SPDR® DoubleLine® Short Duration

Total Return Tactical ETF and SPDR DoubleLine Emerging Markets

Fixed Income ETF Designed to Seek to Help Investors Navigate

Uncertain Bond Markets

State Street Global Advisors (SSGA), the asset management

business of State Street Corporation (NYSE:STT), announced today

that the SPDR DoubleLine Short Duration Total Return Tactical ETF

(Ticker: STOT) and SPDR DoubleLine Emerging Markets Fixed Income

ETF (EMTL) began trading on the Bats Global Markets. Developed by

SSGA and DoubleLine Capital, the new ETFs build on the success of

the SPDR DoubleLine Total Return Tactical ETF (TOTL), the

fastest-growing ETF launched in 20151.

“Our clients have been asking us for solutions to help them

navigate ongoing bond market uncertainty,” said James Ross,

executive vice president and global head of SPDR Exchange Traded

Funds at SSGA. “We’re pleased to be expanding our relationship with

DoubleLine to seek to help clients address this challenge. These

additions to the SPDR line-up provide investors with new actively

managed fixed income ETFs that may be able to help strengthen and

complement core bond holdings.”

The SPDR DoubleLine Short Duration Total Return Tactical ETF

(STOT) seeks to maximize current income with a dollar- weighted

average effective duration between one and three years. STOT is

managed by Jeffrey Gundlach, chief executive officer and chief

investment officer of DoubleLine Capital, Philip Barach, DoubleLine

president and Jeffrey Sherman. The fund seeks to maximize total

return over a full market cycle through active sector and security

selection across a broad range of fixed income securities that

could include, among others, securities issued or guaranteed by the

US government, foreign and domestic corporate bonds, emerging

market bonds and agency and non-agency mortgage backed securities.

STOT has a gross expense ratio of 0.50 percent2 and a net expense

ratio of 0.45 percent3.

The SPDR DoubleLine Emerging Markets Fixed Income ETF (EMTL)

seeks to provide high total return from current income and capital

appreciation. EMTL is managed by Luz Padilla, director of

DoubleLine’s International Markets Fixed Income Team, Mark

Christensen and Su Fei Koo. The fund seeks to maintain a weighted

average effective duration between two and eight years through

active security selection that combines bottom-up research with

sovereign macro overlays.

EMTL seeks to offer actively managed exposure to fixed income

instruments from emerging market sovereign and corporate issuers.

The SPDR DoubleLine Emerging Markets Fixed Income ETF has a gross

expense ratio of 0.75 percent4 and a net ratio of 0.65

percent5.

In February 2015, State Street Global Advisors and DoubleLine

Capital launched the SPDR DoubleLine Total Return Tactical ETF

(TOTL), which offered access to DoubleLine’s active investment

management. Attracting over $1.7 billion during its first ten

months, TOTL was the fastest-growing ETF launched in all of 2015.

Net assets under management in the SPDR DoubleLine Total Return

Tactical ETF totaled over $2.2 billion as of March 31, 2016.6

“The pioneer of exchange-traded funds was the obvious choice

when we partnered with State Street to launch the first

DoubleLine-managed intermediate-term bond ETF,” Mr. Gundlach said.

“With TOTL having recently marked its first anniversary, now is an

appropriate time for our two firms to make DoubleLine’s low

duration and emerging markets expertise available to ETF

investors.”

About DoubleLine Capital

DoubleLine Capital LP, a registered investment adviser under the

Investment Advisers Act of 1940, manages $95 billion in assets

invested in fixed income, equities, commodities and

asset-allocation strategies. DoubleLine-managed investment vehicles

include open-end mutual fund, closed-end fund, exchange-traded

fund, hedge fund, variable annuity, UCITS and separate account.

DoubleLine’s offices in Los Angeles, CA can be reached by telephone

at (213) 633-8200 or by e-mail at info@doubleline.com. Media can

reach DoubleLine by e-mail at media@doubleline.com. DoubleLine® is

a registered trademark of DoubleLine Capital LP.

