UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

LINDSAY

CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-13419 |

|

47-0554096 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

|

| 2222 N 111th Street, Omaha, Nebraska |

|

68164 |

| (Address of principal executive offices) |

|

(Zip Code) |

Eric R. Arneson – (402) 827-6569

(Name and telephone number, including area code, of the person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form

applies:

| x |

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

Section 1 – Conflict Minerals Disclosure

| Item 1.01 |

CONFLICT MINERALS DISCLOSURE AND REPORT |

Lindsay Corporation (the “Company”,

“Lindsay”, “we”, “us” or “our”), after exercising reasonable due diligence as required by Rule 13p-1, was unable to determine whether the tin, tantalum, tungsten and/or gold (“3TG” or “conflict

minerals”) used in one or more of its products, where such 3TGs are necessary to such product(s) functionality or production, originated from the Democratic Republic of the Congo (“DRC”) or an adjoining country that shares an

internationally recognized border with the DRC (the “Covered Region”). Accordingly, the Company declares itself to be “DRC conflict undeterminable” as defined by paragraph (d)(5) of the instructions to Item 1.01 for all

products manufactured and/or contracted to be manufactured for the Company.

Conflict Minerals Disclosure

This Form SD and the Company’s Conflict Minerals Report, filed as Exhibit 1.01 hereto, may be found publicly on our internet website at

http://www.lindsayir.com/Conflict_Minerals. The content of any website referenced in this Form SD is included for general information only and is not incorporated by reference in this Form SD.

The Conflict Minerals Report required by Item 1.01 is filed as Exhibit 1.01 to this Form

SD.

Section 2 – EXHIBITS

Exhibit 1.01 – Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

| Date: June 1, 2015 |

|

|

|

|

|

LINDSAY CORPORATION |

|

|

|

|

|

|

|

|

|

|

By: /s/ James C. Raabe |

|

|

|

|

|

|

James C. Raabe Vice President and Chief

Financial Officer |

Exhibit 1.01

Lindsay Corporation

Conflict Minerals Report

For the Calendar Year Ended December 31, 2014

This is the Conflict Minerals Report of Lindsay Corporation (the “Company”, “Lindsay”, “we”, “us” or “our”)

for calendar year 2014 in accordance with Rule 13p-1 (the “Rule”) under the Securities Exchange Act of 1934. The Rule was adopted by the Securities and Exchange Commission (SEC) to implement reporting and disclosure requirements related to

conflict minerals as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act). The Rule imposes certain reporting obligations on SEC registrants whose manufactured products contain conflict minerals which

are necessary to the functionality or production of their products. “Conflict minerals” are defined as cassiterite, columbite-tantalite, gold, wolframite, and their derivatives, which are limited to tin, tantalum and tungsten (together

with gold, referred to as “3TG”) for the purposes of this assessment. These requirements apply to registrants whatever the geographic origin of the conflict minerals and whether or not they fund armed conflict.

If a registrant can establish that the conflict minerals originated from sources other than the Democratic Republic of the Congo (DRC) or an adjoining

country, or from recycled and scrap sources, they must submit a Form SD which describes the Reasonable Country of Origin Inquiry completed. If a registrant has reason to believe that any of the conflict minerals in their supply chain may have

originated in the DRC or an adjoining country, or if they are unable to determine the country of origin of those conflict minerals, then the registrant must exercise due diligence on the conflict minerals’ source and chain of custody and submit

a Conflict Minerals Report to the SEC that includes a brief description of those due diligence measures.

In accordance with the instructions to Form SD,

this Conflict Minerals Report has not been audited by an independent private sector auditor.

For terms not otherwise defined herein, please refer to Rule

13p-1 and SEC Release No. 34-67716 for such definitions.

Lindsay, along with its subsidiaries, is a global leader in providing a variety of

proprietary water management and road infrastructure products and services. Lindsay’s common stock is traded on the New York Stock Exchange under the ticker symbol LNN. For more information regarding Lindsay, please visit our website at

http://www.lindsay.com.

Lindsay has operations which are categorized into two major reporting segments;

irrigation and infrastructure.

Irrigation Segment – Our irrigation segment includes the manufacture and marketing of center pivot,

lateral move, and hose reel irrigation systems which are used principally in the agricultural industry to increase or stabilize crop production while conserving water, energy and labor. We also manufacture and market repair and replacement parts for

our irrigation systems and controls, design and manufacture water pumping stations and controls for the agriculture, golf, landscape and municipal markets, and manufacture and distribute separators and filtration solutions for groundwater,

agriculture, industrial and heat transfer markets. In January 2015, we acquired Elecsys Corporation, a provider of machine-to-machine (M2M) technology solutions and custom electronic systems.

