TIDMSL.

RNS Number : 6020G

Standard Life plc

09 August 2016

Standard Life plc

Half year results 2016

9 August 2016

Part 1 of 4

Diversification delivers growth in challenging markets

-- Assets under administration up 7% to GBP328.0bn (FY 2015:

GBP307.4bn) helped by gross inflows into our growth channels of

GBP20.6bn (H1 2015: GBP20.5bn) and net inflows of GBP4.1bn (H1

2015: GBP7.4bn)

-- Institutional and Wholesale channels benefiting from diversification:

-- Global Institutional business AUM up to GBP78.1bn helped by

net inflows of GBP2.0bn representing an annualised 6% of opening

AUM

-- Wholesale AUM up to GBP47.3bn with net outflows of GBP0.4bn

in a challenging environment for mutual funds, representing an

annualised outflow of 2% of opening AUM

-- Third party(1) investment performance ahead of benchmark over

1 year: 29%; 3 years: 85%; 5 years: 84%

-- Workplace and Retail channels continuing to see steady growth

with net inflows of GBP2.8bn (H1 2015: GBP2.9bn), representing an

annualised 7% of opening AUA:

-- Assets on our leading adviser Wrap platform up 20%

year-on-year to GBP28.0bn (FY 2015: GBP25.5bn; H1 2015: GBP23.3bn)

with net inflows in H1 2016 up 3% to GBP2.1bn

-- Regular contributions into workplace pensions up 4% to GBP1.5bn

-- Fee based revenue up 4% to GBP794m representing 93% of total

operating income, with revenue across growth channels up 8% to

GBP577m

-- Underlying performance* up 14% and operating profit(2) before

tax up 18% to GBP341m with diluted operating EPS up 16% to 13.5p

(H1 2015: 11.6p)

-- Profit for the period attributable to equity holders of

GBP226m (H1 2015: GBP69m) and basic EPS of 11.5p (H1 2015:

3.2p)

-- Underlying cash generation up 10% to GBP254m and a strong and

stable Solvency II surplus of GBP2.2bn(3)

-- Creating shareholder value in India:

-- Increased our stake in HDFC Life from 26% to 35% for GBP179m

-- HDFC Life has agreed terms that, subject to approvals, will

see the combination of the life insurance businesses of HDFC Life

and Max Life, creating the leading private sector life insurer in

India

-- The enlarged HDFC Life in which Standard Life would hold a

24.1% stake will, as a result of the combination and subject to

approvals, have listings on the Bombay Stock Exchange and the

National Stock Exchange of India

-- Interim dividend up 7.5% to 6.47p

Keith Skeoch, Chief Executive, commented:

"Standard Life continues to make good progress towards building

a world-class investment company, against a backdrop of volatile

investment markets, by growing assets, profits, cash flows and

returns to shareholders.

"Despite elevated uncertainty we are benefiting from our strong

long-term relationships with a broad range of clients and customers

who reacted in different ways to the changing market environment.

The increase in the stake in HDFC Life and the proposed combination

with Max Life will increase our exposure to the attractive and fast

growing Indian market, while the agreement to acquire Elevate will

strengthen our leading position in the advised platform market.

"Targeted investments to further our diversification agenda,

together with our sharpened focus on operational efficiency will

increase our pace of strategic delivery. This will ensure we

continue to meet changing client and customer needs and generate

sustainable returns for our shareholders."

Unless otherwise stated, all figures are reported on a

continuing operations basis(4) .

* Underlying performance is operating profit before tax after

excluding the impact of spread/risk operating actuarial assumption

changes and specific management actions. A full reconciliation to

profit for the period attributable to equity holders of Standard

Life plc is presented on page 2 of this release.

Financial highlights

H1

2016 H1 2015

Profitability GBPm GBPm

============================================================================= ====== ======== =========

Fee based revenue 794 761

Spread/risk margin 63 40

====================================================================================== ======== =========

Total operating income 857 801

Total operating expenses (566) (533)

Capital management 13 1

Share of associates' and joint

ventures' profit before tax 37 30

====================================================================================== ======== =========

Underlying performance 341 299

====================================================================================== ======== =========

One-off contribution to with

profits business in Germany

(operating expenses) - (9)

Operating profit before tax 341 290

====================================================================================== ======== =========

Tax on operating profit (69) (37)

Share of associates' and joint

ventures' tax expense (5) (5)

====================================================================================== ======== =========

Operating profit after tax 267 248

Non-operating items (61) (158)

Tax on non-operating items 20 19

Singapore included in discontinued

operations segment(5) - (40)

====================================================================================== ======== =========

Profit for the period attributable to equity

holders of Standard Life plc 226 69

====================================================================================== ======== =========

IFRS profit from discontinued operations(5) - 1,142

================================================================================= ======== =========

Total IFRS profit for the period attributable

to equity holders of Standard Life plc 226 1,211

====================================================================================== ======== =========

H1

2016 H1 2015

Underlying performance GBPm GBPm

====================================================================================== ======== =========

Standard Life Investments 176 154

UK spread/risk margin 55 38

UK excluding spread/risk margin 96 103

=============================================================================== ==== ======== =========

UK Pensions and Savings 151 141

Europe Pensions and Savings 18 15

Hong Kong (2) 6

Share of associates' and joint

ventures' profit before tax 21 15

=============================================================================== ==== ======== =========

