TIDMSLI

27 AUGUST 2015

STANDARD LIFE INVESTMENTS PROPERTY INCOME TRUST

RESULTS IN RESPECT OF THE PERIOD ENDED 30 JUNE 2015

Financial Highlights

* Net Asset Value total return of 6.6% for the six months ended 30 June 2015.

* Share price increased by 7.0% over the six months ended 30 June 2015 to

83.8p.

* Dividend yield of 5.5% based on 30 June 2015 share price of 83.8p.

* 2 properties purchased for GBP20.4m excluding costs and 4 properties sold for

GBP11.6m excluding costs.

* GBP34.8m of new equity raised over the six months ended 30 June 2015 at an

average premium to Net Asset Value of 5.4%, increasing the number of shares

in issue by 18.1%.

Total Returns (with dividends re-invested) 6 months to 30

June 2015

Net Asset Value per share* +6.6%

Share Price total return* +10.0%

*Source: Winterfloods

Capital Values 30 June 31 December

2015 2014 % Change

Net Asset Value per share 1 78.5p 75.5p +4.0%

EPRA* Net Asset Value per share 2 79.2p 76.6p +3.4%

Share Price 83.8p 78.3p +7.0%

Premium of Share Price to Net Asset 6.8% 3.7% -

Value

Total Assets GBP320.4m GBP278.7m +15.0%

Loan to Value 3 19.8% 29.2% -

Cash Balance GBP27.3m GBP5.4m -

Dividends 30 June 30 June

2015 2014

Dividends per share 4 2.322p 2.294p

Dividend yield 5.5% 6.1%

Property Returns 6 months to 30 12 months to 31

June 2015 December 2014

Property income return 5 3.1% 7.5%

IPD property income monthly index 6 2.5% 5.6%

Property total return (property 5.8% 18.0%

only) 7

IPD property total return monthly 6.3% 17.9%

index 6

1 Calculated under International Financial Reporting Standards.

2 EPRA NAV represents the value of an entity's equity on a long-term

basis. Some items, such as fair value of derivatives, are therefore excluded.

3 Calculated as bank borrowings less all cash as a percentage of the

open market value of the property portfolio as at 30 June 2015.

4 Dividends paid during the 6 months to 30 June 2015.

5 The net income receivable for the period expressed as a percentage of

the capital employed. Quarterly figures are compounded over the period to give

the rate over six months and twelve months.

6 Source: IPD quarterly version of the monthly index funds (excludes

cash).

7 The sum of capital growth and net income for the period expressed as a

percentage of capital employed excluding cash.

* The European Public Real Estate Association (EPRA) is a common

interest group, which aims to promote, develop and represent the European

public real estate sector.

Chairman's Statement

I have pleasure reporting on another very good period for your Company. The

REIT conversion has taken place successfully; the Company has fully utilised

its capacity to raise additional equity under both the Prospectus and

dis-application of pre emption rights authorities; further investment has been

made in real estate assets and the NAV has continued to grow.

The market capitalisation of the Company increased by 27% during the six months

period to GBP242m with total assets increased to GBP320m. The share price rose by

7.0% and the net asset value per share ('NAV') increased by 4.0%. The NAV total

return to shareholders was 6.6%.

The Property Portfolio and Performance

The Investment Manager's report provides detailed information on the portfolio.

At the end of June 2015, it was valued at GBP288m. Additionally there was

positive cash of GBP27.3m. Total assets were GBP320.4m (31 December 2014: GBP278.7m).

The Company's NAV at period end was 78.5p per share (31 December 2014: 75.5p),

an uplift of 4.0% over the period. The table below sets out the components of

the movement in the NAV.

Pence per % of opening

Share NAV

NAV as at 31 December 2014 75.5 100.0

Increase in valuation of property 2.7 3.6

portfolio

Decrease in interest rate swap 0.3 0.4

liability

NAV as at 30 June 2015 78.5 104.0

The Company completed two purchases totalling GBP20.4m in Preston and Bristol and

subsequent to the half year six further properties have been purchased for GBP

26.2m. There is one purchase in the pipeline that the Managers expect to

complete on over the next month.

The Company has sold four properties in the reporting period for GBP11.6m and

since the period end a further two sales and one part sale for GBP11.9m.

Shares and Share Price

At the half year, there were 288,387,160 shares in issue, an increase of 18.1%

over the period. The share price on 30 June 2015 was 83.8p, an uplift of 7.0%

over the six month period, and represented a premium of 6.8% over NAV at the

period end.

Earnings and Dividends

Earnings for the period increased from GBP11.57m to GBP12.92m, an increase of

11.7%. The shares provided a dividend yield of 5.5% based upon the current

annualised dividend of 4.644p per share and the share price at period end.

REIT Conversion

On 1 January 2015 the Company became resident in the UK for tax purposes and

will now be compliant with the UK REIT regime. Following the conversion to a

REIT the Company can pay dividends as property income dividends (PIDs). Indeed

in order to maintain its tax status as a UK REIT the Company must distribute

90% of its real estate profits in the form of PIDs. The Board has resolved that

the first three dividend payments this year will be by way of a PID and will be

paid net of UK tax unless the registered owner of the shares has completed a

HMRC declaration. A number of shareholders attending the May 2015 AGM

highlighted that the cash dividend received had been 20% less than before. This

is due to the deduction of the UK tax of 20% that the Company is required to

withhold. The Company's Registrar has provided the necessary HMRC declaration

forms to all qualifying registered owners of the Company's shares. However the

Board is aware that a number of investors hold shares via execution only

platforms or with ISA/ SIPP providers and may not have been advised of the

requirement to complete a declaration in order to receive dividends gross.

