TIDMSL.

RNS Number : 6137L

Standard Life plc

29 April 2015

Standard Life plc

2015 Q1 AUA and flows update

29 April 2015

Strong demand and investment performance driving growth

-- Assets under administration(1) up 5% to GBP311.9bn driven by

strong net inflows and positive market movements

-- Particularly strong third party net inflows and investment

performance driving 5% increase in Standard Life Investments total

AUM to GBP258.4bn:

o Third party net inflows (excl. strategic partner life

business) of GBP3.7bn

o 73% of net inflows(2) from outside the UK as we continue to

expand our global reach

o Third party AUM(3) funds ahead of benchmark over 1 year: 73%;

3 years: 94%; and 5 years: 89%

-- Continued momentum in our UK business with retail and

workplace fee AUA up 6% to GBP108.5bn driven by net inflows of

GBP1.5bn into our retail new and workplace propositions and

positive market movements:

o Wrap platform, including GBP1bn of net inflows (up 16%),

driving growth in retail new AUA to GBP40bn

o Regular contributions into workplace pensions up 16%

year-on-year with AUA now GBP34bn

o Added 60,000 new savers through auto enrolment, 620,000 since

auto enrolment began

David Nish, Chief Executive, commented:

"Standard Life has made a good start to 2015 benefiting from

strong investment markets as we continue to focus on providing

value for our customers, clients and shareholders. We have

increased the assets that we administer on behalf of our customers

to GBP312bn helped by strong demand for our propositions. We

completed the disposal of our Canadian business and returned

GBP1.75bn of value to shareholders.

"Standard Life Investments now actively manages almost GBP260bn

of assets across the globe driven by consistently strong investment

performance and particularly strong third party net inflows,

benefiting from high demand for our leading suite of multi-asset

investment solutions. We are continuing to see the benefits of our

expanding distribution capabilities and strategic relationships

with 73% of net inflows from outside the UK and 70% of net inflows

through the wholesale channel.

"Our UK fee based propositions continue to build momentum. Our

Wrap platform saw record quarterly net inflows and in our workplace

business regular contributions were up 16% year-on-year as we

continue to see demand for our auto enrolment solutions, with a

further 60,000 savers joining schemes we administer. The strength

of our propositions, investment solutions and market positioning

means we are well placed to deal with the new pensions regulations

and to support customers as saving for their futures becomes

increasingly front of mind.

"In Europe we continue to increase focus on unit linked business

in Germany while in Asia we welcome the changes to foreign direct

investment limits in India.

"We remain very well positioned to deliver ongoing growth. We

have the products, expertise and proven investment performance to

help our customers and clients to save and invest, so that they can

look forward to their financial futures with confidence."

Unless otherwise stated, all figures are reported

on a continuing basis(1) for the three months ended 31 March

2015

Assets and flows

Group assets under administration - three months ended 31 March

2015

Closing

Opening Market AUA at

AUA at Gross Net and other 31 Mar

1 Jan 2015 flows Redemptions flows movements 2015

---

Fee

(F)

Spread/risk

(S/R)

Other

(O) GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

------------------------------ ----------------- ------------ ------- ------------ ------- ----------- --------

Total fee 268.6 10.4 (7.4) 3.0 10.7 282.3

Total spread/risk 16.1 0.1 (0.3) (0.2) 0.6 16.5

Total other 11.9 0.2 (0.1) 0.1 1.1 13.1

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

Total AUA 296.6 10.7 (7.8) 2.9 12.4 311.9

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

By business:

Standard Life Investments

Third party (excl. strategic

partner life business) 117.5 7.9 (4.2) 3.7 4.2 125.4

Third party strategic

partner life business 43.8 - (1.3) (1.3) 2.2 44.7

------------------------------------------------- ------------ ------- ------------ ------- ----------- --------

Standard Life Investments

total third party F 161.3 7.9 (5.5) 2.4 6.4 170.1

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

UK

UK retail new fee business 37.3 1.6 (0.7) 0.9 1.7 39.9

UK retail old fee business 33.5 0.2 (0.7) (0.5) 1.6 34.6

Workplace(4) 32.0 1.0 (0.4) 0.6 1.4 34.0

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

UK retail and workplace(4)

