TIDMSLI

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, IN OR INTO OR

FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION IN PARTICULAR THE UNITED STATES, CANADA,

AUSTRALIA AND JAPAN

This announcement is for information purposes only and shall not constitute an

offer to sell or issue or the solicitation of an offer to buy, subscribe for or

otherwise acquire any ordinary shares of Standard Life Investments Property

Income Trust Limited in any jurisdiction in which any such offer or

solicitation would be unlawful.

13 November 2015

RECOMMENDED PROPOSALS IN RELATION TO THE ACQUISITION OF THE NEW PORTFOLIO AND

THE INITIAL PLACING AND OFFER FOR SUBSCRIPTION

Introduction

The Board announces that the Company has entered into the conditional

Acquisition Agreement in relation to the acquisition of a new portfolio of

22 UK commercial real estate assets. The Acquisition is to be effected by

the Company and the Property Subsidiary acquiring all of the units in the

JPUT and the entire issued share capital of the General Partner which

holds, through the Limited Partnership, the New Portfolio. The JPUT and

the Limited Partnership were established in September 2013 with the

principal purpose of investing in and holding the New Portfolio. The New

Portfolio comprises 22 UK commercial properties and is complementary to the

Company's Property Portfolio (for a detailed analysis of the existing

Property Portfolio, the New Portfolio and the Combined Portfolio, please

see Appendix I).

In order to complete this Acquisition, the Board is proposing to raise up

to GBP100 million by issuing New Shares pursuant to an Initial Placing and

Offer for Subscription at an Issue Price of 82.0 pence per New Share

representing a 2.84 per cent. premium to the NAV per Share as at 30

September 2015 once the accrued dividends for the period ending 30

September 2015 have been deducted. The Board will also need to utilise the

New Bank Facility which will allow the Group to borrow up to approximately

GBP70.6 million (in addition to the existing Bank Facility) and its existing,

available cash reserves of approximately GBP22 million to complete the

Acquisition.

The Acquisition is considered to be a significant transaction under the

Listing Rules and, as a consequence, it requires Shareholder approval. The

Listing Rules also provide that the Company must seek Shareholder approval

prior to issuing its Shares on a non pre-emptive basis. The Company will

shortly publish a Prospectus and Circular which will provide Shareholders

with further details of the Acquisition and the Initial Placing and Offer.

The Circular will also provide Shareholders with notice of the General

Meeting of the Company at which Shareholders will be asked to consider and,

if thought fit, pass the Resolutions to approve the Acquisition and issue

of New Shares pursuant to the Initial Placing and Offer on a non

pre-emptive basis.

Reasons for and Benefits of the Acquisition and the Initial Placing and

Offer for Subscription

The Board believes that the Proposals offer significant benefits for all

Shareholders as noted below:

The Board believes that if the Proposals are successful, the Company's

existing Shareholders will, in particular, benefit from the reduced ongoing

charge, the favourable terms of the New Bank Facility Agreement and the

lower costs of investing the Company's existing cash reserves in the New

Portfolio through the acquisition of the JPUT as opposed to the direct

acquisition of UK commercial real estate assets. For these reasons and the

reasons set out above, the Board is recommending that Shareholders vote in

favour of the Proposals at the General Meeting.

Standard Life Investments Pooled Pensions Property Fund has indicated that

it intends to subscribe for approximately 7.3 million New Shares for an

aggregate price of GBP6 million under the Initial Placing and Offer.

The property portfolios

The Company's existing Property Portfolio

As at 30 September 2015, the Property Portfolio comprised 42 UK commercial

properties with an aggregate market value of approximately GBP308.8 million.

The Property Portfolio generates a current net annual rent of approximately

GBP19.2 million (being an Income Return of 5.9 per cent.) and an aggregate

estimated net annual rent of approximately GBP22 million (giving an

equivalent yield of 6.7 per cent.).

According to the Dun and Bradsheet failure score 74.8 per cent. of the

Company's income is from tenants rated as having a negligible or low risk

of failure score. The average unexpired lease term to earliest termination

of the occupational leases of these Properties (weighted by current gross

annual rent) is approximately 7 years and 1 month and all of the rent

review provisions in the occupational leases of the Properties are upwards

only or subject to fixed/indexed increases.

The Company announced on 9 November 2015 that it had completed the sale of

the Maple Cross Property for a consideration of GBP14.75 million.

The New Portfolio

The Company and its Property Subsidiary have entered into the conditional

Acquisition Agreement to acquire all of the units in the JPUT and the

entire issued share capital of the General Partner. The JPUT holds,

indirectly through its interest as the sole limited partner in the Limited

Partnership, the New Portfolio. The New Portfolio is diversified by

sector, tenant and region and is complementary to the Property Portfolio.

The New Portfolio comprises 22 properties UK commercial properties with an

aggregate market value of approximately GBP165 million as at 19 October

2015. The New Portfolio generates a current net annual rent of

approximately GBP10.8 million (being a net initial yield of 5.96 per cent.).