Infrastructure Segment – Our infrastructure segment includes the manufacture and marketing of moveable barriers, specialty barriers, crash

cushions and end terminals, road marking and road safety equipment, large diameter steel tubing, railroad signals and structures, and outsourced manufacturing services.

We determined that during the 2014 calendar year, we manufactured and sub-contracted to manufacture

products containing 3TG and that the use of these minerals is necessary to the functionality or production of these products.

We rely upon our direct suppliers to provide information regarding the origin of

3TG contained in components and materials supplied to us. Generally, there are multiple tiers of suppliers between us and the mines from which the 3TG materials were mined. Accordingly, most of our suppliers must similarly conduct due diligence up

the supply chain. We do not make purchases of raw ore or unrefined 3TG directly from mines, smelters or refiners. The methods we used to try to determine the origin of 3TG in our products included:

| |

• |

|

sending letters to our direct suppliers, explaining the rule and referring the suppliers to online training materials and instructions; |

| |

• |

|

soliciting information from relevant suppliers of components and materials utilized in our products, using the standard Conflict Minerals Reporting Template designed by the Electronic Industry Citizenship Coalition

(EICC) and the Global e-Sustainability Initiative (GeSI); |

| |

• |

|

reviewing responses that we received from our suppliers and following up on information that appeared to be incomplete, incorrect or not trustworthy; and |

| |

• |

|

sending multiple reminders to suppliers who did not respond to our requests for information and ultimately engaging in a telephone campaign to contact those suppliers who remained non-responsive. |

We engaged a third party service provider, Source Intelligence, to assist with the collection, review and evaluation of information regarding the presence and

sourcing of 3TG materials used in our products.

| 4. |

Reasonable Country of Origin Inquiry (RCOI) and RCOI conclusion |

We conducted an analysis of our

products and found that 3TG can be found in some of our products and are necessary to the functionality or production of those products. Therefore, we are subject to the reporting obligations of

Rule 13p-1.

We conducted, with the assistance of Source Intelligence, a survey of our suppliers using the

EICC/GeSI Conflict Minerals Reporting Template. The template was developed to facilitate disclosure and communication of information regarding smelters that provide material to a company’s supply chain. It includes questions regarding a

company’s conflict-free policy, engagement with its direct suppliers, and a listing of the smelters the company and its suppliers use. In addition, the template contains questions about the origin of conflict minerals included in their

products, as well as supplier due diligence. This template is being widely adopted by many companies in their due diligence processes related to conflict minerals.

Despite having conducted a good faith reasonable country of origin inquiry and due diligence process, we have been unable to reliably determine the origin of

all 3TG within our products. Due to the complexity of our products and supply chain, it will take time for many of our suppliers to verify the origin of all of the minerals. Using our supply chain due diligence processes, we hope to further develop

transparency into our supply chain.

| 5. |

Conflict Minerals Status Analysis and Conflict Status Conclusion |

We have concluded that our supply

chain remains “DRC conflict undeterminable.” We reached this conclusion because we have been unable to determine the origin of the 3TG used in our products.

| |

6.1. |

Conflict Minerals Policy |

Our policy with respect to the sourcing of conflict minerals may be

found publicly on our internet website at http://www.lindsayir.com/Conflict_Minerals.

| |

6.2. |

Due Diligence Process |

Our due diligence processes and efforts have been developed in conjunction with

Annex I of the second edition of the Organization for Economic Co-operation and Development (OECD) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (OECD Guidance) and the related

supplements for gold and for tin, tantalum and tungsten. As described above, our efforts include utilization of the EICC/GeSI Conflict Minerals Reporting Template as part of our supply chain diligence process.

Our conflict minerals due diligence process includes: the development of a Conflict Minerals Policy, establishment of governance structures with cross

functional team members and senior executives, communication with suppliers, due diligence compliance process and measurement, record keeping and escalation procedures. Senior management is briefed about the results of our due diligence efforts on a

regular basis. As mentioned above, we engaged Source Intelligence, a third party service provider, to assist with our due diligence process. Supplier information was collected, stored and evaluated using an online platform provided by Source

Intelligence.

| |

6.3. |

Steps to Be Taken to Mitigate Risk and Maturing Due Diligence Program |

As we work on improving our due

diligence program, we intend to enhance our supplier communication and to improve our due diligence data accuracy in order to mitigate the risk that the necessary 3TG contained in our products could benefit armed groups in the DRC or adjoining

countries.

| 7. |

Identify and Assess Risk in the Supply Chain |

Because of our size, the breadth and complexity of our

products, and the constant evolution of our supply chain, it is difficult to identify parties upstream from our direct suppliers. Our direct suppliers are similarly reliant upon information provided by their suppliers.

