TIDMSL.

RNS Number : 7405X

Standard Life plc

24 February 2017

Standard Life plc

Full Year Results 2016

Part 8 of 8

12. Reports from the Committees of Standard Life Assurance

Limited and the Standard Life Master Trust Co. Ltd.

12.1 Report from the With Profits Committee of Standard Life

Assurance Limited

Whilst the management of its with profits business is the direct

responsibility of the board of Standard Life Assurance Limited

(SLAL), FCA regulations require that a with profits firm's

governance arrangements should make provision for independent

judgement and advice. The SLAL board has established a With Profits

Committee (WPC) for this purpose.

Clifton Melvin,

Chairman, With Profits Committee of Standard Life Assurance

Limited

Membership

All members of the WPC are independent of Standard Life. Their

attendance at WPC meetings was:

Member Attendance

------------------------- ----------

Clifton Melvin, Chairman 10/10

Graham Aslet 10/10

Ross Ainslie(1) 10/10

Finula Cilliers(2) 9/9

------------------------- ----------

(1) Ross Ainslie was appointed for a second term in June

2016.

(2) Finula Cilliers was appointed as a member of the WPC in

March 2016.

The members are appointed by the SLAL board on the

recommendation of the Nomination and Governance Committee.

Directors of the Standard Life plc and SLAL boards, the UK and

Europe Chief Risk Officer and senior actuaries, in particular the

With Profits Actuary and the UK and Europe Actuarial Director,

routinely attend these meetings.

SLAL has had a WPC since demutualisation. Its role is to monitor

and advise the SLAL board on the management of with profits

business, providing independent judgement on the fair treatment of

with profits policyholders, and to take a proactive role in raising

any issues that merit further consideration. The committee reviews

all proposals that are material to the interests of SLAL's with

profits policyholders. The committee has the authority to engage

external advisers and has engaged Nick Dumbreck, an actuary from

Milliman LLP, to routinely provide the members with advice. The

Chairman has a right of access at all times to the Chairman of the

Risk and Capital Committee but saw no requirement during the year

to exercise this right.

The committee's routine formal interaction with the SLAL board

is by the submission of the minutes of its meetings to the board,

together with the provision of feedback on its advice, and by an

annual report to the SLAL board in which it reviews the management

of with profits business having regard to SLAL's duty to treat its

with profits policyholders fairly and to meet their reasonable

benefit expectations. The committee has authority to make a report

to the with profits policyholders. It did not do so during 2016 and

would not expect to do so unless it disagreed materially with

SLAL's own annual report to its with profits policyholders (which

is required by FCA regulations) on the management of the with

profits business. Minutes of the committee meetings are also

submitted to the Board of Standard Life plc and, in May 2016, the

committee Chairman attended a meeting of the Standard Life plc

Board which focused on three key with profits issues - investment

strategy, the implementation of the new Solvency II insurance

regulation regime and the terms on which the main with profits fund

secures guaranteed annuities for customers.

The committee's work in 2016

An indicative breakdown as to how the committee spent its time

is shown below: Diagram removed for the purposes of this

announcement. However it can be viewed in full in the pdf

document.

During 2016, the committee's work focused on these key

areas:

Customer

Policy values - the WPC reviewed the algorithm for setting

regular bonus rates and confirmed that it remains appropriate. It

approved management's recommendations regarding bonus rates and

payout values.

Service - the WPC regularly reviews with profits customer

complaints data and has been pleased to note the continuation of an

improving trend. The WPC visited the Customer Hub to understand how

pensions freedoms are applied to the customer experience from a

digital and telephony perspective. Following SLAL's decision to

close the German With Profits Fund to new business in 2015 and

subsequent restructuring to improve efficiency, the WPC has had

detailed briefings on the management of the with profits business

there, and in 2016, held one of its meetings in the branch office

in Germany. The committee has noted that the reduction in numbers

of complaints has been especially pronounced in Germany.

Balance of interests

A fundamental responsibility of the WPC is to ensure that with

profits customers' interests are protected, with appropriate

balance between different cohorts of customers, and that

shareholder interests do not compromise this protection.

