State Street Global Advisors, the asset management arm of State

Street Corporation (NYSE: STT), today released its Global Market

Outlook for 2018 – Step Forward, Look Both Ways – predicting that

the coming year will be supportive of risk assets. However, the

maturity of the growth cycle and a number of structural

uncertainties will warrant a degree of caution.

State Street Global Advisors forecasts more evenly distributed

global growth, which it expects to return to its historical trend

rate of 3.7 percent in 2018, supporting company earnings and

pushing equity markets even higher. The firm sees the best

opportunities further down the cap spectrum within the US, and

views developed markets such as Japan and Europe as particularly

attractive.

“The slow but steady improvement in global growth, coupled with

modest inflation, provides the kind of macro environment that can

continue to lift markets higher,” said Rick Lacaille, global chief

investment officer for State Street Global Advisors. “Valuations,

although extended in some sectors, remain below fair value at

current interest rate levels. Japan is arguably the most attractive

developed market, given relatively low interest rates and a weak

currency.”

The firm also expects that the ongoing move away from

extraordinary monetary policy accommodation, alongside evidence of

lower cross-asset class correlations, could be more conducive for

active equity managers.

“Historically low interest rates and policy-driven liquidity

following the global financial crisis have challenged active

managers through higher correlations and lower volatility,” said

Lori Heinel, deputy global CIO for State Street Global Advisors.

“That backdrop is changing. However, careful consideration of

where, when and how to go active is essential in order to strike

the right balance alongside smart beta and core index

exposures.”

State Street Global Advisors also sees more opportunity in bond

markets. While further rate rises from the US Federal Reserve (Fed)

and European Central Bank (ECB) are in store despite low inflation,

the firm expects rates to stay anchored at a relatively low

level.

“While we are unlikely to see the bond bull to keep charging in

2018, we do think the bears will probably be proven wrong for

another year, even as the Fed is expected to raise rates and other

major central banks begin tapering their accommodative policy. That

said, investors need to balance duration and credit risks

carefully. While emerging market debt valuations have become less

attractive, a tilt towards quality can continue to deliver

results,” added Lacaille.

State Street Global Advisors tempers its outlook with a degree

of caution recognizing that, eight years into the growth cycle,

some investors are increasingly wary of the potential for a

pullback.

“While volatility remains low, the SKEW Index continues to be

elevated, suggesting investors are worried about a low-probability,

high-impact market correction. We are at that point in the cycle

when investors should review the tail risk protection in their

portfolios. The fundamental backdrop remains favorable, however. We

think investors should look both ways. They should take a more

cautious and risk-aware stance as they step forward to make the

most of the opportunities that synchronized global growth will

likely offer in 2018,” Heinel concluded.

To view the full Global Market Outlook, click here.

About State Street Global Advisors

For nearly four decades, State Street Global Advisors has been

committed to helping our clients, and those who rely on them,

achieve their investment objectives. We partner with many of the

world’s largest, most sophisticated investors and financial

intermediaries to help them reach their goals through a rigorous,

research-driven investment process spanning both indexing and

active disciplines. With trillions* in assets, our scale and global

reach offer clients unrivaled access to markets, geographies and

asset classes, and allow us to deliver thoughtful insights and

innovative solutions.

State Street Global Advisors is the investment management arm of

State Street Corporation.

*Assets under management were $2.67 trillion as of September 30,

2017. AUM reflects approx. $36 billion (as of September 30, 2017)

with respect to which State Street Global Advisors Funds

Distributors, LLC (SSGA FD) serves as marketing agent; SSGA FD and

State Street Global Advisors are affiliated. Please note that AUM

totals are unaudited.

Important Information:

Investing involves risk including the risk of loss of

principal.

The information provided does not constitute investment advice

and it should not be relied on as such.

All information has been obtained from sources believed to be

reliable, but its accuracy is not guaranteed.

There is no representation or warranty as to the current

accuracy, reliability or completeness of, nor liability for,

decisions based on such information and it should not be relied on

as such.

The whole or any part of this work may not be reproduced, copied

or transmitted or any of its contents disclosed to third parties

without SSGA's express written consent.

This document may contain certain statements deemed to be

forward-looking statements. Please note that any such statements

are not guarantees of any future performance and that actual

results or developments may differ materially from those projected

in the forward-looking statements.

The information provided does not constitute investment advice

as such term is defined under the Markets in Financial Instruments

Directive (2004/39/EC) or applicable Swiss regulation and it should

not be relied on as such. It should not be considered a

solicitation to buy or an offer to sell any investment. It does not

take into account any investor’s or potential investor’s particular

investment objectives, strategies, tax status, risk appetite or

investment horizon. If you require investment advice you should

consult your tax and financial or other professional advisor. All

material has been obtained from sources believed to be reliable.

There is no representation or warranty as to the accuracy of the

information and State Street shall have no liability for decisions

based on such information.

Investments in small-sized companies may involve greater risks

than in those of larger, better known companies.

Investments in mid-sized companies may involve greater risks

than in those of larger, better known companies, but may be less

volatile than investments in smaller companies.

Investing in foreign domiciled securities may involve risk of

capital loss from unfavorable fluctuation in currency values,

withholding taxes, from differences in generally accepted

accounting principles or from economic or political instability in

other nations.

Equity securities may fluctuate in value in response to the

activities of individual companies and general market and economic

conditions.

Actively managed funds do not seek to replicate the performance

of a specified index.

The Strategy/fund is actively managed and may underperform its

benchmarks. An investment in the strategy/Fund is not appropriate

for all investors and is not intended to be a complete investment

program. Investing in the strategy/Fund involves risks, including

the risk that investors may receive little or no return on the

investment or that investors may lose part or even all of the

investment.

Bonds generally present less short-term risk and volatility than

stocks, but contain interest rate risk (as interest rates raise,

bond prices usually fall); issuer default risk; issuer credit risk;

liquidity risk; and inflation risk. These effects are usually

pronounced for longer-term securities. Any fixed income security

sold or redeemed prior to maturity may be subject to a substantial

gain or loss.

CORP-3501Expiration Date: 12/31/2018

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171206005780/en/

State Street CorporationAndrew Hopkins,

617-664-2422Ahopkins2@statestreet.com

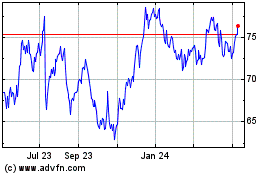

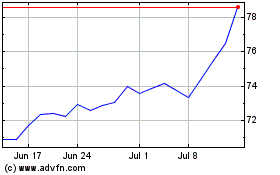

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024