India and China 19 21

Other (23) (32)

=============================================================================== ==== ======== =========

Underlying performance 341 299

=============================================================================== ==== ======== =========

H1

Other performance indicators 2016 H1 2015

=============================================================================== ==== ======== =========

Operating profit before tax (GBPm) 341 290

Underlying cash generation (GBPm) 254 230

Assets under administration (GBPbn) 328.0 307.4(6)

Net inflows (GBPbn) 0.9 3.4

=============================================================================== ==== ======== =========

H1

Other financial highlights 2016 H1 2015

=============================================================================== ==== ======== =========

Solvency II capital surplus (GBPbn):

Regulatory view 2.2(3) 2.1(6)

Investor view 3.0(3) 3.3(6)

Solvency II solvency ratio: Regulatory

view 154%(3) 162%(6)

Investor view 200%(3) 222%(6)

Profit for the period attributable

to equity holders of Standard Life

plc (GBPm) 226 69

Diluted operating EPS (p)(5,7) 13.5 11.6

Diluted EPS (p)(5,7) 11.4 3.2

Basic EPS (p)(5,7) 11.5 3.2

Interim dividend per share (p) 6.47 6.02

=============================================================================== ==== ======== =========

Group performance

Standard Life has continued to deliver profitable growth and has

shown resilience in volatile markets. We have grown assets, revenue

and profits as we continue to make good progress in building a

world-class investment company.

Assets and flows

Assets under administration (AUA) increased by 7% to GBP328.0bn

benefiting from net inflows of GBP0.9bn and positive market and

other movements of GBP19.7bn.

Gross inflows were GBP21.8bn (H1 2015: GBP21.7bn) including

inflows of GBP20.6bn (H1 2015: GBP20.5bn) into our growth channels

primarily Standard Life Investments' Institutional and Wholesale,

and Pensions and Savings' Workplace and Retail.

Net inflows of GBP0.9bn (H1 2015: GBP3.4bn) included net inflows

of GBP4.1bn (H1 2015: GBP7.4bn) into our growth channels. This was

partly offset by net outflows of GBP2.9bn (H1 2015: GBP3.6bn) from

the natural run-off of fee business mature books. Net inflows also

reflected ongoing progress in our India and China associate and

joint venture life businesses which generated net inflows of

GBP0.2bn (H1 2015: GBP0.1bn). Scheduled net outflows from annuities

amounted to GBP0.5bn (H1 2015: GBP0.5bn).

Standard Life Investments continued to deliver strong long-term

investment performance growing total assets under management (AUM)

by 6% to GBP269.0bn (FY 2015: GBP253.2bn). Within this, third party

AUM in our growth channels increased by 6% to GBP137.7bn (FY 2015:

GBP130.5bn) with the benefits of our increasingly diversified

business reflected in net inflows of GBP1.6bn into Institutional

and Wholesale. Within Standard Life Wealth, net inflows increased

to GBP0.2bn while net outflows from our Ignis business improved to

GBP0.1bn. Strategic partner life business AUM of GBP131.3bn (FY

2015: GBP122.7bn), which includes mature books managed on behalf of

Standard Life Group and the Phoenix Group, reflects the benefit of

positive market movements which more than offset scheduled outflows

from annuities and conventional with profits as well as outflows

from the assets managed for the Phoenix Group.

AUA in UK Pensions and Savings of GBP139.2bn (FY 2015:

GBP131.6bn) also benefited from steady flows in our growth

channels. Net inflows into Workplace and Retail of GBP2.8bn

represented an annualised 7% of opening assets. Regular

contributions into Workplace increased by 4% to GBP1.5bn (H1 2015:

GBP1.4bn) while our Wrap platform continues to lead the UK adviser

market(8) and attracted net inflows of GBP2.1bn (H1 2015:

GBP2.1bn).

Steady net inflows in Europe, India and China also contributed

to the growth in AUA.

Market movements of GBP19.7bn benefited from the positive impact

of foreign exchange as Sterling weakened against other currencies

and a reduction in bond yields following the outcome of the EU

referendum.

Profitability

Operating profit before tax increased by 18% to GBP341m (H1

2015: GBP290m). Fee based revenue increased to GBP794m (H1 2015:

GBP761m) with revenue generated by our growth channels, up 8% to

GBP577m (H1 2015: GBP535m), more than offsetting a GBP9m reduction

in revenue from mature books to GBP217m (H1 2015: GBP226m).

Spread/risk margin of GBP63m (H1 2015: GBP40m) included a GBP22m

benefit from an acceleration of payments from our main with profits

fund relating to changes to the scheme of demutualisation in

response to the transition to Solvency II. Our cost/income ratio(9)

improved to 62% (FY 2015: 63%) and with an ongoing focus on

operational efficiency, we will continue to drive our cost/income

ratio to significantly below its current level.

Profit for the period attributable to equity holders was GBP226m

(H1 2015: GBP69m) reflecting increased operating profit and a

decrease in non-operating costs including restructuring

expenses.

Proposed dividend

The Board has proposed an interim dividend of 6.47p per share

(H1 2015: 6.02p), an increase of 7.5%. We continue to apply our

existing progressive pence per share dividend policy taking account

of market conditions and the Group's financial performance.

Group capital surplus

Our solvency position remains strong and stable with a Solvency

II capital surplus of GBP2.2bn(3) (FY 2015: GBP2.1bn), representing

solvency cover of 154%(3) (FY 2015: 162%).

