State Street Global Exchange Honored by the Journal of Portfolio Management

March 20 2015 - 2:33PM

Business Wire

Research on the Causes and Consequences of Divergence in High

and Low Frequency Estimation Receives Outstanding Article Award

State Street Corporation (NYSE: STT) announced today that

research article authored by Global Exchange’s Will Kinlaw and

David Turkington received an outstanding article award as part of

The Journal of Portfolio Management’s (JPM) 16th Annual Bernstein

Fabozzi/Jacobs Levy Awards.

Co-authored with Mark Kritzman, chief executive officer of

Windham Capital Management and founding partner of State Street

Associates, the article, “The Divergence of High- and Low-Frequency

Estimation: Causes and Consequences” looks at the dangers of

extrapolating risk estimates derived from higher frequency data to

forecast outcomes over longer horizons. It also presents a

framework for constructing portfolios that balance short- and

long-term horizons.

“This article presented by Kinlaw, Kritzman and Turkington

exemplifies the ground-breaking research that can be found in the

Journal of Portfolio Management,” said Allison Adams, publisher of

Institutional Investor Journals. "The research is useful for

portfolio managers and investors who are confronting the challenges

of balancing short- and long-term investment outcomes.”

“We’re honored to be recognized by The Journal of Portfolio

Management,” said Will Kinlaw, senior managing director and head of

research and advisory for State Street Global Exchange. “The

‘square root of time’ rule for annualizing standard deviation is

everywhere. It’s hard-coded into risk management and optimization

software packages, required by performance measurement rules, and

embedded in the Black-Scholes equation. Unfortunately, it’s often

wrong.”

The winning article, along with other research published by

State Street, helps inform insights offered through GX Investment

Labs, a recent launched suite of interactive applications that can

be used by clients to inform their investment process.

The Bernstein Fabozzi/Jacobs Levy Awards were established in

1999, on the 25th anniversary of The Journal of Portfolio

Management, to honor Editors Peter Bernstein and Frank Fabozzi for

their contributions and to promote research excellence in the

theory and practice of portfolio management.

The winning article can be found (here).

About The Journal of Portfolio Management

Edited by Frank Fabozzi and founded in 1974 by Peter L.

Bernstein, The Journal of Portfolio Management is the

leading editorial source of cutting-edge strategies and analyses

for institutional investment management. Published by Institutional

Investor, it is available quarterly in print and online.

About State Street

State Street Corporation (NYSE: STT) is one of the world's

leading provider of financial services to institutional investors

including investment servicing, investment management and

investment research and trading. With $28.19 trillion in assets

under custody and administration and $2.45 trillion* in assets

under management as of December 31, 2014, State Street operates in

more than 100 geographic markets worldwide, including the US,

Canada, Europe, the Middle East and Asia. For more information,

visit State Street’s web site at www.statestreet.com.

* Assets under management include the assets of the SPDR® Gold

ETF (approximately $27.3 billion as of December 31, 2014), for

which State Street Global Markets, LLC, an affiliate of SSgA,

serves as the distribution agent.

State Street CorporationAnne McNally, +

1617-664-8576AEMcnally@StateStreet.com@StateStreet

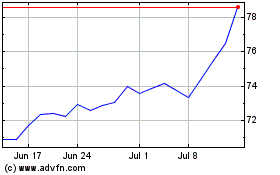

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

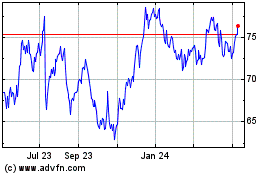

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024