Investors are advised to seek independent advice and to contact their nominee

company to receive the necessary forms should they be eligible to do so. Where

a tax refund is due from HMRC our tax advisers have confirmed that the relevant

tax wrapper plan manager or administrator would be required to complete the

necessary forms and submit them to HMRC.

Loan to Value ratio

At 30 June 2015, the LTV ratio was 19.8% which will increase once the Company's

cash balance is invested. Our loan agreement with RBS sets out an upper limit

of 65% until December 2016, reducing to 60% for the remaining two years.

The Board and Corporate Governance

It is my intention to retire from the Board at the AGM next June having been a

founder director of your Company since 2003. I am delighted to inform you that

the Board has asked Robert Peto to be your new chairman and he has accepted.

The Board has started a search for a new UK based non-executive director.

Fund Raising

During February 2015 the Company issued all of the remaining shares under its

Prospectus authority bringing the total issued since July 2014 to 100m shares.

In addition, over the period from 20 February 2015 to 18 June 2015 the Company

has fully utilised its powers to issue shares on a non pre-emptive basis

issuing a further 27.7m shares. In total during the half year period the

Company issued new shares for a gross consideration of GBP34.8m. In each case the

new shares were issued at a premium of at least 5% to the prevailing NAV and

the proceeds invested timeously into UK commercial real estate properties at

attractive yields.

As a result of being a larger company together with the lower management fee

instituted in July 2014 the ongoing charges ratio has fallen to 1.4% based on

an average NAV from 1.8% a year earlier.

Outlook

The UK economy is continuing to grow. There are interest rate and geopolitical

risks, with some countries experiencing slower growth, but we expect UK growth

to continue. There is now better demand for space from prospective tenants so

that rents in some sectors are rising. In many areas space is in short supply

because of the lack of building in recent years.

The Managers are active with tenants and in the market and your Board is

optimistic that the Company can continue to show good returns.

Richard Barfield

Chairman

27 August 2015

Principal Risks and Uncertainties

The Company's assets consist of direct investments in UK commercial property.

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:06 ET (12:06 GMT)

Its principal risks are therefore related to the commercial property market in

general, but also the particular circumstances of the properties in which it is

invested, and their tenants. The Board and the Investment Manager seek to

mitigate these risks through a strong initial due diligence process, continual

review of the portfolio and active asset management initiatives. All of the

properties in the portfolio are insured, providing protection against risks to

the properties and also protection in case of injury to third parties in

relation to the properties.

The Board has also identified a number of other specific risks that are

reviewed at each Board meeting. These are as follows:

* The Company and its objectives become unattractive to investors. This is

mitigated through regular contact with shareholders, a regular review of

share price performance and the level of the discount or premium at which

the shares trade to net asset value and regular meetings with the Company's

broker to discuss these points and address any issues that arise.

* Poor selection of new properties for investment. A comprehensive and

documented initial due diligence process, which will filter out properties

that do not fit required criteria, is carried out by the Investment

Manager. Where appropriate, this is followed by detailed review and when

necessary challenged by the Board prior to a decision being made to proceed

with a purchase. This process is designed to mitigate the risk of poor

property selection.

* Tenant failure or inability to let property. Due diligence work on

potential tenants is undertaken before entering into new lease

arrangements. In addition, tenants are kept under constant review through

regular contact and various reports both from the managing agents and the

Investment Manager's own reporting process. Contingency plans are put in

place at units that have tenants that are believed to be in financial

trouble. The Company subscribes to the Investment Property Databank Iris

Report which updates the credit and risk ranking of the tenants and income

stream, and compares it to the rest of the UK real estate market.

* Loss on financial instruments. The Company has entered into a number of

interest rate swap arrangements. These swap instruments are valued and

monitored on a monthly basis by the counterparty bank. The Investment

Manager checks the valuation of the swap instruments internally to ensure

they are accurate. In addition, the credit rating of the bank that the

swaps are taken out with is assessed regularly.

Other risks faced by the Company include the following:

* Strategic - incorrect strategy, including sector and property allocation

and use of gearing, could all lead to a poor return for shareholders.

* Tax efficiency - the structure of the Company or changes to legislation

could result in the Company no longer being a tax efficient investment

vehicle for shareholders.

* Regulatory - breach of regulatory rules could lead to the suspension of the

Company's Stock Exchange Listing, financial penalties or a qualified audit

report.

* The implementation of AIFMD during 2014 and the conversion of the Company

to a UK REIT have introduced new regulatory risks to the Company in the

form of ensuring compliance with the respective regulations. In relation to

AIFMD, the Board has put in place a system of regular reporting from the

AIFM and the depositary to ensure both are meeting their regulatory

responsibilities in respect of the Company. In relation to UK REIT status,

the Board has put in place a system of regular reporting to ensure that the

requirements of the UK REIT regime are being adequately monitored and fully

complied with.

* Financial - inadequate controls by the Investment Manager or third party

service providers could lead to misappropriation of assets. Inappropriate

accounting policies or failure to comply with accounting standards could

lead to misreporting or breaches of regulations.

* Operational - failure of the Investment Manager's accounting systems or

disruption to the Investment Manager's business, or that of third party

service providers, could lead to an inability to provide accurate reporting

and monitoring, leading to loss of shareholder confidence.

* Economic - inflation or deflation, economic recessions and movements in

interest rates could affect property valuations and also bank borrowings.

The Board seeks to mitigate and manage all risks through continual review,

policy setting and enforcement of contractual obligations. It also regularly

monitors the investment environment and the management of the Company's

property portfolio, levels of gearing and the overall structure of the Company.