These figures do not recognise additional entity level capital

of GBP0.8bn. This additional capital helps absorb market and other

volatility, resulting in a resilient Solvency II capital surplus.

For example, the Solvency II capital surplus of GBP2.2bn(3) would

change by GBP0.1bn or less following a 20% rise or fall in

equities; 100bps rise or fall in fixed interest yields; or a 50bps

rise or fall in credit spreads.

The solvency cover prescribed by Solvency II regulations of 154%

is diluted by the inclusion of GBP1.1bn of capital requirements for

with profits funds and our defined benefit pension scheme. These

capital requirements are covered in full by surplus assets in those

funds.

Adjusting for the treatment of with profits funds and the

defined benefit pension scheme and including the additional entity

level capital, the Investor view surplus is GBP3.0bn(3) (FY 2015:

GBP3.3bn) with a solvency ratio of 200%(3) (FY 2015: 222%). The

reduction in surplus mainly reflects the amount paid to increase

our stake in HDFC Life of GBP0.2bn.

Outlook

The first half of 2016 can only be characterised as a

challenging external environment. While it would be rash to

extrapolate the economic and political noise of the last six

months, it is clear that the uncertainty that always accompanies

economies, politics and markets will remain elevated. This will

reinforce the global trends that are shaping the savings and

investment landscape, which Standard Life's long-term strategy is

designed to take advantage of.

We are already benefiting from our strong long-term

relationships with a broad range of clients and customers who

reacted in different ways to the changing market environment.

Targeted investments to further our diversification agenda,

together with a sharpened focus on operational efficiency as we

drive our cost income ratio to significantly below its current

level, will increase our pace of strategic delivery. This will

ensure we continue to meet changing client and customer needs and

generate sustainable returns for our shareholders.

Business highlights

Standard Life has a simple and consistent business model that

continues to drive growth in assets, maximise revenue and lower

unit costs. This drives higher profits, and together with

optimisation of our balance sheet, delivers value for our

shareholders.

We continue to make good progress in each of our businesses

focusing on our key growth channels:

Institutional and Wholesale driving profit in Standard Life

Investments

-- Benefiting from strong long-term investment performance,

ongoing product innovation, high levels of client service and an

increasingly global client base

-- Operating profit before tax up 14% to GBP176m (H1 2015:

GBP154m), benefiting from an 11% increase in third party revenue

from our growth channels to GBP331m, a continuing shift in mix

towards higher margin products and controlled growth in

expenses

-- Average revenue yield on third party AUM from our growth

channels increased to 53bps (FY 2015: 52bps)

-- EBITDA up 13% to GBP182m (H1 2015: GBP161m) with EBITDA margin up to 42% (H1 2015: 40%)

-- Our associate, HDFC AMC, a leading Indian private asset

manager with AUM of GBP20.6bn (FY 2015: GBP17.4bn), contributed

GBP16m (H1 2015: GBP15m) to operating profit

-- Third party net inflows from our growth channels of GBP1.7bn

(H1 2015: GBP5.2bn) including net inflows of GBP2.0bn (H1 2015:

GBP1.8bn) into our increasingly global Institutional business and

resilient Wholesale performance with net outflows of GBP0.4bn (H1

2015: GBP5.3bn net inflows) in a challenging environment for mutual

funds

-- MyFolio AUM up 10% to GBP8.9bn (FY 2015: GBP8.1bn) with c85%

distributed through UK Pensions and Savings

-- Strong long-term money weighted average investment

performance with third party(1) AUM above benchmark: 1 year 29%; 3

years 85%; and 5 years 84%

Workplace and Retail driving continuing growth in UK Pensions

and Savings

-- Our UK Pensions and Savings business continues to benefit

from structural market changes and careful strategic positioning,

as well as its attractive propositions and investment solutions

-- Operating profit before tax of GBP151m (H1 2015: GBP141m)

reflects ongoing momentum in our Workplace and Retail fee business

growth channels and increased spread/risk margin

-- Spread/risk margin of GBP55m (H1 2015: GBP38m) benefited from

GBP16m (H1 2015: GBP6m) of asset liability management and an GBP18m

benefit from the acceleration of payments from our main with profit

fund

-- UK fee revenue increased to GBP321m (H1 2015: GBP314m)

benefiting from an 8% increase in Workplace and Retail revenue to

GBP197m (H1 2015: GBP182m) which more than offset a reduction in

Mature Retail revenue to GBP124m (H1 2015: GBP132m). Average fee

revenue yield remains stable at 59bps (FY 2015: 59bps).

-- UK cost/income ratio stable at 59% (FY 2015: 59%) and

reflects an additional GBP7m expenses from the scaling up of our

financial advice business, 1825

-- Our Wrap platform continues to lead the market(8) with net

inflows of GBP2.1bn and AUA up 10% to GBP28.0bn (FY 2015:

GBP25.5bn), while the number of adviser firms using our Wrap

platform increased by 30 to 1,493

-- 21% of Wrap platform AUA of GBP28.0bn is managed by Standard Life Investments

-- Agreed to acquire the Elevate platform from AXA and expect

the transaction to complete in H2 2016

-- Assets in our market-leading drawdown propositions increased

by 8% to GBP14.7bn (FY 2015: GBP13.6bn)

-- Continued building 1825 by completing two acquisitions and

announcing our intention to make a further two acquisitions,

broadening our reach across the UK

Ongoing growth in Europe fee AUA

-- Europe operating profit increased to GBP18m (H1 2015: GBP6m)

and includes a spread/risk benefit of GBP4m from the acceleration

of payments from our main with profits fund. H1 2015 included a

one-off GBP9m negative impact from shareholder support provided to

the German with profits business.

