Standard LifeInvProp Net Asset Value(s)

April 27 2017 - 3:27AM

UK Regulatory

TIDMSLI

27 April 2017

STANDARD LIFE INVESTMENTS PROPERTY INCOME TRUST LIMITED (LSE: SLI)

Unaudited Net Asset Value as at 31 March 2017

Key Highlights

Solid Performance

* Net asset value ("NAV??) per ordinary share was 81.4p (Dec

2016 - 81.0p), a rise of 0.5%, resulting in a NAV total return, including

dividends, of 2.0% for Q1;

* The portfolio valuation increased by 0.7% on a like for like basis, whilst

the IPD/MSCI Monthly Index rose by 0.9% over the same period.

Positive investment activity while maintaining low voids

* Sale of Quadrangle, Cheltenham and the Company's largest asset White Bear

Yard, City of London sold for a combined GBP30.1m, removing future letting

risk and capital expenditure and also eliminating the Company's exposure to

City of London offices;

* Proceeds partially reinvested into acquisition of two higher yielding

properties in Sunderland and Bristol, both in the Company's favoured

industrial sector;

* Low void rate of 3.2% as at 31 March 2017.

Strong balance sheet with prudent gearing

* Sale proceeds also used to repay revolving credit facility with the LTV now

standing at 21.2%;

* Company also has uncommitted cash of GBP15m still available for investment in

future opportunities.

NAV Accretive Share Issuance

* Over 8 million shares issued in the quarter under the Company's

blocklisting authority at prices accretive to existing shareholders while

maintaining Company's rating (see below);

* Share price total return of 2.8% in the quarter resulting in the Company's

shares trading at a premium to NAV of 7.8% as at 31 March 2017.

Attractive dividend yield

* Dividend yield of 5.4% based on a quarterly dividend of 1.19p as at 31

March 2017 compares favourably to the yield on the FTSE All-Share REIT

Index (3.7%) and the FTSE All Share Index (3.5%) as at the same date.

Net Asset Value ("NAV")

The unaudited net asset value per ordinary share of Standard Life Investments

Property Income Trust Limited ("SLIPIT") at 31 March 2017 was 81.4p. The net

asset value is calculated under International Financial Reporting Standards

("IFRS").

The net asset value incorporates the external portfolio valuation by Jones Lang

LaSalle and Knight Frank at 31 March 2017. The next valuation will be

undertaken on 30 June 2017 with Knight Frank valuing the whole portfolio.

Breakdown of NAV movement

Set out below is a breakdown of the change to the unaudited NAV calculated

under IFRS over the period 1 January 2017 to 31 March 2017.

Per Attributable Comment

Share Assets (GBPm)

(p)

Net assets as at 31 Dec 2016 81.0 308.5

Unrealised increase in 0.8 3.0 Like for like increase of 0.7%

valuation of property in property portfolio

portfolio

Loss on sales -0.1 -0.2 Loss on sales after costs at

Quadrangle, Cheltenham & White

Bear Yard, City of London

CAPEX & transaction costs in -0.4 -1.7 Predominantly costs of

the quarter acquisition at Sunderland and

Bristol plus asset management

initiative at Foxhole, Hertford

Net income in the quarter 0.0 0.0 Dividend cover of 100% after

after dividend net sales of GBP18.5m in the

quarter. Significant

uncommitted cash resources of GBP

15m still available for

investment.

Interest rate swaps mark to 0.0 -0.1 Marginal increase in swap

market revaluation liabilities in the quarter

Share issuance in the period 0.1 6.9 NAV accretive share issuance

raising net proceeds of GBP6.9m

Other movement in reserves 0.0 0.0 Minimal movement in lease

incentives in the quarter

Net assets as at 31 March 81.4 316.4

2017

31 Mar 2017 31 Dec 2016

European Public Real Estate Association ("EPRA")*

EPRA Net Asset Value GBP320.1m GBP312.1m

EPRA Net Asset Value per share 82.3p 82.0p

The Net Asset Value per share is calculated using 388,815,419 shares of 1p each

being the number in issue on 31 March 2017.

* The EPRA net asset value measure is to highlight the fair value of net assets

on an on-going, long-term basis. Assets and liabilities that are not expected

to crystallise in normal circumstances, such as the fair value of financial

derivatives, are therefore excluded.

