UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

BT Group plc

|

____________________________________

|

|

(Name of Issuer)

|

| |

|

Ordinary Shares

|

|

____________________________________

|

|

(Title of Class of Securities)

|

| |

|

3091357

|

|

____________________________________

|

|

(SEDOL Number)

|

| |

| |

|

Axel Luetzner

|

|

Vice President

|

|

Deutsche Telekom AG

|

|

Friedrich-Ebert-Allee 140

|

|

53113 Bonn, Germany

|

|

+49-228-181-44070

|

|

____________________________________

|

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

|

| |

|

|

|

January 29, 2016

|

|

(Date of Event which Requires Filing of this Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7(b) for other parties to whom copies are to be sent.

____________

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the U.S. Securities Exchange Act of 1934, as amended (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

|

1

|

NAMES OF REPORTING PERSONS

T-Mobile Global Holding GmbH

IRS Identification Number: 98-0470438

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a) ☐

(b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS(see instructions)

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) x

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Federal Republic of Germany

|

|

NUMBER OF SHARES

|

7

|

SOLE VOTING POWER

1,196,175,322

|

|

BENEFICIALLY OWNED BY

|

8

|

SHARED VOTING POWER

0

|

|

EACH REPORTING PERSON

|

9

|

SOLE DISPOSITIVE POWER

1,196,175,322

|

|

WITH

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,196,175,322(1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.0%(2)

|

|

14.

|

TYPE OF REPORTING PERSON

CO

|

|

(1)

|

The Reporting Persons (as defined in Item 2) may be deemed to be members of a “group,” within the meaning of Section 13(d)(3) of the Act, which could be considered to be comprised of the Reporting Persons and the Orange Entities (as defined in Item 2). If the Reporting Persons were to be deemed to be members of a “group,” within the meaning of Section 13(d)(3) of the Act, comprised of the Reporting Persons and including the Orange Entities, such “group” would be deemed to beneficially own 1,594,900,429 Ordinary Shares, which represents 16.0% of the Issuer’s outstanding Ordinary Shares. However, the Reporting Persons expressly disclaim beneficial ownership of the 398,725,107 Ordinary Shares beneficially owned by the Orange Entities.

|

|

(2)

|

All percentages set forth in this Schedule 13D are based on 9,962,010,468 outstanding ordinary shares issued and outstanding as of January 29, 2016.

|

|

1

|

NAMES OF REPORTING PERSONS

T-Mobile Holdings Limited

IRS Identification Number Not Applicable

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a) ☐

(b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (see instructions)

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) x

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

England and Wales

|

|

NUMBER OF SHARES

|

7

|

SOLE VOTING POWER

1,196,175,322

|

|

BENEFICIALLY OWNED BY

|

8

|

SHARED VOTING POWER

0

|

|

EACH REPORTING PERSON

|

9

|

SOLE DISPOSITIVE POWER

1,196,175,322

|

|

WITH

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,196,175,322(1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.0%(2)

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

(1)

|

The Reporting Persons (as defined in Item 2) may be deemed to be members of a “group,” within the meaning of Section 13(d)(3) of the Act, which could be considered to be comprised of the Reporting Persons and the Orange Entities (as defined in Item 2). If the Reporting Persons were to be deemed to be members of a “group,” within the meaning of Section 13(d)(3) of the Act, comprised of the Reporting Persons and including the Orange Entities, such “group” would be deemed to beneficially own 1,594,900,429 Ordinary Shares, which represents 16.0 per cent. of the Issuer’s outstanding Ordinary Shares. However, the Reporting Persons expressly disclaim beneficial ownership of the 398,725,107 Ordinary Shares beneficially owned by the Orange Entities.

|

|

(2)

|

All percentages set forth in this Schedule 13D are based on 9,962,010,468 outstanding ordinary shares issued and outstanding as of January 29, 2016.

|

|

1

|

NAMES OF REPORTING PERSONS

Deutsche Telekom AG

IRS Identification Number Not Applicable

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a) ☐

(b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (see instructions)

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) x

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Federal Republic of Germany

|

|

NUMBER OF SHARES

|

7

|

SOLE VOTING POWER

1,196,175,322

|

|

BENEFICIALLY OWNED BY

|

8

|

SHARED VOTING POWER

0

|

|

EACH REPORTING PERSON

|

9

|

SOLE DISPOSITIVE POWER

1,196,175,322

|

|

WITH

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,196,175,322(1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.0%(2)

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

(1)

|

The Reporting Persons (as defined in Item 2) may be deemed to be members of a “group,” within the meaning of Section 13(d)(3) of the Act, which could be considered to be comprised of the Reporting Persons and the Orange Entities (as defined in Item 2). If the Reporting Persons were to be deemed to be members of a “group,” within the meaning of Section 13(d)(3) of the Act, comprised of the Reporting Persons and including the Orange Entities, such “group” would be deemed to beneficially own 1,594,900,429 Ordinary Shares, which represents 16.0 per cent. of the Issuer’s outstanding Ordinary Shares. However, the Reporting Persons expressly disclaim beneficial ownership of the 398,725,107 Ordinary Shares beneficially owned by the Orange Entities.

|

|

(2)

|

All percentages set forth in this Schedule 13D are based on 9,962,010,468 outstanding ordinary shares issued and outstanding as of January 29, 2016

|

|

1

|

NAMES OF REPORTING PERSONS

T-Mobile Global Zwischenholding GmbH

IRS Identification Number Not Applicable

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a) ☐

(b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (see instructions)

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) x

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Federal Republic of Germany

|

|

NUMBER OF SHARES

|

7

|

SOLE VOTING POWER

1,196,175,322

|

|

BENEFICIALLY OWNED BY

|

8

|

SHARED VOTING POWER

0

|

|

EACH REPORTING PERSON

|

9

|

SOLE DISPOSITIVE POWER

1,196,175,322

|

|

WITH

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,196,175,322(1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.0%(2)

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

(1)

|

The Reporting Persons (as defined in Item 2) may be deemed to be members of a “group,” within the meaning of Section 13(d)(3) of the Act, which could be considered to be comprised of the Reporting Persons and the Orange Entities (as defined in Item 2). If the Reporting Persons were to be deemed to be members of a “group,” within the meaning of Section 13(d)(3) of the Act, comprised of the Reporting Persons and including the Orange Entities, such “group” shall be deemed to beneficially own 1,594,900,429 Ordinary Shares, which represents 16.0 per cent. of the Issuer’s outstanding Ordinary Shares. However, the Reporting Persons expressly disclaim beneficial ownership of the 398,725,107 Ordinary Shares beneficially owned by the Orange Entities..

|

|

(2)

|

All percentages set forth in this Schedule 13D are based on 9,962,010,468 outstanding ordinary shares issued and outstanding as of January 29, 2016

|

SCHEDULE 13D

|

Item 1.

|

Security and Issuer

|

This statement on Schedule 13D relates to the ordinary shares (the “Ordinary Shares”) of 5 pence each of BT Group plc, an English public limited company (the “Issuer”). The principal executive office of the Issuer is located at 81 Newgate Street, London, EC1A 7AJ, England.

|

Item 2.

|

Identity and Background

|

This Schedule 13D is being filed pursuant to Rule 13d-1 under the Securities Exchange Act of 1934, as amended (the "Act") by each of the following persons (each, a “Reporting Person” and, collectively, the “Reporting Persons”):

|

|

i.

|

T-Mobile Global Holding GmbH, a limited liability company (Gesellschaft mit beschränkter Haftung) organized and existing under the laws of the Federal Republic of Germany, with a business address of Landgrabenweg 151, D-53227 Bonn, Germany ("T-Mobile Global Holding")

|

|

|

ii.

|

T-Mobile Holdings Limited, a private limited company incorporated under the laws of England and Wales whose registered office is at Hatfield Business Park, Hatfield, Hertfordshire AL10 9BW (company no. 03836708) ("DT Holdings")

|

|

|

iii.

|

T-Mobile Global Zwischenholding Gmbh, a limited liability company (Gesellschaft mit beschränkter Haftung) organized and existing under the laws of the Federal Republic of Germany, with a business address of Friedrich-Ebert-Allee 140, D-53113 Bonn, Germany ("T-Mobile Global")

|

|

|

iv.

|

Deutsche Telekom A.G., a stock corporation (Aktiengesellschaft) organized under the laws of the Federal Republic of Germany with a business address of Friedrich-Ebert-Allee 140, 53113 Bonn, Germany ("Deutsche Telekom")

|

DT Holdings is a direct wholly owned subsidiary of T-Mobile Global Holding. T-Mobile Global Holding is a direct wholly owned subsidiary of T-Mobile Global, which in turn is a direct wholly owned subsidiary of Deutsche Telekom.

