State Street Recognized by Global Investor/ISFMagazine as Top Global Custodian for Second Consecutive Year

August 16 2017 - 12:08PM

Business Wire

Company Receives Top Ranking in all 13 Categories in which it

Qualified

State Street Corporation (NYSE: STT) announced today that it has

been named as the overall top-rated global custodian for the second

year in a row by Global Investor/ISF Magazine’s 2017 Global Custody

Survey.

The Global Investor/ISF Global Custody Survey invited

institutional investors including banks, asset managers and asset

owners to rate their custody service provider across 16 service

categories. State Street was a standout performer among its peers,

achieving the highest global average score compared with six other

major organizations.

Additionally, when only taking into consideration respondents

that used multiple custodians, State Street had the top scores in

the weighted table in EMEA, the Americas and Asia Pacific, leading

the way in global total and global average scores.

State Street also scored high rankings in individual service

categories, winning the top ranking in all 13 of the weighted

categories in which it qualified: cash management, class actions,

client services, corporate actions, foreign exchange services, fund

accounting quality, income collections, industry knowledge,

network, relationship management, reporting and safety of client

assets and settlements.

“Client service is at the heart of who we are as an

organization,” said Andrew Erickson, executive vice president and

head of investment servicing, Americas. “To be named top global

custodian for the second year in a row is a reminder of the

commitment we have made to ensure our clients are benefiting from

our talent and technology. We are proud of and honored by this

recognition.”

State Street provides a range of investment servicing solutions

such as custody, fund accounting, performance and analytics, and

client reporting to a broad array of institutional investors

globally.

For full results of the survey please click here.

About State Street CorporationState Street Corporation

(NYSE: STT) is one of the world's leading providers of financial

services to institutional investors, including investment

servicing, investment management and investment research and

trading. With $31.0 trillion in assets under custody and

administration and $2.60 trillion* in assets under management as of

June 30, 2017, State Street operates in more than 100 geographic

markets worldwide, including the US, Canada, Europe, the Middle

East and Asia. For more information, visit State Street’s website

at www.statestreet.com.

* AUM reflects approx. $34 billion (as of June 30, 2017) with

respect to which State Street Global Markets, LLC (SSGM) serves as

marketing agent; SSGM and State Street Global Advisors are

affiliated.

Important Information

All information has been obtained from sources believed to be

reliable, but its accuracy is not guaranteed. There is no

representation or warranty as to the current accuracy, reliability

or completeness of, nor liability for decisions based on such

information and it should not be relied on as such.

State Street Corporation, One Lincoln Street, Boston, MA

02111-2900.

© 2017 State Street Corporation - All Rights Reserved

CORP-3192

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170816005810/en/

State Street CorporationKerri Doherty, +1

617-664-1898KCDoherty@statestreet.com@StateStreet

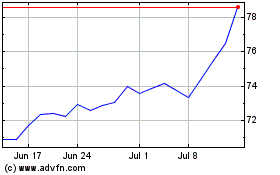

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

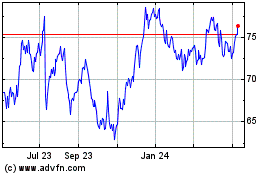

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024