Standard LifeInvProp SLIPIT Purchase

November 24 2014 - 8:49AM

UK Regulatory

TIDMSLI

To: Company Announcements

Date: 24 November 2014

Company: Standard Life Investments Property Income Trust Limited

Subject: SLIPIT Purchase

Standard Life Investments Property Income Trust is pleased to confirm it has

completed the purchase of a portfolio of five industrial and logistics units

for a total of GBP23.75m, reflecting an initial yield of 7.25%. The purchase was

funded from the equity raised on 13th November, is accretive to the net asset

value as the equity was raised on a 5% premium, and the purchase was undertaken

by way of a corporate purchase of an SPV. The five assets are located in

Manchester, Birmingham, Cheltenham and two in Milton Keynes. All are single

let, and total 390,490sq ft. The units are let on leases from 1 year to 21

years term certain, and are considered reversionary, giving scope for further

asset management.

Jason Baggaley, fund manager for SLIPIT said "We are delighted to have

completed this purchase, 2014 has been a very busy year for the Company, as we

raised new equity and invested it for clients. This transaction continues our

strategy of raising money at a sufficient premium to protect existing

investors, and investing in good quality assets that are accretive to the

revenue account, and without undue cash drag to the Company."

All enquiries:

Jason Baggaley

Standard Life Investments Limited

Tel: 01312452833

END

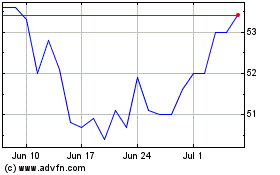

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2023 to Apr 2024