The WPC approved the transfers to shareholder funds, in

accordance with the Scheme of Demutualisation, for the year ended

31 December 2015 of some GBP190m.

The WPC also reviewed the With Profits Actuary's advice on

expense allocation within SLAL and agreed with his conclusion that

the methodology had no material bias against policyholders'

interests. Occasionally there are administrative errors that give

rise to extra costs and particular care is taken to ensure that the

with profits funds do not bear any inappropriate burden from

these.

The WPC approved SLAL's proposal that no changes were required

to the rates of deduction from with profits policies in respect of

the cost of guarantees.

Annuity Rates for Guaranteed Annuity Option/Guaranteed Minimum

Pension Buyouts

Following the committee's review and challenge of the rates

charged by SLAL to the Heritage With Profits Fund (HWPF) for buying

out guaranteed annuity liabilities, SLAL is now offering a

discounted rate to the HWPF on the basis that SLAL is not in a

position to offer the HWPF the benefit of the open market option

that is available to individual customers without taking on

additional risk. The committee is satisfied that the arrangement

will help to protect the interests of the fund, but will continue

to monitor the fairness of this arrangement.

Capital and risk management

During the year the WPC approved a number of proposals to manage

the finances of the with profits funds and to control risks

appropriately. These included revision of the scenarios for testing

investment risk, adjusting Equity Backing Ratios and other

allocations of the assets directly backing with profits policies,

reviewing the effectiveness of hedging strategies, and setting

distribution rates for the Inherited Estate The HWPF was set up at

demutualisation with surplus referred to as an Inherited Estate.

Its primary role is to provide a cushion against the possibility

that the assets set aside to cover the liabilities of the HWPF

prove insufficient and to meet any unforeseen liabilities.

Regulatory and governance

Principles and Practices of Financial Management (PPFM)

The WPC sought and obtained assurance that the with profits

businesses in the UK have been managed in accordance with the

published PPFM.

Solvency II

The introduction of Solvency II on 1 January 2016 has

necessitated a number of technical changes to the Scheme of

Demutualisation, to ensure that it continues to operate as

intended, all of which were reviewed by the WPC. Some required

Court approval, and this was obtained during 2016.

Investments

The WPC receives quarterly presentations from Standard Life

Investments on the performance of the with profits funds. The

committee noted recent slippage in the performance of some asset

classes and challenged their performance. The committee also

advised SLAL on the actions that are being taken to reverse this

and maintain strong long-term performance.

Conclusion

Looking back on 2016, the WPC concluded that:

-- The management of SLAL's with profits business has paid due

regard to its duty to treat its with profits policyholders fairly

and to meet their reasonable benefit expectations

-- The UK Smoothed Managed With Profits Fund and the HWPF PPFMs have been complied with

-- It had continued to challenge management on the exercise of discretion

The committee provides information on its members, composition

and how the committee protects the interests of policyholders and

makes its views known at the following website

www.standardlife.co.uk/c1/funds/with-profits-committee.page

12.2 Report from the Independent Governance Committee of

Standard Life Assurance Limited

During 2016, the Independent Governance Committee (IGC)

published their first annual report. The IGC acts solely in the

interests of scheme members by providing credible and effective

challenge on the value for money of workplace personal pension

schemes.

Rene Poisson

Chairman, Independent Governance Committee of Standard Life

Assurance Limited

In their first report, the IGC concluded that Standard Life does

provide value for money for workplace schemes.

By way of reminder, Independent governance committees have been

established as a response to:

-- The market review undertaken in 2013 by the Office of Fair

Trading which identified that competition was not having the

expected impact in improving value for policyholders in workplace

pension schemes and that change was required to ensure that they

received Value for Money

-- The results of a subsequent 2014 report (the legacy audit) by

the Independent Project Board (IPB) of the Association of British

Insurers which looked at legacy pension schemes at risk of being

exposed to charges over an equivalent of one per cent annual

management charge

Membership

The members are appointed by the SLAL board on the

recommendation of the Nomination and Governance Committee. The

membership of the IGC remains unchanged since inception.

