Square's Revenue Climbs 41%

August 03 2016 - 5:40PM

Dow Jones News

Square Inc. posted a better-than-expected 41% jump in revenue

during its second quarter, narrowing its loss from a year ago,

helped by sharp growth in transaction revenue.

The company also raised annual guidance for adjusted revenue and

adjusted earnings before interest, taxes, depreciation and

amortization. Square did warn, however, that total net revenue

growth would be "impacted" by its continued decline in Starbucks

transaction revenue as the coffee chain switches to a new payment

processor.

Shares of Square climbed 8.4% to $11.32 after hours.

Square said it now expects adjusted revenue to be in the range

of $655 million to $670 million, up from a previous range of $615

million to $635 million. Adjusted Ebitda is also expected to rise

to a range of $18 million to $24 million, up from its previous

range of $8 million to $14 million.

For the current quarter, Square forecast revenue between $410

million to $420 million and adjusted Ebitda between $5 million and

$6 million. The company also released for the first time its

expectations for total net revenue for the year between $1.63

billion and $1.67 billion. Analysts cited by Thomson Reuters

forecast annual revenue of $1.6 billion, and revenue of $415

million for the third quarter.

For the latest quarter, Square reported a loss of $27.3 million,

narrower than its year-earlier loss of $29.6 million. On a

per-share basis, the company posted a loss of 8 cents, compared

with a loss of 20 cents a year earlier.

Revenue rose 41% to $439 million.

Analysts surveyed by Thomson Reuters expected a loss of 11 cents

a share on revenue of $406 million.

Transaction revenue climbed 40% to $364.9 million, while

transaction revenue as a percentage of gross payment volume was

2.93%, down from 2.96%. Gross payment volume in the quarter grew

42% to $12.5 billion.

Square's hardware sales shot up to $11.1 million. That came with

accelerating hardware costs going to $14 million from $6.7 million

a year earlier, as Square spends to develop and distribute the new

devices that work with contactless mobile-phone apps and so-called

chip cards with enhanced security features.

Software and data revenue jumped to $29.7 million from $12.9

million, thanks in part to Square Capital, the company's lending

arm and an expected source of profitability growth. Square Capital

extended $189 million in cash advances and loans during the second

quarter, a 23% increase from the first quarter.

Run by Twitter Inc. founder and Chief Executive Jack Dorsey and

known for the small white payment devices it sells to small

businesses, Square has been the subject of intense focus since its

initial public offering late last year.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

August 03, 2016 17:25 ET (21:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

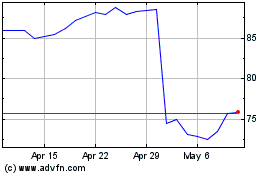

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

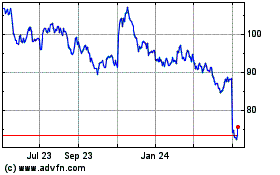

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024