Standard LifeInvProp Unaudited Net Asset Value

November 03 2016 - 3:00AM

UK Regulatory

TIDMSLI

3 November 2016

STANDARD LIFE INVESTMENTS PROPERTY INCOME TRUST LIMITED (LSE: SLI)

Unaudited Net Asset Value as at 30 September 2016

Key Highlights

* Net asset value per ordinary share was 79.0p ( June 2016 - 81.8p), a fall

of 3.4%, resulting in a NAV total return, including dividends, of -2.1% for

Q3;

* The portfolio valuation decreased by 2.2% on a like for like basis, whilst

the IPD/MSCI Monthly Index fell by 3.6% over the same period;

* Positive share price performance in the quarter with share price total

return of 5.0% resulting in the Company's shares trading at a premium to

NAV of 3.5% as at 30 Sep 2016;

* Successful asset management initiatives up to the date of this announcement

included

· 3 new lettings of industrial units in Aberdeen and one

lease renewal

· Refurbishment completed on largest void in the portfolio

- Broadgate Oldham

· Terms agreed for letting of one of three vacant units at

Trafford Park Manchester

* Low void rate of 4.4% as at 30 Sep 2016 (which will decrease by 1% on

completion of sale of a property in Bristol);

* Dividend yield of 5.8% based on a quarterly dividend of 1.19p as at 30 Sep

2016 compares favourably to the yield on the FTSE All-Share REIT Index

(3.6%) and the FTSE All Share Index (3.5%) as at the same date; it is

anticipated the dividend will be covered for the financial year.

Net Asset Value ("NAV")

The unaudited net asset value per ordinary share of Standard Life Investments

Property Income Trust Limited ("SLIPIT") at 30 September 2016 was 79.0p. The

net asset value is calculated under International Financial Reporting Standards

("IFRS").

The net asset value incorporates the external portfolio valuation by Jones Lang

LaSalle and Knight Frank at 30 September 2016. The caveat that was in place for

the Company's valuations as at 30 June 2016, following the result of the EU

referendum, has been removed.

The information in this announcement was inside information.

Breakdown of NAV movement

Set out below is a breakdown of the change to the unaudited NAV per share

calculated under IFRS over the period 1 July 2016 to 30 September 2016.

Per Share Attributable Comment

(p) Assets (GBPm)

Net assets as at 30 June 2016 81.8 311.6

Unrealised decrease in -2.6 -9.9 Like for like decrease of 2.2%

valuation of property portfolio in property portfolio.

Net income in the quarter after 0.2 0.6 Continued strong income

dividend generation with dividend cover

of 126% in the quarter.

Interest rate swaps mark to -0.3 -1.1 Increase in swap liabilities

market revaluation as a result of a continuing

expectation that interest

rates will be lower for longer

as a result of the EU

referendum.

Other movement in reserves -0.1 -0.5 Movement in lease incentives

and capital expenditure in the

quarter.

Net assets as at 30 September 79.0 300.7

2016

30 Sep 2016 30 Jun 2016

European Public Real Estate Association ("EPRA")*

EPRA Net Asset Value GBP307.3m GBP317.0m

EPRA Net Asset Value per share 80.7p 83.3p

The Net Asset Value per share is calculated using 380,690,419 shares of 1p each

being the number in issue on 30 September 2016.

* The EPRA net asset value measure is to highlight the fair value of net assets

on an on-going, long-term basis. Assets and liabilities that are not expected

to crystallise in normal circumstances, such as the fair value of financial

derivatives, are therefore excluded.

Investment Manager Commentary

The third quarter of 2016 was, of course, dominated by the outcome of the EU

Referendum. Perhaps attributable to this, the summer months were quieter than

usual, with many people away and little desire for decisions to be made. We

noticed this for lettings, with transactions being slow to progress. We are

pleased to report, however, that more recently we have since seen signs of

"business as usual" from many of our tenants, especially in the industrial and

logistics sector.

Although the market appears to be stabilising, and several economic indicators

are better than expected, we retain our cautious outlook and will seek to take

risk off the table, especially where this can be done above present valuations.