At the outset of our reasonable country of origin inquiry, we elected to survey and send letters to a broad group of direct suppliers for our products,

including many which are likely out-of-scope for this analysis. The response rate among those suppliers was 26%. Of the responding suppliers, 63% indicated one or more of the regulated metals (3TG) as necessary to the functionality or

production of the products they supply to us. Based on the CMRT responses and Source Intelligence’s smelter/refiner database, there was an indication of sourcing from the DRC or adjoining countries for 36 out of 363 verified smelters and

refiners. Information regarding those smelters and refiners is included as Annex 1 to this report. Of the 36 smelters and refiners sourcing from the DRC or adjoining countries, 32 have been verified as conflict-free, two are progressing toward

certification through the Conflict-Free Sourcing Initiative (CFSI) and two are not currently participating in a certification program.

| 8. |

Audit of Supply Chain Due Diligence |

We do not have a direct relationship with 3TG smelters and

refiners, nor do we perform direct audits of the other entities in our supply chain. However, we do rely upon industry efforts to influence smelters and refineries to participate in the EICC/GeSI Conflict-Free Smelter Program and on the results of

this program.

| 9. |

Continuous Improvement Efforts to Mitigate Risk |

The due diligence process discussed above is an ongoing

process. As we continue to conduct due diligence on our products, we will continue to refine our procedures to meet the goals set forth above. We intend to undertake the following next steps to improve the due diligence process and to gather

additional information which will assist us to determine whether the 3TG we utilize benefit armed groups contributing to human rights violations:

| |

• |

|

continue to improve our threshold analysis as to whether 3TG materials are necessary to the functionality or production of our manufactured products to better focus diligence efforts on in-scope suppliers;

|

| |

• |

|

continue to work with suppliers who provided incomplete or insufficient information in an effort to obtain complete and accurate information in future years; |

| |

• |

|

continue to conduct and report annually on supply chain due diligence for the applicable conflict minerals; |

| |

• |

|

examine the possibility of including a conflict minerals clause in our supplier contracts and purchase order terms and conditions; and |

| |

• |

|

attempt to validate supplier responses using information collected via independent conflict free smelter validation programs such as the EICC/GeSI Conflict Free Smelter Program. |

Forward-Looking Statements

This Report contains

forward-looking statements within the meaning of the federal securities laws. Any statements that do not relate to historical or current or matters are forward-looking statements. You can identify some of the forward-looking statements by

use of forward-looking words, such as “intend” and the like, or the use of future tense. Statements concerning current conditions may also be forward-looking if they imply a continuation of current conditions. Examples of

forward-looking statements include, but are not limited to, statements concerning the Company’s intended future efforts to mitigate the risk that the manufacture of its products benefits arms groups in the DRC region.

Forward-looking statements are subject to risks and uncertainties that could cause actual actions or performance to differ materially from those expressed in

the forward-looking statements. These risks and uncertainties may include, but are not limited to, the implementation of satisfactory traceability and other compliance measures by our direct and indirect suppliers, on a timely basis or at all,

whether smelters and refiners and other market participants responsibly source 3TG and political and regulatory developments, whether in the DRC region, the United States, or elsewhere. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of filing of this document. We do not intend, and undertake no obligation, to publish revised forward-looking statements to reflect events or circumstances after the date of filing of

this document or to reflect the occurrence of unanticipated events.

Annex 1

The following table lists smelters and refiners with indications of sourcing from the DRC and adjoining countries and their certification status.

|

|

|

|

|

|

|

| Metal |

|

Smelter/Refiner |

|

Certification

Status |

|

Mine Countries of Origin |

| GOLD |

|

CCR Refinery - Glencore Canada Corporation |

|

CFSI - Gold, LBMA |

|

Canada, Japan, Australia, United States, Peru, Chile, Germany, DRC- Congo (Kinshasa), Switzerland, Argentina, Zambia |

|

|

|

|

| GOLD |

|

China Nonferrous Metal Mining (Group) Co., Ltd. |

|

|

|

China, Kyrgyzstan, Tajikistan, Zambia |

|

|

|

|

| GOLD |

|

Rand Refinery (Pty) Ltd |

|

CFSI - Gold, LBMA |

|

China, Canada, South Africa, DRC- Congo (Kinshasa), Hong Kong, Namibia, Guinea, Mali, Ghana, Tanzania |

|

|

|

|

| TANTALUM |

|

Conghua Tantalum and Niobium Smeltry |

|

CFSI - Tantalum |

|

China, Brazil, Thailand, Rwanda, Ethiopia, India, Niger |

|

|

|

|

| TANTALUM |

|

Duoluoshan Sapphire Rare Metal Co., Ltd. |

|

CFSI - Tantalum |

|

China, Brazil, Japan, Bolivia, Malaysia, Thailand, Rwanda, Ethiopia, India, Niger, Nigeria |