The Reporting Persons are principally engaged in the telecommunications business.

The Reporting Persons may also be deemed to be members of a “group,” within the meaning of Section 13(d)(3) of the Act, which could be considered to be comprised of the Reporting Persons and Orange S.A. and Orange Telecommunications Group Limited (the “Orange Entities”) due to the entry into the Sale and Purchase Agreement (as defined in Item 3) by DT Holdings, Deutsche Telekom and the Orange Entities with the Issuer. As disclosed in Item 4, any “group” within the meaning of Section 13(d)(3) of the Act that may have been formed among the Reporting Persons and the Orange Entities has been terminated.

The name, business address, citizenship and present principal occupation or employment of each director, executive officer and controlling person of the Reporting Persons are set forth on Schedule 1 hereto and are incorporated herein by reference.

Except as set forth below, during the last five years, none of the Reporting Persons nor, to the best of each Reporting Person’s knowledge, any person on Schedule A has been (a) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (b) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which proceeding such Reporting Person or person is or was subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

In December 2011, the US Department of Justice entered into a two-year non-prosecution agreement with Deutsche Telekom for its failure to keep books and records that accurately detailed the activities of its Hungarian subsidiary, Magyar Telekom, Plc ("Magyar"). In December 2011, Deutsche Telekom also settled the Securities and Exchange Commission’s (the “SEC”) charges of books and records and internal controls violations of the Foreign Corrupt Practices Act ("FCPA"). In 2012, the US District Court of the Southern District of New York issued a final judgment permanently restraining and enjoining Deutsche Telekom and its officers, agents, servants, employees, attorneys and all persons in active concert or participation with them who receive actual notice of the final judgment by personal service or otherwise from violating, directly or indirectly, (A) Section 13(b)(2)(A) of the Act, by failing to make and keep books, records, and accounts which, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of Deutsche Telekom and (B) Section 13(b)(2)(B) of the Act, by failing to devise and maintain a system of internal accounting controls sufficient to provide reasonable assurances regarding the execution and recording of transactions as well as the access to and recorded accountability for assets. Deutsche Telekom paid a total amount with respect to the settlements with the US Department of Justice and the SEC of $4.36 million. Magyar reached separate agreements with the SEC and the US Department of Justice and paid $90.8 million in fines.

|

Item 3.

|

Source and Amount of Funds or Other Consideration

|

DT Holdings, Deutsche Telekom and the Orange Entities entered into an agreement for the sale and purchase of the entire issued share capital of EE Limited ("EE") ("Sale and Purchase Agreement") with the Issuer, dated February 5, 2015, as amended on December 11, 2015, in relation to the sale by DT Holdings and Orange to the Issuer of their respective shareholdings in EE in consideration for inter alia the issue of new ordinary shares of 5 pence each in the capital of the Issuer. In connection with the transaction, the Reporting Persons received 1,196,175,322 Ordinary Shares of the Issuer (the "DT Shares") and Orange S.A. received 398,725,107 Ordinary Shares (the "Orange Shares").

The foregoing description of the Sale and Purchase Agreement does not purport to be complete and is qualified in its entirely by reference to the full text of the Sale and Purchase Agreement, attached hereto as Exhibit 7.1 and hereby incorporated by reference.

|

Item 4.

|

Purpose of Transaction

|

The terms of the Sale and Purchase Agreement described in and incorporated into Item 3 of this Schedule 13D are incorporated by reference in this Item 4.

The DT Shares beneficially owned by DT Holdings were acquired for investment purposes as consideration for the sale by DT Holdings of its shares in EE. The purpose of the sale by DT Holdings of its shares in EE to the Issuer was to build the leading converged telecommunications operator in the UK market, participate in the synergy upsides at EE, exchange an illiquid joint venture stake for a financial stake in a larger more liquid entity and foster further collaboration between Deutsche Telekom and the Issuer.

In connection with the closing of the sale of EE to the Issuer pursuant to the Sale and Purchase Agreement, Deutsche Telekom, DT Holdings and the Issuer entered into a relationship agreement, dated January 29, 2016 (the "DT Relationship Agreement"). The purpose of the DT Relationship Agreement is to regulate the relationship between Deutsche Telekom, DT Holdings and the Issuer, to provide Deutsche Telekom with the right to nominate for appointment the Proposed Director (as defined below), and to impose certain restrictions on the acquisition, disposition and voting of Ordinary Shares by Deutsche Telekom and its affiliates (the "Deutsche Telekom Group"), as more fully described in Item 6 below.

Under the DT Relationship Agreement, subject to compliance with any applicable regulatory requirements, Deutsche Telekom is entitled to nominate for appointment one non-executive director (the “Proposed Director”) to the Issuer's board for so long as the Deutsche Telekom Group holds a minimum percentage (generally 10 per cent) of the issued ordinary share capital of the Issuer. On January 29, 2016, the appointment of Timotheus Höttges to the Issuer's board pursuant to this provision took effect.

Also in connection with the closing of the sale of EE to the Issuer pursuant to the Sale and Purchase Agreement, DT Holdings, Deutsche Telekom and the Issuer entered into the contingent purchase agreement, dated January 29, 2016 (the "Contingent Purchase Agreement"). The purpose of the Contingent Purchase Agreement is to grant the Issuer a right of first offer prior to any disposal of Ordinary Shares by the Deutsche Telekom Group to a Financial Investor as more fully described in Item 6 below.

The Reporting Persons, as investors in the Issuer, intend to review their investment in the Issuer regularly and have any necessary discussions for such purpose and, as a result thereof, may at any time and from time to time determine to take any available course of action and may take any steps to implement any such course of action. Such review, discussions, actions or steps may, subject to compliance with the standstill and lock-up restrictions set forth in the DT Relationship Agreement and the right of first offer set forth in the Contingent Purchase Agreement, involve one or more of the types of transactions specified in clauses (a) through (j) of Item 4 of Schedule 13D or further forms of collaboration.

Any action or actions that a Reporting Person might undertake in respect of the Ordinary Shares will be dependent upon such Reporting Person’s review of numerous factors, including, among other things: the price level and liquidity of the Ordinary Shares; general market and economic conditions; ongoing evaluation of the Issuer’s business, financial condition, operations, prospects and strategic alternatives; the relative attractiveness of alternative business and investment opportunities; tax considerations; and other factors and future developments.

The Reporting Persons may also be deemed to be members of a “group,” within the meaning of Section 13(d)(3) of the Act, which could be considered to be comprised of the Reporting Persons and the Orange Entities due to the entry into the Sale and Purchase Agreement by DT Holdings, Deutsche Telekom and the Orange Entities with the Issuer. The closing of the sale of the shares of EE in consideration for, inter alia, Ordinary Shares under the Sale and Purchase Agreement took place on January 29, 2016 pursuant to which the Reporting Persons acquired the DT Shares and the Orange Entities acquired the Orange Shares. Effective January 29, 2016, there ceased to be any contract, agreement, arrangement or understanding between the Reporting Persons and the Orange Entities with respect to the acquisition, ownership, holding, voting or disposition of securities of the Issuer. Accordingly, any “group” within the meaning of Section 13(d)(3) of the Act that may have been formed among the Reporting Persons and the Orange Entities has been terminated.

The information set forth in or incorporated by reference in Items 3, 5 and 6 of this Schedule 13D, including, without limitation, as to the rights and obligations of the Reporting Persons pursuant to the terms of the Sale and Purchase Agreement, the Relationship Agreement, the Contingent Purchase Agreement and the other matters described therein, is incorporated by reference in its entirety into this Item 4.

|

Item 5.

|

Interest in Securities of the Issuer

|

The information contained in rows 7, 8, 9, 10, 11 and 13 on each of the cover pages of this Schedule 13D and the information set forth or incorporated by reference in Items 2, 4 and 6 is incorporated by reference in its entirety into this Item 5.

