Square Loss Widens as Operating Expenses Surge -- 2nd Update

May 05 2016 - 7:50PM

Dow Jones News

By Peter Rudegeair and Ezequiel Minaya

Square Inc. posted a wider-than-expected loss for its first

quarter as the payments provider reported rising expenses and set

aside $50 million to help resolve a long-running legal dispute over

the company's origins.

Shares dropped about 12% after-hours Thursday.

Aside from the legal charge, many of the San Francisco company's

main business are expanding rapidly. Square's revenue increased 51%

to $379 million, above the $344 million estimate of analysts

surveyed by Thomson Reuters.

But operating expenses grew to $207 million, as product

development expenses climbed 63%, reflecting higher personnel

costs. Overall operating expenses surged 72%.

Run by Twitter Inc. founder and Chief Executive Jack Dorsey and

known for the small white payment devices it sells to small

businesses, Square has been the subject of intense focus since its

initial public offering late last year. Despite settling for a

lower per-share price in that deal than many expected, Square

shares have since bounced back to overcome a growing tide of

pessimism about Silicon Valley startups' valuations.

For the quarter however, Square reported a loss of $96.8

million, wider than its year-earlier loss of $48 million. On a

per-share basis, the company posted a loss of 29 cents, compared

with a loss of 33 cents a year earlier.

Analysts surveyed by Thomson Reuters expected a loss of nine

cents a share.

The company's earnings per share still would have fallen about

five cents short of analyst expectations without the $50 million

litigation charge the company took. The sum will go toward the

settlement of legal proceedings that date back to 2010 involving

Square and Washington University professor Robert E. Morley Jr.

Square said that without the litigation charge and the cost of

compensation employees with shares, operating expenses would have

only risen 18%.

Mr. Morley holds many of the patents that underlie Square's

payments technology, and he and the company have been fighting in

court over the monetary value of his claims.

Square now expects it could earn as much as $14 million in

earnings on an adjusted basis this year, which takes out costs such

as taxes and stock compensation. That was up from the $12 million

the company said in March it expected to earn for 2016.

Transaction revenue climbed 42% to $300 million, while

transaction revenue as a percentage of gross payment volume was

2.92%, down from 2.97%. Gross payment volume in the quarter grew

45% to $10.3 billion.

Square's hardware sales rose more than 7 times to $16 million,

as it shipped its new payment devices. That came with accelerating

hardware costs as well, to $26.7 million from $4.2 million in the

first quarter of 2015, as Square spends to develop and distribute

the new devices that work with contactless mobile-phone apps and

"chip" cards with enhanced security features.

Software and data revenue tripled to $24 million, thanks in part

to Square Capital, the company's lending arm and an expected source

of profitability growth.

Square Capital extended $153 million in cash advances and loans

during the first quarter, a 4% increase from the fourth quarter.

The company said "more challenging credit market conditions" were a

reason for the slow growth, as two new, unnamed investors delayed

their purchases of Square Capital credits.

Square also reminded investors that its 180-day post-IPO lockup

period was due to expire on May 16. That would make 64 million

stock options and warrants exercisable, or 10% more than the 335

million Square shares that are currently outstanding.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com and Ezequiel

Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

May 05, 2016 19:35 ET (23:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

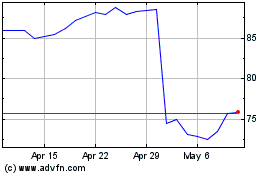

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

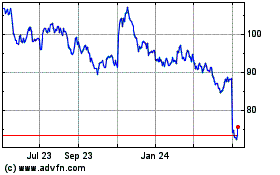

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024