Going Concern

The Directors have reviewed detailed cash flow, income and expense projections

in order to assess the Company's ability to pay its operational expenses, bank

interest and dividends for the foreseeable future. The Directors have examined

significant areas of possible financial risk including cash and cash

requirements and the debt covenants, in particular those relating to LTV and

interest cover. They have not identified any material uncertainties which cast

significant doubt on the ability to continue as a going concern for a period of

not less than 12 months from the date of the approval of the financial

statements. The Directors have satisfied themselves that the Company has

adequate resources to continue in operational existence for the foreseeable

future and the Board believes it is appropriate to adopt the going concern

basis in preparing the financial statements.

Investment Manager's Report

UK Real Estate Market

The UK economic fundamentals continue to strengthen as the economy is now

estimated to have grown by 0.7% in Q2 according to the first estimate of the

ONS, representing a solid rebound albeit dominated by the service sector's

contribution. Business sentiment and consumer confidence remain buoyant. Over

the six months to 30 June 2015 the All Property total return, as recorded by

the Quarterly version of the IPD Monthly Index, was 6.3% which, although

attractive, lagged the 8.4% total return for the same period in 2014. Capital

values increased by 3.7% in the half year to end June (5.5% in 2014). Rental

growth however continues to improve, and grew by 1.8% in the six months to 30

June 2015, compared to 1.4% for the same period in 2014. It is noticeable that

rental growth is spreading out across the UK and is no longer limited to London

and the South East, although it is less evident in the retail sector on

anything but the best product. This reflects the relative performance of the

three main sectors with offices providing a total return of 8.7% over the

reporting period, industrial 7.8% and retail again lagging the market at 3.7%.

Demand from investors has remained robust over the first half of 2015,

continuing the theme of weight of money driving pricing that was most evident

in 2014. There remains a diverse source of investors from overseas, to private

equity type buyers to UK institutions. This is driven as much by the relative

pricing of real estate (especially compared to gilts) as it is the improving

fundamentals of rental growth resulting from strong occupational demand and

limited supply.

Investment Outlook

UK Commercial Real Estate continues to make steady progress in 2015 although

momentum has reduced compared to the same point last year. We expect positive

total returns for investors on a three year holding period due to the elevated

yield and improving income growth prospects. The sector remains attractive from

a fundamental point of view, i.e., strengthening economic drivers and a limited

pipeline of future new developments. Rising interest rates are an emerging risk

although there is a reasonable buffer in pricing to compensate if the market

prices in a further acceleration of rate rises. The retail sector continues to

face a series of headwinds that may hold back recovery in weaker locations due

to oversupply and structural issues but the prospects for retail towards the

South East and Central London are expected to improve further as economic

recovery gains more traction. Prime, good quality secondary assets and

selective poorer quality secondary assets in stronger locations are likely to

provide the best opportunities in the robust economic environment we anticipate

over the remainder of 2015 and into 2016.

Performance

Over the first 6 months of 2015 the Company had a NAV Total Return of 6.6% and

a share price total return (assuming dividends reinvested) of 10%.

UK listed real estate equities (as measured by the FTSE EPRA/ NAREIT UK index)

provided a total return of 8% over the six months to 30 June 2015, which

compared well to the 1.4% from the FTSE100 over the same period and 3% from the

FTSE All Share.

The portfolio level return has slightly lagged over the reporting period,

influenced heavily by the level of transactions. The NAV total return

demonstrates the benefit of raising new equity at a premium to cover the

transaction costs and protect existing shareholder's returns.

We have also written down some of the valuations based on expected or actual

sale prices as we sold out of our smaller assets with poorer performance

expectations. This includes one asset in particular which has now been sold

(Drakes Way, Swindon) where we had hope value in the valuation for a proposed

food store development which is no longer going to happen. The standing

portfolio (assets held over the period), continued to perform well, with a

total return of 18.7% over the 12 months to end June, compared to the IPD

return of 16.3% for the same period.

Investment Strategy

The Investment Manager and the Board are focussed on providing investors a

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:06 ET (12:06 GMT)

sustainable and attractive level of income by investing in good quality

commercial real estate assets in the UK. We target assets that we believe will

appeal to occupiers, where we can add value and generate rental growth through

actively managing the assets. The Company targets a covered dividend over the

course of each year.

Portfolio Valuation

The property is valued on a quarterly basis by Jones Lang Lasalle. As at 30

June 2015 the investment portfolio comprised a total of 39 assets valued at a

total of GBP288.39m. In addition the Company had cash of GBP27.3m. This compares to

GBP178.8m and GBP23.2m respectively at end June 2014.

Lease Expiry Profile

The Company has an average lease length to earliest of lease end or break

option of 7.1 years. This is similar to the IPD index (with leases over 35

years excluded). We take an active approach to managing lease expiries, and for

2015 we have secured 73% of income at risk thorough lease expiry or break, with

another 10% in solicitors hands for lease regears. 68% of the income at risk in

2016 has also been secured.

As the occupational market improves and supply though development remains

limited, there is increasing opportunity to add value through lease events;

either renewing existing leases, or taking accommodation back to refurbish and

then relet.

Portfolio sector/subsector allocations

The portfolio is invested solely in UK Commercial Real Estate. Retail has been

an underperforming sector and the Company is likely to remain underweight to

retail whilst it believes the current divergence between large prime dominant

retail destinations and smaller more secondary ones will continue. The

exposure the Company has to retail is generally by way of retail warehousing

rather than high street property as we feel more confident in this sub sector.

Geographic distribution

The Company invests throughout the UK to provide a diversified portfolio.

Investment Activity

Purchases

The Company completed two purchases in the first six months of 2015 for a total

of GBP20.4m:

1. DSG Preston GBP15.8m, 7% yield - let for a further 16 years with fixed

uplifts, units adjacent to the prime dominant park.

2. Interplex 16 Bristol GBP4.6m, 8% yield - two industrial units, one of which

is vacant, the other let on a short lease.