(a)-(b) As of the date hereof, DT Holdings may be deemed to beneficially own 1,196,175,322 Ordinary Shares, which constitutes approximately 12.0 per cent of the issued and outstanding Ordinary Shares. To the knowledge of the Reporting Persons, other than Daniel Daub, a director of DT Holdings, who beneficially owns 650 Ordinary Shares (representing less than 0.1% of the issued and outstanding Ordinary Shares) as of the date hereof, none of the persons named on Schedule 1 beneficially own any Ordinary Shares.

Because T-Mobile Global, T-Mobile Holding and Deutsche Telekom may be deemed to control DT Holdings, each of T-Mobile Global, T-Mobile Holding and Deutsche Telekom may be deemed to beneficially own, and to have the power to vote or direct the vote of, or dispose or direct the disposition of, all the Ordinary Shares beneficially owned by DT Holdings.

In addition, if the Reporting Persons were to be deemed to be members of a group with the Orange Entities, such group would be deemed to beneficially own 1,594,900,429 shares of Ordinary Shares, which represents approximately 16.0 per cent of the Issuer's outstanding Ordinary Shares. However, the Reporting Persons expressly disclaim beneficial ownership of the 398,725,107 Ordinary Shares beneficially owned by the Orange Entities and, as disclosed in Item 4, effective January 29, 2016, there ceased to be any contract, agreement, arrangement or understanding between the Reporting Persons and the Orange Entities with respect to the acquisition, ownership, holding, voting or disposition of securities of the Issuer. Accordingly, any “group” within the meaning of Section 13(d)(3) of the Act that may have been formed among the Reporting Persons and the Orange Entities has been terminated.

The filing of this Schedule 13D shall not be construed as an admission that any Reporting Person is the beneficial owner of any of the Ordinary Shares that such Reporting Person may be deemed to beneficially own. Without limiting the foregoing sentence, each of T-Mobile Global, T-Mobile Holding and Deutsche Telekom disclaims beneficial ownership of all Ordinary Shares reported in this Schedule 13D. In addition, the filing of this Schedule 13D shall not be construed as an admission that any partner, member, director, officer or affiliate of any Reporting Person is the beneficial owner of any of the shares of Ordinary Shares that such partner, member, director, officer or affiliate may be deemed to beneficially own.

(c) Except as set forth in this Item 5, to the knowledge of the Reporting Persons, none of the Reporting Persons or the persons set forth on Schedule 1 hereto has beneficial ownership of, or has engaged in any transaction during the past 60 days in, any Ordinary Shares.

(d) To the knowledge of the Reporting Persons, no other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds of the sale of, the securities that are the subject of this Schedule 13D.

(e) Not applicable.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

The terms of the Sale and Purchase Agreement described in and incorporated into Item 3 of this Schedule 13D are incorporated by reference in this Item 6.

Subsequent to the execution of the Sale and Purchase Agreement and the amendment thereto, DT Holdings, Deutsche Telekom and the Issuer entered into a side letter, dated January 22, 2016 related to certain of the closing conditions. DT Holdings, Deutsche Telekom and the Issuer entered into a second side letter, dated January 22, 2016. Pursuant to the terms thereof and in accordance with the provisions of the Sale and Purchase Agreement, the Issuer consented to the payment by EE, of a dividend up to a maximum amount of £263 million to Deutsche Telekom and DT Holdings prior to completion of the acquisition of EE provided that, if the customary post completion adjustments (to reflect the actual debt and cash free price of the acquisition) result in Deutsche Telekom being entitled to share consideration of less than 12.0 per cent. of the Issuer's issued Ordinary Share capital, Deutsche Telekom will sell up to 30.7 million Ordinary Shares in the market and remit to the Issuer the profit from such sale (being the sale price less 427.96 pence per share) and any dividends on such Ordinary Shares it has received.

Relationship Agreement

Deutsche Telekom, DT Holdings and the Issuer entered into the DT Relationship Agreement on January 29, 2016.

Under the DT Relationship Agreement, subject to compliance with any applicable regulatory requirements, Deutsche Telekom is able to nominate for appointment one non-executive director (the “Proposed Director”) to the Issuer's board for so long as the Deutsche Telekom Group holds 10.0 per cent. or more of the issued ordinary share capital of the Issuer (provided that, if the shareholding is reduced below 10.0 per cent. as a result of any non-pre-emptive share issuance by the Issuer, the board appointment nomination right shall continue for as long as the Deutsche Telekom Group holds at least 8.0 per cent. of the issued ordinary share capital of the Issuer but provided further that such reduced shareholding shall not have occurred as a result of the Deutsche Telekom Group selling 2.0 per cent. or more of the issued ordinary share capital of the Issuer in aggregate at any time, and provided always that within 12 months following such non-preemptive equity issuance, the Deutsche Telekom Group's aggregated interest in the issued ordinary share capital of the Issuer is 10.0 per cent. or more, otherwise the right will lapse). Any such nomination for appointment shall be made in consultation with the Issuer's Nominating & Governance Committee and the appointee must be approved by the Issuer's Chairman (such approval not to be unreasonably withheld or delayed). On January 29, 2016, the appointment of Timotheus Höttges to the Issuer's board pursuant to this provision took effect.

The DT Relationship Agreement contains lock-up provisions pursuant to which Deutsche Telekom and DT Holdings undertake for a period of 18 months from the date of the DT Relationship Agreement, subject to certain exceptions, that neither they nor any of their group members will, directly or indirectly, effect any Disposal. As used herein, "Disposal" includes any offer of, sale of, contract to sell, grant or sale of options over, purchase of any option or contract to sell, transfer of, charge or pledge over, grant of any right or warrant to purchase or otherwise transfer, lending of or disposal of, directly or indirectly, any Ordinary Shares or any securities convertible into or exercisable or exchangeable for Ordinary Shares or the entry into of any swap or other agreement that transfers, in whole or in part, any of the economic consequences of ownership of Ordinary Shares or other securities in the Issuer, whether any such transaction described above is to be settled by delivery of Ordinary Shares or such other securities, in cash or otherwise or any other disposal or agreement to dispose of any Ordinary Shares or other securities or any announcement or other publication of the intention to do any of the foregoing.

The exceptions to the lock-up provisions in the Deutsche Telekom Relationship Agreement include, (i) where Deutsche Telekom or DT Holdings accepts any offer by a third party for the whole of the ordinary share capital of the Issuer, whether by tender offer or scheme of arrangement, or provides an irrevocable undertaking or letter of intent to accept or vote in favor of any such offer, (ii) any Disposal to any member of the Deutsche Telekom Group, provided that the transferee agrees to be bound by the restrictions of the DT Relationship Agreement and (iii) any sale of shares via any single off-market trade to a Financial Investor of no more than 5.0 per cent. of the Ordinary Shares in issue of the Issuer (or, on one occasion only, the sale of two stakes of not more than 5.0 per cent. at the same time to two different Financial Investors), provided that any transferee enters into a lock-up agreement on substantially similar terms to the lock-up provisions of the DT Relationship Agreement. As used herein, the term "Financial Advisor" means a "Qualified Institutional Buyer" as defined in Rule 144A under the US Securities Act of 1933, as amended or a "Qualified Investor" as described in point (1) of Section I of Annex II to the Markets in Financial Instruments Directive (Directive 2004/39/EC), other than any activist fund, or any company licensed as a telecommunications operator (or its affiliates).