The IGC intends to meet as often as necessary to fulfil its

obligations. During 2016, as the IGC fulfilled the commitments they

outlined in their first report, the committee has met 12 times.

Member attendance at meetings for the year ending 31 December

2016 was:

IGC Member Attendance

------------------------------- ----------

Rene Poisson, Chairman 12/12

Richard Butcher 11/12

Ingrid Kirby 12/12

Roger Mattingly 12/12

Michael Craig (non-independent

member) 12/12

------------------------------- ----------

The Head of Pensions Strategy routinely attends these meetings

and the Managing Director for Corporate, Retail and Wholesale has

had regular interactions with the committee. The committee's

routine formal interaction with the SLAL board is by the minutes of

its meetings. The directors of SLAL and of the Company have an open

invitation to attend any of the committee meetings. Minutes of the

committee meetings are submitted to the Board. In May 2016, the

committee chairman attended a meeting of the Standard Life plc

Board to present the findings from the IGC's first report.

The Chairman is responsible for the production of an annual

report, the first of which was published on 29 March 2016. The

report and information on the committee's composition can be found

at the following website www.standardlife.co.uk/igc

The committee's work in 2016

An indicative breakdown as to how the committee spent its time

is shown below: Diagram removed for the purposes of this

announcement. However it can be viewed in full in the pdf

document.

Legacy audit

The IGC has focused on the implementation of the changes agreed

under the legacy audit which were successfully implemented on 31

October 2016 as per the deadline agreed between the IGC and

SLAL.

Value for money

In its first annual report the IGC concluded overall that

Standard Life's various workplace personal pension products (both

newer and older style) offer policyholders value for money; are of

good quality; benefit from well-designed investment solutions, good

administration and governance; and, comprehensive member support

and communication materials. However, it noted that to achieve a

suitable level of income in retirement, adequate contributions are

required through the lifetime of pension saving.

Looking ahead to 2017

The IGC is looking more closely at the value for money offered

by the wider range of investment options as well as default

arrangements that have been designed by employer sponsors and/or

scheme advisers. It has commissioned some independent analysis to

help with this work.

The IGC recognises the importance of gathering the views of

scheme members as customers and has continued to attend retirement

roadshows. One of Standard Life's commitments to the IGC referenced

in the 2016 report was to commission member research. Standard

Life, along with ten other providers, sponsored and participated in

independent research co-ordinated by Sacker & Partners LLP.

This approach allowed insight to be gathered from scheme members to

build an understanding of what they value and why. The results of

this will be shown in the second annual report due to be published

in March 2017.

The annual report can be found at the following website

www.standardlife.co.uk/igc

12.3 Report from the Standard Life Master Trust Co. Ltd

During 2015, Standard Life Master Trust Co. Ltd (SLMTC) was

established as a subsidiary of SLAL. Its role is to act as trustee

and to work in the interests of members of the Standard Life

Defined Contribution Master Trust and Stanplan A pension schemes,

both of which are trust based schemes designed for multiple

employers.

Similar to the IGC, SLMTC has a duty to assess whether members

of these schemes are receiving good value. Alongside their trustee

duties they are following a similar programme to the IGC to carry

out this assessment.

Richard Butcher

Chairman, Standard Life Master Trust Co. Ltd

Membership

The board of SLMTC consists of five members, all of whom are

independent of Standard Life. They meet regularly throughout the

year. Pitmans Trustees Limited was appointed as chair of the board

of directors of the SLMTC. Richard Butcher is their

representative.

The membership of the board remains unchanged since

inception.

The SLMTC board intends to meet at least four times a year and

as often as necessary to fulfil its obligations. During its second

year the board of SLMTC has met six times.

Member attendance at meetings for the year ending 31 December

2016 was:

Member Attendance

----------------- ----------

Richard Butcher,

Chairman 6/6

Rene Poisson 6/6

Stella Girvin 6/6

Ruston Smith 6/6

Francois Barker 6/6

----------------- ----------

The Head of Pensions Strategy routinely attends these meetings

and the Managing Director for Corporate, Retail and Wholesale has

had regular interactions with the board.