fee F 102.8 2.8 (1.8) 1.0 4.7 108.5

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

Conventional with profits F 2.1 - (0.2) (0.2) - 1.9

Annuities S/R 15.5 0.1 (0.3) (0.2) 0.6 15.9

Assets not backing products O 7.7 - - - 0.7 8.4

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

UK total 128.1 2.9 (2.3) 0.6 6.0 134.7

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

Europe

Fee F 17.2 0.6 (0.3) 0.3 0.5 18.0

Spread/risk S/R 0.6 - - - - 0.6

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

Europe total 17.8 0.6 (0.3) 0.3 0.5 18.6

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

UK and Europe total 145.9 3.5 (2.6) 0.9 6.5 153.3

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

Asia and Emerging Markets

Wholly owned F 0.4 - - - 0.1 0.5

Joint ventures O 2.1 0.2 (0.1) 0.1 0.1 2.3

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

Asia and Emerging Markets

total 2.5 0.2 (0.1) 0.1 0.2 2.8

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

Other corporate assets O 2.5 - - - 0.3 2.8

Consolidation and eliminations(5) F/O (15.6) (0.9) 0.4 (0.5) (1.0) (17.1)

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

Group AUA - continuing

operations 296.6 10.7 (7.8) 2.9 12.4 311.9

----------------------------------- ------------ ------------ ------- ------------ ------- ----------- --------

Standard Life Investments assets under management - three months

ended 31 March 2015

Opening Closing

AUM at Market AUM at

1 Jan Gross Net and other 31 Mar

2015 flows Redemptions flows movements 2015

GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

----------- ------------------ --------------- ---------- ------ ------------ ------- ---------- -------

Third

party AUM

(excl.

Strategic

partner

life

business) UK 75.5 3.8 (2.8) 1.0 3.6 80.1

-----------

Europe 11.3 1.6 (0.4) 1.2 (0.4) 12.1

North America 8.1 1.1 (0.3) 0.8 0.6 9.5

Asia Pacific 2.0 0.4 (0.2) 0.2 0.2 2.4

India 6.1 0.5 - 0.5 (0.1) 6.5

Ignis 14.5 0.5 (0.5) - 0.3 14.8

-------------------- ------------------------- ---------- ------ ------------ ------- ---------- -------

By geography of client 117.5 7.9 (4.2) 3.7 4.2 125.4

--------------------------------------------------- ------ ------ ------------ ------- ---------- -------

Equities 15.5 0.6 (0.7) (0.1) 1.2 16.6

Fixed income 22.0 1.2 (0.8) 0.4 0.3 22.7

Multi-asset(6) 38.6 4.3 (1.6) 2.7 2.6 43.9

Real estate 7.4 0.2 (0.1) 0.1 0.2 7.7

MyFolio 5.9 0.6 (0.2) 0.4 0.3 6.6

Other(7) 13.6 0.5 (0.3) 0.2 (0.7) 13.1

Ignis(8) 14.5 0.5 (0.5) - 0.3 14.8

-------------------- --------------- -------------------- ------ ------------ ------- ---------- -------

By asset class 117.5 7.9 (4.2) 3.7 4.2 125.4

--------------------------------------------------- ------ ------ ------------ ------- ---------- -------

Wholesale(9) 35.5 4.5 (1.9) 2.6 1.1 39.2

Institutional 61.4 2.7 (1.6) 1.1 2.5 65.0

Wealth 6.1 0.2 (0.2) - 0.3 6.4

Ignis 14.5 0.5 (0.5) - 0.3 14.8

----------------------------------------- ---------------- ------ ------------ ------- ---------- -------

By channel 117.5 7.9 (4.2) 3.7 4.2 125.4

--------------------------------------------------- ------ ------ ------------ ------- ---------- -------

Standard Life Group 84.6 0.9 (1.4) (0.5) 4.2 88.3

Phoenix Group 43.8 - (1.3) (1.3) 2.2 44.7

----------------------------------------- ---------------- ------ ------------ ------- ---------- -------

Strategic partner life

business AUM 128.4 0.9 (2.7) (1.8) 6.4 133.0

----------------------------------------- ---------------- ------ ------------ ------- ---------- -------

AUM - continuing operations 245.9 8.8 (6.9) 1.9 10.6 258.4

----------------------------------------- ---------------- ------ ------------ ------- ---------- -------

For further information please contact:

Institutional Equity Investors Retail Equity Investors

0131 245 8028 / 07515 Capita Asset

Jakub Rosochowski* 298 608 Services* 0845 113 0045

0131 245 6466 / 07711

Neil Longair* 357 595

0131 245 2176 / 07525

Chris Stewart* 149 377

Media Debt Investors

0131 245 1365 / 07702

Steve Hartley* 934 651 Stephen Percival* 0131 245 1571

0131 245 2737 / 07515

Nicki Lundy* 298 302 Nick Mardon* 0131 245 6371

Tulchan Communications 020 7353 4200

* Calls may be monitored and/or recorded to protect both you and

us and help with our training. Call charges will vary.

