State Street, UC Berkeley and Stanford University Form Consortium for Data Analytics in Risk

April 15 2015 - 11:00AM

Business Wire

New Research Initiative Will Explore How Cutting-Edge Data

Science Can Help Manage and Mitigate Financial and Economic

Risk

The University of California, Berkeley (UC Berkeley) and State

Street Global Exchange today announced a collaboration to establish

the Consortium for Data Analytics in Risk (CDAR), a new research

center focused on applying advanced data-science techniques to

manage and mitigate economic and financial risk. The announcement

comes as State Street opens GX Lab, its new presence in Silicon

Valley focused on partnering with local talent, industry leaders,

and academic institutions to create solutions for its clients in

the fields of data science and risk management.

CDAR will bring together researchers from across UC

Berkeley and build upon the programs of the Center for Risk

Management Research (CRMR), an existing unit dedicated to

understanding the dynamics of risk in financial markets. The work

of the consortium will be tied to the mission of CRMR to address

the most important and pressing issues in risk and portfolio

management – a goal closely aligned with State Street’s commitment

to helping solve its clients’ pressing challenges.

An additional founding member of the consortium is Stanford

University’s Center for Financial and Risk Analytics, which

pioneers models, algorithms and numerical tools to address

questions related to financial markets. A fourth founding member

from within the technology industry will be named later this

year.

“We are excited to be working with leading data scientists to

tackle the immensely complex data challenges that face our clients

and the institutional financial services industry today,” said

Jessica Donohue, executive vice president and chief innovation

officer, State Street Global Exchange. “CDAR has significant

potential to forge new pathways in the fields of data science and

risk management and improve insights that can be actionable for our

clients.”

As part of the collaboration, CDAR will organize and sponsor

conferences, workshops and research related to data and analytics

with industry and academic experts in fields such as statistics,

economics, finance, mathematics, electrical engineering, computer

science and industrial engineering and operations.

“We are honored that State Street has chosen UC Berkeley to

oversee this vitally important research initiative,” says Carla

Hesse, executive dean for the College of Letters & Science.

“This consortium will provide our researchers with a unique

opportunity to work with and learn from State Street, and to apply

leading-edge analysis tools to both public and proprietary data to

better understand the complex interactions that drive the global

economy. CDAR has the potential to become a formidable brain trust

for merging data science with risk measurement and management.”

State Street will draw upon the expertise of data scientists

from across disciplines through its new membership in the Berkeley

Institute for Data Science (BIDS), which was established in 2013 to

explore how data science can address important questions about

highly complex topics, such as the nature of the universe, climate

and biodiversity, seismology, neuroscience, human behavior and

other areas. BIDS is led by Saul Perlmutter, a Nobel Prize-winning

physicist, and brings together domain experts from the life,

social, and physical sciences and methodological experts from

computer science, statistics, and applied mathematics to address

major challenges related to data-centric research.

“The financial crisis highlighted the urgent need for better

financial risk management tools,” says Robert M. Anderson, director

of the CRMR. “We are delighted to partner with State Street Global

Exchange to develop data-driven tools to manage financial risk.”

Lisa R. Goldberg, CRMR’s research director, commented that “There

is tremendous power in a partnership between industry and academia.

Together, they can achieve much more than either can do alone.”

According to a recent survey commissioned by State Street of

more than 400 senior executives at investment organizations,

integrating data scientists and their insight into existing

operations is the number one priority, with fifty percent of

respondents intending to prioritize investment in the quality and

availability of data talent over the next three years.

About the University of California, Berkeley: UC Berkeley

is consistently recognized by U.S. News and World Report as the

top-ranked public university in the United States; in 2014, it

ranked as the #3 top global university. Berkeley has 130 academic

departments and programs and has more than 27,000 undergraduate

students, 10,455 graduate students, and 1620 full-time faculty. UC

Berkeley is widely considered a global leader in data science and

is renowned center for research in finance and economics, with

faculty earning five Nobel Prizes in economics since 1983. To learn

more, see www.berkeley.edu.

About State Street Corporation:State Street Corporation

(NYSE: STT) is one of the world's leading provider of financial

services to institutional investors including investment servicing,

investment management and investment research and trading. With

$28.19 trillion in assets under custody and administration and

$2.45 trillion* in assets under management as of December 31, 2014,

State Street operates in more than 100 geographic markets

worldwide, including the US, Canada, Europe, the Middle East and

Asia. For more information, visit State Street’s web site at

www.statestreet.com.

*Assets under management include the assets of the SPDR® Gold

ETF (approximately $27.3 billion as of December 31, 2014), for

which State Street Global Markets, LLC, an affiliate of SSgA,

serves as the distribution agent.

CORP-1389

State Street CorporationAnne McNally, +1

617-664-8576aemcnally@statestreet.com

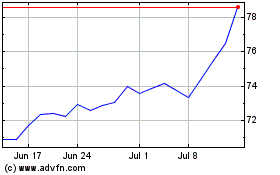

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

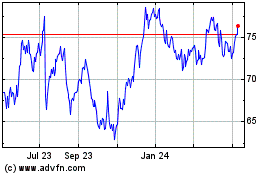

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024