The board's work in 2016

An indicative breakdown as to how the board spent its time is

shown below: Diagram removed for the purposes of this announcement.

However it can be viewed in full in the pdf document.

Legacy audit

Alongside the IGC, the SLMTC has focused on the implementation

of the changes agreed under the legacy audit which were

successfully implemented on 31 October 2016 as per the deadline

agreed between the SLMTC board and SLAL.

Good value

In the first chairman's statement published in July 2016, it was

concluded that Standard Life's Defined Contribution and Stanplan A

Master Trusts offer good value.

Audit and assurance framework

In 2016, the board of SLMTC adopted the framework provided by

the Audit and Assurance faculty of the Institute of Chartered

Accountants in England and Wales entitled Assurance Reporting on

Master Trusts (Master Trust Supplement to ICAEW AAF 02/07). This

report provides information and assurance on the design and

description of governance and administrative control procedures in

relation to the business operations of SLMTC for providing pensions

trustee services.

Looking ahead to 2017

A key focus for the board is the impact of the Pension Schemes

Bill and the changes to come in the months ahead.

More information on the composition of SLMTC can be found at the

following website

www.standardlife.co.uk/c1/master-trust-committee.page

13. Glossary

Annuity

A periodic payment made for an agreed period of time (usually up

to the death of the recipient) in return for a cash sum. The cash

sum can be paid as one amount or as a series of premiums. If the

annuity commences immediately after the payment of the sum, it is

called an immediate annuity. If it commences at some future date,

it is called a deferred annuity.

Articles

The Articles of Association detail the provisions relating to

the regulation of a company in terms of the rights of its members

and the authority of its directors.

Assets under administration (AUA)

AUA is a measure of the total assets we administer. It includes

Standard Life Investments assets under management (AUM), as well as

those assets that the Group administers where the customer has made

a choice to select an external third party investment manager.

AUA represents the IFRS gross assets of the Group, adjusted to

include third party AUA which is not included on the consolidated

statement of financial position, and excluding certain assets which

do not constitute AUA. The assets excluded are primarily

reinsurance assets, deferred acquisition costs and intangible

assets.

Assets under management (AUM)

A measure of the total assets that Standard Life Investments

manages on behalf of individual customers and institutional

clients, for which it receives a fee.

Auto enrolment

The UK Government introduced auto enrolment to help people save

for their retirement. Employers have to automatically enrol

eligible employees into a qualifying workplace pension scheme

(QWPS). This pension scheme needs to meet the standards set by the

Pensions Regulator.

Board

The Board of Directors of the Company.

Capital management

Capital management is a component of operating profit and

relates to the return from the net assets of the shareholder

business, net of costs of financing. This includes the net assets

in defined benefit staff pension plans and net assets relating to

the financing of subordinated liabilities. The measure excludes

short-term fluctuations in investment return.

Capital surplus

This is a regulatory measure of our financial strength. From 1

January 2016 our capital surplus is measured on a Solvency II

basis. Prior to

1 January 2016, our capital surplus was measured in accordance

with the Insurance Groups Directive.

Chief Operating Decision Maker

The strategic executive committee.

Company

Standard Life plc.

Cost/income ratio

This is an efficiency measure that is calculated as operating

expenses divided by operating income on a rolling 12 month basis,

and includes the share of associates' and joint ventures' profit

before tax.

Deferred acquisition costs (DAC)

The method of accounting whereby acquisition costs on long-term

business are deferred on the consolidated statement of financial

position as an asset and amortised over the life of those

contracts. This leads to a smoothed recognition of up front

expenses instead of the full cost in the year of sale.

Deferred income reserve (DIR)

The method of accounting whereby front end fees that relate to

services to be provided in future periods are deferred on the

consolidated statement of financial position as a liability and

amortised over the life of those contracts. This leads to a

smoothed recognition of up front income instead of the full income

in the year of sale.

