Standard LifeInvProp Net Asset Value(s)

May 07 2015 - 7:33AM

UK Regulatory

TIDMSLI

7 May 2015

STANDARD LIFE INVESTMENTS PROPERTY INCOME TRUST LIMITED (LSE: SLI)

Unaudited Net Asset Valueas at 31 March 2015

Key Highlights

* Net asset value per ordinary share was 75.6p as at 31 March 2015 which is

arrived at after deducting the Q1 dividend due to be paid in May 2015. This

is an increase of 1.7% from 31 December 2014.

* Successful placing of approximately 31.3m ordinary shares at 78.1p per

share under the Placing Programme announced on 12 February 2015, following

this an additional 1.3m ordinary shares were also issued on 4 March 2015 at

80.2p per share, raising in total gross proceeds of approximately GBP25.5m.

* One retail property purchased in March 2015 for GBP15.8m excluding costs and

one office property sold in January 2015 for GBP3.2m excluding costs.

* Dividend yield of 5.2% based on share price of88.5p (5May 2015).

Net Asset Value ("NAV")

The unaudited net asset value per ordinary share of Standard Life Investments

Property Income Trust Limited ("SLIPIT") at 31 March 2015 was 75.6 pence

including the adjustment for the Q1 dividend payment due in May 2015. This is

an increase of 1.7% over the net asset value of 74.3 pence (including the

adjustment for the Q4 dividend)per share at 31 December 2014. The net asset

value is calculated under International Financial Reporting Standards ("IFRS").

The net asset value incorporates the external portfolio valuation by Jones Lang

LaSalle at 31 March 2015. The property portfolio will next be valued by the

external valuer during June 2015 and the next quarterly net asset value will be

published thereafter.

Breakdown of NAV movement

Set out below is a breakdown of the change to the unaudited NAV per share

calculated under IFRS over the period 31December 2014 to 31 March 2015.

GBPm Pence % of opening

per NAV

share

Unaudited Net Asset Value at 31 December 2014 184.4 75.5 -

Gain - valuation increase on the standing 3.7 1.5 2.0%

property portfolio

Loss - unrealised following the purchase of

investment property (0.7) (0.3) (0.4%)

Capex receipts 0.2 0.1 0.1%

Rent free smoothing (0.2) (0.1) (0.1%)

Increase in unrealised interest rate swap (0.3) (0.1) (0.1%)

liability

0.2 0.2 0.2%

Other movement in reserves

Increase in share capital 25.2

Unaudited Net Asset Value at 31 March 2015

before adjustment for dividend 212.5 76.8 1.7%

Adjustment for Q1 dividend (3.2) (1.2)

Unaudited Net Asset Value at 31 March 2015 after

adjustment for dividend 209.3 75.6

European Public Real Estate Association 31 Mar 2015 31 Dec 2014

("EPRA")*

EPRA Net Asset Value before adjustment GBP215.5m GBP187.0m

for dividend

EPRA Net Asset Value after adjustment GBP212.2m GBP184.2m

for dividend

EPRA Net Asset Value per share before 77.9p 76.6p

adjustment for dividend

EPRA Net Asset Value per share after 76.7p 75.4p

adjustment for dividend

The Net Asset Value per share is calculated using 276,779,237 shares of 1p each

being the number in issue on 31 March 2015.

*The EPRA net asset value measure is to highlight the fair value of net assets

on an on-going, long-term basis. Assets and liabilities that are not expected

to crystallise in normal circumstances, such as the fair value of financial

derivatives, are therefore excluded.

Investment Manager Commentary

During Q1 the Company issued new shares under the live prospectus, raising GBP

25.5m. This fully utilised the capacity of the prospectus, and enabled the

Company to complete on the purchase of a retail warehouse in Preston for GBP

15.8m. The property is let to DSG (Dixons) for a further 16 years. The purchase

price reflected a yield of 7%. We also completed the sale of a small office in

Weybridge that had a lease expiry in February this year. The sale price was GBP

3.2m.

During the quarter we started on site with the refurbishment of 6 industrial

units at Ocean Trade Centre in Aberdeen. The total cost will be circa GBP1.4m and

we are close to completing a new 10 year lease on 4 of the units. We are also

working up a refurbishment and upgrade of our office investment at White Bear

Yard in Farringdon, at a potential cost of GBP2.5m. This building is in a very

desirable area and we want to capitalise on the strong tenant demand.