Investment Manager Commentary

The Company had a busy start to 2017 with the completion of the sale of two

offices for a total of GBP30.1m, and the purchase of two industrial assets for GBP

10.7m. The sales were undertaken where we could exit at an attractive price and

avoid future risk and capex requirements, whilst the purchases were of

industrial assets with greater prospects for rental growth. Following the sale

of White Bear Yard we have no Central London office exposure, other than a

small office suite as part of a mixed use investment in Westminster. The

downside of the repositioning is the impact of transaction costs in the

quarter.

Performance was negatively affected by adverse valuation movement on a couple

of the retail warehouse assets and on an industrial asset as it gets closer to

a lease end. There were positives, however, from asset management with 4 rent

reviews settled resulting in increases in rent totalling GBP97,000, a lease

regear securing a rent of GBP360,000 pa for an additional 6 years (giving 11

years term certain), and three new lettings securing rents of GBP168,000 pa.

As a result of asset management the void rate stands at 3.2% (under half the

rate of the market average). The voids are dominated by one unit, a logistics

building in Oldham, North Manchester, where we have seen an increase in

interest from potential tenants.

The Company has now repaid all borrowings under the Revolving Credit facility

and the Company's overall LTV at 31 March 2017 was 21.2%. The Company has

approximately GBP15m cash available to reinvest. The valuation of the interest

rate swap against the term loan moved slightly against the Company during the

quarter, and now stands at a liability of GBP3.7 million.

Market Commentary

The UK economy has clearly demonstrated its resilience post the referendum vote

with GDP growth for Q4 2016 recently being revised up to +0.7%. The data,

released thus far for Q1 2017, however, has been mixed regarding the strength

of the economy. Although the manufacturing and production indicators remain

strong, tentative evidence of the rapid squeeze on consumers' spending power

has appeared lately as a result of rising inflation. Furthermore, the UK

household savings ratio fell to a record low at the end of 2016, bringing into

question the scope for further drawdowns in savings. With inflation now running

at the same rate as wages growth in March, real incomes are likely to fall over

the coming months. Although retail sales data have been volatile, the 3-month

average growth rate has clearly slowed. Not surprisingly, some retailers are

becoming more cautious about the outlook for spending including Next, Tesco and

John Lewis.

Over the twelve months to end March, All Property recorded a total return of

3.8% p.a. The sharp capital decline following the EU Referendum in July 2016

continued to have a negative impact on the overall figures, but market

conditions and sentiment have stabilised in recent months with a total return

for Q1 2017 of 2.3%. Capital values fell by 1.7% p.a. in the year to end March,

but again Q1 2017 was positive at 0.9%. Rental growth remained positive however

and grew by 1.6% p.a. in the twelve months to end March.

The industrial sector has continued to outperform with a total return of 9.4%

p.a. in the twelve months to end March. Retail was no longer the laggard

sector in the same period, recording total returns of 2.3% p.a., noticeably

ahead of offices which recorded total returns of 1.4% p.a. reflecting the

political uncertainties associated with the Central London market.

As for the equity markets, the FTSE All Share and the FTSE 100 total returns

were 4.0% and 3.7% respectively over the quarter. For listed real estate

equities, total returns were relatively modest growth at 1.7% over the quarter.

Investment Outlook

UK real estate continues to provide an elevated yield compared to other asset

classes with capital values more stable following the post Brexit upheaval last

year. Lending to the sector is at a lower level than in 2007/2008 and

liquidity remains reasonable. Additionally, development continues to be

relatively constrained by historic standards, and vacancy rates are below long

term average levels. These factors should all help to maintain the positive

returns the sector is currently recording. In this environment, the steady

secure income component generated by the asset class is likely to be the key

driver of returns going forward.

From a sector perspective, we continue to favour industrial and logistics

property, although pricing on prime assets is likely to remain competitive as

the stable income component and positive fundamentals appeal to investors. As

for the retail sector, inflationary pressures may prove to be a significant

headwind going forward with static real wage growth despite a tight labour

market. Further polarisation within the market is likely to be experienced.

During the Brexit negotiations we continue to expect Central London offices to

be the most impacted sector given the linkages to European markets via cross

border trading. Overall, investor appetite is expected to be sustained in an

environment of low numbers and location and asset quality will be crucial

determinants of how markets respond to pressures in the year ahead.

Dividends

The Company paid total dividends in respect of the quarter ended 31 December

2016 of 1.19p per Ordinary Share, with a payment date of 31 March 2017.

