Statement of Changes in Beneficial Ownership (4)

August 03 2016 - 7:45PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

CONSIDINE TERRY

|

2. Issuer Name

and

Ticker or Trading Symbol

APARTMENT INVESTMENT & MANAGEMENT CO

[

AIV

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__

X

__ Director

_____ 10% Owner

__

X

__ Officer (give title below)

_____ Other (specify below)

Chairman & CEO

|

|

(Last)

(First)

(Middle)

4582 S. ULSTER STREET, SUITE 1100

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

8/2/2016

|

|

(Street)

DENVER, CO 80237

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Class A Common Stock

(1)

|

8/2/2016

|

|

M

|

|

346180

|

A

|

$42.43

|

498178

(2)

|

D

|

|

|

Class A Common Stock

|

8/2/2016

|

|

F

|

|

318897

|

D

|

$46.06

|

179281

(2)

|

D

|

|

|

Class A Common Stock

|

8/2/2016

|

|

S

|

|

27283

|

D

|

$45.29

(4)

|

151998

(2)

|

D

|

|

|

Class A Common Stock

|

8/2/2016

|

|

M

|

|

563016

|

A

|

$28.33

|

715014

(2)

|

D

|

|

|

Class A Common Stock

|

8/2/2016

|

|

F

|

|

353116

|

D

|

$45.17

|

361898

(2)

|

D

|

|

|

Class A Common Stock

|

8/2/2016

|

|

S

|

|

148717

|

D

|

$45.29

(4)

|

213181

(2)

(3)

(5)

(6)

(7)

|

D

|

|

|

Class A Common Stock

|

|

|

|

|

|

|

|

33695

|

I

|

See footnote

(8)

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Stock Option (right to buy)

|

$42.43

|

8/2/2016

|

|

M

|

|

|

346180

|

(9)

|

2/5/2017

|

Class A Common Stock

|

346180

|

(11)

|

0

|

D

|

|

|

Stock Option (right to buy)

|

$28.33

|

8/2/2016

|

|

M

|

|

|

563016

|

(10)

|

1/29/2018

|

Class A Common Stock

|

563016

|

(11)

|

0

|

D

|

|

|

Explanation of Responses:

|

|

(

1)

|

Taking into account all of the transactions reported on this form, Mr. Considine has an overall equity stake in the company of 3,786,228 shares, partnership units and options, the details of which are more fully described in footnotes 5, 6 and 7 below.

|

|

(

2)

|

In addition to the reporting person's overall equity stake in the company, 106,051 shares are held by a tax exempt organization under 501(c)(3) of the Internal Revenue Code, for which the reporting person disclaims beneficial ownership.

|

|

(

3)

|

The reporting person settled 909,196 options which were expiring in 2017 and 2018, in return for 237,183 shares, selling 176,000 at a weighted average price of $45.29 to fund related income taxes and charitable gifts and retaining 61,183 for investment.

|

|

(

4)

|

This is a weighted average price. The prices for which the shares were actually sold ranged from $45.035 to $45.67. The reporting person has provided to the issuer and will provide to any security holder or the staff of the Securities and Exchange Commission, upon request, information regarding the number of shares sold at each price within the range.

|

|

(

5)

|

In addition to the 213,181 shares held directly, the reporting person holds 274,027 shares of performance-based restricted stock. Upon conclusion of the various performance periods and depending on the results thereof, the reporting person may vest in all, some or none of the performance-based restricted stock.

|

|

(

6)

|

In addition to the 213,181 shares held directly, the reporting person holds 850,185 common partnership units in AIMCO Properties, L.P. ("OP Units"). The 850,185 OP Units include 510,452 OP Units held directly by the reporting person, 179,735 OP Units held by an entity in which the reporting person has sole voting and investment power, 2,300 OP Units held by Titahotwo Limited Partnership RLLLP ("Titahotwo"), a registered limited liability limited partnership for which the reporting person serves as the general partner and holds a 0.5% ownership interest, and 157,698 OP Units held by the reporting person's spouse, for which the reporting person disclaims beneficial ownership except to the extent of his pecuniary interest therein. Titahotwo also holds 1,589,372 Class I High Performance Units in AIMCO Properties, L.P.

|

|

(

7)

|

In addition to the 213,181 shares held directly, the reporting person holds 825,768 stock options, 262,062 of which are vested and exercisable and 563,706 of which are subject to certain vesting conditions. Of the unvested stock options, 384,809 are subject to certain performance criteria. Upon conclusion of the performance period and depending on the results thereof, the reporting person may vest in all, some or none of performance-based stock options.

|

|

(

8)

|

Held by reporting person's spouse, for which the reporting person disclaims beneficial ownership except to the extent of his pecuniary interest therein.

|

|

(

9)

|

All of the options were fully vested and exercisable as of February 5, 2012.

|

|

(

10)

|

All of the options were fully vested and exercisable as of January 29, 2012.

|

|

(

11)

|

Option Award approved by Compensation and Human Resources Committee; price column not applicable.

|

Remarks:

The sales reported on this Form 4 were made to provide for tax planning and to fund charitable commitments.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

CONSIDINE TERRY

4582 S. ULSTER STREET

SUITE 1100

DENVER, CO 80237

|

X

|

|

Chairman & CEO

|

|

Signatures

|

|

Terry Considine

|

|

8/3/2016

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

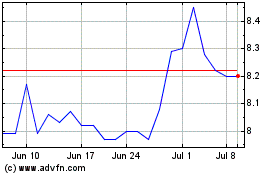

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

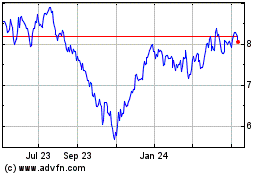

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Apr 2023 to Apr 2024