Standard Life plc Capital markets day and assets and flows update (9385Y)

May 23 2016 - 3:30AM

UK Regulatory

TIDMSL.

RNS Number : 9385Y

Standard Life plc

22 May 2016

Standard Life plc

Capital markets day and assets and flows update

Standard Life is holding a capital markets day for investors and

analysts in London on 23 May 2016.

The day will focus on how Standard Life is building a simplified

and well diversified investment company that capitalises on global

trends shaping the investments landscape.

Presentations from management across the business will focus on

Standard Life's growth channels that are the key drivers of asset,

revenue and profit growth. Topics covered will include the breadth

and depth of Standard Life Investments' global investment

capabilities and how these, combined with expanding distribution

and growing diversification by geography, asset class, channel and

client type, have helped to create a business that can deliver

long-term profitable growth. Presentations will also demonstrate

how the Pension and Savings business is delivering premium

propositions that are valued by employers, financial advisers and a

growing number of individual customers. Additional insights will be

given into the cost base and scalability of the business.

In the context of the capital markets day, participants will be

provided with an update on assets and flows. The presentations will

shortly be available at www.standardlife.com where interested

parties can also view the webcast of the event.

Group assets under administration GBPbn

----------------------------------- ------

Group assets under administration

at 31 December 2015 307.4

----------------------------------- ------

Institutional net inflows 1.5

Wholesale net inflows 0.1

Workplace net inflows 0.4

Retail net inflows 1.1

Other net outflows (0.3)

Eliminations (0.5)

----------------------------------- ------

Growth channels net inflows 2.3

----------------------------------- ------

Mature fee books net outflows (1.3)

Spread/risk net outflows (0.2)

----------------------------------- ------

Mature books net outflows (1.5)

----------------------------------- ------

Associate and joint venture life

businesses net inflows 0.1

Market/other movements 5.7

----------------------------------- ------

Group assets under administration

at 31 March 2016 314.0

----------------------------------- ------

Net inflows across the Institutional and Wholesale channels

included net inflows into multi-asset of GBP1.0bn. Standard Life

Investments total assets under management at 31 March 2016 were

GBP258.6bn while third party assets under management excluding

strategic partner life business stood at GBP132.7bn.

23 May 2016

Investor Enquiries

Jakub Rosochowski

Head of Investor Relations

+44 (0) 131 245 8028*

+44 (0) 7515 298 608

Email: jakub_rosochowski@standardlife.com

* Calls may be monitored and/or recorded to protect both you and

us and help with our training. Call charges will vary.

Forward looking statements

This document, and the presentations referenced in this

document, may contain certain "forward-looking statements" with

respect to certain of Standard Life's plans and its current goals

and expectations relating to its future financial condition,

performance, results, strategy and objectives. Statements

containing the words "believes", "intends", "expects", "plans",

"pursues", "seeks" and "anticipates", and words of similar meaning,

are forward-looking. By their nature, all forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances which are beyond Standard Life's

control including among other things, UK domestic and global

economic and business conditions, market related risks such as

fluctuations in interest rates and exchange rates, and the

performance of financial markets generally; the policies and

actions of regulatory authorities, the impact of competition,

inflation, and deflation; experience in particular with regard to

mortality and morbidity trends, lapse rates and policy renewal

rates; the timing, impact and other uncertainties of future

acquisitions or combinations within relevant industries; and the

impact of changes in capital, solvency or accounting standards, and

tax and other legislation and regulations in the jurisdictions in

which Standard Life and its affiliates operate. This may for

example result in changes to assumptions used for determining

results of operations or re-estimations of reserves for future

policy benefits. As a result, Standard Life's actual future

financial condition, performance and results may differ materially

from the plans, goals, and expectations set forth in the

forward-looking statements. Standard Life undertakes no obligation

to update the forward-looking statements contained in these

materials or any other forward-looking statements it may make.

-

Standard Life plc is registered in Scotland (SC286832) at

Standard Life House, 30 Lothian Road, Edinburgh EH1 2DH.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLLFSEEIIFFIR

(END) Dow Jones Newswires

May 23, 2016 03:30 ET (07:30 GMT)

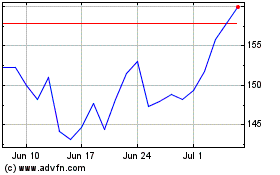

Abrdn (LSE:ABDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn (LSE:ABDN)

Historical Stock Chart

From Apr 2023 to Apr 2024