Starbucks Gives Soft Profit Outlook--Update

January 21 2016 - 5:28PM

Dow Jones News

By Chelsey Dulaney

Starbucks Corp. on Thursday offered a soft earnings outlook for

its current quarter, despite posting strong core sales growth at

its U.S. cafes and better-than-expected profit for the fiscal first

quarter.

For the second quarter, Starbucks forecast adjusted earnings of

38 cents to 39 cents a share, below Wall Street's consensus

forecast of 40 cents, according to Thomson Reuters.

Shares, up 45% in the past year, fell 4% to $56.70 a share in

after-hours trading.

The disappointing forecast came as Starbucks reported an 8%

increase in same-store sales for the quarter ended Dec. 27, topping

analysts' forecast for 7.3% growth, according to Consensus

Metrix.

Starbucks cited strong gift card sales during the holiday

period, a 4% increase in traffic, and strong results in its

Americas business, which includes the U.S., Canada and Latin

America.

Starbucks said its U.S. same-store sales were up 9% in the

quarter. The Seattle-based company is benefiting from efforts to

expand its offerings with more food items and alcohol. It has been

focusing on digital efforts and launched a mobile ordering and pay

app in September.

Altogether at the Americas division, same-store sales were up

9%. Analysts had forecast 7.7% growth.

But growth disappointed in its China and Asia Pacific division,

where same-store sales rose 5%. That was below the 6.1% growth

analysts had forecast.

Starbucks has set a torrid pace of growth in Asia in recent

quarters, but concerns are mounting over a slowdown in China's

economy.

Same-store sales growth of 1% in the Europe, Middle East and

Africa division fell below the 4.5% increase analysts had been

expecting.

Starbucks has also been working to expand its offerings beyond

coffee with more food items and alcohol. It has been focusing on

digital efforts and launched a mobile ordering and pay app in

September. Altogether, the efforts have helped drive strong

momentum at its Americas business, which includes the U.S., Canada

and Latin America.

In the latest quarter, same-store sales in the that division

rose 9%. Analysts had forecast 7.7% growth.

Overall, Starbucks reported earnings of $687.6 million, or 46

cents a share, down from $983.1 billion, or 65 cents a share, a

year earlier. The prior-year period was boosted by a $391 million

gain related to a joint venture.

Starbucks had forecast earnings of 44 cents to 45 cents a share

for the quarter.

Revenue rose 12% to $5.37 billion. Analysts had forecast $5.39

billion in revenue.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

January 21, 2016 17:13 ET (22:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

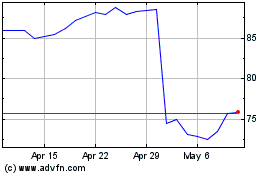

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

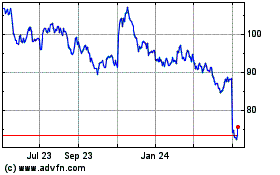

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024