Stada Arzneimittel Braced for Investor Battle

August 15 2016 - 10:20AM

Dow Jones News

FRANKFURT—Germany is gearing up for a rare proxy fight between

activist investors and a company's incumbent management with

pressure mounting on the board of generic drugmaker Stada

Arzneimittel AG ahead of a shareholder meeting later this

month.

Shareholder advisory firm International Shareholder Services is

among those leading the charge against Stada's management, calling

for the chairman of the company's supervisory board Martin Abend to

be replaced by Eric Cornut, a former executive at Swiss drugs giant

Novartis AG.

Mr. Cornut has been nominated for the chairmanship by Active

Ownership Capital, a German activist investment fund which is

Stada's largest individual shareholder with roughly a 5% stake.

Proxy fights remain relatively rare in Germany where it is usual

practice for companies to have a supervisory board and a management

board unlike the single-board structure typical in the U.S. or

U.K.

A maker of household German cold treatment Grippostad and

over-the-counter products like sunscreen with yearly revenue of

€2.12 billion ($2.36 billion), Stada has been long been seen as a

possible takeover target for bigger rivals or private-equity

firms.

The company rejected an informal approach earlier this year by

Polish peer Polpharma SA, which floated the idea of merging the two

companies, according to people familiar with the matter.

These people added that a tie-up could have resulted in more

than €140 million in yearly synergies. A spokesman for Stada

declined to comment.

In the spotlight at Stada is what some investors see as a

mismatch between the company's executive pay and its long-term

earnings record

"There appears to be a misalignment between performance-linked

remuneration and the company's actual performance," said ISS in the

report dated Aug. 10

ISS said Stada's shares have "significantly underperformed

peers" over the past couple of years. "Change on Stada's

supervisory board is warranted due to weak past performance and

governance," ISS said.

"We strongly disagree with ISS' evaluation and recommendations

with regard to the supervisory board elections as well as executive

board remuneration. We note that ISS appears to have had at least

in parts access to incomplete or erroneous assumptions and data,"

Stada told institutional investors in a letter reviewed by The Wall

Street Journal.

It added the activist fund's "proposal is aimed at obtaining

full control over Stada via the supervisory board."

Stada's shares were flat over the past five years until February

this year.

Since then its shares nearly doubled to currently above €50,

partly fueled by hopes on a takeover offer. The Wall Street Journal

reported in May that Stada held initial talks with private-equity

firm CVC Capital Partners. People familiar with the matter said

private-equity firms remain interested in a potential buyout.

In contrast, shares of U.S. rival Mylan NV gained around 150%

over the past five years. On the other hand, shares in another

rival, Perrigo Co., fell by more than 40%, mainly because of a

steep decline this year after its CEO was tapped to lead Valeant

Pharmaceuticals International Inc.

Stada is also reportedly under pressure from other quarters.

Another shareholder adviser, Ivox Glass Lewis, recommended that

investors vote against the company's management salary system,

while supporting supervisory board chairman Mr. Abend, according to

German daily Boersenzeitung.

U.S. activist investor Guy Wyser-Pratte told a German daily

earlier this summer that he took a stake in Stada, saying the

company had missed opportunities in the past and that it should

team up with an international rival.

Write to Eyk Henning at eyk.henning@wsj.com

(END) Dow Jones Newswires

August 15, 2016 10:05 ET (14:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

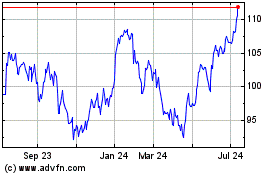

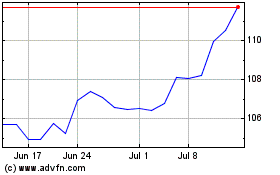

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024