Newswires and online publications

A conference call for newswires and online publications will

take place on Wednesday 29 April at 07:30 (UK time). Participants

should dial +44 (0)20 3059 8125 and quote Standard Life Q1 AUA and

flows update. A replay facility will be available for seven days.

To access the replay please dial +44 (0)121 260 4861 and use pass

code 0594829#.

Investors and Analysts

A conference call for analysts and investors will take place on

Wednesday 29 April at 09:00 (UK time). Participants should dial +44

(0)20 3059 8125 and quote Standard Life Q1 AUA and flows update. A

replay facility will be available for seven days. To access the

replay please dial +44 (0)121 260 4861. The pass code is

0595163#.

There will also be a live audiocast at the same time with the

facility to ask questions.

Notes to Editors

1 Continuing operations excludes the Canadian business assets

sold on 30 January 2015 (GBP32.8bn).

2 Excluding strategic partner life business.

3 Excluding strategic partner life business and Ignis.

4 In the 3 months to 31 March 2015, UK corporate assets have been renamed as workplace.

5 Certain products are included in both Group AUA and Standard

Life Investments third party AUM. Therefore, at a Group level an

elimination adjustment is required to remove any duplication, in

addition to other necessary consolidation adjustments. Comprises

GBP16.7bn (FY 2014: GBP15.2bn) related to fee business eliminations

and GBP0.4bn (FY 2014: GBP0.4bn) related to other eliminations.

6 Comprises suite of global absolute return strategies and balanced funds.

7 Comprises cash, private equity and Wealth. Net inflows from

India cash funds GBP0.2bn (Q1 2014: net outflow GBP0.1bn).

8 Net inflows from Ignis liquidity funds GBP0.3bn (Q1 2014: GBPnil).

9 India cash funds were reclassified as Wholesale in the year to 31 December 2014.

Supplementary information

Group assets under administration net flows - 15 months ended 31

March 2015

Fee (F) 3 months 3 months 3 months 3 months 3 months

Spread/risk to to to to to

(S/R) 31 Mar 31 Dec 30 Sep 30 Jun 31 Mar

2015 2014 2014 2014 2014

Other

(O) GBPbn GBPbn GBPbn GBPbn GBPbn

----------------------------------- -------------- --------- --------- --------- --------- ---------

Total fee 3.0 (3.1) 0.2 2.3 2.3

Total spread/risk (0.2) (0.3) (0.2) (0.2) (0.2)

Total other 0.1 0.1 - - 0.1

--------------------------------------------------- --------- --------- --------- --------- ---------

Total net flows 2.9 (3.3) - 2.1 2.2

--------------------------------------------------- --------- --------- --------- --------- ---------

By business:

Standard Life Investments

Third party (excl. strategic

partner life business) 3.7 (2.9) 0.6 2.1 1.9

Third party strategic

partner life business (1.3) (0.9) (0.7) - -

--------------------------------------------------- --------- --------- --------- --------- ---------

Standard Life Investments

total third party F 2.4 (3.8) (0.1) 2.1 1.9

----------------------------------- -------------- --------- --------- --------- --------- ---------

UK

UK retail new fee business 0.9 0.8 0.6 0.7 0.8

UK retail old fee business (0.5) (0.5) (0.6) (0.5) (0.6)

Workplace(4) 0.6 0.6 0.7 0.4 0.5

--------------------------------------------------- --------- --------- --------- --------- ---------

UK retail and workplace(4)

fee F 1.0 0.9 0.7 0.6 0.7

----------------------------------- -------------- --------- --------- --------- --------- ---------

Conventional with profits F (0.2) (0.3) (0.2) (0.3) (0.2)

Annuities S/R (0.2) (0.3) (0.2) (0.2) (0.2)

Assets not backing products O - - - - -

----------------------------------- -------------- --------- --------- --------- --------- ---------

UK total 0.6 0.3 0.3 0.1 0.3

--------------------------------------------------- --------- --------- --------- --------- ---------

Europe

Fee F 0.3 0.3 0.2 0.3 0.3

Spread/risk S/R - - - - -

----------------------------------- -------------- --------- --------- --------- --------- ---------

Europe total 0.3 0.3 0.2 0.3 0.3

--------------------------------------------------- --------- --------- --------- --------- ---------

UK and Europe total 0.9 0.6 0.5 0.4 0.6

--------------------------------------------------- --------- --------- --------- --------- ---------

