Statement of Ownership (sc 13g)

June 26 2017 - 4:33PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 13G

(Rule 13d-102)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO

RULES 13d-1(b), (c) AND (d) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(b)

Pangaea

Logistics Solutions Ltd.

(Name of Issuer)

Common Shares, $0.0001 par value

(Title of Class of Securities)

G6891L105

(CUSIP Number)

June 15, 2017

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to

designate the rule pursuant to which this Schedule is filed:

☐ Rule 13d-1(b)

☒ Rule 13d-1(c)

☐

Rule 13d-1(d)

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF

REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

VR Global Partners, L.P.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP*

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

2,222,2222

|

|

|

6

|

|

SHARED VOTING POWER

0

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

2,222,2222

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

0

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,222,2222

|

|

10

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (9) EXCLUDES CERTAIN SHARES*

☐

|

|

11

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 9

5.1% **

|

|

12

|

|

TYPE OF REPORTING PERSON*

PN

|

|

*

|

SEE INSTRUCTIONS BEFORE FILLING OUT

|

2

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF

REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

VR Advisory Services Ltd

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP*

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

2,222,2222

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

2,222,2222

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,222,2222

|

|

10

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (9) EXCLUDES CERTAIN SHARES*

☐

|

|

11

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 9

5.1% **

|

|

12

|

|

TYPE OF REPORTING PERSON*

CO, IA

|

|

*

|

SEE INSTRUCTIONS BEFORE FILLING OUT

|

3

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF

REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

VR Capital Participation Ltd.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP*

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

2,222,2222

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

2,222,2222

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,222,2222

|

|

10

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (9) EXCLUDES CERTAIN SHARES*

☐

|

|

11

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 9

5.1% **

|

|

12

|

|

TYPE OF REPORTING PERSON*

CO, HC

|

|

*

|

SEE INSTRUCTIONS BEFORE FILLING OUT

|

4

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF

REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

VR Capital Group Ltd.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP*

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

2,222,2222

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

2,222,2222

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,222,2222

|

|

10

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (9) EXCLUDES CERTAIN SHARES*

☐

|

|

11

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 9

5.1% **

|

|

12

|

|

TYPE OF REPORTING PERSON*

CO, HC

|

|

*

|

SEE INSTRUCTIONS BEFORE FILLING OUT

|

5

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF

REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

VR Capital Holdings Ltd.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP*

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

2,222,2222

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

2,222,2222

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,222,2222

|

|

10

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (9) EXCLUDES CERTAIN SHARES*

☐

|

|

11

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 9

5.1% **

|

|

12

|

|

TYPE OF REPORTING PERSON*

CO, HC

|

|

*

|

SEE INSTRUCTIONS BEFORE FILLING OUT

|

6

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF

REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

Richard Deitz

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP*

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

2,222,2222

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

2,222,2222

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,222,2222

|

|

10

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (9) EXCLUDES CERTAIN SHARES*

☐

|

|

11

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 9

5.1% **

|

|

12

|

|

TYPE OF REPORTING PERSON*

IN, HC

|

|

*

|

SEE INSTRUCTIONS BEFORE FILLING OUT

|

7

SCHEDULE 13G

This Schedule 13G (this “Schedule 13G”) relates to shares of Common Shares, $0.0001 par value (“Common Stock”), of Pangaea

Logistics Solutions Ltd., a Bermuda exempted company (the “Issuer”), and is being filed on behalf of (i) VR Global Partners, L.P. (the “Fund”), a Cayman Islands exempted limited partnership, (ii) VR Advisory Services

Ltd (“VR”), a Cayman Island exempted company, as the general partner of the Fund, (iii) VR Capital Participation Ltd. (“VRCP”), a Cayman Islands exempted company, as the sole shareholder of VR, (iv) VR Capital Group

Ltd. (“VRCG”), a Cayman Islands exempted company, as the sole shareholder of VRCP, (v) VR Capital Holdings Ltd. (“VRCH”), a Cayman Islands exempted company, as the sole shareholder of VRCG and (vi) Richard Deitz, the

principal of VR, VRCP, VRCG, VRCH (collectively with the Fund, VR, VRCP, VRCG and VRCH, the “Reporting Persons”). All shares of Common Stock are held by the Fund.

|

Item 1(a)

|

Name of Issuer.

|

Pangaea Logistics Solutions Ltd.

|

Item 1(b)

|

Address of Issuer’s Principal Executive Offices.

|

c/o Phoenix Bulk Carriers (US)

LLC

109 Long Wharf

Newport,

RI 02840

|

Item 2(a)

|

Name of Person Filing.

|

(i) VR Global Partners, L.P. (the “Fund”),

(ii) VR Advisory Services Ltd (“VR”), (iii) VR Capital Participation Ltd. (“VRCP”), (iv) VR Capital Group Ltd. (“VRCG”), VR Capital Holdings Ltd. “VRCH”) and (iv) Richard Deitz.

|

Item 2(b)

|

Address of Principal Business Office, or, if none, Residence.

|

For the Fund, VRCP, VRCG

and VRCH:

c/o o Intertrust (Cayman) Limited

190 Elgin Avenue

George Town

Grand Cayman

KY1-9005

Cayman Islands

For VR and

Mr. Deitz:

Niddry Lodge, 51 Holland Street, First Floor

London W8 7JB

8

|

Item 2(c)

|

Citizenship or Place of Organization.

|

The Fund is a Cayman Islands exempted limited

partnership. VR is a Cayman Islands exempted company. VRCP is a Cayman Islands exempted company. VRCG is a Cayman Islands exempted company. VRCH is a Cayman Islands exempted company. Mr. Deitz is a United States citizen.

|

Item 2(d)

|

Title of Class of Securities.

|

Common Shares, $0.0001 par value (the “Common

Stock”).

