Standard Life Invs Property Inc Tst Edison issues review on Standard Life Inv.

May 24 2017 - 7:53AM

RNS Non-Regulatory

TIDMSLI

Standard Life Invs Property Inc Tst

24 May 2017

London, UK, 23 May 2017

Edison issues review on Standard Life Inv. Property Income Trust

(SLI)

Standard Life Investments Property Income Trust (SLI) aims to

generate both income and capital growth from investing directly in

UK commercial property. Its emphasis continues to be on generating

above-average income for shareholders and it currently yields 5.4%.

In FY16, the dividend was 117% covered by earnings and the manager,

Jason Baggaley, is reasonably sanguine about future dividend

prospects. Relative performance is measured against the quarterly

version of the IPD Monthly Index Funds, which is representative of

UK direct property funds. SLI has outperformed this benchmark, in

NAV total return terms, over one, three and five years.

SLI's current share price premium to NAV of 8.7% is higher than

the averages of the last one, three and five years (range of 4.6%

to 7.1%), perhaps reflecting SLI's high real income generation and

growth potential in a low-income, low-growth world. The ongoing

programme to issue shares at a premium should help improve supply

while also serving to enhance the NAV per share for existing

shareholders.

Click here to view the full report.

All reports published by Edison are available to download free

of charge from its website

www.edisoninvestmentresearch.com

About Edison: Edison is an investment research and advisory

company, with offices in North America, Europe, the Middle East and

AsiaPac. The heart of Edison is our world-renowned equity research

platform and deep multi-sector expertise. At Edison Investment

Research, our research is widely read by international investors,

advisers and stakeholders. Edison Advisors leverages our core

research platform to provide differentiated services including

investor relations and strategic consulting.

Edison is authorised and regulated by the Financial Conduct

Authority.

Edison is not an adviser or broker-dealer and does not provide

investment advice. Edison's reports are not solicitations to buy or

sell any securities.

For more information please contact Edison:

Neil Shah, +44 (0)20 3077 5715

Mel Jenner, +44 (0)20 3077 5720

investmenttrusts@edisongroup.com

Learn more at www.edisongroup.com and connect with Edison

on:

LinkedIn https://www.linkedin.com/company/edison-investment-research

Twitter www.twitter.com/Edison_Inv_Res

YouTube www.youtube.com/edisonitv

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRAOKQDQDBKDFPB

(END) Dow Jones Newswires

May 24, 2017 07:53 ET (11:53 GMT)

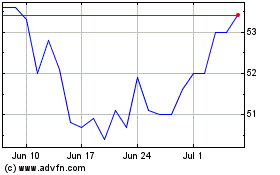

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2023 to Apr 2024