We expect the UK real estate market to provide a total return of low double

digits in 2015. Although this is attractive it will fall short of the

exceptional returns experienced in 2014.This growth is in part due to continued

strong investment demand driven by a weight of money in the sector, but with

the continued improvement in occupier demand as well throughout the UK we can

expect to see more rental growth than in 2014. It is not envisaged that the

election will have a material impact on demand, and we intend to continue

investing in good quality real estate that appeals to occupiers. The Company

had an occupation rate of 97.5% as at the quarter end, with solicitors

instructed on two further lettings, and the average unexpired lease term (to

earliest termination) has increased to 7.1 years.

Cash position

As at 31 March 2015 the Company had borrowings of GBP84.4mand a cash position of

GBP17.4m (excluding rent deposits) therefore cash as a percentage of debt was

20.6%.

Dividends

The Company paid an interim dividend in respect of the quarter ended 31December

2014, of 1.161p per Ordinary Share, with ex-dividend and payment dates of5

February 2015and 20 February 2015respectively.

Loan to value and interest rate

As at 31 March 2015 the loan to value ratio (assuming all cash is placed with

RBS as an offset to the loan balance) was 23.4% (31December 2014: 29.3%). The

bank covenant level is 65%.As a result of interest rate swaps the weighted

average interest rate on the loan is fixed at 3.7% until the loan matures in

December 2018.

The Company has two interest rate hedges which mature in December 2018 and have

a current liability of GBP2.9m (31 December 2014: GBP2.7m).These had a negative

impact on the NAV of 0.1p per share or 0.1% over the quarter.

Net Asset analysis as at 31 March 2015 (unaudited)

GBPm %of net

assets

Office 112.8 53.1

Retail 63.4 29.8

Industrial 110.4 51.9

Total Property Portfolio 286.6 134.8

Adjustment for lease (2.0) (0.9)

incentives

Fair value of Property 284.6 133.9

Portfolio

Cash 17.4 8.2

Other Assets 3.8 1.8

Total Assets 305.8 143.9

Non-current liabilities (87.0) (40.9)

Current liabilities (6.3) (3.0)

Total Net Assets 212.5 100.0

Breakdown in valuation movements over the period 1 Jan 2015 to 31 Mar 2015

Exposure as Capital Value Capital

at 31 Mar Movement on Value

2015 (%) Standing Movement on

Portfolio (%) Portfolio (GBPm)

External Property Valuation 270.2

at 31 Dec 2014

IPD Sub Sector Analysis:

RETAIL

South East Retail 5.7 2.2 0.4

Retail Warehouses 16.4 0.1 15.9*

OFFICES

London City Offices 6.2 5.5 0.9

London West End Offices 3.3 0.0 0.0

South East Offices 19.6 1.5 (2.3)*

Rest of UK Offices 10.3 (0.7) (0.2)

INDUSTRIAL

South East Industrial 8.7 2.8 0.7

Rest of UK Industrial 29.8 1.3 1.1

External Property Valuation 100.0 1.5 286.7**

at 31 Mar 2015

*Due to purchase of oneretail investment and the sale of one office investment

**Adjusted to exclude sales costs of properties held for sale at 31 March 2015

Top 10 Properties

31 Mar 15 (GBPm)

White Bear Yard, London 15-20

DSG, Preston 15-20

Chester House, Farnborough 15-20

Symphony, Rotherham 15-20

Denby242, Denby 10-15

Hertford Place, Rickmansworth 10-15

St James's House, Cheltenham 10-15

Hollywood Green, London 10-15

3B - C Michigan Drive, Milton Keynes 10-15

Howard Town Retail Park, Glossop 10-15

The Board is not aware of any other significant events or transactions which

have occurred between 31 March 2015 and the date of publication of this statement

which would have a material impact on the financial position of the Company.

Details of the Company may also be found on the Investment Manager's website

which can be found at:www.standardlifeinvestments.com/its

For further information:-

Jason Baggaley - Real Estate Fund Manager Standard Life Investments

Tel +44 (0) 131 245 2833 or jason_baggaley@standardlife.com

Gordon Humphries - Head of Investment Companies Standard Life Investments

Tel +44 (0) 131 245 2735 or gordon_humphries@standardlife.com

The Company Secretary

Northern Trust International Fund Administration Services (Guernsey) Ltd

Trafalgar Court

Les Banques

St Peter Port

GY1 3QL

Tel: 01481 745001

Fax: 01481 745085

END

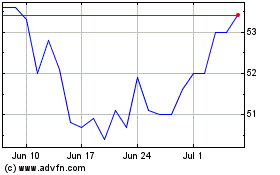

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2023 to Apr 2024