apr 2023 to Apr 2024