A further four purchases were completed in July and August 2015, after the

reporting period end, for a total of GBP26.2m:

1. Office portfolio GBP13.2m, 7.25% yield - three offices, located in York,

Milton Keynes and Dartford - all good quality let to strong tenants.

2. Halfords Bradford GBP5.1m, 8.5% yield - retail warehouse and car showroom

adjacent to the dominant retail park.

3. Office in Kiddlington for GBP4.8m, 8.25% yield - modern single let office in

an area with infrastructure improvement.

4. Industrial unit in Fareham for GBP3.1m, 7% yield - low site cover, asset

management potential.

One other investment is also in solicitors hands:

5. Industrial unit GBP2.9m, 7.2% yield - in the North-East, well specified for

parcel delivery.

As can be seen from the above, the year started with a large investment but

since then we have found more value in small lot sizes.

Sales

The Company has undertaken the sale of a number of assets that are unlikely to

perform well in the future or where there is an opportunity to realise a

capital gain.

The following sales were completed in the first six months of 2015:

1. Weybridge GBP3.2m - sale of over rented office with lease expiry in 2015.

2. Swindon GBP3.5m - sale to tenant after prospective redevelopment as a

foodstore fell through.

3. Swansea GBP1.3m - sale of small short let office out of town.

4. Chelmsford GBP3.6m - sale of over rented office with lease expiries in 2015,

needing capex.

The following sales were completed in July and August of 2015, after the

reporting period end:

1. Mansfield GBP2.6m - part sale of small industrial estate.

2. Leeds GBP3.8m - sale of two industrial units with income at risk.

3. Glasgow GBP5.5m - sale of office off market.

One other sale is also in solicitors hands:

4. Stockton GBP1.3m - sale of small single let industrial unit.

Voids

During the reporting period key asset management transactions included:

1. Ocean Trade Centre Aberdeen: two leases were extended with the existing

tenants, and a major refurbishment undertaken on 7 units (completed mid July).

5 of the units were let on an agreement for lease for 10 years to CCF, and the

other two put in solicitors hands after the reporting period.

2. Explorer Crawley: Lease break with Amey removed to give a further 5 years

term certain.

3. Coal Rd Leeds: Five year lease extension agreed on one unit.

4. St James House Cheltenham: A new 10 year lease agreed on part of the third

floor to the existing tenant reinforced current ERVs and exceeded valuation

assumptions.

Asset Management

The Company has maintained low voids during the period, and as at the period

end they stood at 2.8% of ERV. Lettings in solicitors hands should reduce this

to under 2%, with the main void (1.5% of ERV) being the new purchase in Bristol

where the Company plans a refurbishment before reletting. Maintaining low

voids remains a key aim of the Investment Manager.

Debt

The Company has a debt facility in place with RBS that expires in December

2018. The facility is for GBP84m and is fully drawn down. There is an interest

rate swap in place meaning that the all in cost is 3.7%. As at 30 June the

Company had an LTV of 19.8% (bank covt 65%). The Company is reviewing its debt

strategy as a longer term facility might be more appropriate.

Equity Raise

During the period the Company issued new equity on three occasions to fund new

acquisitions.

February 31.3m shares at 78.1p per share

March 1.3m shares at 80.2p per share

June 11.6m shares at 80.3p per share

Jason Baggaley

Fund Manager

Directors' Responsibility Statement

The Directors are responsible for preparing the Interim Management Report in

accordance with applicable law and regulations. The Directors confirm that to

the best of their knowledge:

* The condensed set of Financial Statements have been prepared in accordance

with IAS 34; and

* The Interim Management Report includes a fair review of the information

required by 4.2.7R and 4.2.8R of the Financial Services Authority's

Disclosure and Transparency Rules.

* In accordance with 4.2.9R of the Financial Services Authority's Disclosure

and Transparency Rules, it is confirmed that this publication has not been

audited, or reviewed by the Company's auditors.

The Interim Report, for the six months ended 30 June 2015, comprises an Interim

Management Report in the form of the Chairman's Statement, the Investment

Manager's Report, the Directors' Responsibility Statement and a condensed set

of Unaudited Consolidated Financial Statements.

The Directors each confirm to the best of their knowledge that:

a. the Unaudited Consolidated Financial Statements, prepared in accordance

with IFRSs as adopted by the European Union, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the Group; and

b. the Interim Report includes a fair review of the development and

performance of the business and the position of the Group, together with a

description of the principal risks and uncertainties faced.

For and on behalf of the Directors of Standard Life Investments Property Income

Trust Limited

Richard Barfield

Chairman

27 August 2015

UNAUDITED FINANCIAL STATEMENTS

Unaudited Consolidated Statement of Comprehensive Income

for the period ended 30 June 2015

Notes 1 Jan 15 to 1 Jan 14 to

30 Jun 15 30 Jun 14

GBP GBP

Rental income 9,739,210 7,462,953

Surrender premium income - 18,154

Valuation gain from investment 5 7,529,522 9,176,100

properties

Loss on asset acquisition (65,129) -

Loss on disposal of investment (796,363) (2,032,950)

properties

Investment management fees 3 (1,121,035) (735,457)

Other direct property operating (504,924) (483,017)

expenses

Directors' fees and expenses (62,150) (68,052)

Valuer's fee (37,809) (22,787)

Auditor's fee (23,008) (22,900)

Other administration expenses (163,143) (110,643)

Operating profit 14,495,171 13,181,401

Finance income 26,256 25,420

Finance costs (1,597,490) (1,636,315)

Profit for the period 12,923,937 11,570,506

Other comprehensive income

Valuation gain / (loss) on cash flow 757,123 (141,937)

hedges

Total comprehensive income for the 13,681,060 11,428,569

period

Earnings per share: pence pence

Basic and diluted earnings per share 4.84 7.31

Adjusted (EPRA) earnings per share 2.32 2.80

All items in the above Unaudited Consolidated Statement of Comprehensive Income

derive from continuing operations.