Pursuant to the DT Relationship Agreement, Deutsche Telekom has undertaken on behalf of itself and its group for a period of three years from the date of the DT Relationship Agreement (the “Initial Standstill Period”), subject to certain exceptions, not to:

|

|

a)

|

acquire or offer to acquire any interest in any shares or other securities of the Issuer as a result of which the aggregate interest of the Deutsche Telekom Group and any of its concert parties increases above 12.0 per cent. of the Ordinary Shares in issue at any time;

|

|

|

b)

|

act in concert with any person in respect of the holding, voting or disposition of any shares or other securities of the Issuer;

|

|

|

c)

|

solicit or participate in any solicitation of the Issuer's shareholders to vote in a particular manner at any meeting of the shareholders; or

|

|

|

d)

|

actively or publicly make any proposals for any merger, consolidation or share exchange involving shares or other securities of the Issuer.

|

The exceptions to the above standstill provisions include:

|

|

a)

|

where the Deutsche Telekom Group acquires an interest in any shares or other securities of the Issuer from the Orange Entities provided that such acquisition does not increase the aggregate interest of the Deutsche Telekom Group and its concert parties above 15.0 per cent. of the Ordinary Shares in issue;

|

|

|

b)

|

where the Deutsche Telekom Group exercises its votes in respect of shares or other securities in the Issuer in such manner as it may determine in its absolute discretion or in making known its intention to vote in a particular way (or not to vote) or that it has voted in a particular way (or not voted);

|

|

|

c)

|

where the Deutsche Telekom Group announces an offer under Rule 2.7 of the UK City Code on Takeovers and Mergers (the “Code”) or takes any action requiring it to make an offer under Rule 9 of the Code, in each case if such offer is recommended by the Issuer's directors;

|

|

|

d)

|

where any third party which is not acting in concert with Deutsche Telekom or any of its affiliates makes or announces under Rule 2.7 of the Code an offer to acquire the issued ordinary share capital of the Issuer, whether such offer is recommended by the Issuer's directors or not;

|

|

|

e)

|

where the Issuer makes any offering or issue of shares or other securities and the Deutsche Telekom Group take up its rights to subscribe for or acquire the shares or other securities offered to it by the Issuer;

|

|

|

f)

|

where the Deutsche Telekom Group takes advantage of any bonus issue and/or scrip dividend offered by the Issuer;

|

|

|

g)

|

where a pension fund of the Deutsche Telekom Group acquires shares or other securities in the Issuer provided that the assets of the pension fund are managed under an agreement or arrangement with a third party which gives such third party absolute discretion regarding dealing, voting and acceptance decisions;

|

|

|

h)

|

where any interest in shares or other securities of the Issuer are acquired by any connected fund manager or principal trader (as defined in the Code); and

|

|

|

i)

|

where the Deutsche Telekom Group's interest in the Issuer is increased as a result of any reduction or re-organization of share capital or re-purchase of shares or other securities of the Issuer, by the Issuer or any of its affiliates.

|

Under the DT Relationship Agreement, Deutsche Telekom has also undertaken, among other things, that for a period of two years from the expiry of the Initial Standstill Period, in the event that the Deutsche Telekom Group acquires (other than as a result of a reduction or re-organization of share capital or re-purchase of shares or other securities of the Issuer) any Ordinary Shares in excess of 15.0 per cent. of the Ordinary Shares in issue (the “Excess Shares”), it shall procure that the votes attaching to such Excess Shares shall be exercised (subject to the provisions of the Code and applicable law or regulation) in accordance with the recommendation of the Board on all shareholder resolutions which relate to a transfer of an interest in Ordinary Shares carrying in aggregate 30 per cent. or more of the voting rights of the Issuer and on all special resolutions of the Issuer. After expiry of the Initial Standstill Period, the Deutsche Telekom Group will otherwise be free to increase its shareholding in the Issuer.

Other than the standstill and lock-up provisions, board appointment nomination provisions and certain other provisions of the DT Relationship Agreement, which shall survive for the respective periods specified therein, the DT Relationship Agreement will terminate upon the earlier of (i) the Ordinary Shares no longer being listed on the premium listing segment of the Official List of the Financial Conduct Authority and admitted to trading on the London Stock Exchange's main market for listed securities or (ii) the Deutsche Telekom Group ceasing to be interested in more than 3.0 per cent. of the issued ordinary share capital of the Issuer.

Contingent Purchase Agreement

Deutsche Telekom, DT Holdings and the Issuer entered into the Contingent Purchase Agreement on January 29, 2016. Pursuant to the Contingent Purchase Agreement, prior to any Disposal by the Deutsche Telekom Group to a Financial Investor in accordance with the DT Relationship Agreement, the Issuer has a right of first offer in relation to the relevant shares.

The Contingent Purchase Agreement will terminate 18 months from January 29, 2016, after which the Deutsche Telekom Group will be free to dispose of its shareholding in the Issuer without further restriction.

The foregoing descriptions do not purport to be complete and are qualified in their entirely by reference to the full text of the agreements, attached hereto and hereby incorporated by reference.

To the knowledge of the Reporting Persons, except as provided herein, there are no other contracts, arrangements, understandings or relationships (legal or otherwise) among the Reporting Persons and between any of the Reporting Persons and any other person with respect to any securities of the Issuer, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies, or a pledge or contingency, the occurrence of which would give another person voting power over the securities of the Issuer.

It is the understanding of the Reporting Persons that the Orange Entities are also party to the following agreements related to the Ordinary Shares.

Orange Standstill and Lock-up Agreement

The Reporting Persons understand that Orange S.A., Orange and the Issuer entered into a Standstill and Lock-up Agreement (the "Orange Standstill and Lock-up Agreement") dated January 29, 2016 that regulates the ability of the Orange Group Entities to deal in shares and other securities of the Issuer.

The Standstill and Lock-up Agreement contains lock-up provisions pursuant to which Orange S.A. and Orange have undertaken for a period of 12 months from the date of the Orange Standstill and Lock-up Agreement, subject to certain exceptions, that neither they nor any of their group members will, directly or indirectly, effect any Disposal.

The exceptions to the lock-up provisions in the Orange Standstill and Lock-up Agreement include (i) any Disposal to the Deutsche Telekom Group, (ii) where Orange S.A. or Orange accepts any offer by a third party for the whole of the ordinary share capital of the Issuer, whether by tender offer or scheme of arrangement, or provides an irrevocable undertaking or letter of intent to accept or vote in favor of any such offer, (iii) any Disposal to any of the Orange Entities, provided that the transferee agrees to be bound by the restrictions of the Orange Standstill and Lock-up Agreement, (iv) any sale of shares via any single off-market trade to a Financial Investor (or at the same time to two different Financial Investors) of up to all the shares of the Issuer in which any of the Orange Entities has an interest, provided that the transferee enters into a lock-up agreement on substantially similar terms to the lock-up provisions of the Orange Standstill and Lock-up Agreement and (v) if the Orange Entities own 2.0 per cent. or less of the issued ordinary share capital of the Issuer, any Disposal which is by way of a swap or other agreement to transfer the economic ownership of the shares.

Pursuant to the Orange Standstill and Lock-up Agreement, Orange S.A. will undertake on behalf of itself and its group for a period of three years from the date of the Orange Standstill and Lock-up Agreement, subject to certain exceptions, not to:

|

|

a)

|

acquire or offer to acquire any interest in any shares or other securities of the Issuer as a result of which the aggregate interest of the Orange Entities and its concert parties increases above 4.0 per cent. of the Ordinary Shares in issue at any time;

|

|

|

b)

|

act in concert with any person in respect of the holding, voting or disposition of any shares or other securities of the Issuer;

|

|

|

c)

|

solicit or participate in any solicitation of shareholders of the Issuer to vote in a particular manner at any meeting of the shareholders; or

|

|

|

d)

|

actively or publicly make any proposals for any merger, consolidation or share exchange involving shares or other securities of the Issuer.

|

The exceptions to the above standstill provisions include:

|

|

a)

|

where the Orange Entities annonuce an offer under Rule 2.7 of the Code or takes any action requiring it to make an offer under Rule 9 of the Code, in each case if such offer is recommended by the Issuer's directors;

|

|

|

b)

|

where any third party makes or announces under Rule 2.7 of the Code an offer to acquire the issued ordinary share capital of the Issuer, whether such offer is recommended by the Issuer's directors or not; and

|

|

|

c)

|

where the Issuer makes any offering or issue of shares or other securities and the Orange Entities take up their rights to subscribe for or acquire the shares or other securities offered to it by the Issuer.

|

After expiry of the standstill period, the Orange Entities will otherwise be free to increase their shareholding in the Issuer.