Director

A director of the Company.

Discounting

The reduction to present value at a given date of a future cash

transaction at an assumed rate, using a discount factor reflecting

the time value of money. The choice of a discount rate will usually

greatly influence the value of insurance provisions, and may give

indications on the conservatism of provisioning methods.

Drawdown (flexible income)

Drawdown, also known as flexible income, allows the policyholder

to withdraw pension income as and when they request it. The

remainder of the pension fund remains invested, giving it the

potential for growth.

Earnings before interest, tax, depreciation and amortisation

(EBITDA)

EBITDA is defined as earnings before interest, taxation,

depreciation, amortisation, restructuring costs, other

non-operating items and

non-controlling interests.

Earnings per share (EPS)

EPS is a commonly used financial metric which can be used to

measure the profitability and strength of a company over time. EPS

is calculated by dividing profit by the number of ordinary shares.

Basic EPS uses the weighted average number of ordinary shares

outstanding during the year. Diluted EPS adjusts the weighted

average number of ordinary shares outstanding to assume conversion

of all dilutive potential ordinary shares, such as share options

awarded to employees.

EBITDA margin

This is an industry measure of performance for investment

management companies. It is calculated as EBITDA divided by fee

based revenue.

Effective tax rate

Tax expense/(credit) attributable to equity holders' profit

divided by profit before tax attributable to equity holders'

profits expressed as a percentage.

Fair value through profit or loss (FVTPL)

FVTPL is an IFRS measurement basis permitted for assets and

liabilities which meet certain criteria. Gains or losses on assets

or liabilities measured at FVTPL are recognised directly in the

income statement.

Fee based business/revenue

Fee based business is a component of operating profit and is

made up of products where we generate revenue primarily from asset

management charges (AMCs), premium based charges and transactional

charges. AMCs are earned on products such as SIPP, corporate

pensions and mutual funds, and are calculated as a percentage fee

based on the assets held. Investment risk on these products rests

principally with the customer, with our major indirect exposure to

rising or falling markets coming from higher or lower AMCs.

Fee revenue yield (bps)

The average revenue yield on fee based business is a measure

that illustrates the average margin being earned on the assets that

we administer. It is calculated as a rolling 12 month fee based

revenue divided by a rolling 12 month monthly average AUA.

Global absolute return strategies (GARS)

A discretionary multi-asset fund provided under several

regulated pooled and segregated structures globally by Standard

Life Investments. The investment objective is to target a level of

return over a rolling 3 year period equivalent to cash plus 5% a

year (gross of fees), and to do so with as little risk as

possible.

Group, Standard Life Group or Standard Life

Prior to demutualisation on 10 July 2006, SLAC and its

subsidiaries and, from demutualisation on 10 July 2006, the Company

and its subsidiaries.

Growth channels

We aim to drive the increase in our assets, revenue and profit

via our growth channels. This comprises Standard Life Investments

Institutional and Wholesale, UK Workplace and Retail, Europe

(excluding Germany with profits), Hong Kong, Standard Life Wealth

and Ignis.

Heritage With Profits Fund (HWPF)

The Heritage With Profits Fund contains all business - both with

profits and non-profit - written before demutualisation in the UK,

Irish or German branches, with the exception of the classes of

business which the Scheme of Demutualisation allocated to funds

outside the HWPF. The HWPF also contains increments to this

business.

International Financial Reporting Standards (IFRS)

International Financial Reporting Standards are accounting

standards issued by the International Accounting Standards Board

(IASB). The Group's consolidated financial statements are prepared

in accordance with IFRS as endorsed by the EU.

Investor view

The investor view of Solvency II adjusts the regulatory position

for the impact from unrecognised capital and with profit funds /

defined benefit pension plans.

Key performance indicators (KPI)

A measure by reference to which the development, performance or

position of the business can be measured effectively.

Liability aware

Liability aware is a framework for proactively managing the

various liability risks and requirements that are faced by defined

benefit pension plans and insurance companies.

