Starwood's Four Points Debuts in Brisbane - Analyst Blog

March 06 2014 - 2:00PM

Zacks

Starwood Hotels & Resorts Worldwide, Inc.

(HOT) remains steadfast in its goal to expand its presence in the

international market. The company recently unveiled Four Points by

Sheraton Brisbane signaling the debut of the brand in the city. The

new property will be owned by Felicity Hotel Pty Ltd.

The 246-roomed property is located at Brisbane’s Central Business

District, at a stone’s throw away from the city’s main attractions

like the Brisbane Botanical Gardens, Brisbane River and Queensland

Art Gallery. In our view, the upscale location and close proximity

to the major attractions will act as a major crowd-puller for the

hotel.

In recent times, Four Points has emerged as one of the strongest

brands of Starwood, especially after the completion of the $1

billion revitalization program. Boasting an affordable price point

and the largest pipeline among all the brands of Starwood, the

mid-scale and contemporary lifestyle brand has been a major success

worldwide.

Starwood has a considerable presence in Australia with 10

properties, out of which 4 are under the Four Points by Sheraton

brand. Besides Four Points, two other brands — Westin and Sheraton

— also operate in the country.

The global hotel chain sees huge development opportunities in

Australia — one of the world’s wealthiest countries. With a limited

supply environment, the country is set to witness a surge in demand

for luxury accommodation driven by a considerable increase in the

number of domestic as well as international travelers.

With Australia’s consistent GDP growth over the last few years,

Starwood’s decision to expand in the country appears to be

strategically apt. Brisbane – one of the largest cities of

Australia – serves as a major trade and transportation hub and,

attracts both business and leisure travelers, and Starwood is

seeking to capitalize on the rising demand in the city.

Stocks to Consider

Starwood currently retains a Zacks Rank #4 (Sell). A better-ranked

stock in the hotel industry is Marriott International,

Inc. (MAR), with a Zacks Rank #2 (Buy). In the broader

leisure services sector, investors may consider Wynn

Resorts Ltd. (WYNN) and MGM Resorts

International (MGM). While Wynn Resorts sports a Zacks

Rank #1 (Strong Buy), MGM Resorts has the same Zacks Rank as

Marriott.

STARWOOD HOTELS (HOT): Free Stock Analysis Report

MARRIOTT INTL-A (MAR): Free Stock Analysis Report

MGM RESORTS INT (MGM): Free Stock Analysis Report

WYNN RESRTS LTD (WYNN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

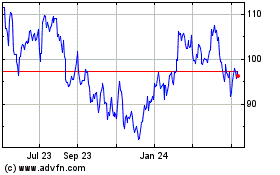

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024