About SPDR Exchange Traded Funds

SPDR ETFs are a comprehensive family spanning an array of

international and domestic asset classes. SPDR ETFs are managed by

SSGA Funds Management, Inc., a registered investment adviser and

wholly owned subsidiary of State Street Corporation. The funds

provide investors with the flexibility to select investments that

are precisely aligned to their investment strategy. Recognized as

an industry pioneer, State Street created the first US listed ETF

in 1993 (SPDR S&P 500® – Ticker SPY) and has remained on the

forefront of responsible innovation, as evidenced by the

introduction of many ground-breaking products, including

first-to-market launches with gold, international real estate,

international fixed income, and sector ETFs. For more information,

visit www.spdrs.com.

About State Street Global Advisors

For nearly four decades, State Street Global Advisors has been

committed to helping financial professionals and those who rely on

them achieve their investment objectives. We partner with

institutions and financial professionals to help them reach their

goals through a rigorous, research-driven process spanning both

active and index disciplines. We take pride in working closely with

our clients to develop precise investment strategies, including our

pioneering family of SPDR ETFs. With trillions* in assets under

management, our scale and global footprint provide access to

markets and asset classes, and allow us to deliver expert insights

and investment solutions.

State Street Global Advisors is the investment management arm of

State Street Corporation.

*Assets under management were $2.24 trillion as of December

31, 2015. AUM reflects approx. $22.0 billion (as of December 31,

2015) with respect to which State Street Global Markets, LLC (SSGM)

serves as marketing agent; SSGM and State Street Global Advisors

are affiliated.

Important Information

Actively managed funds do not seek to replicate the

performance of a specified index. An actively managed fund may

underperform its benchmark. An investment in the fund is not

appropriate for all investors and is not intended to be a complete

investment program. Investing in the fund involves risks, including

the risk that investors may receive little or no return on the

investment or that investors may lose part or even all of the

investment.

Bank Loans are subject to credit, interest rate, income

and prepayment risks. The fund may invest in secured and unsecured

participations in bank loans. Participation loans are loans made by

multiple lenders to a single borrower, e.g., several banks

participate in one large loan with one of the banks taking the role

of the lead bank. The lead bank recruits other banks to participate

and share in the risks and profits. There is also the risk that the

collateral may be difficult to liquidate or that a majority of the

collateral may be illiquid. In participation the fund assumes the

credit risk of the lender selling the participation in addition to

the credit risk of the borrower.

Bonds generally present less short-term risk and

volatility than stocks, but contain interest rate risk (as interest

rates raise, bond prices usually fall), issuer default risk, issuer

credit risk, liquidity risk and inflation risk. These effects are

usually pronounced for longer-term securities. Any fixed income

security sold or redeemed prior to maturity may be subject to a

substantial gain or loss. High yield securities may be subject to

greater risks (including the risk of default) than other fixed

income securities.

Derivatives are based on one or more underlying

securities, financial benchmarks, indices, or other obligations or

measures of value; additional risks with derivatives trading (e.g.,

market, credit, counterparty and illiquidity) are possibly greater

than the risks associated with investing directly in the underlying

instruments. Derivatives can have a leveraging effect and increase

fund volatility that can have a large impact on Fund

performance.

ETFs trade like stocks, are subject to investment risk,

fluctuate in market value and may trade at prices above or below

the ETFs net asset value. Brokerage commissions and ETF expenses

will reduce returns.

Floating rate bank loans are often lower-quality debt

securities and may involve greater risk of price changes and

greater risk of default on interest and principal payments. The

market for floating rate bank loans is largely unregulated and

these assets usually do not trade on an organized exchange. As a

result, floating rate bank loans can be relatively illiquid and

hard to value.

Foreign investments involve greater risks than U.S.

investments, including political and economic risks and the risk of

currency fluctuations, all of which may be magnified in emerging

markets.

Sovereign bonds are issued by governments and government

agencies and instrumentalities, which may be unable or unwilling to

repay principal or interest on debt obligations in times of

economic uncertainty.

Investments in asset backed and mortgage backed

securities are subject to prepayment risk which can limit the

potential for gain during a declining interest rate environment and

increases the potential for loss in a rising interest rate

environment.