Mature book/business

Mature books are expected to provide a stable and consistent

contribution to our profit. This includes UK mature Retail,

Standard Life Investments Strategic Partner Life books and

spread/risk based business. It also includes the with profits

business in Germany which closed to new business in April 2015.

Net flows

Net flows represent gross inflows less gross outflows or

redemptions. Gross inflows are new funds from clients and

customers. Gross outflows or redemptions is the money withdrawn by

clients or customers during the period, including annuity

payments.

Operating expenses

Operating expenses is a component of operating profit and

relates to the day-to-day expenses of managing our business.

Operating income

Operating income is a component of operating profit and consists

of fee based revenue and spread/risk margin.

Operating profit

Operating profit is the Group's key alternative performance

measure. Operating profit excludes impacts arising from short-term

fluctuations in investment return and economic assumption changes.

It is calculated based on expected returns on investments backing

equity holder funds, with consistent allowance for the

corresponding expected movements in equity holder liabilities.

Impacts arising from the difference between the expected return and

actual return on investments, and the corresponding impact on

equity holder liabilities except where they are directly related to

a significant management action, are excluded from operating profit

and are presented within profit before tax. The impact of certain

changes in economic assumptions is also excluded from operating

profit and is presented within profit before tax.

Operating profit also excludes the impact of the following

items:

-- Restructuring costs and corporate transaction expenses.

Restructuring includes the impact of major regulatory change.

-- Impairment of intangible assets acquired in business

combinations

-- Profit or loss arising on the disposal of a subsidiary, joint

venture or associate

-- Amortisation of intangibles acquired in business combinations

and fair value movements in contingent consideration

-- Items which are one-off in nature and which, due to their

size or nature, are not indicative of the long-term operating

performance of the business

Operating return on equity (RoE)

The annualised post-tax operating profit expressed as a

percentage of the opening IFRS equity, adjusted for time

apportioned dividends paid to equity holders.

Own funds

Under Solvency II, the capital resources available to meet

solvency capital requirements are called own funds.

Platform

An investment platform (eg Wrap or Elevate) which is essentially

a trading platform enabling investment funds, pensions, direct

equity holdings and some life assurance contracts to be held in the

same administrative account rather than as separate holdings.

Recourse cash flows (RCF)

Certain cash flows arising in the Heritage With Profits Fund

(HWPF) on specified blocks of UK and Ireland business, which are

transferred out of the fund annually and accrue to the ultimate

benefit of equity holders, as determined by the Scheme of

Demutualisation.

Regular premium

A regular premium contract (as opposed to a single premium

contract), is one where the policyholder agrees at inception to

make regular payments throughout the term of the contract.

Scheme of Demutualisation or the Scheme

The scheme pursuant to Part VII of, and Schedule 12 to, the

Financial Services and Markets Act 2000, under which substantially

all of the long-term business of SLAC was transferred to Standard

Life Assurance Limited on 10 July 2006.

SICAV

A SICAV (société d'investissement à capital variable) is an

open-ended collective investment scheme common in Western Europe.

SICAVs can be cross-border marketed in the EU under the

Undertakings for Collective Investment in Transferable Securities

(UCITS) directive.

Single premium

A single premium contract (as opposed to a regular premium

contract), which involves the payment of one premium at inception

with no obligation for the policyholder to make subsequent

additional payments.

SIPP

A self invested personal pension which provides the policyholder

with greater choice and flexibility as to the range of investments

made, how those investments are managed, the administration of

those assets and how retirement benefits are taken.

SLAC

The Standard Life Assurance Company (renamed The Standard Life

Assurance Company 2006 on 10 July 2006).

SLAL

Standard Life Assurance Limited.

Solvency II

Solvency II is an EU-wide initiative that brings consistency to

how EU insurers manage capital and risk. Solvency II was

implemented on

1 January 2016.

Solvency capital requirement (SCR)

Under Solvency II, insurers are required to identify their key

risks - for example that equity markets fall - and hold sufficient

capital to withstand adverse outcomes from those risks. This amount

of capital is referred to as the Solvency capital requirement or

SCR.