Unaudited Consolidated Balance Sheet

as at 30 June 2015

Notes 30 Jun 2015 31 Dec 2014

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:06 ET (12:06 GMT)

GBP GBP

ASSETS

Non-current assets

Investment properties 5 272,669,703 261,672,121

Lease incentives 5 2,471,229 2,436,976

275,140,932 264,109,097

Current assets

Investment properties held for sale 6 13,010,300 6,550,100

Trade and other receivables 4,884,695 2,660,440

Cash and cash equivalents 27,329,945 5,399,095

45,224,940 14,609,635

Total assets 320,365,872 278,718,732

LIABILITIES

Current liabilities

Trade and other payables 7,485,896 7,205,415

Other liabilities - 500

7,485,896 7,205,915

Non-current liabilities

Bank borrowings 84,036,866 83,980,382

Interest rate swaps 1,917,816 2,674,939

Other liabilities - 6,094

Rental deposits due to tenants 525,002 483,880

86,479,684 87,145,295

Total liabilities 93,965,580 94,351,210

Net assets 226,400,292 184,367,522

EQUITY

Capital and reserves attributable

to Company's equity holders

Share capital 130,589,115 96,188,648

Retained earnings 7,776,524 7,634,503

Capital reserves (9,803,719) (17,294,001)

Other distributable reserves 97,838,372 97,838,372

Total equity 226,400,292 184,367,522

Net Asset Value (NAV) per Share

NAV 9 78.5p 75.5p

EPRA NAV 79.2p 76.6p

9

Approved by the Board of Directors on 27 August 2015 and signed on its behalf

by:

Richard Barfield

Director

Unaudited Consolidated Statement of Changes in Equity

for the period ended 30 June 2015

Other

Share Retained Capital distributable

Notes Capital earnings reserves reserves Total equity

GBP GBP GBP GBP GBP

Opening balance 1 96,188,648 7,634,503 (17,294,001) 97,838,372 184,367,522

January 2015

Profit for the - 12,923,937 - - 12,923,937

period

Valuation gain on - - 757,123 - 757,123

cash flow hedges

Total comprehensive

gain for the period - 12,923,937 757,123 - 13,681,060

Dividends paid 8 - (6,048,757) - - (6,048,757)

Ordinary 34,400,467 - - - 34,400,467

shares issued*

Valuation gain

of investment 5 - (7,529,522) 7,529,522 - -

properties

Loss on disposal

of investment - 796,363 (796,363) - -

properties

Balance at 30

June

2015 130,589,115 7,776,524 (9,803,719) 97,838,372 226,400,292

* this value represents both the nominal and the premium raised on issuing the

ordinary shares.

Unaudited Consolidated Statement of Changes in Equity

for the period ended 30 June 2014

Share Retained Capital Other

Notes Capital earnings reserves distributable Total equity

reserves

GBP GBP GBP GBP GBP

Opening balance 1 31,337,024 6,560,853 (34,144,454) 97,838,372 101,591,795

January 2014

Profit for the - 11,570,506 - - 11,570,506

period

Valuation loss on - - (141,937) - (141,937)

cash flow hedges

Total comprehensive - 11,570,506 (141,937) - 11,428,569

gain for the period

Dividends paid 8 - (3,621,919) - - (3,621,919)

Ordinary shares 4,032,940 - - - 4,032,940

issued*

Valuation gain of

investment - (9,176,100) 9,176,100 - -

properties

Loss on disposal of

investment - 2,032,950 (2,032,950) - -

properties

Balance at 30 35,369,964 7,366,290 (27,143,241) 97,838,372 113,431,385

June 2014

* this value represents both the nominal and the premium raised on issuing the

ordinary shares.

Unaudited Consolidated Cash Flow Statement

for the period ended 30 June 2015

Notes 1 Jan 15 to 1 Jan 14 to

30 Jun 15 30 Jun 14

GBP GBP

Cash generated from operating activities

Profit for the period 12,923,937 11,570,506

Movement in non-current lease incentives 19,373 (67,274)

Movement in trade and other receivables (2,224,255) (141,935)

Movement in trade and other payables 324,462 1,533,160

Finance costs 1,597,490 1,636,315

Finance income (26,256) (25,420)

Valuation gain from investment properties (7,529,522) (9,176,100)

Loss on disposal of investment properties 796,363 2,032,950

Net cash inflow from operating activities 5,881,592 7,362,202

Cash flows from investing activities

Interest received 26,256 25,420

Purchase of investment properties 5 (21,441,843) (19,611,648)

Capital expenditure on investment properties 5 (593,112) (2,206,823)

Net proceeds from disposal of investment 5 11,303,737 26,567,050

properties

Net cash used in investing activities (10,704,962) 4,773,999

Cash flows from financing activities

Ordinary shares issued net of issue costs 34,400,467 4,032,940

Interest paid on bank borrowing (988,881) (1,010,693)

Payments on interest rate swaps (608,609) (625,622)

Dividends paid to the Company's shareholders 8 (6,048,757) (3,621,919)

Net cash used in financing activities 26,754,220 (1,225,294)

Net increase in cash and cash equivalents in the 21,930,850 10,910,907

period

Cash and cash equivalents at beginning of period 5,399,095 12,303,310

Cash and cash equivalents at end of period 27,329,945 23,214,217

Standard Life Investments Property Income Trust Limited

Notes to the Unaudited Consolidated Financial Statements

for the period ended 30 June 2015

1 GENERAL INFORMATION

Standard Life Investments Property Income Trust Limited ("the Company") and its

subsidiary (together the "Group") carries on the business of property

investment through a portfolio of freehold and leasehold investment properties

located in the United Kingdom. The Company is a limited liability company

incorporated and domiciled in Guernsey, Channel Islands. The Company has its

listing on the London Stock Exchange.