Standard & Poor’s, S&P and SPDR are registered

trademarks of Standard & Poor’s Financial Services LLC

(S&P); Dow Jones is a registered trademark of Dow Jones

Trademark Holdings LLC (Dow Jones); and these trademarks have been

licensed for use by S&P Dow Jones Indices LLC (SPDJI) and

sublicensed for certain purposes by State Street Corporation. State

Street Corporation’s financial products are not sponsored,

endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their

respective affiliates and third party licensors and none of such

parties make any representation regarding the advisability of

investing in such product(s) nor do they have any liability in

relation thereto, including for any errors, omissions, or

interruptions of any index.

DoubleLine® is a registered trademark of DoubleLine Capital

LP.

Distributor: State Street Global Markets, LLC, member FINRA,

SIPC, a wholly owned subsidiary of State Street Corporation.

References to State Street may include State Street Corporation and

its affiliates. Certain State Street affiliates provide services

and receive fees from the SPDR ETFs. State Street Global Markets,

LLC is the distributor for all registered products on behalf of the

advisor. SSGA Funds Management has retained DoubleLine Capital LP

as the subadvisor. DoubleLine Capital LP and State Street Global

Markets, LLC are not affiliated.

Before investing, consider the funds’ investment objectives,

risks, charges and expenses. To obtain a prospectus or summary

prospectus which contains this and other information, call

1-866-787-2257 or visit www.spdrs.com. Read it

carefully.

Not FDIC Insured – No Bank Guarantee – May Lose Value

CORP-1903

© 2016 State Street Corporation - All Rights Reserved

Expiration Date: 04-30-2018

1 Source: Bloomberg as of 12.31.152 The gross expense ratio is

the fund’s total annual operating expense ratio. It is gross of any

fee waivers or expense reimbursements. It can be found in the

fund’s most recent prospectus.3 The Adviser has contractually

agreed to waive its advisory fee and/or reimburse certain expenses,

until October 31, 2017, so that the net annual fund operating

expenses of the Fund will be limited to 0.45% of the Fund’s average

daily net assets before application of any extraordinary expenses

or acquired fund fees and expenses. The contractual fee waiver

and/or reimbursement does not provide for the recoupment by the

Adviser of any fees the Adviser previously waived. The Adviser may

continue the waiver and/or reimbursement from year to year, but

there is no guarantee that the Adviser will do so and after October

31, 2017, the waiver and/or reimbursement may be cancelled or

modified at any time. This waiver and/or reimbursement may not be

terminated during the relevant period except with the approval of

the SSGA Active Trust’s Board of Trustees.4 The gross expense ratio

is the fund’s total annual operating expense ratio. It is gross of

any fee waivers or expense reimbursements. It can be found in the

fund’s most recent prospectus.5 The Adviser has contractually

agreed to waive its advisory fee and/or reimburse certain expenses,

until October 31, 2017, so that the net annual fund operating

expenses of the Fund will be limited to 0.65% of the Fund’s average

daily net assets before application of any extraordinary expenses

or acquired fund fees and expenses. The contractual fee waiver

and/or reimbursement does not provide for the recoupment by the

Adviser of any fees the Adviser previously waived. The Adviser may

continue the waiver and/or reimbursement from year to year, but

there is no guarantee that the Adviser will do so and after October

31, 2017, the waiver and/or reimbursement may be cancelled or

modified at any time. This waiver and/or reimbursement may not be

terminated during the relevant period except with the approval of

the SSGA Active Trust’s Board of Trustees.6 Source Bloomberg

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160414005944/en/

State Street CorporationAndrew Hopkins,

+1-617-664-2422Ahopkins2@StateStreet.com

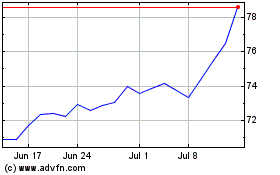

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

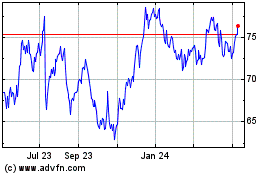

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024