According to the Dun and Broadsheet failure score 82 per cent. of the New

Portfolio's income is from tenants rated as having a negligible or low risk

of failure score. The average unexpired lease term of the occupational

leases of the New Properties (weighted by current gross annual rent) is

approximately 4 years and 2 months and all of the rent review provisions in

occupational leases of the New Properties are upwards only or have fixed/

indexed increases.

The Combined Portfolio

In the event that the Resolutions are approved by Shareholders and the

Acquisition is completed, the Combined Portfolio will comprise 63

properties with an aggregate market value of GBP460 million (on the basis of

the valuations of the Property Portfolio as at 30 September 2015 and the

New Portfolio as at 19 October 2015). The Combined Portfolio would

generate a current net annual rent of approximately GBP29 million (being a

net initial yield of 5.97 per cent.).

The average unexpired lease term of the occupational leases of these

properties (weighted by current gross annual rent) is approximately 6 years

and 2 months, compared to the equivalent figure for an average commercial

property portfolio, as represented by the independent IPD IRIS (excluding

leases over 35 years), of 7 years and 4 months.

The Directors believe that the Combined Portfolio will be accretive to the

level of dividend cover and will provide a number of asset management

opportunities which should enhance the income profile and the capital value

of the assets.

Details of the terms of the Proposals

The Initial Placing and Offer

In order to complete this Acquisition, the Company is proposing to issue up

to 121,951,220 New Shares under the Initial Placing and Offer

(representing up to approximately 42.3 per cent. of the Company's current

issued share capital) to raise up to approximately GBP100 million. The Issue

Price is 82.0 pence representing a premium of 2.84 per cent. to the NAV per

Share as at 30 September 2015 once the accrued dividends for the period

ending 30 September 2015 have been deducted. The net proceeds of the

Initial Placing and Offer will be used to fund the Acquisition together

with the New Bank Facility and the Company's existing cash resources. If

the Initial Placing and Offer does not proceed and Admission does not

occur, the Acquisition will not proceed and no funds will be drawn down

under the New Bank Facility.

The Initial Placing and Offer is conditional on:

(i) the Placing Agreement becoming wholly unconditional (save as

to Admission) and not having been terminated in accordance with its terms

prior to Admission;

(ii) the Admission Condition being satisfied prior to 8.00 a.m. on

15 December 2015 (or such later time and/or date, not being later than 8.00

a.m. on 18 December 2015 as the Board may determine);

(iii) Shareholder approval being granted in respect of the issue of

New Shares, on a non pre-emptive basis, in relation to the Initial Placing

and Offer and the Acquisition at the General Meeting; and

(iv) the gross proceeds of the Initial Placing and Offer being the

equivalent of at least GBP80 million (the "Minimum Issue Proceeds").

The maximum number of New Shares to be issued pursuant to the Initial

Placing and Offer will be 121,951,220. In the event that the number of New

Shares applied for under the Initial Placing and Offer at the Issue Price

results in the Company receiving gross proceeds which are significantly in

excess of the size of the Initial Placing and Offer then it would be

necessary to scale back such applications. In such event New Shares will be

allocated, as far as reasonably possible, so that applications from

existing Shareholders are given priority over other applicants, and, where

applicable, with a view to ensuring that existing Shareholders are

allocated such percentage of New Shares as is as close as possible to their

existing percentage holding of Ordinary Shares.

The actual number of New Shares issued under the Initial Placing and Offer

will be determined by the Company and the Placing Agent, after taking into

(MORE TO FOLLOW) Dow Jones Newswires

November 13, 2015 04:00 ET (09:00 GMT)

account demand for the New Shares, prevailing market conditions and the

acquisition costs of the New Portfolio. The final results of the Initial

Placing and Offer and any scaling back will be announced via a Regulatory

Information Service.

In the event that Admission does not occur, the Acquisition of the New

Portfolio will not complete and any monies raised under the Initial Placing

and Offer will be returned to investors.

The Acquisition

The Company and the Property Subsidiary have entered into the conditional

Acquisition Agreement with the Vendors dated 12 November 2015. Under this

Acquisition Agreement the Company and the Property Subsidiary have agreed

to purchase the New Portfolio by way of acquiring all of the units in the

JPUT (the sole limited partner in the Limited Partnership) and the entire

issued share capital in the General Partner (the general partner of the

Limited Partnership). The JPUT was established on 11 September 2013 and

its principal activity is to invest in the Limited Partnership which holds

the New Portfolio. The JPUT has not taken out any debt. It's income is

derived solely through its investment in the New Portfolio, by way of it

being the sole limited partner of the Limited Partnership, and its

expenditure relates only to administration and advisory expenses and

property expenses.

Pursuant to the Acquisition Agreement, the aggregate consideration payable

for all of the units in the JPUT, shares in the General Partner and the New

Portfolio will be approximately GBP165 million adjusted to take into account

any accruals and contingencies of the JPUT and the Limited Partnership on

the date of completion of the Acquisition. The Company will need to use

the net proceeds of the Initial Placing and Offer, the New Bank Facility

and its existing cash reserves to fund the Acquisition. The New Properties

have been externally valued by Knight Frank with a market value as at 19

October 2015 of approximately GBP165 million.