On 1 January 2015 the Company became resident in the UK for tax purposes and

will now be compliant with the UK REIT regime.

The address of the registered office is Trafalgar Court, Les Banques, St Peter

Port, Guernsey.

These Unaudited Consolidated Financial Statements were approved for issue by

the Board of Directors on 27 August 2015.

The Audited Consolidated Financial Statements of the company for the year ended

31 December 2014 are available on request from the registered office or from

the Investment Manager's website (www.standardlifeinvestments.com/its).

2 ACCOUNTING POLICIES

Basis of preparation

The Unaudited Consolidated Financial Statements of the Group have been prepared

in accordance with IAS 34 Interim Financial Reporting, and all applicable

requirements of The Companies (Guernsey) Law, 2008. The Unaudited Consolidated

Financial Statements have been prepared under the historical cost convention as

modified by the measurement of investment property and derivative financial

instruments at fair value. The Unaudited Consolidated Financial Statements are

presented in pound sterling and all values are not rounded except when

otherwise indicated.

These statements do not contain all of the information required for full annual

statements and should be read in conjunction with the Audited Consolidated

Financial Statements of the Company for the year ended 31 December 2014. The

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:06 ET (12:06 GMT)

accounting policies adopted in the preparation of the Interim Condensed

Consolidated Financial Statements are consistent with those followed in the

preparation of the Group's Annual Consolidated Financial Statements for the

year ended 31 December 2014, except for the adoption of new standards and

interpretations effective in the European Union as of 1 January 2015.

New standards and amendments apply for the first time in 2015. However, they do

not impact the Unaudited Interim Condensed Consolidated Financial Statements of

the Group and are listed below:

* Annual Improvements to IFRSs 2011-2013 Cycle

3 RELATED PARTY DISCLOSURES

Parties are considered to be related if one party has the ability to control

the other party or exercise significant influence over the other party in

making financial or operational decisions.

Investment Manager

On 19 December 2003 Standard Life Investments (Corporate Funds) Limited ("the

Investment Manager") was appointed as Investment Manager to manage the property

assets of the Group. A new Investment Management Agreement ("IMA") was entered

into on 7 July 2014, appointing the Investment Manager as the AIFM

("Alternative Investment Fund Manager").

Under the terms of the IMA dated 19 December 2003, the Investment Manager was

entitled to receive a fee at the annual rate of 0.85% of the total assets,

payable quarterly in arrears except where cash balances exceed 10% of the total

assets. The fee applicable to the amount of cash exceeding 10% of total assets

was altered to be 0.20% per annum, payable quarterly in arrears. The Investment

Manager also agreed to reduce its charge to 0.75% of the total assets of the

Group until such time as the net asset value per share returns to the launch

level of 97p. This was applicable from the quarter ending 31 December 2008

onwards and did not affect the reduced fee of 0.20% on cash holdings above 10%

of total assets.

Under the terms of the IMA dated 7 July 2014, the above fee arrangements apply

up to 31 July 2014. From 1 August 2014, the fee was changed to 0.75% of total

assets up to GBP200 million; 0.70% of total assets between GBP200 million and GBP300

million; and 0.65% of total assets in excess of GBP300 million. The total fees

charged for the period ended 30 June 2015 amounted to GBP1,121,035 (period ended

30 June 2014: GBP735,457). The amount due and payable at the period end amounted

to GBP571,005, excluding VAT (period ended 30 June 2014: GBP373,266 excluding VAT).

4 TAXATION

Current income tax

A reconciliation of the product of accounting profit multiplied by the

applicable tax rate for the period ended 30 June 2015 and 2014 is, as follows:

30 Jun 2015 30 Jun 2014

GBP GBP

Profit before tax 12,923,937 11,570,506

Tax calculated at UK statutory income tax/

corporation tax 2,584,787 2,314,101

rate of 20% (30 June 2014: 20%)

UK REIT exemption on net income and gains (1,140,949) -

Valuation gain in respect of investment

properties not (1,505,904) (1,835,220)

subject to tax

Loss on disposal of investment properties not

subject to - 406,590

tax

Income not subject to tax - (289,189)

Expenditure not allowed for income tax purposes - 74,720

Tax loss not utilised/(utilised) 62,066 (671,002)

Current income tax charge - -

The Group has not recognised a deferred tax asset of GBP62,066 arising as a

result of revenue tax losses. Tax losses that existed prior to the Group's

election to be treated as a UK Real Estate Investment Trust (REIT) (see below)

have been written off as they cannot be utilised against profits of the Group

arising in the REIT regime.

The Group elected to be treated as a UK Real Estate Investment Trust (REIT)

from 1 January 2015. Under the UK REIT rules, profits of the Group's property

rental business are exempt from the charge to corporation tax. Gains on the

disposal of property assets are also exempt from tax provided they are not held

for trading or, in the case of developed property, sold within three years of

completion of the development. The Group is subject to UK corporation tax on

all other profits and gains.

