UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

TYCO INTERNATIONAL PLC

(Exact name of the registrant as specified in its charter)

|

| | |

Ireland | | 98-0390500 |

(Jurisdiction of Incorporation) | | (IRS Employer Identification Number) |

001-13836

(Commission File Number)

Unit 1202 Building 1000 City Gate

Mahon, Cork Ireland

(Address of principal executive offices)

|

| | |

Corporate Secretary | | 353-21-423-5000 |

Name and telephone number, including area code, of the

person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

| |

x | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

| |

1. | Conflict Minerals Disclosures |

Tyco International plc (the “Company”) has filed as an exhibit to this Specialized Disclosure Form a Conflict Minerals Report in accordance with the requirements of Rule 13p-1 of the Securities Exchange Act of 1934. The Conflict Minerals Report is also available on the Company’s Internet site at www.tyco.com.

Exhibit 1.01 – Conflict Minerals Report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

|

| | |

| TYCO INTERNATIONAL PLC |

| | |

| By: | /s/ JUDITH A. REINSDORF |

| | Judith A. Reinsdorf |

Date: June 1, 2015 | | Executive Vice President and General Counsel |

Conflict Minerals Report of Tyco International plc

In accord with Rule 13p-1 under the Securities Exchange Act of 1934

This is the Conflict Mineral Report of Tyco International plc (hereinafter referred to as “we,” the “Company” or “Tyco”) for calendar year 2014 in accord with Rule 13p-1 under the Securities Exchange Act of 1934 (“Rule 13p-1”).

1. Introduction

Tyco is a leading global provider of security products and services, fire detection and suppression products and services and life safety products. Our broad portfolio of products and services serve security, fire detection and suppression and life safety needs across commercial, industrial, retail, institutional and governmental markets, as well as non-U.S. residential and small business markets. We operate and report financial and operating information in the following three operating segments:

| |

• | North America Installation & Services designs, sells, installs, services and monitors electronic security systems and fire detection and suppression systems for commercial, industrial, retail, institutional and governmental customers in North America. |

| |

• | Rest of World (“ROW”) Installation & Services designs, sells, installs, services and monitors electronic security systems and fire detection and suppression systems for commercial, industrial, retail, residential, small business, institutional and governmental customers in the ROW regions. |

| |

• | Global Products designs, manufactures and sells fire protection, security and life safety products, including intrusion security, anti-theft devices, breathing apparatus and access control and video management systems, for commercial, industrial, retail, residential, small business, institutional and governmental customers worldwide, including products installed and serviced by our NA and ROW Installation & Services segments. |

In accordance with Rule 13p-1, we have concluded that during 2014:

| |

a) | Our Global Products segment manufactured, or contracted to manufacture, certain products for which gold, wolframite, cassiterite, coltan, and/or their derivatives tin, tantalum and tungsten ( collectively “3TG” or “conflict minerals” (as defined in Section 1502(e)(4) of the Dodd-Frank Wall Street Reform and Consumer Protection Act)) are necessary to the functionality or production of such products. |

| |

b) | Based on our reasonable country of origin inquiry and subsequent due diligence, we do not have concrete findings on whether our sourcing practices directly or indirectly funded armed groups in the Democratic Republic of Congo or the countries adjoining it (the “DRC Region”). |

2. Product Description

As noted above, our Global Products segment manufactures (or contracts to manufacture) and sells fire protection, security and life safety products, including intrusion security, anti-theft devices, breathing apparatus and access control and video management system products. We have determined that certain products within these product families contain 3TG that is necessary to the functionality or production of such products (the “in scope product categories”). These product families include intrusion security, access control, video management, nurse call, loss prevention, fire control and fire suppression systems and the products or components supplied to us that we determined contain 3TG primarily included capacitors, resistors, wire and cable assemblies, hardware packs, connectors and terminal blocks, keyboards, magnetics and integrated circuits. For our in scope product categories, we conducted a reasonable country of origin inquiry that was reasonably designed to determine the country of origin of the 3TG contained in these products.