In addition to the conditions to the Initial Placing and Offer (as set out

above) including the condition that the Minimum Issue Proceeds require to

be raised under the Initial Placing and Offer, the Acquisition Agreement

provides that the Acquisition is conditional on: (i) at least GBP80 million

(or such lower amount as the Company shall, in its discretion, consider is

sufficient to enable it to proceed to completion of the Acquisition) being

raised pursuant to the Initial Placing and offer; and (ii) JFSC consent

being granted in relation to the change in investment manager of the JPUT

on completion.

The Acquisition is also conditional upon Shareholder approval being granted

in favour of the resolutions at the General Meeting and the satisfaction of

all of the conditions precedent in the New Bank Facility Agreement (which

are customary for a facility of this nature and include that sufficient

funds must be raised under the Initial Placing and Offer to satisfy the

Minimum Issue Proceeds). Therefore if the Minimum Issue Proceeds are not

raised under the Initial Placing and Offer, the Acquisition will not

complete and no new funds will be able to be drawn down under the New Bank

Facility.

The Acquisition Agreement contains warranties, indemnities and

representations customary to agreements of this nature. The liability of

the Vendor in relation to these warranties, indemnities and representation

has been capped to a nominal value. Therefore warranty and indemnity

insurance has been taken out on behalf of the Company and the Property

Subsidiary. Completion of the Acquisition is expected to occur on 15

December 2015 immediately after Admission. The parties are entitled to

rescind the Acquisition Agreement in the event that the conditions thereto

are not satisfied by 18 December 2015.

The current intention of the Group is to undertake a restructuring,

immediately post Acquisition, involving the New Properties and the

subsequent liquidation of the JPUT.

Gearing and borrowings

The Company has the power under the Articles to borrow an amount up to 65

per cent. of the Group's gross assets. It is the present intention of the

Directors that the Company's loan to value ratio (calculated as borrowings

less all cash as a proportion of the Property Portfolio valuation) will not

exceed 45 per cent. and the Investment Manager is currently instructed to

target a LTV between 25 per cent. to 35 per cent.

The Group's current borrowings

The Group currently has a fully drawn down debt facility of GBP84,432,692

with the Bank which is repayable on 16 December 2018. As at 30 September

2015, the Group's LTV was approximately 22 per cent.

Interest on the Bank Facility is payable at a rate equal to the aggregate

of three month LIBOR, and a margin of 1.65 per cent. per annum (below 40

per cent. LTV) or 1.75 per cent. per annum (40 to 60 per cent. LTV

inclusive) or 1.95 per cent. (above 60 per cent. LTV). The current

applicable margin is 1.65 per cent. per annum.

The Group has two interest rate swap agreements with the Bank for a

notional principal amount of GBP84,432,692 in aggregate which results, based

upon current LTV, in the all-in margin in respect of the Group's borrowing

being fixed until 16 December 2018 at 3.66 per cent. per annum. If the

existing Bank Facility is repaid prior to 16 December 2018 such swaps will

require to be broken and the associated termination costs will require to

be paid.

The Group's proposed additional borrowings on completion of the Acquisition

The Property Subsidiary and the Company have entered into the New Bank

Facility Agreement with the Bank conditional on, inter alia, the completion

of the Acquisition and the satisfaction of the conditions precedent (which

are customary for a facility of this nature). The New Bank Facility is in

addition to the existing Bank Facility and consists of the New Term Loan of

GBP40,567,308 and the Revolving Credit Facility of GBP30,000,000 which amounts

to, in aggregate, GBP70,567,308.

The Facility Agreement will therefore be amended, subject to the completion

of the Acquisition, pursuant to an amendment and restatement agreement (the

New Bank Facility Agreement) in order to effect the new terms of the

existing Bank Facility and the New Bank Facility. The New Bank Facility

Agreement has a term of 18 months. Therefore, as a result of these new

arrangements the repayment date, in relation to the existing Bank Facility

(as well as the New Bank Facility) has been brought forward from 16

December 2018 to 17 June 2017. Interest will be payable in relation to the

existing Bank Facility at the all-in rate of 3.26 per cent. per annum

pursuant to the swaps that are already in place (further details on the

swaps are set out above) and in relation to the New Bank Facility at a rate

equal to the aggregate of the applicable LIBOR rate and a margin of 1.25

per cent. per annum.

For illustrative purposes and on the assumption that the maximum amount

under the New Bank Facility is required to be drawn down, the Group's

maximum level of borrowings (the existing Bank Facility plus the New Bank

Facility) will be GBP155 million, and the maximum LTV, once the New Portfolio

has been acquired, would be approximately 32 per cent. The structure and

terms of the New Bank Facility Agreement provide the Company with the

flexibility to make repayments prior to the repayment date of 17 June

2017. Thereby it could reduce the LTV shortly after the completion of the

Acquisition with the proceeds of any disposals of New Properties (or

existing Properties). In the event the Revolving Credit Facility is repaid

in full with the proceeds of any disposals, the Group's maximum LTV

(assuming the maximum amount under the New Term Loan is drawn down) could

reduce to approximately 28 per cent. The Property Subsidiary will only

draw down funds under the New Bank Facility once Admission has occurred on

the completion of the Acquisition.