G6891L105

|

Item 3

|

If this statement is filed pursuant to

§§240.13d-1(b)

or

240.13d-2(b)

or (c), check whether the person filing is a:

|

Inapplicable.

For the Fund:

|

|

|

|

|

|

|

|

|

|

|

Sole Beneficial

Ownership

|

|

Shared Beneficial

Ownership

|

|

|

Percentage of

Outstanding (1)

|

|

|

2,222,222

|

|

|

0

|

|

|

|

5.1

|

%

|

For VR:

|

|

|

|

|

|

|

|

|

|

|

Sole Beneficial

Ownership

|

|

Shared Beneficial

Ownership

|

|

|

Percentage of

Outstanding (1)

|

|

|

0

|

|

|

2,222,222

|

|

|

|

5.1

|

%

|

For VRCP:

|

|

|

|

|

|

|

|

|

|

|

Sole Beneficial

Ownership

|

|

Shared Beneficial

Ownership

|

|

|

Percentage of

Outstanding (1)

|

|

|

0

|

|

|

2,222,222

|

|

|

|

5.1

|

%

|

For VRCG:

|

|

|

|

|

|

|

|

|

|

|

Sole Beneficial

Ownership

|

|

Shared Beneficial

Ownership

|

|

|

Percentage of

Outstanding (1)

|

|

|

0

|

|

|

2,222,222

|

|

|

|

5.1

|

%

|

For VRCH:

|

|

|

|

|

|

|

|

|

|

|

Sole Beneficial

Ownership

|

|

Shared Beneficial

Ownership

|

|

|

Percentage of

Outstanding (1)

|

|

|

0

|

|

|

2,222,222

|

|

|

|

5.1

|

%

|

For Mr. Deitz:

|

|

|

|

|

|

|

|

|

|

|

Sole Beneficial

Ownership

|

|

Shared Beneficial

Ownership

|

|

|

Percentage of

Outstanding (1)

|

|

|

0

|

|

|

2,222,222

|

|

|

|

5.1

|

%

|

|

(1)

|

The above percentages were computed using 43,928,515 shares of Common Stock outstanding as of June 15, 2016 as reported by the Issuer to the Reporting Persons.

|

9

The filing of this Amendment shall not be construed as an admission that VR, VRCP, VRCG, VRCH or Mr. Deitz

is or was the beneficial owner of any of the Common Stock of the Issuer purchased by the Fund. Pursuant to Rule 16a-1, VR, VRCP, VRCG, VRCH and Mr. Deitz disclaim such beneficial ownership except to the extent of its or his respective pecuniary

interest therein.

|

Item 5

|

Ownership of Five Percent or Less of a Class.

|

Inapplicable.

|

Item 6

|

Ownership of More Than Five Percent on Behalf of Another Person.

|

Inapplicable.

|

Item 7

|

Identification and Classification of the Subsidiary which Acquired the Security Being Reported On by the Parent Holding Company.

|

Inapplicable.

|

Item 8

|

Identification and Classification of Members of the Group.

|

Inapplicable.

|

Item 9

|

Notice of Dissolution of Group.

|

Inapplicable.

By signing below each of the Reporting Persons certifies that, to the

best of such person’s knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were not acquired

and are not held in connection with or as a participant in any transaction having that purpose or effect.

Joint Filing Agreement by and among the Reporting Persons dated as of

June 26, 2017.

10

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date: June 26, 2017

|

|

|

|

|

|

|

VR Global Partners, L.P.

|

|

|

|

By: VR Advisory Services Ltd, its general partner

|

|

|

|

|

|

|

|

By:

|

|

/s/ Richard Deitz

|

|

|

|

Name:

|

|

Richard Deitz

|

|

|

|

Title:

|

|

Authorized Person

|

|

|

|

VR Advisory Services Ltd

|

|

|

|

|

|

|

|

By:

|

|

/s/ Richard Deitz

|

|

|

|

Name:

|

|

Richard Deitz

|

|

|

|

Title:

|

|

Authorized Person

|

|

|

|

VR Capital Participation Ltd.

|

|

|

|

|

|

|

|

By:

|

|

/s/ Richard Deitz

|

|

|

|

Name:

|

|

Richard Deitz

|

|

|

|

Title:

|

|

Authorized Person

|

|

|

|

VR Capital Group Ltd.

|

|

|

|

|

|

|

|

By:

|

|

/s/ Richard Deitz

|

|

|

|

Name:

|

|

Richard Deitz

|

|

|

|

Title:

|

|

Authorized Person

|

|

|

|

VR Capital Holdings Ltd.

|

|

|

|

|

|

|

|

By:

|

|

/s/ Richard Deitz

|

|

|

|

Name:

|

|

Richard Deitz

|

|

|

|

Title:

|

|

Authorized Person

|

|

|

|

/s/ Richard Deitz

|

|

Richard Deitz

|

11

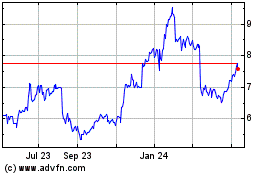

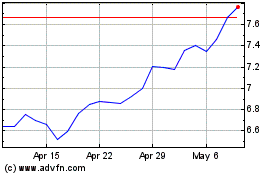

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Apr 2023 to Apr 2024