Our void level has increased slightly over the quarter, but is still very low

at 4.4% compared to the IPD benchmark of 7.1%. Across the portfolio we have

about 225 tenants, and have 18 units available to let, ranging in size from

215sq.ft (a kiosk worth GBP11,000 per annum) to a 101,000sq.ft logistics unit

worth GBP520,000 per annum. Income remains key to us, and our focus is on letting

these vacant units, and interest is encouraging in a number of them. It is

pleasing however that the dividend cover remains robust at 126%.

Since the quarter end we have exchanged contracts to sell an asset in Bristol

that included our second largest void (an industrial unit of 51,000sq.ft worth

GBP308,000 pa). Encouragingly, the sale price is above the June valuation and the

sale proceeds will be used, at least initially, to repay part of the revolving

credit facility ("RCF"). This transaction is due to complete in early November

and will reduce the void rate in the Company to 3.4%.

Last quarter we highlighted the new debt facility the Company had entered into

in April this year and the disadvantageous movement in the mark to market value

of the interest rate swap. As at the end of September, the Company had a term

loan of GBP110m and GBP21m outstanding under the RCF. This provided a Loan to Value

Ratio of 27.3%. The all in cost of the debt is 2.56%, however the NAV

recognises another GBP1.1m adverse movement in the value of the interest rate

swap - taking the liability recognised to GBP6.5m. This will revert to GBP0 at

maturity of the swap in April 2023, or sooner if longer term interest rates

were to rise.

Market Commentary

The economic data following the referendum has not been as negative as feared

although the heightened uncertainty has had some impact on overall activity and

this is likely to continue. Significant monetary support and the rapid

formation of a workable government have helped support the wider economy also.

Although the recent economic data makes an immediate recession after the vote

less likely, potential longer term constraints on economic growth in the UK

remain as uncertainty dampens business investment. The weaker pound should help

to boost net export growth and the depreciated currency also makes UK real

estate more attractive to overseas investors.

Over the twelve months to end September, the All Property Monthly Index

recorded a total return of 3.2% against 9.2% in the twelve months to end June

this year. The sharp capital decline following the unexpected result of the EU

Referendum was the main contributor to the fall in returns, with capital values

in the Monthly Index falling by 3.6% over the quarter to September 2016,

although market conditions and sentiment have stabilised in recent weeks.

Encouragingly, rental growth remained stable at 2.7% in the twelve months to

end September.

As for the equity markets, the FTSE All Share and the FTSE 100 total returns

were 7.8% and 7.1% respectively in the third quarter. For listed real estate

equities, total returns have regained the declines they experienced immediately

after the vote to leave the EU, closing the quarter end with a rise of nearly

5%.

Investment Outlook

The measures taken by real estate funds after the unexpected referendum vote to

protect existing fund investors and stem the initial liquidity driven outflows

are gradually being unwound and stability and a level of normality is returning

to the UK property market. In the environment where the economic fundamentals

are expected to soften further and with uncertainty remaining above "normal"

levels, we expect lower returns from property than has been the case over the

last few years. Given this background, the steady secure income component

generated by the asset class is likely to be the key driver of returns going

forward.

In the short term, the market is likely to be sentiment driven, which will

further affect capital values until there is clarity on the timeline and nature

of the EU exit, while the medium term impact will hinge on the economic

effects. From a sector perspective, we continue to expect Central London

offices to be the most impacted sector in the near term given the linkages to

European markets via cross border trading. Industrial and retail assets are

expected to be comparatively resilient, although not immune, given their close

connection to consumers. Despite the uncertain outlook, UK real estate

continues to provide an elevated yield compared to other assets and, unlike in

the financial crisis, lending to the sector is at a much lower level than in

2007/2008. Furthermore, existing vacancy rates are below average levels in most

markets and development remains relatively constrained, which should all help

stabilise the market further out. The "global hunger for yield" can only

strengthen the demand for real estate in the current ultra-low interest rate

environment. The retention of the UK's safe haven status should also ensure the

asset class is better placed longer term.

Cash and Borrowing position

As at 30 September 2016 the Company had cash of GBP13.3million. The LTV as at

this date (Borrowings less cash divided by portfolio value) was 27.3%.

Dividends

The Company paid total dividends in respect of the quarter ended 30 June 2016

of 1.19p per Ordinary Share, with a payment date of 31 August 2016.