-- Fee AUA increased 15% to GBP20.7bn (FY 2015: GBP18.0bn)

driven by favourable foreign exchange movements and continued

momentum in our Europe growth business

Continued progress in India and China associate and joint

venture life businesses

-- Operating profit before tax of GBP19m (H1 2015: GBP21m)

reflects higher profit from associate and joint venture life

businesses which increased to GBP21m (H1 2015: GBP15m) partly

offset by lower profitability in our Hong Kong business which is

continuing to adapt to regulatory change

-- Increased stake in HDFC Life from 26% to 35% for GBP179m

-- HDFC Life has agreed terms that, subject to approvals, will

see the combination of the life insurance businesses of HDFC Life

and Max Life, creating the leading private sector life insurer in

India

-- The enlarged HDFC Life in which Standard Life would hold a

stake of 24.1% will, as a result of the combination and subject to

approvals, have listings on the Bombay Stock Exchange and the

National Stock Exchange of India

-- In China, Heng An Standard Life continues to build a

sustainable and profitable business with strong growth in new

business sales in H1 2016 (up 31%)

For a PDF version of the full half year results announcement,

please click here:

http://www.rns-pdf.londonstockexchange.com/rns/6020G_-2016-8-8.pdf

For further information please contact:

Institutional Equity Investors Retail Equity Investors

0131 245 8028 / Capita Asset 0345 113

Jakub Rosochowski* 07515 298 608 Services* 0045

0131 245 6466 /

Neil Longair* 07711 357 595

0131 245 2176 /

Chris Stewart* 07525 149 377

Media Debt Investors

0131 245 1365 / 0131 245

Steve Hartley* 07702 934 651 Stephen Percival* 1571

0131 245 6165 / 0131 245

Barry Cameron* 07712 486 463 Nick Mardon* 6371

Tulchan Communications 020 7353 4200

* Calls may be monitored and/or recorded to protect both you and

us and help with our training. Call charges will vary.

Newswires and online publications

A conference call for newswires and online publications will

take place on Tuesday 9 August at 7.15am (UK time). Participants

should dial +44 (0)20 3059 8125 and quote Standard Life half year

results 2016. A replay facility will be available for seven days

after the event. To access the replay please dial +44 (0)121 260

4861 followed by the passcode 3749117#.

Investors and Analysts

The half year results 2016 analyst and investor presentation

will take place on Tuesday 9 August at 8.30am (UK time). The

presentation will take place at Goldman Sachs International, River

Court, 120 Fleet Street, London EC4A 2BE. There will also be a live

webcast and teleconference starting at 8.30am, both of which will

have the facility to ask questions at the end of the formal

presentation. Participants should dial +44 (0)20 3059 8125 and

quote Standard Life half year results 2016. A replay facility will

be available for seven days after the event. To access the replay

please dial +44 (0)121 260 4861 followed by passcode 4677589#.

Notes to Editors:

1. Excluding strategic partner life business.

2. Operating profit is IFRS profit before tax adjusted to remove

the impact of short-term market driven fluctuations in investment

return and economic assumptions, restructuring costs, amortisation

and impairment of intangible assets acquired in business

combinations, gain or loss on the sale of a subsidiary, associate

or joint venture and other significant one-off items which are not

indicative of the long-term operating performance of the Group.

3. Based on draft regulatory returns.

4. Continuing operations excludes the Canadian and Singapore

operations reported as discontinued operations in 2015.

5. Under IFRS 5, Singapore did not constitute a discontinued

operation and was included under continuing operations in the IFRS

condensed consolidated income statement. Therefore the analysis of

Group operating profit includes the reclassification of Singapore

results between discontinued and continuing operations. The Group

diluted operating earnings per share from continuing operations

excludes Singapore while the Group diluted and basic earnings per

share from continuing operations includes Singapore.

6. As at 31 December 2015 (Solvency II as at 1 January 2016).

7. The Company undertook a share consolidation in 2015 followed

by a return of value to shareholders. In accordance with IAS 33,

earnings per share were not restated following the share

consolidation as there was an overall corresponding change in

resources. As a result of the share consolidation, earnings per

share from continuing operations for the six months ended 30 June

2016 are not directly comparable with prior periods.

8. Source: Fundscape latest available net inflow data.

9. On a rolling 12 months basis, operating expenses divided by

operating income (including share of associates' and joint

ventures' profit before tax).

10. For more detailed information on the statutory results of

the Group refer to the half year results 2016.