3. Reasonable Country of Origin Inquiry

The Company’s reasonable country of origin inquiry (“RCOI”) primarily involved contacting over 1,000 suppliers of products or components for our in scope product categories through a third-party service provider. We reached out to all such suppliers through various communication channels, including escalation procedures and follow-on communications to non-responsive suppliers. Outreach efforts included an introductory email requesting that suppliers of in scope product categories register with our third-party vendor and review materials pertaining to our conflict mineral compliance program contained in the vendor’s conflict minerals resource center. Subsequent engagement included the following steps:

| |

• | Following initial introductions to the program and information request, up to four reminder emails were sent to each non-responsive supplier requesting survey completion. |

| |

• | Special focus on non-responsive high-spend suppliers, who were contacted by telephone and offered assistance in completing the registration process and the CMRT referred to below. This assistance included, but was not limited to, further information about our conflict minerals compliance program, an explanation of why the information was being collected, a review of how the information would be used and clarification of how the information could be provided. |

Suppliers were asked to provide information regarding the sourcing of their materials with the ultimate goal of identifying the 3TG smelters or refiners (“SORs”) and associated mine countries of origin. Suppliers were generally requested to use the Conflict-Free Sourcing Initiative’s Conflict Minerals Reporting Template (“CMRT”). In limited instances where a supplier was unable to provide a CMRT, information was requested of second tier suppliers which may have provided products or components containing 3TG. All supplier responses were evaluated for plausibility, consistency and gaps by our third party vendor. Additional supplier contacts were conducted to attempt to resolve certain quality control flags. Supplier responses were evaluated for plausibility, consistency, and gaps both in terms of which products were stated to contain or not contain necessary 3TG, as well as the origin of those materials.

4. Due Diligence Measures

Based on the Company’s RCOI, the Company concluded that, with respect to the in scope product categories, 3TG contained in and necessary to the functionality or production of certain products may have been sourced from the DRC Region. As a result, the Company performed due diligence to determine the source and chain of custody of such 3TG. The Company’s due diligence process is based on the Organization for Economic Cooperation and Development’s (OECD’s) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas: Second Edition, and accompanying Supplements (“OECD Guidance”). It is important to note that the OECD Guidance was written for both upstream and downstream companies in the supply chain. As Tyco is a downstream company in the supply chain, our due diligence practices were tailored accordingly.

Under the Company’s due diligence process, SORs in the supply chain that are certified by any of the Conflict Free Sourcing Initiative (“CFSI”) Conflict-Free Smelter Program, the London Bullion Market Association Good Delivery Program or the Responsible Jewellery Council are deemed to have delivered 3TG that has not benefitted or financed armed groups in the DRC Region. An SOR that is not certified by one of these internationally recognized schemes is subject to additional inquiries. Attempts are made to contact the SOR to gain more information about its sourcing practices, including countries of origin and transfer, and whether there are any internal due diligence procedures in place or other processes the SOR takes to track the chain-of-custody on the source of its mineral ores. The following table lists the SORs that were identified by responsive suppliers of materials used in the in scope product categories that indicated that 3TG sourced by them may have originated in the DRC Region, the location of the mine in the DRC Region that may have supplied the applicable material to the SOR, and the certification status of the SOR.

|

| | | |

Metal | Smelter / Refiner | Certification Status | Mine Countries of Origin |

Gold | CCR Refinery - Glencore Canada Corporation | CFSI - Gold, LBMA | DRC- Congo (Kinshasa), Zambia |