5 INVESTMENT PROPERTIES

Country UK UK UK

Class Industrial Office Retail Total

GBP GBP GBP GBP

Market value as at 1 January 2015 108,660,000 114,265,100 47,125,000 270,050,100

Purchase of investment properties 4,851,800 - 16,590,043 21,441,843

Capital expenditure on investment 452,089 137,696 3,327 593,112

properties

Carrying value of disposed investment (3,750,000) (8,350,100) - (12,100,100)

properties

Valuation gain/(loss) from investment 3,259,433 4,409,592 (139,503) 7,529,522

properties

Movement in lease incentives receivable 40,395 329,295 (8,867) 360,823

Investment properties recategorised as (8,393,717) (4,616,583) - (13,010,300)

held for sale

Closing market value 105,120,000 106,175,000 63,570,000 274,865,000

Adjustment for lease incentives* (503,068) (1,130,062) (562,167) (2,195,297)

Closing carrying value as at 30 June 104,616,932 105,044,938 63,007,833 272,669,703

2015

*Lease incentives are split between non current assets of GBP2,471,229 and

current liabilities of GBP275,932.

The valuations were performed by Jones Lang Lasalle, an accredited independent

valuer with a recognised and relevant professional qualification and recent

experience of the location and category of the investment properties being

valued. The valuation model in accordance with Royal Institute of Chartered

Surveyors ('RICS') requirements on disclosure for Regulated Purpose Valuations

has been applied (RICS Valuation - Professional Standards January 2014

published by the Royal Institution of Chartered Surveyors). These valuation

models are consistent with the principles in IFRS 13.

The market value provided by Jones Lang Lasalle at the period ended 30 June

2015 was GBP288,390,000 (30 June 2014: GBP178,795,000) however an adjustment has

been made for lease incentives of GBP2,195,297* (30 June 2014: GBP1,344,492) that

are already accounted for as an asset. The valuation at 30 June 2015 of GBP

288,390,000 includes GBP3,725,000 in relation to Units 2001 & 2002 Coal Road in

Leeds, GBP4,950,000 in relation to 140 West George Street in Glasgow, GBP1,300,000

in relation to Portrack Interchange in Stockton on Tees and GBP3,550,000 in

relation to Windsor Court and Crown Farm in Mansfield, four investment

properties held for sale at the Balance Sheet date (see note 6).

Valuation gains and losses from investment properties are recognised in profit

and loss for the period and are attributable to changes in unrealised gains or

losses relating to investment property (completed and under construction) held

at the end of the reporting period.

Country UK UK UK

Class Industrial Office Retail Total

GBP GBP GBP GBP

Market value as at 1 January 2014 48,175,000 79,945,000 48,295,000 176,415,000

Purchase of investment properties 72,084,707 15,097,439 10,671,653 97,853,799

Capital expenditure on investment 29,971 2,779,559 (101,508) 2,708,022

properties

Carrying value of disposed investment (14,550,000) - (14,050,000) (28,600,000)

properties

Valuation gain from investment 2,961,019 16,132,344 2,104,506 21,197,869

properties

Movement in lease incentives receivable (40,697) 310,758 205,349 475,410

Investment properties recategorised as - (6,550,100) - (6,550,100)

held for sale

Closing market value 108,660,000 107,715,000 47,125,000 263,500,000

Adjustment for lease incentives* (462,673) (800,767) (571,033) (1,834,473)

Adjustment for financial lease - 6,594 - 6,594

obligations

Closing carrying value as at 31 108,197,327 106,920,827 46,553,967 261,672,121

December 2014

In the Consolidated Cash Flow Statement, proceeds from disposal of investment

properties comprise:

1 Jan 15 1 Jan 14 to

to

30 Jun 15 30 Jun 14

Carrying value of disposed investment 12,100,100 28,600,000

properties

Loss on disposal of investment (796,363) (2,032,950)

properties

Proceeds from disposal of investment 11,303,737 26,567,050

properties

Valuation Methodology

The fair value of completed investment properties are determined using the

income capitalisation method.

The income capitalisation method is based on capitalising the net income stream

at an appropriate yield. In establishing the net income stream the valuer has

reflected the current rent (the gross rent) payable to lease expiry, at which

point the valuer has assumed that each unit will be re-let at their opinion of

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:06 ET (12:06 GMT)

ERV. The valuer has made allowances for voids and rent free periods where

appropriate, as well as deducting non recoverable costs where applicable. The

appropriate yield is selected on the basis of the location of the building, its

quality, tenant credit quality and lease terms amongst other factors.

No properties have changed valuation technique since 31 December 2014.

The Company appoints a suitable valuer (such appointment is reviewed on a

periodic basis) to undertake a valuation of all the direct real estate

investments on a quarterly basis. The valuation is undertaken in accordance

with the then current RICS guidelines and requirements as mentioned above.

The Investment Manager meets with the valuer on a quarterly basis to ensure the

valuer is aware of all relevant information for the valuation and any change in

the investment over the quarter. The Investment Manager then reviews and

discusses the draft valuations with the valuer to ensure correct factual

assumptions are made. The valuer reports a final valuation that is then

reported to the Board.

The management group that determines the Company's valuation policies and

procedures for property valuations is the Property Valuation Committee. The

Committee reviews the quarterly property valuation report produced by the

Valuer (or such other person as may from time to time provide such property

valuation services to the Company) before its submission to the Board,

focussing in particular on:

* significant adjustments from the previous property valuation report.

* reviewing the individual valuations of each property.

* compliance with applicable standards and guidelines including those issued

by RICS and the UKLA Listing Rules.

* reviewing the findings and any recommendations or statements made by the

valuer.

* considering any further matters relating to the valuation of the

properties.

The Chairman of the Committee makes a brief report of the findings and

recommendations of the Committee to the Board after each Committee meeting. The

minutes of the Committee meetings are circulated to the Board. The Chairman

submits an annual report to the Board summarising the Committee's activities

during the year and the related significant results and findings.

All investment properties are classified as Level 3 in the fair value

hierarchy. There were no movements between levels since 31 December 2014.

There are currently no restrictions on the realisability of investment

properties or the remittance of income and proceeds of disposal.