Forward-looking statements

This document may contain certain "forward-looking statements"

with respect to certain of Standard Life's plans and its current

goals and expectations relating to its future financial condition,

performance, results, strategy and objectives. Statements

containing the words "believes", "intends", "expects", "plans",

"pursues", "seeks" and "anticipates", and words of similar meaning,

are forward-looking. By their nature, all forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances which are beyond Standard Life's

control including among other things, UK domestic and global

political, economic and business conditions, market related risks

such as fluctuations in interest rates and exchange rates, and the

performance of financial markets generally; the policies and

actions of regulatory authorities, the impact of competition,

inflation, and deflation; experience in particular with regard to

mortality and morbidity trends, lapse rates and policy renewal

rates; the timing, impact and other uncertainties of future

acquisitions or combinations within relevant industries; and the

impact of changes in capital, solvency or accounting standards, and

tax and other legislation and regulations in the jurisdictions in

which Standard Life and its affiliates operate. This may for

example result in changes to assumptions used for determining

results of operations or re-estimations of reserves for future

policy benefits. As a result, Standard Life's actual future

financial condition, performance and results may differ materially

from the plans, goals, and expectations set forth in the

forward-looking statements. Standard Life undertakes no obligation

to update the forward-looking statements contained in this press

release or any other forward-looking statements it may make.

Inside Information

This announcement contains inside information which is disclosed

in accordance with the Market Abuse Regulation which came into

effect on 3 July 2016.

Supplementary information

Analysis of flows, AUA and revenue by channel

We analyse our simplified business in three distinct

components:

-- Growth channels which are sources of strong scalable growth

and diversification by geography, asset class, product, client and

customer. These primarily comprise the Institutional and Wholesale

channels of Standard Life Investments, and the Workplace and Retail

channels of UK Pensions and Savings.

-- Mature books of largely legacy pension and insurance business

that provide a stable contribution to revenue and profit as well as

being a source of financial strength

-- Our strategic associate and joint venture life businesses in

India and China that are sources of future potential growth and

diversification

Fee

Gross Fee based revenue

flows Net flows AUA revenue yield

H1 H1 H1 H1 H1 H1 H1 H1 H1

2016 2015 2016 2015 2016 2015 2016 2015 2016

GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPm GBPm bps

--------------------------- ------ ------ ------ ------ ------- ------- ------ ---------- ---------

Institutional 8.4 5.4 2.0 1.8 78.1 64.6 178 157 49

Wholesale 6.5 8.9 (0.4) 5.3 47.3 40.6 125 102 70

Workplace 2.0 2.1 0.8 1.1 34.0 33.2 91 88 54

Retail 4.1 3.6 2.0 1.8 45.7 40.4 106 94 49

Standard Life Wealth 0.5 0.4 0.2 - 6.7 6.3 24 19 79

Ignis(1) 0.3 1.3 (0.1) (1.9) 5.6 12.9 4 20 8

Europe Growth 0.7 0.7 0.3 0.3 10.4 9.0 39 32 71

Hong Kong - - - - 0.6 0.4 10 23 -

Fee business eliminations (1.9) (1.9) (0.7) (1.0) (19.5) (17.1) - - -

--------------------------- ------ ------ ------ ------ ------- ------- ------ ---------- ---------

Total Growth fee 20.6 20.5 4.1 7.4 208.9 190.3 577 535 60

--------------------------- ------ ------ ------ ------ ------- ------- ------ ---------- ---------

UK Mature Retail 0.4 0.4 (1.2) (1.2) 32.6 33.4 124 132 77

Europe Mature fee 0.3 0.4 0.1 0.2 10.3 7.9 47 50 129

Third party strategic

partner life business - - (1.4) (2.2) 43.0 42.1 34 34 20

Other fee including

CWP(2) - - (0.4) (0.4) 1.0 1.7 12 10 -

--------------------------- ------ ------ ------ ------ ------- ------- ------ ---------- ---------

Total Mature fee 0.7 0.8 (2.9) (3.6) 86.9 85.1 217 226 53

--------------------------- ------ ------ ------ ------ ------- ------- ------ ---------- ---------

Total fee 21.3 21.3 1.2 3.8 295.8 275.4 794 761 -

--------------------------- ------ ------ ------ ------ ------- ------- ------ ---------- ---------

Spread/risk 0.1 0.1 (0.5) (0.5) 16.1 15.4 - - -

Associate and joint

venture life businesses 0.4 0.3 0.2 0.1 3.5 2.2 - - -

Other - - - - 13.2 9.5 - - -

Other eliminations - - - - (0.6) (0.4) - - -

--------------------------- ------ ------ ------ ------ ------- ------- ------ ---------- ---------

Total 21.8 21.7 0.9 3.4 328.0 302.1 794 761 -

--------------------------- ------ ------ ------ ------ ------- ------- ------ ---------- ---------

1. In H1 2016 a number of Ignis funds were merged with other SLI

funds, resulting in a decrease in reported Ignis AUM of GBP5.6bn.

These assets are now included in Institutional (GBP4.0bn) and

Wholesale (GBP1.6bn).

2. Fee based revenue income from investment management expenses

charged directly to internal policyholder funds managed by Standard

Life Investments for the Standard Life Group. These policyholder

funds largely comprise assets across both growth channels and

mature books as well as conventional with profits. AUA and flows

comprise conventional with profits only.

Supplementary information continued

Assets under administration and net flows

Assets under administration (AUA) is a measure of the total

assets administered on behalf of individual customers and

institutional clients. It includes those assets for which we

provide investment management services, as well as those assets we

administer where the customer has made a choice to select an

external third party investment manager. As an investment company,

AUA and net flows are key drivers of shareholder value.

