TIDMSPX

RNS Number : 0224X

Spirax-Sarco Engineering PLC

21 November 2017

News Release

Tuesday 21(st) November 2017

TRADING UPDATE

Underlying markets remain positive, overall expectations

unchanged

Spirax-Sarco Engineering plc, the world leader in the control

and efficient use of steam, electrical thermal energy solutions and

peristaltic pumping and associated fluid path technologies, issues

the following trading update in respect of the period ended 31(st)

October 2017.

Economic Environment

The global macro-economic environment for the Group remains

positive with the latest forecast for Global Industrial Production

(IP) growth for 2017 being 3.5%, marginally above the 3.3% forecast

at the time of our Interim Report. As in the first half, growth is

skewed towards the emerging economies where the increase is

forecast to be 5.0%, compared with 2.5% in the developed economies,

with much of the differential coming from strong growth in

China.

Trading

As anticipated, Group organic* sales growth in the four months

to October increased modestly from that achieved in the first half

of the year, reflecting the generally positive industrial

backdrop.

In EMEA, organic sales growth in the four months to October was

higher than in the first half of the year with the segment

benefitting from a strong order book at the beginning of the second

half of the year and improved underlying markets. Organic growth in

Asia Pacific has continued to be strong with good performance in

China and Korea, our two largest territories in the region. In the

Americas, however, organic growth has continued to be difficult to

find and performance was only marginally ahead of that seen in the

first half of the year. Growth in the Watson-Marlow Fluid

Technology Group continues to be strong, in line with that seen in

the first half of the year.

Hiter and Aflex which were acquired in 2016 and Gestra and

Chromalox which joined the Group this year are all progressing well

and are performing in line with expectations. To date we have had a

positive response from the customers and employees of these

businesses and their integration is proceeding as planned. In

particular, we were pleased that the relatively complex carve-out

of some of the Gestra businesses from their previous parent were

completed on schedule at the end of September. The net effect of

these acquisitions is anticipated to increase the full-year sales

by approximately 19%.

As at the half year, Group operating profit is ahead of the

comparable ten-month period at constant currency, both on an

organic basis and when the effects of the above acquisitions are

included.

Following the anniversary of the Brexit vote in June this year,

currency effects have moderated. If spot rates at 31(st) October

2017 prevail to the end of 2017, sales for the full year would be

increased by approximately 5% with the uplift in profits expected

to be in the region of 8%.

If October's foreign exchange rates continue into next year we

would expect to see a reduction in sales and profits in 2018 due to

currency movements of just under 2% and 3% respectively.

Financial position

Our business remains highly cash generative and we maintain a

strong balance sheet. The Group financed the acquisitions of Gestra

in May and Chromalox in July from existing cash resources and new

debt facilities. At 31(st) October 2017 the net borrowings of the

Group were GBP379 million. The interim dividend for 2017 of 25.5p

per share was paid on 10th November at a cash cost of GBP19

million.

In line with the increased level of debt, interest costs will

increase and in total (cash and pension) are expected to be in the

region of GBP7 million for the year.

Outlook

Industrial production growth rates are forecast to remain

positive for the remainder of the year in both developed and

emerging markets although predictions for 2018 are less clear,

particularly with regard to China. We continue with our investment

programmes in support of future growth and the implementation of

our strategy to generate growth from our own actions to outperform

our markets. We achieve this by being more effective in identifying

and generating engineered solutions to help our customers with

energy efficiency, sustainability, productivity, quality, cost

reduction and compliance with ever increasing regulatory

requirements.

Whilst, as always, we have limited visibility due to the

short-term nature of our order book, we have good diversification

across market sectors and geographic regions and remain focused on

our strategies for growth, which, together with the Group's

fundamental strengths, stand us in good stead. We still have much

to do in the remainder of this year but our overall expectations

for the full-year are unchanged and the Board has confidence that

the Group will make further progress in 2017.

Spirax Sarco expects to publish its preliminary 2017 results on

15(th) March 2018.

Enquiries:

Nicholas Anderson, Group Chief Executive

Kevin Boyd, Group Finance Director

Tel: 01242 535234

Note: References to profit are to adjusted profit that excludes

the amortisation and impairment of acquisition-related intangible

assets and acquisition and disposal costs, together with the tax

effects of these items.

* References to organic changes are excluding acquisitions and

disposals, and are expressed at constant currency.

About Spirax Sarco

Spirax-Sarco Engineering plc comprises two world-leading

businesses, Spirax Sarco for steam and electrical thermal energy

solutions and Watson-Marlow Fluid Technology Group for niche

peristaltic pumps and associated fluid path technologies. Spirax

Sarco provides a broad range of fluid control and electrical

process heating products, engineered packages, site services and

systems expertise for a diverse range of industrial and

institutional customers. The business helps its end users to

improve production efficiency, reduce energy costs, water usage and

emissions, improve product quality and enhance the safety of their

operations. Watson-Marlow Fluid Technology Group offers the ideal

solution for a wide variety of demanding fluid path applications

with highly accurate, controllable and virtually maintenance free

pumps and associated technologies. The Group is headquartered in

Cheltenham, England, has strategically located manufacturing plants

around the world and employs over 7,000 people, of whom

approximately 1,550 are direct sales and service engineers. Its

shares have been listed on the London Stock Exchange since 1959

(symbol: SPX).

Further information can be found at

www.spiraxsarcoengineering.com

RNS filter: Inside information prior to release

LEI 213800WFVZQMHOZP2W17

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTQBLFLDFFZFBQ

(END) Dow Jones Newswires

November 21, 2017 02:00 ET (07:00 GMT)

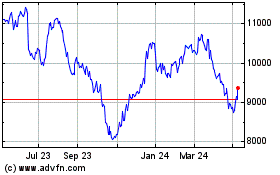

Spirax-sarco Engineering (LSE:SPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

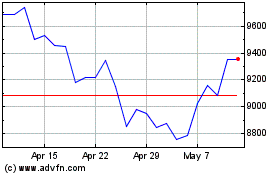

Spirax-sarco Engineering (LSE:SPX)

Historical Stock Chart

From Apr 2023 to Apr 2024