The Property Subsidiary does not currently intend to hedge the New Bank

Facility. In the light of the current low interest rate environment it is

likely that the Group would look to refinance all of their debt (the

existing Bank Facility as well as the New Bank Facility) in the near term.

As part of the refinancing the Group would have to break the existing

interest rate swaps and it would, at that time, consider entering into the

new arrangements to mitigate interest rate risk in respect of any new debt

incurred.

Dividends

Dividend policy

It is the Board's policy that in paying dividends it should target

aggregate annual dividends which are fully covered by the Group's net

income. Dividends on the Ordinary Shares are expected to be paid in equal

instalments quarterly in respect of each financial year in March, May,

August and November. All dividends are paid as interim dividends.

Payment of dividends

The Company has declared a dividend of 1.161 pence per Share for the

quarter ending 30 September 2015 which will be paid on 27 November 2015 to

existing Shareholders.

The Company expects that its final interim dividend of 1.161 pence per

Share in respect of the period to 31 December 2015 will be split into: (i)

a fourth interim dividend for the period between 1 October 2015 and 14

December 2015 (the date immediately prior to Admission and the completion

of the Acquisition); and (ii) a fifth interim dividend for the period

between 15 December 2015 and 31 December 2015. The Company's existing

Shareholders will qualify for the fourth and fifth interim dividends in

respect of their existing holdings of Ordinary Shares which together equal

the equivalent of 1.161 pence for the quarter per Share. New Shares issued

pursuant to the Initial Placing and Offer will only qualify for the fifth

interim dividend.

Save as referred to above, New Shares will rank pari passu with the

Ordinary Shares in respect of dividends.

In the event that the Acquisition completes, the Board believes that the

(MORE TO FOLLOW) Dow Jones Newswires

November 13, 2015 04:00 ET (09:00 GMT)

dividend cover would be enhanced. Accordingly if the Acquisition completes

it is the Board's intention to increase the quarterly dividend by 2.5 per

cent. to 1.19 pence per Share commencing with the quarter ending 31 March

2016. If Admission does not occur and the Acquisition does not proceed, the

Board does not intend to increase the dividend in the near term but will

continue to keep the Company's dividend policy under review.

Costs and expenses of the Proposals

The costs and expenses of the Proposals (including the consideration for

the purchase price of the JPUT and the New Portfolio, the commission

payable to the Placing Agent and the costs in relation to the publication

of the Prospectus and the Circular) are expected to be approximately GBP171

million. The New Shares will be issued at a premium of 2.84 per cent. to

the NAV per Share as at 30 September 2015 once the accrued dividends for

the period ending 30 September 2015 have been deducted.

Indicative timetable

An indicative timetable of principal events is as follows:

Event Indicative Timing

Initial Placing and Offer opens 17 November 2015

Publication of Circular and Prospectus 17 November 2015

Latest date for receipt of Application Forms 9 December 2015

under the Offer

Latest date for commitments under the Initial 10 December 2015

Placing

General Meeting 11 December 2015

Results of the Initial Placing and Offer and 11 December 2015

General Meeting announced

Admission and dealings in New Shares commence 15 December 2015

A more detailed timetable will be included in the Prospectus.

General

In deciding whether or not to vote in favour of the Resolutions at the

General Meeting to implement the Proposals, Shareholders should rely only

on the information contained in, and should follow the procedures described

in, the Circular and the Prospectus.

All enquiries:

Jason Baggaley/Gordon Humphries, Standard Life Investments

Tel: 0131 245 2833/0131 245 2735

Graeme Caton, Winterflood Investment Trusts

Tel: 020 3100 0268

Douglas Armstrong, Dickson Minto W.S.

Tel: 020 7649 6823

Winterflood Securities Limited, which is authorised and regulated by the

Financial Conduct Authority, is acting for the Company and for no-one else in

connection with the Proposals and will not be responsible to anyone other than

the Company for providing the protections afforded to clients of Winterflood

Securities Limited, or for affording advice in relation to the Proposals.

Dickson Minto W.S., which is authorised and regulated by the Financial Conduct

Authority, is acting for the Company and for no-one else in connection with the

Proposals and will not be responsible to anyone other than the Company for

providing the protections afforded to clients of Dickson Minto W.S., or for

affording advice in relation to the contents of the Proposals.