Net Asset analysis as at 31 March 2017 (unaudited)

GBPm % of net assets

Office 194.9 61.6

Retail 121.3 38.3

Industrial 97.5 30.8

Total Property 413.7 130.7

Portfolio

Adjustment for lease -3.9 -1.2

incentives

Fair value of Property 409.8 129.5

Portfolio

Cash 22.3 7.0

Other Assets 6.9 2.2

Total Assets 439.0 138.7

Current liabilities -9.8 -3.1

Non-current liabilities -112.8 -35.6

(bank loans & swap)

Total Net Assets 316.4 100.0

Breakdown in valuation movements over the period 1 Jan 2017 to 31 Mar 2017

Portfolio Exposure as Like for Like Capital

Value as at at 31 Mar Capital Value Value Shift

31 Mar 2017 2017 (%) Shift (excl (incl

(GBPm) transactions) transactions

(GBPm)

(%)

External valuation at 429.9

31 Dec 2016

Retail 97.5 23.6 -0.2 -0.2

South East Retail 6.7 -0.4 -0.1

Rest of UK Retail 1.3 3.2 0.2

Retail Warehouses 15.6 -0.4 -0.3

Offices 121.3 29.3 0.7 -29.2

London City Offices 0.0 0.0 -18.9*

London West End Offices 2.8 2.4 0.3

South East Offices 23.3 0.1 0.1

Rest of UK Offices 3.2 3.1 -10.7**

Industrial 194.9 47.1 1.3 13.2

South East Industrial 12.4 2.8 1.4

Rest of UK Industrial 34.7 0.8 11.8***

External valuation at 413.7 100.0 0.7 413.7

31 Mar 2017

* Includes sale of White Bear Yard, City of London

** Includes sale of Quadrangle Cheltenham

*** Includes purchases of Stephenson's Industrial Estate, Sunderland and Kings

Business Park, Bristol

Top 10 Properties

31 Mar 17 (GBPm)

Elstree Tower, Borehamwood 15-20

Denby 242, Denby 15-20

Symphony, Rotherham 15-20

DSG, Preston 15-20

Chester House, Farnborough 15-20

3B - C Michigan Drive, Milton Keynes 10-15

Charter Court, Slough 10-15

Howard Town Retail Park, High Peak 10-15

Hollywood Green, London 10-15

New Palace Place, London 10-15

Top 10 tenants

Tenant group Passing As % of total

rent rent

1 Sungard Availability Services 1,320,000 4.8

(UK) Ltd

2 BAE Systems 1,257,640 4.5

3 Techno Cargo Logistics Ltd 1,242,250 4.5

4 DSG 1,177,677 4.2

5 The Symphony Group Plc 1,080,000 3.9

6 Bong UK 741,784 2.7

7 Euro Car Parts Ltd 703,430 2.5

8 Ricoh UK Limited 696,995 2.5

9 Matalan 696,778 2.5

10 Grant Thornton UK LLP 680,371 2.5

9,596,925 34.6

Total Fund Passing Rent 27,752,278

Regional Split

South East 42.4%

East Midlands 15.9%

North West 12.6%

North East 10.6%

West Midlands 6.5%

Scotland 5.0%

South West 4.2%

London West End 2.8%

The Board is not aware of any other significant events or transactions which

have occurred between 31 Mar 17 and the date of publication of this statement

which would have a material impact on the financial position of the Company.

The information contained within this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulations

(EU) No. 596/2014). Upon the publication of this announcement via Regulatory

Information Service this inside information is now considered to be in the

public domain.

Details of the Company may also be found on the Investment Manager's website

which can be found at: www.standardlifeinvestments.com/its

For further information:-

Jason Baggaley - Real Estate Fund Manager, Standard Life Investments

Tel +44 (0) 131 245 2833 or jason_baggaley@standardlife.com

Graeme McDonald - Real Estate Finance Manager, Standard Life Investments

Tel +44 (0) 131 245 3151 or graeme_mcdonald@standardlife.com

The Company Secretary

Northern Trust International Fund Administration Services (Guernsey) Ltd

Trafalgar Court

Les Banques

St Peter Port

GY1 3QL

Tel: 01481 745001

END

(END) Dow Jones Newswires

April 27, 2017 03:27 ET (07:27 GMT)

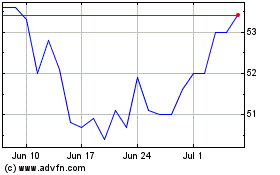

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2023 to Apr 2024