Other than the standstill provisions set forth above, which shall continue for a period of three years, and the lock up provisions, which shall continue for a period of 12 months, the Orange Standstill and Lock-up Agreement will terminate upon the earlier of (i) the Ordinary Shares no longer being listed on the premium listing segment of the Official List of the Financial Conduct Authority and admitted to trading on the London Stock Exchange's main market for listed securities or (ii) the Orange Entities ceasing to be interested in more than 3.0 per cent. of the issued Ordinary Share capital of the Issuer.

Orange Contigent Purchase Agreement

The Reporting Persons understand that Orange S.A., Orange and the Issuer entered into a contingent purchase agreement (the "Orange Contingent Purchase Agreement") dated January 29, 2016. Pursuant to the Orange Contingent Purchase Agreement, prior to any Disposal by any of the Orange Entities to a Financial Investor in accordance with the Orange Standstill and Lockup Agreement, the Issuer has a right of first offer in relation to the relevant shares.

The Orange Contingent Purchase Agreement will terminate 12 months from January 29, 2016, after which the Orange Entities will be free to dispose of their shareholding in the Issuer without further restriction.

|

Item 7.

|

Material to Be Filed as Exhibits

|

|

Exhibit Number

|

Description of Exhibit

|

|

Exhibit 1

|

Sale and Purchase Agreement, dated February 5, 2015, as amended on December 11, 2015, among T-Mobile Holdings Limited, Orange Telecommunications Group Limited, BT Group plc, Deutsche Telekom AG, as guarantor and Orange S.A., as guarantor.

|

|

Exhibit 2

|

Side Letter to the Sale and Purchase Agreement, dated 22 January 2016 among BT Group plc, T-Mobile Holdings Limited and Deutsche Telekom A.G. |

|

Exhibit 3

|

Side Letter to the Sale and Purchase Agreement, dated 22 January 2016 among BT Group plc, T-Mobile Holdings Limited, Orange Telecommunications Group Limited, Deutsche Telekom A.G. and Orange S.A.

|

|

Exhibit 4

|

Relationship Agreement, dated January 29, 2016 among BT Group plc, T-Mobile Holdings Limited and Deutsche Telekom A.G.

|

|

Exhibit 5

|

Contingent Purchase Agreement, dated January 29, 2016 among BT Group plc, T-Mobile Holdings Limited and Deutsche Telekom A.G.

|

SIGNATURE

After reasonable inquiry and to the best of each undersigned’s knowledge and belief, each undersigned certifies as to itself that the information set forth in this statement is true, complete and correct.

Dated: February 8, 2016

| |

T-MOBILE GLOBAL HOLDING GMBH

|

| |

|

| |

/s/ Franco Musone Crispino_________________________

|

| |

Name:

|

| |

Title:

|

| |

|

| |

|

| |

/s/ Uli Kühbacher__________________________________

|

| |

Name:

|

| |

Title:

|

| |

|

| |

|

| |

T-MOBILE HOLDINGS LIMITED

|

| |

|

| |

/s/ Jeevan D'Silva___________________________________

|

| |

Name:

|

| |

Title:

|

| |

|

| |

|

| |

/s/ Nicholas McLean_________________________________

|

| |

Name:

|

| |

Title:

|

| |

|

| |

|

| |

DEUTSCHE TELEKOM AG

|

| |

|

| |

/s/ Axel Lützner_____________________________________

|

| |

Name:

|

| |

Title:

|

| |

|

| |

|

| |

/s/ Ulrich Zwach_____________________________________

|

| |

Name:

|

| |

Title:

|

| |

|

| |

|

| |

T-MOBILE GLOBAL ZWISCHENHOLDING GMBH

|

| |

|

| |

/s/ Helmut Becker____________________________________

|

| |

Name:

|

| |

Title:

|

| |

|

| |

|

| |

/s/ Christian Doren Kamp______________________________

|

| |

Name:

|

| |

Title:

|

SCHEDULE 1

Directors and Executive Officers of T-Mobile Global Holding GmbH

The following table sets forth the names, business addresses and present principal occupation of each director and executive officer of T-Mobile Global Holding GmbH.

|

Name

|

Citizenship

|

Business Address

|

Present Principal Occupation

|

|

Franco Musone Crispino

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Vice President, Corporate Finance EU, Deutsche Telekom AG

|

|

Michaela Klitsch

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

CFO Innovations, Deutsche Telekom AG

|

|

Dr. Uli Kühbacher

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Vice President, DT Legal, Deutsche Telekom AG

|

|

Dr. Frank Schmidt

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Senior Vice President Energy, T-Systems International GmbH

|

Directors and Executive Officers of T-Mobile Holdings Limited

The following table sets forth the names, business addresses and present principal occupation of each director, executive officer and controlling person of T-Mobile Holding Limited.

|

Name

|

Citizenship

|

Business Address

|

Present Principal Occupation

|

|

Jeevan D'Silva

|

British

|

21st Floor, Euston Tower, Euston Road, London NW1 3 DP

|

General Counsel T-Systems Limited

|

|

Daniel Daub

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Vice President, Group Equity and Innovation Controlling, Deutsche Telekom AG

|

|

Dr. Uli Kuehbacher

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Vice President, DT Legal, Deutsche Telekom AG

|

|

Nicholas James Mclean

|

British

|

Hatfield Business Park, Hatfield, Hertfordshire, AL10 9BW

|

Finance Director, Deutscher Telecom (UK) Limited

|

Directors and Executive Officers of Deutsche Telekom AG

The following tables I and II set forth the names, business addresses and present principal occupation of each director and executive officer of Deutsche Telekom AG.

I. Board of Management

|

Name

|

Citizenship

|

Business Address

|

Present Principal Occupation

|

|

Timotheus Höttges

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Chief Executive Officer

|

|

Reinhard Clemens

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Board Member for T-Systems

|

|

Niek Jan van Damme

|

Dutch

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Board Member for Germany

|

|

Thomas Dannenfeldt

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Board Member for Finance (CFO)

|

|

Christian P. Illek

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Board Member for Human Resources

|

|

Thomas Kremer

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Board Member for Data Privacy, Legal Affairs and Compliance

|

|

Claudia Nemat

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Board Member for Europe and Technology

|

II. Supervisory Board

|

Name

|

Citizenship

|

Business Address

|

Present Principal Occupation

|

|

Sari Baldauf

|

German

|

Keilaniementie 1

Espoo, Finland 02150

|

Chairwoman of the Board of Directors of Fortum Oyj, Espoo, Finland

|

|

Josef Bednarski

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Chairman of the Group Works Council Deutsche Telekom AG, Bonn

|

|

Dr. Wulf H. Bernotat

|

German

|

Bruesseler Platz 1, 45131 Essen

|

Managing Director and Partner of Bernotat & Cie. GmbH and former Chairman of the Board of Management E.ON AG, Düsseldorf

|

|

Monika Brandl

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Chairwoman of the Central Works Council of Deutsche Telekom AG, Bonn

|

|

Johannes Geismann

|

German

|

Wilhelmstrasse 97, 10117 Berlin

|

State Secretary, Federal Ministry of Finance, Berlin

|

|

Dr. Hubertus von Grünberg

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Former Chairman of the Board of Directors of ABB Ltd., Zurich, Switzerland

|

|

Klaus-Dieter Hanas

|

German

|

Sachsenseite 2, 04103 Leipzig

|

Chairman of the Works Council Deutsche Telekom Kundenservice GmbH, Region Middle-East, Bonn

|

|

Sylvia Hauke

|

German

|

Landgrabenweg 151, , 53227 Bonn, Germany

|

Chairwoman of the Central Works Council of Telekom Deutschland GmbH, Bonn

|

|

Lars Hinrich

|

German

|

Gaensemarkt 43, 20354 Hamburg

|

CEO Cinco Capital GmbH, Hamburg

|

|

Hans-Jürgen Kallmeier

|

German

|

Hahnstrasse 43a, 60528 Frankfurt am Main

|

Chairman of the Central Works Council T-Systems International GmbH, Frankfurt

|

|

Prof. Dr. Michael Kaschke

|

German

|

Carl-Zeiss-Strasse 22, 73447 Oberkochen

|

CEO & President Carl Zeiss AG, Oberkochen

|

|

Nicole Koch

|

German

|

Landgrabenweg 147, 53227 Bonn

|

Vice Chairwoman of the Group Works Council Deutsche Telekom AG, Bonn and Chairwoman of the Central Works Council of Telekom Shop Vertriebsgesellschaft mbH, Bonn

|

|

Dagmar P. Kollman

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Entrepreneur and former chairwoman of the Board of Management of Morgan Stanley Bank AG, Frankfurt am Main

|

|

Petra Steffi Kreusel

|

German

|

Hahnstrasse 43d, 60528 Frankfurt am Main

|

SVP Strategic Development & Support T-Systems International GmbH, Frankfurt

|

|

Prof. Dr. Ulrich Lehner

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Member of the Shareholders' Committee Henkel AG & Co. KGaA, Dusseldorf;