APPENDIX I

DETAILS OF THE PROPERTY PORTFOLIO, THE NEW PORTFOLIO AND THE COMBINED PORTFOLIO

A detailed description and comparison of the Company's existing Property

Portfolio (based on the Valuer's valuation report as at 30 September 2015), the

New Portfolio (based on the Knight Frank valuation report as at 19 October

2015) and the Combined Portfolio is set out below:

Current net

Properties* Sector Region annual rent

receivable

Properties valued at GBP15 - GBP20 million - Property Portfolio

White Bear Yard, Standard London GBP527,334

Clerkenwell, London Office Mid-Town

DSG Blackpool Road, Retail North West GBP1,040,895

Preston Warehouse

Chester House, Office Park South East GBP1,257,640

Farnborough

Aerospace Centre,

Farnborough GU14 6TQ

(Leasehold)

The Symphony Group, Industrial North West GBP1,080,000

Ickles Way, ROUK

Rotherham

Properties valued at GBP15 - GBP20 million - New Portfolio

Elstree Tower, Standard South East GBP1,320,000

Borehamwood Office

Properties valued at GBP10 - GBP15 million - Property Portfolio

Denby 242, Denby, Industrial Midlands GBP0 Rent Free, GBP

DE5 8NN ROUK 1,153,138 per

annum from 15

March 2015

Hertford Place Maple Standard South East GBP1,156,900

Cross Rickmansworth Office

St James's House, Standard Midlands GBP862,102

Cheltenham Office

3b-c Michigan Drive Industrial South East GBP712,980

Milton Keynes ROSE

Hollywood Green, High Street London GBP787,878

Wood Green, London Retail

Bourne House, The Standard South East GBP0 Rent Free, GBP

Causeway, Staines Office 696,995 per

annum from 15

January 2016

Ocean Trade Centre, Industrial Scotland GBP442,700

Altens Industrial ROUK

Estate, Aberdeen

Ground Floor, New Standard London GBP546,103

Palace Place, Monck Office and

Street, Retail

Westminster, London

(Leasehold)

Howard Town Retail Retail North West GBP677,430

Park, Glossop Warehouse

Properties valued at GBP10 - GBP15 million - New Portfolio

Charter Court, Bath Standard South East GBP815,448

Road, Slough Office

82-84 Eden Street, Retail Greater GBP200,264

Kingston Upon Thames London

Properties valued at GBP5 - GBP10 million - Property Portfolio

Tetron 141, Industrial Midlands GBP635,216

Swadlingcote ROUK

Explorer 1 & 2, Standard South East GBP701,490

Mitre Court, Crawley Office

1/1A Marsh Way, Industrial Eastern GBP450,000

Fairview Industrial England

Park, Rainham, Essex

(Leasehold)

Tetron 93, Industrial Midlands GBP375,448

Swadlingcote ROUK

Dorset Street, Standard South East GBP459,166

Southampton Office

Bathgate Retail Retail Scotland GBP478,625

Park, Bathgate Warehouse

Unit 6 Broadway Industrial North West GBP854,626

Business Park,

Oldham

Silbury House, Standard South East GBP373,500

Silbury Boulevard, Office

Milton Keynes

Units 1&2 Olympian Retail North West GBP380,000

Way, Leyland, Warehouse

Preston

Halfords, Valley Retail North West GBP515,825

Road, Bradford Warehouse

Matalan, Kings Lynne Retail Eastern GBP378,500

Warehouse England

Properties valued at GBP5 - GBP10 million - New Portfolio

The Quadrangle Standard South West GBP700,000

Cheltenham Office

Ceva Logistics Standard East Midlands GBP597,637

Earlstrees Rd Corby Industrial

The Kirkgate, Church Standard South East GBP550,000

St Epsom Office

Walton Summit Industrial North West GBP590,000

Industrial Estate ROUK

Preston

Budbrooke Industrial Standard West Midlands GBP476,623

Estate Warwick industrial

Swift House, Cosford Industrial West Midlands GBP523,574

Lane Rugby ROUK

Foxholes Business Standard South East GBP459,747

Park Hertford Industrial

P&O, Whitecliffs Industrial South East GBP479,090

Business Park, Dover ROSE

Victoria Shopping Retail West Midlands GBP485,000

Park Hednesford

Causeway House Standard South East GBP347,703

Teddington Office

Symiths Toys, Middle Retail North East GBP371,138

Engine Lane, North Warehouse

Shields

The Point Retail Retail North West GBP370,000

Park Rochdale Warehouse

Wincanton, Portbury, Industrial South West GBP379,643

Bristol ROUK

Foundary Lane Industrial South East GBP125,450

Horsham ROSE

Properties valued at GBP0 - GBP5 million - Property Portfolio

Endeavour House, Office Park South West GBP415,000

Langford Business

Park Kiddlington

Interplex 16 Ash Industrial South West GBP192,000

Bridge Rd Bristol ROUK

Interfleet House, Office Park East Midlands GBP390,000

Pride Park, Derby

The IT Centre, Office Park North East GBP360,624

Innoation Way, York

Matalan, Mayo Retail North West GBP318,278

Avenue, Bradford Warehouse

Dawson Rd, Mount Standard South East GBP282,758

Farm Milton Keynes Industrial

Units 1&2 Deans Ind Standard Scotland GBP405,076

Estate, Cullen Sq Industrial

Livingston

Persimon House, Office Park South East GBP306,643

Crossways Business

Park, Dartford

31/32 Queen Sq, Standard South West GBP160,000

Bristol Office

Unit 2 Brunel Way, Standard South East GBP225,000

Segensworth East Industrial

Fareham

Farrah Unit, Standard South East GBP212,380

Crittall Rd, Witham Industrial

Turin Crt Bird Hall Office Park North West GBP340,850

Lane Cheadle Hume

Stockport

Unit 4 Monkton Industrial North East GBP220,000

Business Park ROUK

Hebburn, Newcastle

(MORE TO FOLLOW) Dow Jones Newswires

November 13, 2015 04:00 ET (09:00 GMT)