Asia and Emerging Markets

Wholly owned F - - 0.1 - -

Joint ventures O 0.1 0.1 - - 0.1

----------------------------------- -------------- --------- --------- --------- --------- ---------

Asia and Emerging total 0.1 0.1 0.1 - 0.1

--------------------------------------------------- --------- --------- --------- --------- ---------

Other corporate assets O - - - - -

Consolidation and eliminations(5) F/O (0.5) (0.2) (0.5) (0.4) (0.4)

Group net flows - continuing

operations 2.9 (3.3) - 2.1 2.2

--------------------------------------------------- --------- --------- --------- --------- ---------

Standard Life Investments assets under management net flows - 15

months ended 31 March 2015

3 months 3 months 3 months 3 months 3 months

to to to to to

31 Mar 31 Dec 30 Sep 30 Jun 31 Mar

2015 2014 2014 2014 2014

GBPbn GBPbn GBPbn GBPbn GBPbn

----------------------- -------------------------------- ----------- --------- --------- --------- ---------

Third party net flows

(excl. Strategic

partner life

business) UK 1.0 0.4 (0.3) 1.4 0.4

-----------------------

Europe 1.2 0.5 0.2 0.1 0.5

North America 0.8 0.3 0.1 0.4 0.7

Asia Pacific 0.2 0.1 0.2 - 0.1

India 0.5 0.3 0.2 0.2 0.2

Ignis - (4.5) 0.2 - -

-------------------------------------------------------- ----------- --------- --------- --------- ---------

By geography of client 3.7 (2.9) 0.6 2.1 1.9

------------------------------------------------------------- ------ --------- --------- --------- ---------

Equities (0.1) (1.0) (0.5) - 0.2

Fixed income 0.4 - (0.9) (0.1) -

Multi-asset(6) 2.7 1.4 1.0 1.4 1.3

Real estate 0.1 0.3 0.2 0.2 -

MyFolio 0.4 0.5 0.3 0.4 0.4

Other(7) 0.2 0.4 0.3 0.2 -

Ignis(8) - (4.5) 0.2 - -

-------------------------------------------------------- ----------- --------- --------- --------- ---------

By asset class 3.7 (2.9) 0.6 2.1 1.9

--------------------------------------------------------- ---------- --------- --------- --------- ---------

Wholesale(9) 2.6 1.5 1.2 1.1 1.4

Institutional 1.1 0.1 (0.8) 0.9 0.6

Wealth - - - 0.1 (0.1)

Ignis - (4.5) 0.2 - -

-------------------------------------------------------- ----------- --------- --------- --------- ---------

By channel 3.7 (2.9) 0.6 2.1 1.9

------------------------------------------------------------- ------ --------- --------- --------- ---------

Standard Life Group (0.5) (0.5) (0.8) (0.7) (0.4)

Phoenix Group (1.3) (0.9) (0.7) - -

------------------------------------------------------------- ------ --------- --------- --------- ---------

Strategic partner life business

net flows (1.8) (1.4) (1.5) (0.7) (0.4)

------------------------------------------------------------- ------ --------- --------- --------- ---------

Asset management net flows -

continuing operations 1.9 (4.3) (0.9) 1.4 1.5

--------------------------------------------------------- ---------- --------- --------- --------- ---------

Group assets under administration - three months ended 31 March

2014

Opening Closing

AUA at Market AUA at

1 Jan Gross Net and other 31 Mar

2014 flows Redemptions flows movements 2014

Fee (F)

Spread/risk

(S/R)

Other

(O) GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

------------------------------- ------------------ -------- ------- ------------ ------- ----------- --------

Total fee 190.7 6.8 (4.5) 2.3 0.9 193.9

Total spread/risk 15.1 0.1 (0.3) (0.2) 0.3 15.2

Total other 8.9 0.1 - 0.1 - 9.0

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

Total AUA 214.7 7.0 (4.8) 2.2 1.2 218.1

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

By business:

Standard Life Investments

Third party (excl. strategic

partner life business) 89.8 5.3 (3.4) 1.9 0.8 92.5

Third party strategic

partner life business - - - - - -

-------------------------------- ----------------- -------- ------- ------------ ------- ----------- --------