The table below outlines the valuation techniques used to derive Level 3 fair

values for each class of investment properties:

* The fair value measurements at the end of the reporting period.

* The level of the fair value hierarchy (e.g. Level 3) within which the fair

value measurements are categorised in their entirety.

* A description of the valuation techniques applied.

* Fair value measurements, quantitative information about the significant

unobservable inputs used in the fair value measurement.

* The inputs used in the fair value measurement, including the ranges of rent

charged to different units within the same building.

Country & Fair value Valuation Key Range

Class Technique Unobservable (weighted average)

GBP input

· Initial Yield

· Reversionary · 0% to 9.01% (4.97%)

Yield · 5.67% to 10.42% (7.25%)

UK Industrial 113,010,649 · Income · Equivalent · 5.67% to 8.70% (6.98%)

Level 3 Capitalisation Yield · GBP23.68 to GBP86.10 (GBP

· Estimated 53.14)

rental value per

Sq.m

· Initial Yield

· Reversionary · 0% to 11.05% (6.14%)

Yield · 5.72% to 9.89% (6.83%)

UK Office 109,661,521 · Income · Equivalent · 5.34% to 9.60% (6.65%)

Level 3 Capitalisation Yield · GBP137.47 to GBP588.94 (GBP

· Estimated 271.50)

rental value per

Sq.m

· Initial Yield

· Reversionary · 6.13% to 7.46% (6.59%)

Yield · 3.97% to 7.41% (5.78%)

UK Retail 63,007,833 · Income · Equivalent · 6.27% to 7.45% (6.74%)

Level 3 Capitalisation Yield · GBP76.56 to GBP179.90 (GBP

· Estimated 141.32)

rental value per

Sq.m

285,680,003**

**includes the market values of the four properties held for sale as detailed

in note 6.

Descriptions and definitions

The table above includes the following descriptions and definitions relating to

valuation techniques and key unobservable inputs made in determining the fair

values:

Estimated rental value (ERV)

The rent at which space could be let in the market conditions prevailing at the

date of valuation.

Equivalent yield

The equivalent yield is defined as the internal rate of return of the cash flow

from the property, assuming a rise to ERV at the next review, but with no

further rental growth.

Initial yield

Initial yield is the annualised rents of a property expressed as a percentage

of the property value.

Reversionary yield

Reversionary yield is the anticipated yield to which the initial yield will

rise (or fall) once the rent reaches the ERV.

The table below shows the ERV per annum, area per square foot, average ERV per

square foot, initial yield and reversionary yield as at the Balance Sheet date.

30 Jun 2015 31 Dec 2014

GBP GBP

ERV p.a. 20,882,883 20,460,185

Area sq. ft. 2,651,764 2,736,927

Average ERV per sq. ft. GBP7.88 GBP7.48

Initial Yield 5.78% 6.59%

Reversionary Yield 5.02% 5.13%

The initial yield moved inwards due to a combination of factors which included

a shift in market yield, the sale of some higher yielding assets with short

leases (income reinvested after the period end was at yields of over 7%) and an

increase in voids from 0.6% in June 2014 to 2.8% June 2015.

Sensitivity analysis

The table below presents the sensitivity of the valuation to changes in the

most significant assumptions underlying the valuation of completed investment

property.

30 Jun 2015 31 Dec 2014

GBP GBP

Increase in equivalent yield of 25 (11,000,000) (10,100,000)

bps

Decrease in rental rates of 5% (ERV) (10,300,000) (10,100,000)

Below is a list of how the interrelationships in the sensitivity analysis above

can be explained. In both cases outlined in the sensitivity table the estimated

Fair Value would increase (decrease) if:

* The ERV is higher (lower)

* Void periods were shorter (longer)

* The occupancy rate was higher (lower)

* Rent free periods were shorter (longer)

* The capitalisation rates were lower (higher)

6 INVESTMENT PROPERTIES HELD FOR SALE

As at 30 June 2015 the Group had exchanged contracts with third parties for the

sale of Portrack Interchange, Stockton for GBP1,300,000 excluding a rent free

reduction on the sale price and excluding related sale costs. The part sale of

Windsor Court and Crown Farm completed on 15 July 2015 for GBP2,610,877 excluding

costs. Units 2001 & 2002 Coal Road, Leeds completed on 31 July 2015 for GBP

3,830,664 excluding costs and 140 West George Street, Glasgow completed on 10

August 2015 for GBP5,525,287 excluding costs. All of these properties were being

actively marketed for sale at 30 June 2015 and meet the criteria of non current

assets held for sale at the Balance Sheet date. The independently assessed

market value of each property held for sale at 30 June 2015 is detailed below:

30 Jun 2015 31 Dec 2014

GBP GBP

De Ville Court - 3,150,000

Chancellors Place - 3,575,000

Portrack Interchange 1,300,000 -

Windsor Court and Crown 3,550,000 -

Farm

Units 2001 & 2002 Coal Road 3,725,000 -

140 West George Street 4,950,000 -

Less: transaction costs (514,700) (174,900)

Closing Adjusted Market 13,010,300 6,550,100

Value

7 INVESTMENT IS SUBSIDIARY UNDERTAKINGS

The Company owns 100 per cent of the issued ordinary share capital of Standard

Life Investments Property Holdings Limited, a company with limited liability

incorporated and domiciled in Guernsey, Channel Islands, whose principal

business is property investment.

The Group, through its subsidiary, owns 100 per cent of the issued ordinary

share capital of Huris (Farnborough) Limited, a company incorporated in the

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:06 ET (12:06 GMT)

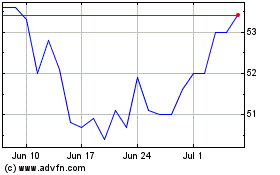

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2023 to Apr 2024