Chairman of the Supervisory Board Deutsche Telekom AG

|

|

Dr. Ulrich Schröder

|

German

|

Palmengartenstr. 5-9

Frankfurt, Germany 60325

|

Chairman of the Managing Board KfW, Frankfurt on the Main

|

|

Lothar Schröder

|

German

|

Paula-Thiede-Ufer 10

Berlin, Germany 10179

|

Member of the ver.di National Executive Board, Berlin; Deputy Chairman of the Supervisory Board Deutsche Telekom AG

|

|

Michael Sommer

|

German

|

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Former Chairman of the German Confederation of Trade Unions (DGB), Berlin

|

|

Sibylle Spoo

|

German

|

Paula-Thiede-Ufer 10

Berlin, Germany 10179

|

Lawyer, Trade Union Secretary at the ver.di Federal Administration, Berlin

|

|

Karl-Heinz Streibich

|

German

|

Uhlandstrasse 12, 64279 Darmstadt-Eberstadt

|

CEO Software AG, Darmstadt

|

Directors and Executive Officers of T-Mobile Global Zwischenholding GmbH

The following table sets forth the names, business addresses and present principal occupation of each director and executive officer of T-Mobile Global Zwischenholding GmbH.

|

Name

|

Citizenship

|

Business Address

|

Present Principal Occupation

|

|

Helmut Becker

|

German |

Innere Kanalstr. 98, 50672, Köln

|

Senior Vice President General Accounting, Deutsche Telekom Services GmbH

|

|

Dr. Christian Dorenkamp

|

German |

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Senior Vice President Group Tax, Deutsche Telekom AG

|

|

Roman Zitz

|

German |

Friedrich-Ebert-Allee 140, 53113 Bonn, Germany

|

Head of Legal Services International Subsidiaries, Deutsche Telekom AG

|

COMPOSITE CONFORMED COPY

Exhibit 1

T-Mobile Holdings Limited

(Seller)

Orange Telecommunications Group Limited

(Seller)

BT Group plc

(Purchaser)

Deutsche Telekom AG

(Guarantor)

Orange S.A.

(Guarantor)

