Steel Giant Expects Pain to Ease -- WSJ

May 07 2016 - 3:04AM

Dow Jones News

By John W. Miller and Alex MacDonald

LONDON -- ArcelorMittal, the world's biggest steel producer,

said U.S. and European markets are stabilizing after record Chinese

steel exports last year caused prices to plummet around the

globe.

"It's recovery with a pinch-of-salt concern about Chinese

overcapacity," Chief Executive Lakshmi Mittal said in an interview

on Friday.

The Luxembourg-based steelmaker, which accounts for roughly 6%

of global steel output, posted a net loss of $416 million in the

first quarter, compared with a $728 million net loss in the same

period a year earlier, missing analysts' forecasts.

Revenue fell 22% to $13.4 billion, reflecting lower steel and

iron-ore prices as well as lower steel and iron-ore shipments by

the company.

The steel industry has been cyclical since its creation in the

19th century, but the latest downturn has been particularly

pernicious because of Chinese capacity. The country now accounts

for half the world's annual production of 1.6 billion metric tons

of steel, and it has been on an export binge. China last year set a

record, shipping out 100.4 million tons of the metal, more than the

U.S. produced annually during World War II. Last year, only Japan

made more steel than China exported.

As a result, prices fell almost everywhere. "China's dumping

steel and overcapacity has clearly influenced prices," Mr. Mittal

said. "We always believed those price levels were not

sustainable."

Chinese officials have denied dumping, or selling without profit

to gain market share, saying lower demand has deflated prices.

The wave of low-cost shipments coming out of China prompted

European Union and U.S. governments to impose import tariffs to

protect their steelmakers. Imports are now ebbing in the U.S. and

EU. That trend along, with falling inventories and strengthening

demand, has buoyed prices. In the U.S., the benchmark hot-rolled

coil index has risen 45% to $548 since Jan. 1, after declining by a

third in 2015.

Inventories in the U.S. are now below the historical average,

said Jim Baske, executive vice president for North America. Demand

in the automotive sector is still strong, and there has been a

moderate pickup in construction, he said.

Chinese steel officials have said they need to eliminate 200

million tons of overcapacity. Mr. Mittal said he thought China had

become much more serous about cutting capacity.

Mr. Mittal cautioned that the global steel market remains

vulnerable to excess steel capacity in China. He urged governments

to remain vigilant about unfair trade and granting China so-called

market economy status, a certification by the European Union or

U.S. that would make it harder to impose tariffs on Chinese

imports.

ArcelorMittal's mining business has also suffered from the

downturn. Its iron-ore production of 14.1 million tons in the first

quarter was down 9.1% from a year earlier.

The company's narrower first-quarter loss stemmed in part from a

small foreign-exchange gain compared with a foreign-exchange and

net financing loss of $756 million in the year-earlier quarter.

ArcelorMittal earlier this year raised EUR2.8 billion ($3.2

billion) through a rights issue to strengthen its balance sheet

given the protracted steel-price rout. Other steelmakers, such as

Sweden's SSAB AB, followed suit.

ArcelorMittal's shares subsequently rallied after the rights

issue was announced and are up nearly 50% so far this year, buoyed

by the pickup in steel prices in its key U.S. and European markets

as well as China. The company's American depositary receipts fell

0.9% to $5.26 in New York on Friday.

The steelmaker expects the higher steel prices to be fully

reflected in its earnings in the second half of the year. The

company kept its 2016 forecast for earnings before interest, taxes,

depreciation and amortization at a minimum of $4.5 billion.

Jefferies analyst Seth Rosenfeld said he was slightly surprised

that ArcelorMittal didn't raise its outlook, although he noted the

company doesn't necessarily need to revise the guidance since it is

open-ended.

Net debt rose to $17.3 billion as of the end of March, from

$15.7 billion at the end of December, because of seasonal working

capital adjustments.

At the end of the first quarter, net debt was estimated at $13.3

billion after taking into account the proceeds from its $3.2

billion rights issue in April and the roughly $1 billion sale of

its 35% stake in Spanish auto-parts manufacturer Gestamp

Automoción, the company said.

Write to John W. Miller at john.miller@wsj.com and Alex

MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

May 07, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

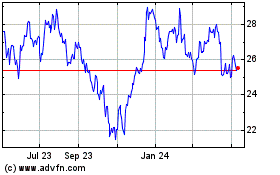

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

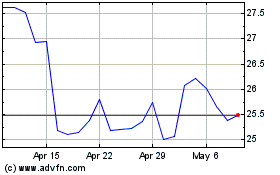

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024