Net Asset analysis as at 30 September 2016 (unaudited)

GBPm % of net

assets

Office 182.8 60.8

Retail 97.2 32.3

Industrial 151.1 50.2

Total Property Portfolio 431.1 143.3

Adjustment for lease incentives (3.7) (1.2)

Fair value of Property Portfolio 427.4 142.1

Cash 13.3 4.4

Other Assets 7.2 2.4

Total Assets 447.9 148.9

Non-current liabilities (bank (136.5) (45.4)

loans & swap)

Current liabilities (10.7) (3.5)

Total Net Assets 300.7 100.0

Breakdown in valuation movements over the period 1 Jul 2016 to 30 Sep 2016

Portfolio Exposure as Like for Capital

Value as at at 30 Sep Like Value Shift

30 Sep 2016 Capital

(GBPm) Value Shift

2016 (%) (%)

Valuation as of 30 450.1

Jun 2016

Retail 97.2 22.5 -1.4 -1.3

South East Retail 6.4 -0.8 -0.2

Rest of UK Retail 1.2 -2.0 -0.1

Retail Warehouses 14.9 -1.6 -1.0

Offices 151.1 35.1 -3.6 -5.7

London City Offices 4.7 -5.4 -1.2

London West End 2.6 0.0 0.0

Offices

South East Offices 22.4 -3.5 -3.5

Rest of UK Offices 5.4 -4.2 -1.0

Industrial 182.8 42.4 -1.5 -2.8

South East Industrial 11.1 -0.2 -0.1

Rest of UK Industrial 31.3 -1.9 -2.7

Sale of Teddington -9.2

and

Kingston-upon-Thames

External valuation at 431.1 100.0 -2.2 431.1

30 Sep 2016

Top 10 Properties

30 Sep 16 (GBPm)

White Bear Yard, London 20-25

Elstree Tower, Borehamwood 15-20

Denby 242, Denby 15-20

DSG, Preston 15-20

Symphony, Rotherham 15-20

Chester House, Farnborough 15-20

Charter Court, Slough 10-15

3B - C Michigan Drive, Milton Keynes 10-15

Ocean Trade Centre, Aberdeen 10-15

Hollywood Green, London 10-15

Top 10 tenants:

Tenant group Passing As % of total

rent rent

1 Sungard Availability Services 1,320,000 4.6 %

(UK) Ltd

2 BAE Systems 1,257,640 4.4 %

3 Techno Cargo Logistics Ltd 1,242,250 4.3 %

4 DSG 1,177,677 4.1 %

5 The Symphony Group Plc 1,080,000 3.8 %

6 Bong UK 727,240 2.5 %

7 Euro Car Parts Ltd 703,430 2.5 %

8 Royal Bank of Scotland Plc 700,000 2.4 %

9 Ricoh UK Limited 696,995 2.4 %

10 Matalan 696,778 2.4 %

9,602,010 33.5 %

Total Fund Passing Rent 28,666,652

Regional Split:

South East 39.9%

East Midlands 15.1%

North West 12.0%

North East 8.6%

South West 6.1%

West Midlands 5.9%

Scotland 5.1%

London City 4.7%

London West End 2.6%

The Board is not aware of any other significant events or transactions which

have occurred between 30 Sep 2016 and the date of publication of this statement

which would have a material impact on the financial position of the Company.

Details of the Company may also be found on the Investment Manager's website

which can be found at: www.standardlifeinvestments.com/its

For further information:-

Jason Baggaley - Real Estate Fund Manager, Standard Life Investments

Tel +44 (0) 131 245 2833 or jason_baggaley@standardlife.com

Graeme McDonald - Real Estate Finance Manager, Standard Life Investments

Tel +44 (0) 131 245 3151 or graeme_mcdonald@standardlife.com

The Company Secretary

Northern Trust International Fund Administration Services (Guernsey) Ltd

Trafalgar Court

Les Banques

St Peter Port

GY1 3QL

Tel: 01481 745001

END

(END) Dow Jones Newswires

November 03, 2016 03:00 ET (07:00 GMT)

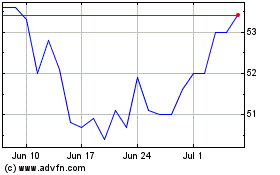

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2023 to Apr 2024