Agreement

for the sale and purchase of the entire issued share

capital of EE Limited dated 5 February 2015, as

amended pursuant to Amendment Deed

dated 11 December 2015

CONTENTS

|

|

3

|

|

2. Price

|

3

|

|

3. Conditions to Closing

|

6

|

|

4. Pre-Closing Undertakings

|

16

|

|

5. Closing

|

18

|

|

6. Seller Warranties, Undertakings and Indemnities

|

18

|

|

7. Purchaser Warranties, Undertakings and Indemnities

|

23

|

|

8. Guarantee Provisions

|

25

|

|

9. Conduct of Claims

|

26

|

|

10. BT NGN Claims and Other TCP NGN Claims

|

27

|

|

11. Termination

|

29

|

|

12. Break Fee

|

29

|

|

13. Tax

|

30

|

|

14. Insurance

|

30

|

|

15. Guarantees and other Third Party Assurances

|

30

|

|

16. Changes of name and Brand

|

31

|

|

17. Protective Covenants Post-closing

|

32

|

|

18. Standstill

|

35

|

|

19. Payments

|

37

|

|

20. Set-off, withholding and Tax on payments

|

37

|

|

21. VAT

|

38

|

|

22. Announcements

|

39

|

|

23. Confidentiality

|

39

|

|

24. Assignment

|

43

|

|

25. Further Assurances

|

43

|

|

26. Costs

|

43

|

|

27. Notices

|

44

|

|

28. Conflict with other Agreements

|

44

|

|

29. Whole Agreement and Several Obligations

|

45

|

|

30. Waivers, Rights and Remedies

|

45

|

|

31. Effect of Closing

|

45

|

|

32. Counterparts

|

45

|

|

33. Variations

|

45

|

|

34. Invalidity

|

45

|

|

35. Third Party Enforcement Rights

|

45

|

|

36. Governing Law and Dispute Resolution

|

46

|

|

Schedule 1 Sellers Warranties

|

47

|

|

Schedule 2 Limitations on Sellers’ Liability

|

74

|

|

Schedule 3 Purchaser Warranties

|

79

|

|

Schedule 4 Limitations on Purchaser’s Liability

|

82

|

|

Schedule 5 Conduct of the Target Companies Pre-Closing

|

86

|

|

Schedule 6 Closing Arrangements

|

94

|

|

Schedule 7 Tax

|

97

|

|

Schedule 8 Brand Licence Principles

|

118

|

|

Schedule 9 Post-Closing Financial Adjustments

|

122

|

|

Schedule 10 Definitions and Interpretation

|

128

|

|

Exhibit 1 Third Party Assurances

|

150

|

|

Exhibit 2 Information on Target Companies

|

152

|

|

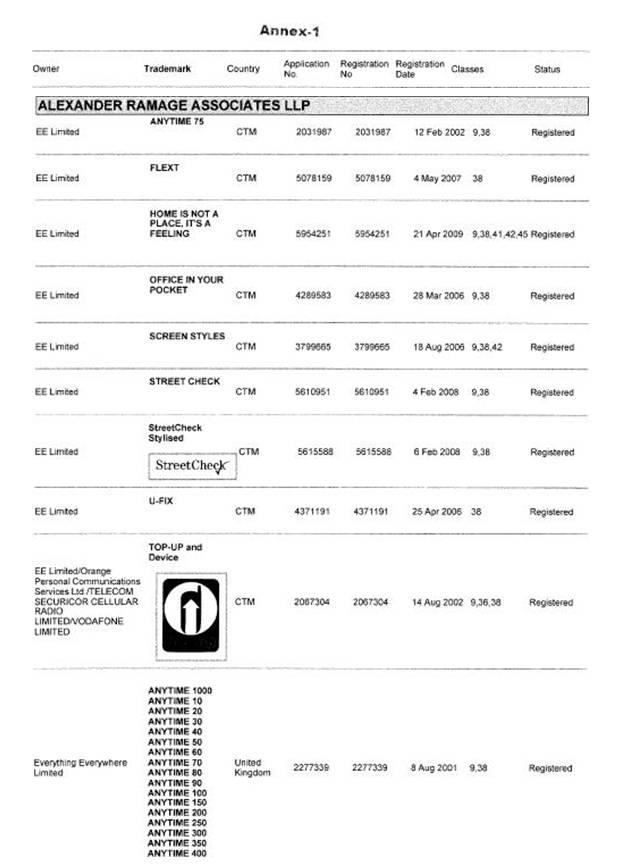

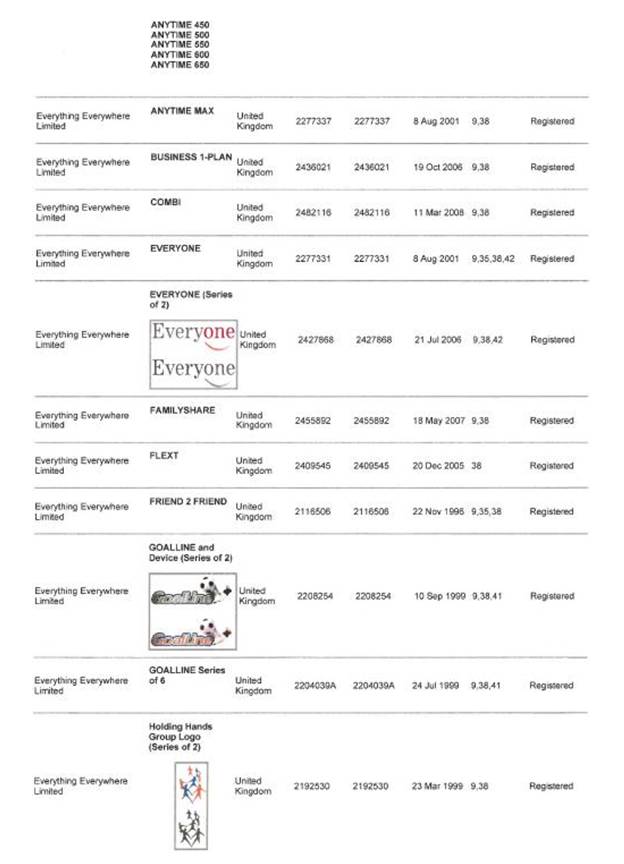

Exhibit 3 Registered Target Company IPR

|

180

|

|

Exhibit 4 Information on Properties

|

202

|

|

Exhibit 5 Financial Adjustments

|

213

|

|

Exhibit 6 Hutchison 3G Contracts

|

221

|

|

Exhibit 7 MBNL Agreements

|

223

|

AGREED FORM DOCUMENTS REFERRED TO IN THIS AGREEMENT

|

Description

|

Clause/Schedule

|

|

-

|

Orange Holdings Standstill and Lock-Up Agreement

|

|

|

-

|

DT Director Appointment Letter

|

|

|

-

|

MBNL Back to Back Guarantee

|

|

|

-

|

BT NGN Settlement Agreement

|

|

THIS AGREEMENT is made on 05_/_02_/2015

Parties:

|

(1)

|

T-Mobile Holdings Limited of Hatfield Business Park, Hatfield, Hertfordshire AL10 9BW (company no. 03836708) (DT Holdings);

|

|

(2)

|

Orange Telecommunications Group Limited of 3 More London Riverside, London SE1 2AQ (company no. 07168292) (Orange Holdings), (DT Holdings and Orange Holdings together being the Sellers);

|

|

(3)

|

BT Group plc of 81 Newgate Street, London EC1A 7AJ (company no. 04190816) (the Purchaser);

|

|

(4)

|

Deutsche Telekom AG of Friedrich-Ebert-Allee 140, 53113 Bonn, Germany (Deutsche Telekom); and

|

|

(5)

|

Orange S.A. of 78 rue Olivier de Serres, Paris 75015, France (Orange S.A.), (Deutsche Telekom and Orange S.A. together being the Seller Guarantors),

|

(each a party and together the parties).

Words and expressions used in this Agreement shall be interpreted in accordance with Schedule 10.

It is agreed:

|

1.1

|

DT Holdings shall sell the A Shares and Orange Holdings shall sell the B Shares and, in each case, the Purchaser shall purchase the Shares with effect from Closing with all rights then attaching to them including the right to receive all distributions and dividends declared, paid or made in respect of the Shares after Closing. The sale and purchase of the Shares shall be on the terms set out in this Agreement and made with Full Title Guarantee.

|

|

1.2

|

The Shares shall be sold free from all Third Party Rights and ownership and risk in them shall (except as otherwise set out in this Agreement) pass to the Purchaser with effect from Closing.

|

|

2.1

|

The aggregate price for all the Shares (the Final Price) shall be the amount which results from taking £12,500,000,000 (twelve billion, five hundred million pounds sterling) (the Debt Free/Cash Free Price) and:

|

|

(a)

|

subtracting the amount of the Debt;

|

|

(b)

|

adding the amount of the Cash;

|

|

(c)

|

adding the amount of the difference (being an absolute value) between the amount of the Working Capital and the amount of the Target Working Capital if that Working Capital is greater (which, where Target Working Capital is a negative number, means a less negative number, or a positive number) than the Target Working Capital (or subtracting the amount of such difference (being an absolute value) if that Working Capital is less (which, where Target Working Capital is a negative number, means a more negative number) than the Target Working Capital); and

|

|

(d)

|

adding the amount of the Capex Adjustment (in accordance with the worked example set out in Exhibit 5) but for the avoidance of doubt, no adjustment shall be made if the difference between Capex and Target Capex is less than 1 per cent. of Target Capex (as set out in the worked example at Exhibit 5).

|

|

2.2

|

At least five Business Days prior to Closing, the Sellers shall deliver to the Purchaser a summary of the Estimated Debt, Estimated Cash, Estimated Working Capital, Estimated Capex and Estimated Incremental Project Costs (showing whether such Estimated Incremental Project Costs constitute Cash, Debt, Working Capital or Capex) each as at the Closing Date. The Estimated Debt, Estimated Cash, Estimated Working Capital, Estimated Capex and Estimated Incremental Project Costs shall be prepared in good faith, in reasonable consultation with the Purchaser, and in accordance with the accounting treatments set out in Schedule 9 and in the form contained in Part C of Exhibit 5 (the Estimated Closing Statement) (provided that a summary of Estimated Incremental Project Costs (showing whether such Estimated Incremental Project Costs constitute Cash, Debt, Working Capital or Capex) shall also be provided). For the avoidance of doubt, provided that the Sellers comply with their obligations in this clause 2.2 and clause 4.7, the Estimated Incremental Project Costs shall (subject to paragraph 11 of Part A of Schedule 9 and any other provisos specified in the specific accounting treatments set out in Part B of Exhibit 5) be disregarded for the purposes of the calculation of the Initial Price.

|

|

2.3

|

At Closing, the Purchaser shall pay to the Sellers an amount (the Initial Price) which is £12,500,000,000 (twelve billion, five hundred million pounds sterling):

|

|

(a)

|

minus the aggregate of the amount of the Estimated Debt;

|

|

(b)

|

plus the aggregate of the amount of the Estimated Cash;

|

|

(c)

|

plus the amount of the difference between the amount of the Estimated Working Capital and the amount of the Target Working Capital if the Estimated Working Capital is greater (which, where Target Working Capital is a negative number, means a less negative number or a positive number) than the Target Working Capital (or minus the amount of such difference if that Estimated Working Capital is less (which, where Target Working Capital is a negative number, means a more negative number) than the Target Working Capital);

|

|

(d)

|

plus the amount of the Capex Adjustment, but for the avoidance of doubt, no adjustment shall be made if the difference between Estimated Capex and Target Capex is less than 1 per cent. of Target Capex (as set out in the worked example at Exhibit 5) and for the purposes of this sub-clause (d) only, references in the definition of Capex Adjustment to “Capex” shall be replaced with “Estimated Capex”.

|

|

2.4

|

Payment for the Shares shall be satisfied partly in cash and partly by the issue of Purchaser Shares. In order to calculate the mix of Purchaser Shares and cash, the Sellers and the Purchaser have agreed a target price for each Purchaser Share of £4.115 (the Reference Price). The amount of DT Holdings Cash Consideration and the Orange Holdings Cash Consideration shall vary in accordance with the adjustments set out in this Clause 2.4, depending upon the BT Closing Share Price. The Initial Price shall be payable by:

|

|

(a)

|

subject to Clause 2.7, the issue of such number of Consideration Shares to DT Holdings as is equal to 12 per cent. of the total number of Purchaser Shares in issue immediately after the issue of all Consideration Shares (the DT Holdings Consideration Shares);

|

|

(b)

|

the issue of such number of Consideration Shares to Orange Holdings as is equal to 4 per cent. of the total number of Purchaser Shares in issue immediately after the issue of all Consideration Shares (the Orange Holdings Consideration Shares);

|

|

(c)

|

the payment of an amount equal to A in cash in pounds sterling to DT Holdings (the DT Holdings Cash Consideration); and

|

|

(d)

|

the payment of an amount equal to B in cash in pounds sterling to Orange Holdings (the Orange Holdings Cash Consideration),