Assets under administration (summary)

6 months ended 30 June 2016

Opening Market Closing

AUA at Gross Net and other AUA at

1 Jan 2016 flows Redemptions flows movements 30 Jun 2016

GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

------------------- ------------------- ------------ ------- ------------ ------- ----------- -------------

Total Growth

channels 198.3 20.6 (16.5) 4.1 6.5 208.9

Total Mature Books

fee 82.0 0.7 (3.6) (2.9) 7.8 86.9

Total Mature Books

spread/risk 14.9 0.1 (0.6) (0.5) 1.7 16.1

Total Other 12.2 0.4 (0.2) 0.2 3.7 16.1

------------------- ------------------- ------------ ------- ------------ ------- ----------- -------------

Total AUA 307.4 21.8 (20.9) 0.9 19.7 328.0

------------------- ------------------- ------------ ------- ------------ ------- ----------- -------------

Growth channels Institutional 67.0 8.4 (6.4) 2.0 9.1 78.1

------------------

Wholesale 45.9 6.5 (6.9) (0.4) 1.8 47.3

Wealth 6.5 0.5 (0.3) 0.2 - 6.7

Ignis(1) 11.1 0.3 (0.4) (0.1) (5.4) 5.6

Standard Life

Investments 130.5 15.7 (14.0) 1.7 5.5 137.7

-------------------- ------------ ------- ------------ ------- ----------- -------------

Workplace 33.0 2.0 (1.2) 0.8 0.2 34.0

Retail(2) 42.6 4.1 (2.1) 2.0 1.1 45.7

UK Pensions and

Savings 75.6 6.1 (3.3) 2.8 1.3 79.7

-------------------- ------------ ------- ------------ ------- ----------- -------------

Europe Growth(2) 9.6 0.7 (0.4) 0.3 0.5 10.4

Pensions and

Savings 85.2 6.8 (3.7) 3.1 1.8 90.1

-------------------- ------------ ------- ------------ ------- ----------- -------------

Hong Kong 0.5 - - - 0.1 0.6

Eliminations(3) (17.9) (1.9) 1.2 (0.7) (0.9) (19.5)

-------------------- ------------ ------- ------------ ------- ----------- -------------

Total Growth

channels 198.3 20.6 (16.5) 4.1 6.5 208.9

-------------------- ------------ ------- ------------ ------- ----------- -------------

Mature books UK Mature Retail 32.7 0.4 (1.6) (1.2) 1.1 32.6

------------------

Europe Mature fee 8.4 0.3 (0.2) 0.1 1.8 10.3

Third party

strategic partner

life business 39.6 - (1.4) (1.4) 4.8 43.0

Other fee including

CWP 1.3 - (0.4) (0.4) 0.1 1.0

-------------------- ------------ ------- ------------ ------- ----------- -------------

Total Mature Books

fee 82.0 0.7 (3.6) (2.9) 7.8 86.9

-------------------- ------------ ------- ------------ ------- ----------- -------------

Spread/risk 14.9 0.1 (0.6) (0.5) 1.7 16.1

Total Mature Books 96.9 0.8 (4.2) (3.4) 9.5 103.0

-------------------- ------------ ------- ------------ ------- ----------- -------------

Associate and joint

venture life

businesses(4) 2.3 0.4 (0.2) 0.2 1.0 3.5

Other(5) 10.4 - - - 2.8 13.2

Other

eliminations(3) (0.5) - - - (0.1) (0.6)

-------------------- ------------------ ------------ ------- ------------ ------- ----------- -------------

Total 307.4 21.8 (20.9) 0.9 19.7 328.0

-------------------- ------------------ ------------ ------- ------------ ------- ----------- -------------

1. In H1 2016 a number of Ignis funds were merged with other SLI

funds, resulting in a decrease in reported Ignis AUM of GBP5.6bn.

These assets are now included in Institutional (GBP4.0bn) and

Wholesale (GBP1.6bn) with the transfers shown in Market and other

movements.

2. Wrap AUA is reported predominantly within Retail: GBP25.8bn

(FY 2015: GBP23.4bn). International bond AUA is reported within

Europe growth fee business: GBP2.2bn (FY 2015: GBP2.1bn).

3. Certain products are included in both Pensions and Savings

growth AUA and Standard Life Investments growth AUM. Therefore, at

a Group level an elimination adjustment is required to remove any

duplication, in addition to other necessary consolidation

adjustments. Comprises GBP19.5bn (FY 2015: GBP17.9bn) related to

growth channels business eliminations and GBP0.6bn (FY 2015:

GBP0.5bn) related to other consolidation/eliminations.

4. Market and other movements includes GBP0.8bn relating to

stake increase in HDFC Life in April 2016.

5. Other comprises Assets not backing products of GBP10.5bn (FY

2015: GBP7.7bn) and Other corporate assets of GBP2.7bn (FY 2015:

GBP2.7bn).