Unit 4 Easter Industrial North West GBP184,000

ParkWingates Bolton ROUK

21 Gavin Way Nexus Industrial West Midlands GBP200,250

Point Birmingham ROUK

Unit 14 Interlink Industrial East Midlands GBP155,415

Park Bardon ROUK

Travis Perkins Standard South West GBP112,000

Cheltenham Industrial

1b Crown Farm, Standard East Midlands GBP60,000

Mansfield Industrial

Properties valued at GBP0 - GBP5 million - New Portfolio

Broadoak Business Standard North West GBP303,179

Park, Trafford Park, Industrial

Manchester

Anglia House, Standard South East GBP426,648

Station Road, Office

Bishops Stortford

The Range, Southend Retail South East GBP303,410

on Sea Warehouse

Units 1-4 Opus Way, Standard North West GBP268,035

Warrington Industrial

Ceres Court, Standard South East GBP198,712

Kingston Upon Thames Retail

(leasehold)

1. Details of the ten largest properties (Combined Portfolio)

Set out below is a brief description of the ten largest Properties in the

Combined Portfolio.

White Bear Yard, Clerkenwell, London

Mid Town Office

Tenant Lease Term Lease expiry/break Rent review

option

B&W Group 10 years 13 November 2018 N/A

Limited

White Bear Yard 5 years 23 June 2019 N/A

Management

Limited

IDEO LLC 10 years 23 June 2019 N/A

White Bear Yard 10 years 23 June 2019 N/A

Management

Limited

Current net annual rent GBP527,334 (increasing

to GBP1,057,743 on expiry of rent frees)

Market Value GBP15-20

million

Elstree Tower, Elstree Way, Borehamwood

Office South East

Tenant Lease Term Lease expiry/break Rent review

option

Sungard 10 years 24 March 2025 / 24 25 March 2020

Availability March 2020

Services (UK)

Ltd

Current net annual rent GBP1,320,000

Market Value GBP15-20 million

Currys and PC World, Preston

Retail Warehouse

Tenant Lease Term Lease expiry/break Rent review

option

DSG 25 years 25 December 2030 25 November 2020

Current net annual rent GBP1,040,895

Market Value GBP15-20 million

Chester House, Farnborough Aerospace Centre, Farnborough

Office Park

Tenant Lease Term Lease expiry/break Rent review

option

BAE Systems plc 27 years 31 December 2023 10 April 2017

Current net annual rent GBP1,257,640

Market Value GBP15-20 million

The Symphony Group, Ickles Way Rotherham

Industrial

Tenant Lease Term Lease expiry/break Rent review

option

The Symphony 20 years 15 September 2034 16 September

Group plc 2019

Current net annual rent GBP1,080,000

Market Value GBP15-20 million

Denby 242, Denby Rd, Denby

Industrial

Tenant Lease Term Lease expiry/break Rent review

option

Techno Cargo 15 years 14 March 2025 15 March 2016

Logistics

Current net annual rent GBP0 (increasing to GBP

1,153,138 at expiry of rent free)

Market Value GBP10-GBP15

million

Hertford Place, Rickmansworth

Office

Tenant Lease Term Lease expiry/break Rent review

option

Trebor Bassett 20 years 19 December 2022 20 December 2017

Ltd

Current net annual rent GBP1,156,900

Market Value GBP10-GBP15

million

St James's House, Cheltenham

Office

Top five tenants Lease Term Lease expiry/break Rent review

option

BPE Solicitors 12 years 21 March 2024 22 March 2019

LLP

Barnett 11 years 29 October 2022 29 October 2019

Waddingham LLP

Tangible UK 10 years 6 July 2021/ 7 7 July 2016

Limited July 2016

Local World Ltd 10 years 8 August 2025 / 9 August 2020

8 August 2020

Volo Commerce 10 years 3 March 2024 4 March 2019

Ltd

Current net annual rent GBP862,102

Market Value GBP10-GBP15 million

Charter Court, 50 Windsor Road, Slough

Office

Tenant Lease Term Lease expiry/break Rent review

option

Webloyalty 7 years 22 June 2020 1 March 2015

International

Ltd

Airwave 13 years 24 December 2021 30 April 2018

Solutions Ltd

Webloyalty 7 years 22 June 2020 1 March 2015

International

Ltd

Current net annual rent GBP815,448

Market Value GBP10-GBP15

million

3 B - C Michigan Drive Milton Keynes

Industrial

Tenant Lease Term Lease expiry/break Rent review

option

Bong UK Ltd 12 years 2 January 2026 Annual fixed

increases

Current net annual rent GBP712,980

Market Value GBP10-GBP15

million

1. Tenant concentration

The tenants that contribute in excess of two per cent. of the current net

annual rent of the Property Portfolio and the New Portfolio can be summarised

as follows:

Lease Name Sector Current % of Current

net annual net annual

rent rent of

Property

Portfolio

Sunguard Availability Office GBP1,320,000 4.1%

Services (UK) Ltd

BAE Systems Office GBP1,257,640 3.9%

Trebor Basset Office GBP1,156,900 3.6%

The Symphony Group Plc Industrial GBP1,080,000 3.4%

DSG Retail GBP1,040,895 3.3%

Warehouse

Bong UK Ltd Industrial GBP712,980 2.2%

Royal Bank Of Scotland PLC Office GBP700,000 2.2%

Matalan Retail GBP696,778 2.2%

Warehouse

Grant Thornton Office GBP680,371 2.1%

Euro Car Parks Ltd Industrial GBP635,216 2.0%

1. Summary of tenure

As a percentage of aggregate Market Value

Tenure Property New Portfolio Combined

Portfolio Portfolio

Freehold/ 70.6% 86.1% 76.0%

Feuhold

Leasehold 29.4% 13.9% 24.0%

1. Lease length

The Properties in the Property Portfolio have a total of 113 tenants (excluding

car parking spaces, wayleaves and substations). The New Properties in the New

Portfolio have a total of 118 tenants. The length of the leases can be

summarised as follows:

As a percentage of current gross annual rent

Lease Property New Portfolio Combined IPD Quarterly

Length Portfolio Portfolio Universe*

0-5 years 31.6% 66.4% 34.0% 35%

5-10 years 43.6% 30.9% 37.4% 31%

10-15 17.8% 2.7% 20.2% 15%

years

15-20 5.4% 0.0% 4.0% 7%

years

20 + years - 0.0% 1.0% 12%

% Void (by 2.2% 1.46% 2.0% 6.9%

rent)

AWULTC 7.1 years 4.4 years 6.2 years 7.45 years

*Source: IPD Quarterly Universe (excluding leases over 35 years) 30 June 2015

AWULTC means Average Weighted Unexpired Lease Term Certain (to lease end or

break option date if sooner).

1. Income profile (Combined Portfolio)

The occurrence of the earlier of lease expiries and break options of the

Property Portfolio and the New Portfolio can be summarised as follows:

Year of Current gross % of current Cumulative %

expiration or annual rent gross annual of current

break option rent gross annual

rent

2016 GBP2,598,142 8.5% 8.5%

2017 GBP2,290,483 7.5% 16%

2018 GBP2,906,199 9.5% 25.5%

2019 GBP2,552,809 8.3% 33.8%

2020 GBP1,707,521 5.6% 39.4%

2021+ GBP17,448,366 57.0% 100%

The aggregate current net annual rent of the Property Portfolio is

approximately GBP19.23 million and the aggregated estimated net annual rental

value is approximately GBP22.04 million.

The aggregate current net annual rent of the New Portfolio is approximately GBP

10.81 million and the aggregated estimated net annual rental value is

approximately GBP11.81 million.

1. Covenants

The covenant strength of the tenants of the Properties and the New Properties

can be summarised as follows:

As a percentage of current gross annual rent

(MORE TO FOLLOW) Dow Jones Newswires

November 13, 2015 04:00 ET (09:00 GMT)

Covenant Property New Portfolio Combined IPD Quarterly

Strength Portfolio Portfolio Universe*

Negligible & 61% 58% 58% 57%

Government

risk

Low risk 15% 24% 18% 21%

Low-medium 10% 2% 7% 6%

risk

Medium-high 8% 4% 6% 2%

risk

High risk 3% 2% 3% 4%

Maximum risk 2% 1% 1% 6%

Unscored 0% 8% 3% 2%

Administration 0% 1% 0% 0%

* Source: IPD Quarterly Universe

** Based on D&B Risk of Failure

1. Lease terms

The occupational leases of the Properties and the New Properties are on terms

which could reasonably be expected for properties of the type comprised in the

Property Portfolio and the New Portfolio. Subject to the above and viewing the

Property Portfolio and New Portfolio as a whole, the occupational leases of the

Properties in the Property Portfolio and the New Properties in the New

Portfolio are in general terms institutionally acceptable.

1. Property condition

Independent building surveys, mechanical and electrical surveys and

environmental surveys have been undertaken for each of the Properties and the

New Properties. These have been reviewed by the Investment Manager and it is

considered that the condition of the Properties and the New Properties is

acceptable having regard to the properties' age, use, type and lease terms.

1. Regional weightings

The regional weightings of the Property Portfolio, the New Portfolio and the

Combined Portfolio can be summarised as follows:

As a percentage of current gross annual rent

Region Property New Portfolio Combined IPD Quarterly

Portfolio Portfolio Universe*

London 3% 0.0% 2% 15.2%

West End

London 7% 0.0% 4.3% 4.9%

City

East 5.1% 10.5% 14.2% 10.5%

Midlands

South East 36% 55% 43% 33.6%

South West 8% 9% 8% 6.5%

West 1% 19% 4% 6.6%

Midlands

North East 10% 3% 8% 2%

North West 11% 14% 12% 12%

Scotland 7% 0.0% 4% 5.5%

* Source: IPD Quarterly Universe

1. Sectoral weightings

The sectoral weightings of the Property Portfolio, the New Portfolio and the

Combined Portfolio can be summarised as follows:

As a percentage of current gross annual rent

Sector Property New Portfolio Combined IPD Quarterly

Portfolio Portfolio Universe*

Retail 21% 21% 21% 42.6%

Office 42% 37% 40% 29.8%

Industrial 37% 41% 39% 18.4%

Other 0% 0% 0% 9.2%

* Source: IPD Quarterly Universe

1. Sub-sector weightings

The sub-sector weightings of the Property Portfolio, the New Portfolio and the

Combined Portfolio can be summarised as follows:

As a percentage of current gross annual rent

Region Property New Combined IPD Quarterly

Portfolio Portfolio Portfolio Universe*

South East Standard 5.4% 8.3% 7.6% 9.7%

Retail

Rest of UK Standard 0% 0% 0% 7.1%

Retail

Shopping Centres 0% 0% 0% 9.1%

Retail Warehouses 15.4% 13.6% 14.5% 16.7%

Central London 10.0% 0.0% 6.5% 15.2%

Offices

South East Offices 22.5% 31% 19.1% 9.5%

Rest of UK Offices 9.3% 6.2% 8.2% 5.1%

South East 9.8% 13.1% 12.1% 10.8%

Industrial

Rest of UK 27.6% 27.8% 31.9% 7.6%

Industrial

Other 0% 0.0% 0% 9.2%

* Source: IPD Quarterly Universe

12. Disposals from the Property Portfolio

Since 30 September 2015, the Company has completed the sale of the Maple Cross

Property for a consideration of GBP14.75 million. As at 30 September 2015, the

market value of the Maple Cross Property was GBP14 million. This sale completed

on 6 November 2015.

APPENDIX II

DEFINITIONS

The meanings of the following terms shall apply throughout this document unless

the context otherwise requires.

Acquisition the acquisition of all of the units in the JPUT, the two ordinary shares in the

General Partner and the New Portfolio by the Group

Acquisition Agreement the sale and purchase agreement relating to all the units in the JPUT and the

entire issued share capital of the General Partner dated 12 November 2015

Admission the admission of the New Shares to the Official List and to trading on the Main

Market pursuant to the Initial Placing and Offer

Admission Condition (i) the UKLA having acknowledged to the Company or its agent (and such

acknowledgement not having been withdrawn) that the application for the

admission of the New Shares arising under the Issues, as the case may be, to

the Official List with a premium listing has been approved and (after

satisfaction of any conditions to which such approval is expressed to be

subject ("listing conditions")) will become effective as soon as a dealing

notice has been issued by the FCA and any listing conditions having been

satisfied and (ii) the London Stock Exchange having acknowledged to the Company

or its agent (and such acknowledgement not having been withdrawn) that the New

Shares will be admitted to trading

Application Form the application form which accompanies this document for use in connection with

the Offer

Bank The Royal Bank of Scotland plc, a company incorporated in Scotland with

registered number SC090312

Bank Facility the GBP84,432,692 term loan facility provided to the Company by the Bank pursuant

to the Facility Agreement

Board or Directors the directors of the Company

Circular the circular to be published in connection with the Proposals

Combined Portfolio the Property Portfolio and the New Portfolio

Company Standard Life Investments Property Income Trust Limited, a company incorporated

in Guernsey with registered number 41352

Combined Portfolio the Property Portfolio and the New Portfolio

Estimated Net Annual Rent is based on the current rental value of a property:

(i) ignoring any special receipts or deductions arising from the

property;

(ii) excluding Value Added Tax and before taxation (including tax on

profits and any allowances for interest on capital or loans);

(iii) after making deductions for superior rents (but not for

amortisation), and any disbursements including, if appropriate, expenses of

managing the property and allowances to maintain it in a condition to command

its rent; and

(iv) where a property, or part of it, is let at the date of valuation,

the rental value reflects the terms of the lease,

and, where a property, or part of it, is vacant at the date of valuation, the

rental value reflects the rent the Valuer considers would be obtainable on an

open market letting as at the valuation date

Facility Agreement the facility agreement in relation to the Bank Facility between, among others,

the Bank in various capacities and the Company and the Property Subsidiary,

originally dated 22 December 2011, as amended by first and second amendment

agreements both dated 19 December 2014

FCA the Financial Conduct Authority acting in its capacity as the competent

authority for the purposes of Part IV of FSMA, or any successor authority

FSMA the Financial Services and Markets Act 2000, as amended

General Meeting the general meeting of the Company to be held at 30 St Mary Axe, London EC3A

8EP at 10 a.m. on 11 December 2015 to approve the issue of New Shares pursuant

to the Initial Placing and Offer and the Acquisition

General Partner Aviva Investors UK Real Estate Recovery II (General Partner) Limited

(MORE TO FOLLOW) Dow Jones Newswires

November 13, 2015 04:00 ET (09:00 GMT)

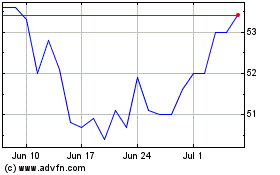

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2023 to Apr 2024