Tin | CV United Smelting | CFSI - Tin | DRC- Congo (Kinshasa) |

Tin | China Tin Group Co., Ltd. | CFSI-Active - Tin | DRC- Congo (Kinshasa) |

Tantalum | Conghua Tantalum and Niobium Smeltry | CFSI - Tantalum | Rwanda |

Tantalum | Duoluoshan Sapphire Rare Metal Co., Ltd. | CFSI - Tantalum | Rwanda |

Tin | Empresa Metallurgica Vinto | CFSI - Tin | DRC- Congo (Kinshasa) |

Tantalum | H.C. Starck Co., Ltd. | CFSI - Tantalum | Rwanda |

Tungsten | H.C. Starck GmbH | CFSI-Progressing - Tungsten | Rwanda |

Tantalum | H.C. Starck GmbH Goslar | CFSI - Tantalum | Rwanda |

Tantalum | H.C. Starck GmbH Laufenburg | CFSI - Tantalum | Rwanda |

Tantalum | H.C. Starck Hermsdorf GmbH | CFSI - Tantalum | Rwanda |

Tantalum | H.C. Starck Inc. | CFSI - Tantalum | Rwanda |

Tantalum | H.C. Starck Ltd. | CFSI - Tantalum | Rwanda |

Tantalum | Hi-Temp Specialty Metals, Inc. | CFSI - Tantalum | Rwanda |

Tantalum | Jiujiang Tanbre Co., Ltd. | CFSI - Tantalum | DRC- Congo (Kinshasa) |

Tantalum | KEMET Blue Metals | CFSI - Tantalum | Burundi, Rwanda |

Tantalum | Kemet Blue Powder | CFSI - Tantalum | Burundi, DRC- Congo (Kinshasa), Rwanda |

Tin | Malaysia Smelting Corporation (MSC) | CFSI - Tin | DRC- Congo (Kinshasa), Rwanda |

Tin | Metallo Chimique | CFSI - Tin | DRC- Congo (Kinshasa) |

Tin | Minsur | CFSI - Tin | DRC- Congo (Kinshasa), Rwanda |

Tantalum | Ningxia Orient Tantalum Industry Co., Ltd. | CFSI - Tantalum | Burundi, Rwanda |

Tin | Operaciones Metalurgical S.A. | CFSI - Tin | DRC- Congo (Kinshasa) |

Tin | PT Bangka Putra Karya | CFSI - Tin | DRC- Congo (Kinshasa) |

Tin | PT Bukit Timah | CFSI - Tin | DRC- Congo (Kinshasa) |

Tin | PT Pelat Timah Nusantara Tbk | NONE | Burundi, DRC- Congo (Kinshasa), Rwanda |

Tin | PT Stanindo Inti Perkasa | CFSI - Tin | DRC- Congo (Kinshasa) |

Tin | PT Timah (Persero), Tbk | CFSI - Tin | DRC- Congo (Kinshasa) |

Gold | Rand Refinery (Pty) Ltd | CFSI - Gold, LBMA | DRC- Congo (Kinshasa), Tanzania |

Tin | Thaisarco | CFSI - Tin | DRC- Congo (Kinshasa), Rwanda |

Tantalum | Ulba | CFSI - Tantalum | Burundi, DRC- Congo (Kinshasa), Rwanda |

Tungsten | Wolfram Company CJSC | CFSI-Progressing - Tungsten | Rwanda |

Tungsten | Xiamen Tungsten (H.C.) Co., Ltd. | CFSI - Tungsten | Burundi, Rwanda |

Tungsten | Xiamen Tungsten Co., Ltd. | CFSI - Tungsten | Rwanda |

Tin | Yunnan Tin Company Limited | CFSI - Tin | Angola, DRC- Congo (Kinshasa) |

Tantalum | Zhuzhou Cement Carbide | CFSI - Tantalum | Burundi, DRC- Congo (Kinshasa), Rwanda |

Due to the breadth and complexity of the supply chain for its products, and non-responsive suppliers in the in scope product category supply chains, the Company has been unable to verify the country of origin of all of the 3TG that is necessary to the functionality or production of its products. However, the Company’s RCOI and due diligence efforts have not resulted in any concrete evidence that the 3TG used in the products or components provided by suppliers that may have been sourced in the DRC Region have directly or indirectly funded armed groups in the DRC Region.