Assets under administration and net flows

Assets under administration (summary)

6 months ended 30 June 2015

Opening Market Closing

AUA at Gross Net and other AUA at

1 Jan 2015 flows Redemptions flows movements 30 Jun 2015

GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

------------------- ------------------- ------------ ------- ------------ ------- ----------- -------------

Total Growth

channels 180.7 20.5 (13.1) 7.4 2.2 190.3

Total Mature Books

fee 87.9 0.8 (4.4) (3.6) 0.8 85.1

Total Mature Books

spread/risk 16.1 0.1 (0.6) (0.5) (0.2) 15.4

Total Other 11.9 0.3 (0.2) 0.1 (0.7) 11.3

------------------- ------------------- ------------ ------- ------------ ------- ----------- -------------

Total AUA 296.6 21.7 (18.3) 3.4 2.1 302.1

------------------- ------------------- ------------ ------- ------------ ------- ----------- -------------

Growth channels Institutional 61.4 5.4 (3.6) 1.8 1.4 64.6

------------------

Wholesale 35.5 8.9 (3.6) 5.3 (0.2) 40.6

Wealth 6.1 0.4 (0.4) - 0.2 6.3

Ignis 14.5 1.3 (3.2) (1.9) 0.3 12.9

Standard Life

Investments 117.5 16.0 (10.8) 5.2 1.7 124.4

-------------------- ------------ ------- ------------ ------- ----------- -------------

Workplace 32.0 2.1 (1.0) 1.1 0.1 33.2

Retail(1) 37.3 3.6 (1.8) 1.8 1.3 40.4

UK Pensions and

Savings 69.3 5.7 (2.8) 2.9 1.4 73.6

-------------------- ------------ ------- ------------ ------- ----------- -------------

Europe Growth(1) 8.7 0.7 (0.4) 0.3 - 9.0

Pensions and

Savings 78.0 6.4 (3.2) 3.2 1.4 82.6

-------------------- ------------ ------- ------------ ------- ----------- -------------

Hong Kong 0.4 - - - - 0.4

Eliminations(2) (15.2) (1.9) 0.9 (1.0) (0.9) (17.1)

-------------------- ------------ ------- ------------ ------- ----------- -------------

Total Growth

channels 180.7 20.5 (13.1) 7.4 2.2 190.3

-------------------- ------------ ------- ------------ ------- ----------- -------------

Mature books UK Mature Retail 33.5 0.4 (1.6) (1.2) 1.1 33.4

------------------

Europe Mature fee 8.5 0.4 (0.2) 0.2 (0.8) 7.9

Third party

strategic partner

life business 43.8 - (2.2) (2.2) 0.5 42.1

Other fee including

CWP 2.1 - (0.4) (0.4) - 1.7

-------------------- ------------ ------- ------------ ------- ----------- -------------

Total Mature Books

fee 87.9 0.8 (4.4) (3.6) 0.8 85.1

-------------------- ------------ ------- ------------ ------- ----------- -------------

Spread/risk 16.1 0.1 (0.6) (0.5) (0.2) 15.4

Total Mature Books 104.0 0.9 (5.0) (4.1) 0.6 100.5

-------------------- ------------ ------- ------------ ------- ----------- -------------

Associate and joint

venture life

businesses 2.1 0.3 (0.2) 0.1 - 2.2

Other(3) 10.2 - - - (0.7) 9.5

Other

eliminations(2) (0.4) - - - - (0.4)

-------------------- ------------------ ------------ ------- ------------ ------- ----------- -------------

Total 296.6 21.7 (18.3) 3.4 2.1 302.1

-------------------- ------------------ ------------ ------- ------------ ------- ----------- -------------

1. Wrap AUA is reported predominantly within Retail: GBP21.4bn.

International bond AUA is reported within Europe growth fee

business: GBP1.9bn.

2. Certain products are included in both Pensions and Savings

growth AUA and Standard Life Investments growth AUM. Therefore, at

a Group level an elimination adjustment is required to remove any

duplication, in addition to other necessary consolidation

adjustments. Comprises (GBP17.1bn) related to growth channels

business eliminations and (GBP0.4bn) related to other

consolidation/eliminations.

3. Other comprises Assets not backing products of GBP6.8bn and

Other corporate assets of GBP2.7bn.

Supplementary information continued

Standard Life Investments assets under management and net

flows

6 months ended 30 June Opening Closing

2016 AUM Market AUM

at and at

1 Jan Gross Net other 30 Jun

2016 flows Redemptions flows movements 2016

--------------------------------------

GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

------------ ------------------------ -------- ------- ------------ ------- ----------- --------

Growth AUM UK 83.2 8.6 (7.5) 1.1 7.0 91.3

------------

Europe 14.2 2.5 (3.1) (0.6) 2.7 16.3

North America 11.7 3.0 (2.5) 0.5 0.3 12.5

Asia Pacific 3.3 0.5 (0.5) - 0.4 3.7

India 7.0 0.8 - 0.8 0.5 8.3

Ignis(1) 11.1 0.3 (0.4) (0.1) (5.4) 5.6

------------------------------------- -------- ------- ------------ ------- ----------- --------

By geography of client 130.5 15.7 (14.0) 1.7 5.5 137.7

------------------------------------- -------- ------- ------------ ------- ----------- --------

Equities 16.9 1.6 (2.2) (0.6) (0.6) 15.7

Fixed income 21.8 2.8 (2.5) 0.3 3.1 25.2

Multi-asset(2) 50.3 6.5 (5.9) 0.6 1.1 52.0

Real estate 8.6 0.6 (0.7) (0.1) 2.3 10.8

MyFolio 8.1 1.2 (0.5) 0.7 0.1 8.9

Other(3) 13.7 2.7 (1.8) 0.9 4.9 19.5

Ignis(1) 11.1 0.3 (0.4) (0.1) (5.4) 5.6

------------------------------------- -------- ------- ------------ ------- ----------- --------