Spread/risk business

Spread/risk business mainly comprises products where we provide

a guaranteed level of income for our customers in return for an

investment, for example, annuities. The 'spread' referred to in the

title primarily relates to the difference between the guaranteed

amount we pay to customers and the actual return on the assets over

the period of the contract.

Spread/risk margin

Spread/risk margin is a component of operating profit and

reflects the margin earned on spread/risk business. This includes

net earned premiums, claims and benefits paid, net investment

return using long-term assumptions and reserving changes.

Spread/risk margin excludes the impact of economic assumption

changes, which are not included in determining operating

profit.

Standard Life Investments Institutional

Standard Life Investments Institutional sell to institutions

(including corporates, pension schemes, local authorities,

government agencies and insurance companies) either directly or

through intermediaries.

Standard Life Investments Wholesale

Standard Life Investments Wholesale sell retail products through

wholesale distributors including third party fund supermarkets,

global financial institutions and private banks.

Strategic executive committee

Responsible for the day-to-day running of the business and

comprises; Chief Executive, Chief Executive - Life Insurance, Chief

Executive - Pensions and Savings, Chief Financial Officer, Chief

Investment Officer, Chief Operating Officer, Chief People Officer,

Chief Risk Officer, General Counsel and the Global Client

Director.

Strategic partner life business

A measure of the assets that Standard Life Investments manages

on behalf of Standard Life Group companies and under other

long-term life book partnership agreements with third party

companies such as Phoenix Group.

Subordinated liabilities

Subordinated liabilities are debts of a company which, in the

event of liquidation, rank below its other debts but above share

capital.

Technical provisions

The best estimate market consistent value of our policyholder

liabilities is referred to as technical provisions. The calculation

is discounted to recognise the time value of money and includes a

risk margin, calculated in accordance with Solvency II

regulations.

Third party (excluding strategic partner life business)

A measure of the assets that Standard Life Investments manages

on behalf of individual customers and institutional clients, for

which it receives a fee. This measure excludes the assets that are

managed on behalf of strategic partners in life assurance

books.

Transitional relief

Solvency II regulations allow insurers to smooth the

introduction of new rules for calculating policyholder liabilities.

This relief includes a deduction from the amount of Solvency II

technical provisions, based on the difference between technical

provisions under the previous regulatory framework and Solvency II.

The deduction decreases over the course of 16 years from 1 January

2016.

UK Retail

This relates to business where we have a relationship with the

customer either directly or through an independent financial

adviser. We analyse this type of business into growth and mature

categories. Retail growth includes the products, platforms,

investment solutions and services of our UK Retail business that we

continue to market actively to our customers. Retail mature

includes business that was predominantly written before

demutualisation.

UK Workplace

UK Workplace pensions, savings and benefits to UK employers and

employees. These are sold through corporate benefit consultants,

independent financial advisers, or directly to employers.

Underlying cash generation

This presents a shareholder view of underlying cash earnings.

The IFRS consolidated statement of cash flows includes policyholder

cashflows, and does not exclude underlying adjustments and

non-operating items.

Underlying cash generation adjusts underlying performance for

certain non-cash items. Adjustments are made for deferred

acquisition costs/deferred income reserve, fixed/intangible assets

and the Asian joint ventures and associates.

Depreciation/amortisation that would normally be included in

operating profit is replaced with the cash movement in the period.

The measure is stated net of current (cash) tax on underlying

performance. A reconciliation of underlying performance to

underlying cash generation is included in the Strategic report.

Reconciliations between underlying performance, operating profit

and profitability on an IFRS basis are also included in this

report.

Underlying performance

Underlying performance is operating profit before tax after

excluding the impact of spread/risk operating actuarial assumption

changes and specific management actions in the reporting

period.

Unit linked policy

A policy where the benefits are determined by reference to the

investment performance of a specified pool of assets referred to as

the unit linked fund.