|

where, if the BT Closing Share Price is four per cent. higher than the Reference Price (being £4.2796) or more (the Cap Amount):

| |

A =

|

Initial Price

|

- (4.2796 x the number of DT Holdings Consideration Shares)

|

|

2

|

| |

B =

|

Initial Price

|

- (4.2796 x the number of Orange Holdings Consideration Shares)

|

|

2

|

if the BT Closing Share Price is four per cent. lower than the Reference Price (being £3.9504) or less (the Collar Amount):

| |

A =

|

Initial Price

|

- (3.9504 x the number of DT Holdings Consideration Shares)

|

|

2

|

| |

B =

|

Initial Price

|

- (3.9504 x the number of Orange Holdings Consideration Shares)

|

|

2

|

if the BT Closing Share Price is less than the Cap Amount but more than the Collar Amount (the Variable Range) then:

| |

A =

|

Initial Price

|

- (the BT Closing Share Price x the number of DT Holdings Consideration Shares)

|

|

2

|

| |

B =

|

Initial Price

|

- (the BT Closing Share Price x the number of Orange Holdings Consideration Shares)

|

|

2

|

and BT Closing Share Price means the volume weighted average trading price of a Purchaser Share on the London Stock Exchange as reported through Bloomberg and based on all trades in Purchaser Shares for the 15 trading days prior to (i) the Unconditional Date, or (ii) if Closing takes place according to the timing set out in Clause 5.1(b), the date falling 5 Business Days prior to the Closing Date.

|

2.5

|

Any payments by the Purchaser satisfied by the issue of Consideration Shares shall be made only in whole shares, and any fractional shares shall be rounded down to the nearest whole share.

|

|

2.6

|

The Final Price shall be calculated after Closing on the basis set out in Schedule 9. Any amount required to be paid by the Sellers to the Purchaser under the Financial Adjustments shall be paid 50 per cent. by DT Holdings and 50 per cent. by Orange Holdings. Any amount required to be paid by the Purchaser to the Sellers under the Financial Adjustments shall be paid 50 per cent. to DT Holdings and 50 per cent. to Orange Holdings. The Final Price shall be adopted for all Tax reporting purposes.

|

|

2.7

|

If the DT Holdings Cash Consideration is less than zero (the Cash Deficit), the Purchaser may, by notice in writing to DT Holdings, reduce the number of DT Holdings Consideration Shares that the Purchaser is required to issue to DT Holdings by such number as results in the DT Holdings Cash Consideration being equal to zero or a positive number (being as near as possible to zero). Any notice given pursuant to this Clause 2.7 shall be given not later than three Business Days prior to the Closing Date and shall be in the form of Exhibit 8 and shall state the revised number of DT Holdings Consideration Shares.

|

|

2.8

|

Any payment made in satisfaction of a liability arising under a Seller Obligation or a Purchaser Obligation, other than a payment of interest, shall so far as possible be made by way of adjustment to the consideration for the sale by the relevant Seller of the Shares.

|

|

3.1

|

Closing shall be conditional on the following Conditions having been fulfilled or waived in accordance with this Agreement:

|

|

(a)

|

the passing of an ordinary resolution by the shareholders of the Purchaser approving the Proposed Transaction for the purposes of Chapter 10 of the Listing Rules and the passing of a resolution by the shareholders of the Purchaser authorising the directors of the Purchaser to allot the Consideration Shares (the Resolutions);

|

|

(b)

|

the Consideration Shares having been allotted to the Sellers unconditionally subject only to their admission to the Official List and to trading as referred to in Clause 3.1(c);

|

|

(c)

|

the UK Listing Authority having acknowledged that the application for the admission of the Consideration Shares to the Official List has been approved and will become effective and the London Stock Exchange having acknowledged that the Consideration Shares will be admitted to trading on the London Stock Exchange’s main market for listed securities with effect from Closing;

|

|

(i)

|

confirmation having been received in writing by the Purchaser or the Sellers from the UK Competition and Markets Authority (the CMA) that:

|

|

(A)

|

the CMA does not intend to refer the Proposed Transaction or any matters arising therefrom for a Phase 2 CMA Reference; or

|

|

(B)

|

the CMA does not intend to refer the Proposed Transaction or any matters arising therefrom for a Phase 2 CMA Reference on the condition that undertakings in lieu are provided and the Purchaser agreeing to give such undertakings as the Purchaser (in its sole discretion, but in coordination and consultation with the Sellers) considers satisfactory; or

|

|

(ii)

|

following a Phase 2 CMA Reference of the Proposed Transaction or any matters arising therefrom, confirmation having been received by the Purchaser from the CMA that:

|

|

(A)

|

the Proposed Transaction has not resulted or may not be expected to result in a substantial lessening of competition within any market or markets in the UK for goods or services (SLC);

|

|

(B)

|

the Proposed Transaction has resulted, or may be expected to result, in a SLC but no action should be taken by itself or others to remedy, mitigate or prevent such outcome; or

|

|

(C)

|

the Proposed Transaction has resulted, or may be expected to result, in a SLC and that it will seek undertakings or make an order, and the Purchaser agreeing to give such undertakings or accept such order as, acting reasonably and in coordination and consultation with the Sellers, the Purchaser considers satisfactory (in consultation with the Sellers) provided that (a) the Purchaser shall not be obliged to give any undertakings sought or agree to any orders proposed by the CMA or otherwise take ancillary actions reasonably necessary to ensure clearance that (i) have a cumulative material adverse effect on the Purchaser and/or the Target Group; or (ii) would not be reasonable for the Purchaser and/or the Target Group from a financial or strategic perspective; and (b) in the event the Purchaser agrees any such undertakings or accepts any such orders and those undertakings or orders have a financial impact on the Purchaser and/or the Target Group (the Reasonable Remedies Impact Amount), the Initial Price will be reduced by a reasonable contribution to the Reasonable Remedies Impact Amount by the Sellers (the Remedies Contribution Amount);

|

|

(e)

|

insofar as the Proposed Transaction lacks a “Community dimension” within the meaning of article 1 of Council Regulation (EC) No 139/2004 (the European Union Merger Regulation), the competition authority of any relevant EU Member State in which notification is required requesting referral to the European Commission pursuant to article 22(1) of the European Union Merger Regulation to review all or part of the Proposed Transaction and such a request being accepted, and either:

|

|

(i)

|

the European Commission declaring the Proposed Transaction to be compatible with the common market pursuant to article 6(1)(b) (an EUMR Article 6.1(b) Decision), 8(1) or 8(2) (an EUMR Article 8(1) or 8(2) Decision) of the European Union Merger Regulation applied directly or pursuant to article 22(4) subparagraph 1 of the European Union Merger Regulation in respect of all parts of the Proposed Transaction which were the subject of such a request, either unconditionally or:

|

|

(A)

|

in the case of an EUMR Article 6(1)(b) decision, on conditions satisfactory to the Purchaser (in its sole discretion, in coordination and consultation with the Sellers; or

|

|

(B)

|

in the case of an EUMR Article 8(1) or 8(2) Decision, on conditions satisfactory to the Purchaser acting reasonably and in coordination and consultation with the Sellers provided that (a) the Purchaser shall not be obliged to give any remedies sought by the European Commission or otherwise take ancillary actions reasonably necessary to secure clearance that (i) have a cumulative material adverse effect on the Purchaser and/or the Target Group; or (ii) would not be reasonable for the Purchaser and/or the Target Group from a financial or strategic perspective; and (b) in the event the Purchaser agrees any such remedies and those remedies have a financial impact on the Purchaser and/or the Target Group (the Reasonable Remedies Impact Amount), the Initial Price will be reduced by a reasonable contribution to the Reasonable Remedies Impact Amount by the Sellers (the Remedies Contribution Amount); or

|

|

(ii)

|

all parts of the Proposed Transaction which were the subject of the request having been deemed compatible with the common market pursuant to article 10(6) of the European Union Merger Regulation applied directly or pursuant to article 22(4) subparagraph 1 of the European Union Merger Regulation;

|

|

(f)

|

no EE Material Adverse Change having occurred; and

|

|

(g)

|