Summarized below are additional due diligence measures undertaken by the Company in accordance with the OECD Guidance:

| |

• | Development of a conflict minerals policy. We have implemented additional contractual provisions in all newly executed master supply agreements that require our suppliers to comply with conflict mineral provisions. These provisions require suppliers to certify that any 3TG in components supplied to Tyco either (i) was not sourced from the DRC or adjoining countries, or (ii) if it was, that such 3TG did not directly or indirectly fund armed groups in the DRC or adjoining countries. |

In addition, Tyco has updated its Guide to Supplier Social Responsibility with conflict minerals related provisions that include requirements that suppliers:

| |

◦ | Develop policies and processes aimed toward preventing the use of conflict minerals or derivative metals necessary to the functionality or production of their products that finance or benefit armed groups in the DRC or adjoining countries; and |

| |

◦ | Not knowingly procure conflict minerals that originate from facilities in the DRC or adjoining countries that are not certified as “conflict free” |

| |

• | Assembled an internal team to support supply chain due diligence. An internal team led by the Global Supply Chain function and including members of the legal department and the Engineering and Operation Excellence departments of each of the business units within the Global Products segment was assembled to advance and implement the supply chain review required by the rule. |

| |

• | Established a system of controls and transparency over the mineral supply chain. The internal team created and implemented procedures to review all product categories to determine, based primarily on reviewing bills of material, whether the product category contained, or was likely to contain, 3TG. Based on this review, suppliers were contacted and asked to complete the CMRT to report on the status of 3TG in the products they supplied to Tyco. |

| |

• | Implement measures taken to strengthen company engagement with suppliers. Tyco engaged a third party service provider (Source Intelligence) to assist in the outreach effort to suppliers, to track and analyze responses, and to perform multiple follow up efforts for suppliers that were unresponsive. As part of this effort, tier 1 and tier 2 suppliers were engaged to collect information regarding the presence and sourcing of 3TG used in the products supplied to Tyco. Information was collected and stored using an online platform provided by the third party service provider. |

| |

• | Identify the Smelters or Refiners (SORs) in the supply chain. As noted above, as a result of the Company’s RCOI, Tyco was able to identify SORs within its supply chain for those suppliers who affirmatively responded to outreach efforts. |

| |

• | Documentation Processes. Tyco has established its due diligence compliance program and is in the process of documenting and formalizing a record maintenance mechanism to ensure the diligence procedures are sustainable. |

| |

• | Report findings to senior management. Included in the process established by the internal team is routine reporting to senior management of the progress of the supply chain due diligence, including periodic reporting to the Audit Committee of the Board of Directors. |

| |

• | Report Annually on Supply Chain Due Diligence. The Form SD and CMR contained herein and publicly available at www.tyco.com. |

5. Steps to Improve Due Diligence

Tyco will endeavor to continuously improve upon its supply chain due diligence efforts via the following measures:

| |

• | Continue to assess the presence of 3TG in its supply chain; |

| |

• | Clearly communicate expectations with regard to supplier performance, transparency and sourcing; |

| |

• | Increase the response rate for its RCOI |

| |

• | Continue to compare supplier outreach results to information collected via independent conflict free smelter validation programs such as the CMRT; |

| |

• | Contact smelters identified as a result of the supplier outreach process and request their participation in obtaining a “conflict free” designation from an industry program such as the ones mentioned above; |

| |

• | Implement a risk management plan, monitor and track risk mitigation, report to senior management and evaluate supplier relationships; |

| |

• | Undertake additional fact and risk assessments for risks requiring mitigation, or after a change of circumstances; and |

| |

• | Carry out independent third-party audit of SOR due diligence if deemed necessary. |

6. Independent Private Sector Audit

An independent private sector audit is not required at this time and has not been conducted.

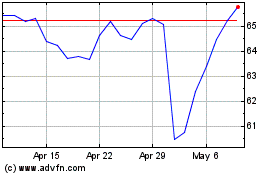

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

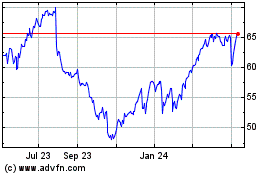

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024