Standard Life Investments

total third party F 89.8 5.3 (3.4) 1.9 0.8 92.5

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

UK

UK retail new fee business 33.8 1.6 (0.8) 0.8 0.3 34.9

UK retail old fee business 33.5 0.2 (0.8) (0.6) 0.2 33.1

Workplace(4) 29.2 0.9 (0.4) 0.5 (0.2) 29.5

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

UK retail and workplace(4)

fee F 96.5 2.7 (2.0) 0.7 0.3 97.5

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

Conventional with profits F 2.9 - (0.2) (0.2) - 2.7

Annuities S/R 14.6 0.1 (0.3) (0.2) 0.2 14.6

Assets not backing products O 5.7 - - - - 5.7

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

UK total 119.7 2.8 (2.5) 0.3 0.5 120.5

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

Europe

Fee F 14.9 0.6 (0.3) 0.3 0.4 15.6

Spread/risk S/R 0.5 - - - 0.1 0.6

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

Europe total 15.4 0.6 (0.3) 0.3 0.5 16.2

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

UK and Europe total 135.1 3.4 (2.8) 0.6 1.0 136.7

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

Asia and Emerging Markets

Wholly owned F 0.3 - - - - 0.3

Joint ventures O 1.6 0.1 - 0.1 - 1.7

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

Asia and Emerging total 1.9 0.1 - 0.1 - 2.0

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

Other corporate assets O 2.0 - - - - 2.0

Consolidation and eliminations(5) F/O (14.1) (1.8) 1.4 (0.4) (0.6) (15.1)

Group AUA - continuing

operations 214.7 7.0 (4.8) 2.2 1.2 218.1

------------------------------------- ------------ -------- ------- ------------ ------- ----------- --------

Standard Life Investments assets under management - three months

ended 31 March 2014

Opening Closing

AUM at Market AUM at

1 Jan Gross Net and other 31 Mar

2014 flows Redemptions flows movements 2014

GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

----------- ------------------ --------------- ---------- ------ ------------ ------- ---------- -------

Third

party AUM

(excl.

Strategic

partner

life

business) UK 68.3 3.2 (2.8) 0.4 0.5 69.2

-----------

Europe 10.4 0.8 (0.3) 0.5 (0.2) 10.7

North America 5.2 0.9 (0.2) 0.7 0.5 6.4

Asia Pacific 1.8 0.2 (0.1) 0.1 (0.1) 1.8

India 4.1 0.2 - 0.2 0.1 4.4

Ignis - - - - - -

-------------------- ------------- ---------- ------ ------------ ------- ---------- -------

By geography of client 89.8 5.3 (3.4) 1.9 0.8 92.5

--------------------------------------------------- ------ ------ ------------ ------- ---------- -------

Equities 15.1 0.8 (0.6) 0.2 0.1 15.4

Fixed income 20.2 0.7 (0.7) - 0.2 20.4

Multi-asset(6) 31.4 2.9 (1.6) 1.3 0.1 32.8

Real estate 6.1 0.2 (0.2) - 0.2 6.3

MyFolio 4.0 0.5 (0.1) 0.4 - 4.4

Other(7) 13.0 0.2 (0.2) - 0.2 13.2

Ignis(8) - - - - - -

-------------------- --- -------------------- ------ ------------ ------- ---------- -------

By asset class 89.8 5.3 (3.4) 1.9 0.8 92.5

--------------------------------------------------- ------ ------ ------------ ------- ---------- -------

Wholesale(9) 28.9 3.2 (1.8) 1.4 (0.1) 30.2

Institutional 55.1 2.0 (1.4) 0.6 0.8 56.5

Wealth 5.8 0.1 (0.2) (0.1) 0.1 5.8

Ignis - - - - - -

----------------------------- ---------------- ------ ------------ ------- ---------- -------

By channel 89.8 5.3 (3.4) 1.9 0.8 92.5

--------------------------------------------------- ------ ------ ------------ ------- ---------- -------

Standard Life Group 80.3 1.3 (1.7) (0.4) 0.8 80.7

Phoenix Group - - - - - -

----------------------------- ---------------- ------ ------------ ------- ---------- -------

Strategic partner life

business AUM 80.3 1.3 (1.7) (0.4) 0.8 80.7

----------------------------------------- ---------------- ------ ------------ ------- ---------- -------

AUM - continuing operations 170.1 6.6 (5.1) 1.5 1.6 173.2

----------------------------------------- ---------------- ------ ------------ ------- ---------- -------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSIPMRTMBBTBAA

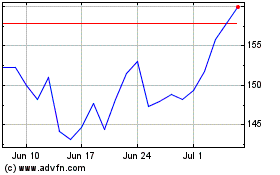

Abrdn (LSE:ABDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn (LSE:ABDN)

Historical Stock Chart

From Apr 2023 to Apr 2024