14. Shareholder information

Registered office

Standard Life House

30 Lothian Road

Edinburgh

EH1 2DH

Scotland

Company registration number: SC286832

Phone: 0345 850 9071* or 0131 225 2552*

For shareholder services call:

0345 113 0045*

* Calls may be monitored and/or recorded to protect both you and

us and help with our training. Call charges will vary.

Secretary

Kenneth A Gilmour

Registrar

Capita Registrars Limited

Auditors

PricewaterhouseCoopers LLP

Solicitors

Slaughter and May

Brokers

JP Morgan Cazenove

Goldman Sachs

Shareholder services

We offer a wide range of shareholder services. For more

information, please:

-- Contact our registrar, Capita, on 0345 113 0045* if calling

from the UK. International numbers can be found on the next

page.

-- Visit our share portal at www.standardlifeshareportal.com

Sign up for Ecommunications

Signing up means:

-- You'll receive an email when documents like the Annual report

and accounts, Half year results and AGM guide are available on our

website

-- Voting instructions for the Annual General Meeting will be sent to you electronically

Set up a share portal account

Having a share portal account means you can:

-- Manage your account at a time that suits you

-- Download your documents when you need them

To find out how to sign up, visit

www.standardlifeshareportal.com

Preventing unsolicited mail

By law, the Company has to make certain details from its share

register publicly available. Because of this, it is possible that

some registered shareholders could receive unsolicited mail or

phone calls. You could also be targeted by fraudulent 'investment

specialists'. Remember, if it sounds too good to be true, it

probably is.

You can find more information about share scams at the Financial

Conduct Authority website www.fca.org.uk/consumers/scams

If you are a certificated shareholder, your name and address may

appear on a public register. Using a nominee company to hold your

shares can help protect your privacy. You can transfer your shares

into the Company-sponsored nominee - the Standard Life Share

Account - by contacting Capita, or you could get in touch with your

broker to find out about their nominee services.

If you want to limit the amount of unsolicited mail you receive

generally, please visit www.mpsonline.org.uk

2017 Financial calendar

Full year results 2016 24 February

----------------------------------- ------------

Ex-dividend date for 2016 final 13 April

dividend

----------------------------------- ------------

Record date for 2016 final dividend 18 April

----------------------------------- ------------

Last date for DRIP elections 03 May

for 2016 final dividend

----------------------------------- ------------

Annual General Meeting 16 May

----------------------------------- ------------

Dividend payment date for 2016 23 May

final dividend

----------------------------------- ------------

Half year results 2017 08 August

----------------------------------- ------------

Ex-dividend date for 2017 interim 07 September

dividend

----------------------------------- ------------

Record date for 2017 interim 08 September

dividend

----------------------------------- ------------

Last date for DRIP elections 27 September

for 2017

interim dividend

----------------------------------- ------------

Dividend payment date for 2017 18 October

interim dividend

----------------------------------- ------------

Analysis of registered shareholdings at 31 December 2016

Number % of % of

Range of total Number total

of shares holders holders of shares shares

-------------- -------- -------- ------------- -------

1-1,000 63,383 61.57 27,054,291 1.37

1,001-5,000 34,672 33.68 70,479,180 3.56

5,001-10,000 2,898 2.82 19,440,771 0.98

10,001-100,000 1,528 1.48 35,141,061 1.78

(#) 100,001+ 461 0.45 1,826,769,134 92.31

-------------- -------- -------- ------------- -------

Total 102,942 100 1,978,884,437 100

-------------- -------- -------- ------------- -------

# These figures include the Company-sponsored nominee - the

Standard Life Share Account - which had 1,060,964 participants

holding 746,304,323 shares.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR LFFVFFTIVFID

(END) Dow Jones Newswires

February 24, 2017 02:02 ET (07:02 GMT)

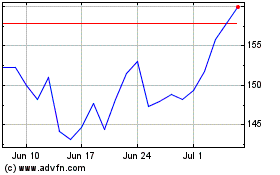

Abrdn (LSE:ABDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn (LSE:ABDN)

Historical Stock Chart

From Apr 2023 to Apr 2024