By asset class 130.5 15.7 (14.0) 1.7 5.5 137.7

------------------------------------- -------- ------- ------------ ------- ----------- --------

Institutional 67.0 8.4 (6.4) 2.0 9.1 78.1

Wholesale 45.9 6.5 (6.9) (0.4) 1.8 47.3

Wealth 6.5 0.5 (0.3) 0.2 - 6.7

Ignis(1) 11.1 0.3 (0.4) (0.1) (5.4) 5.6

------------------------------------- -------- ------- ------------ ------- ----------- --------

By channel 130.5 15.7 (14.0) 1.7 5.5 137.7

------------------------------------- -------- ------- ------------ ------- ----------- --------

Standard Life Group 83.1 1.9 (2.7) (0.8) 6.0 88.3

Phoenix Group 39.6 - (1.4) (1.4) 4.8 43.0

-------------------------------------- -------- ------- ------------ ------- ----------- --------

Strategic partner life

business AUM 122.7 1.9 (4.1) (2.2) 10.8 131.3

-------------------------------------- -------- ------- ------------ ------- ----------- --------

Standard Life Investments

AUM 253.2 17.6 (18.1) (0.5) 16.3 269.0

-------------------------------------- -------- ------- ------------ ------- ----------- --------

6 months ended 30 June Opening Closing

2015 AUM Market AUM

at and at

1 Jan Gross Net other 30 Jun

2015 flows Redemptions flows movements 2015

--------------------------------------

GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

------------ ------------------------ -------- ------- ------------ ------- ----------- --------

Growth AUM UK 75.5 7.7 (5.6) 2.1 2.5 80.1

------------

Europe 11.3 3.1 (0.9) 2.2 (1.0) 12.5

North America 8.1 2.3 (0.8) 1.5 0.1 9.7

Asia Pacific 2.0 1.1 (0.3) 0.8 0.1 2.9

India 6.1 0.5 - 0.5 (0.3) 6.3

Ignis 14.5 1.3 (3.2) (1.9) 0.3 12.9

------------------------------------- -------- ------- ------------ ------- ----------- --------

By geography of client 117.5 16.0 (10.8) 5.2 1.7 124.4

------------------------------------- -------- ------- ------------ ------- ----------- --------

Equities 15.5 1.3 (1.4) (0.1) 0.9 16.3

Fixed income 22.0 1.9 (1.5) 0.4 (1.2) 21.2

Multi-asset(2) 38.6 8.9 (3.3) 5.6 1.7 45.9

Real estate 7.4 0.5 (0.3) 0.2 0.4 8.0

MyFolio 5.9 1.3 (0.4) 0.9 0.1 6.9

Other(3) 13.6 0.8 (0.7) 0.1 (0.5) 13.2

Ignis 14.5 1.3 (3.2) (1.9) 0.3 12.9

------------------------------------- -------- ------- ------------ ------- ----------- --------

By asset class 117.5 16.0 (10.8) 5.2 1.7 124.4

------------------------------------- -------- ------- ------------ ------- ----------- --------

Institutional 61.4 5.4 (3.6) 1.8 1.4 64.6

Wholesale 35.5 8.9 (3.6) 5.3 (0.2) 40.6

Wealth 6.1 0.4 (0.4) - 0.2 6.3

Ignis 14.5 1.3 (3.2) (1.9) 0.3 12.9

------------------------------------- -------- ------- ------------ ------- ----------- --------

By channel 117.5 16.0 (10.8) 5.2 1.7 124.4

------------------------------------- -------- ------- ------------ ------- ----------- --------

Standard Life Group 84.6 2.3 (3.5) (1.2) 0.1 83.5

Phoenix Group 43.8 - (2.2) (2.2) 0.5 42.1

-------------------------------------- -------- ------- ------------ ------- ----------- --------

Strategic partner life

business AUM 128.4 2.3 (5.7) (3.4) 0.6 125.6

-------------------------------------- -------- ------- ------------ ------- ----------- --------

Standard Life Investments

AUM 245.9 18.3 (16.5) 1.8 2.3 250.0

-------------------------------------- -------- ------- ------------ ------- ----------- --------

1. Ignis fund mergers in H1 2016 transferred GBP5.6bn of AUM,

shown in Market and other movements, into the following categories

- by geography: UK (GBP5.6bn); by asset class: real estate

(GBP1.6bn) and other (GBP4.0bn); by channel: Institutional

(GBP4.0bn) and Wholesale (GBP1.6bn).

2. Comprises absolute return strategies, enhanced

diversification strategies, risk-based portfolios and traditional

balanced portfolios.

3. Comprises cash, private equity, liquidity funds and Wealth.

Net inflows from India cash funds GBP0.5bn (H1 2015: net inflow

GBP0.2bn), net inflows from liquidity funds of GBPnil (H1 2015: net

inflows GBP0.7bn).

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DMGGRGRRGVZZ

(END) Dow Jones Newswires

August 09, 2016 02:01 ET (06:01 GMT)

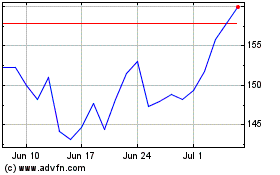

Abrdn (LSE:ABDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn (LSE:ABDN)

Historical Stock Chart

From Apr 2023 to Apr 2024