|

|

|

|

| TANTALUM |

|

H.C. Starck Co., Ltd. |

|

CFSI - Tantalum |

|

Brazil, Australia, Bolivia, Thailand, Rwanda, Mozambique, Ethiopia, India, Namibia, Zimbabwe, Sierra Leone |

|

|

|

|

| TANTALUM |

|

H.C. Starck GmbH Goslar |

|

CFSI - Tantalum |

|

China, Canada, Brazil, Japan, Australia, United States, Bolivia, Thailand, Germany, Rwanda, Mozambique, Ethiopia, India, Namibia, Zimbabwe, Sierra Leone |

|

|

|

|

| TANTALUM |

|

H.C. Starck GmbH Laufenburg |

|

CFSI - Tantalum |

|

China, Canada, Brazil, Japan, Australia, Bolivia, Germany, Rwanda, Mozambique, Ethiopia, India, Namibia, Zimbabwe, Sierra Leone |

|

|

|

|

| TANTALUM |

|

H.C. Starck Hermsdorf GmbH |

|

CFSI - Tantalum |

|

China, Canada, Brazil, Japan, Australia, Bolivia, Germany, Rwanda, Mozambique, Ethiopia, India |

|

|

|

|

| TANTALUM |

|

H.C. Starck Inc. |

|

CFSI - Tantalum |

|

China, Canada, Brazil, Japan, Australia, United States, Bolivia, Germany, Rwanda, Mozambique, Ethiopia, India, Namibia, Zimbabwe, Sierra Leone |

|

|

|

|

| TANTALUM |

|

H.C. Starck Ltd. |

|

CFSI - Tantalum |

|

China, Canada, Brazil, Japan, Australia, Bolivia, Germany, Rwanda, Mozambique, Ethiopia, India, Namibia, Zimbabwe, Sierra Leone |

|

|

|

|

| TANTALUM |

|

Hi-Temp Specialty Metals, Inc. |

|

CFSI - Tantalum |

|

China, Brazil, Australia, United States, Bolivia, Rwanda, Mozambique, Ethiopia, India, Namibia, Zimbabwe, Sierra Leone |

|

|

|

|

| TANTALUM |

|

Jiujiang Tanbre Co., Ltd. |

|

CFSI - Tantalum |

|

China, DRC- Congo (Kinshasa) |

|

|

|

|

| TANTALUM |

|

KEMET Blue Metals |

|

CFSI - Tantalum |

|

Mexico, Rwanda, Mozambique, Niger, Nigeria, Burundi |

|

|

|

|

|

|

|

| Metal |

|

Smelter/Refiner |

|

Certification

Status |

|

Mine Countries of Origin |

| TANTALUM |

|

Kemet Blue Powder |

|

CFSI - Tantalum |

|

China, United States, DRC- Congo (Kinshasa), Mexico, Rwanda, Mozambique, Niger, Nigeria, Burundi |

|

|

|

|

| TANTALUM |

|

Ningxia Orient Tantalum Industry Co., Ltd. |

|

CFSI - Tantalum |

|

China, Brazil, Australia, Malaysia, Rwanda, Mozambique, Switzerland, Ethiopia, Niger, Nigeria, Burundi |

|

|

|

|

| TANTALUM |

|

Ulba |

|

CFSI - Tantalum |

|

China, Canada, Brazil, Japan, Australia, United States, Russia, DRC- Congo (Kinshasa), Rwanda, Mozambique, Ethiopia, Kazakhstan, Zimbabwe, Burundi, Belarus |

|

|

|

|

| TANTALUM |

|

Zhuzhou Cement Carbide |

|

CFSI - Tantalum |

|

China, Brazil, Japan, Russia, Malaysia, DRC- Congo (Kinshasa), Rwanda, Kazakhstan, Niger, Nigeria, Burundi |

|

|

|

|

| TIN |

|

Minsur |

|

CFSI - Tin |

|

China, Canada, Brazil, Indonesia, United States, Peru, Bolivia, Malaysia, Thailand, DRC- Congo (Kinshasa), Rwanda, Switzerland |

|

|

|

|

| TIN |

|

PT Timah (Persero), Tbk |

|

CFSI - Tin |

|

China, Canada, Brazil, Indonesia, Peru, Bolivia, Malaysia, Thailand, DRC- Congo (Kinshasa), India |

|

|

|

|

| TIN |

|

Malaysia Smelting Corporation (MSC) |

|

CFSI - Tin |

|

China, Canada, Brazil, Japan, Australia, Indonesia, Peru, Bolivia, Malaysia, Chile, Thailand, DRC- Congo (Kinshasa), Rwanda, Switzerland, Portugal, Spain, Niger, Nigeria |

|

|

|

|

| TIN |

|

China Tin Group Co., Ltd. |

|

CFSI - Active - Tin |

|

China, Canada, Brazil, Japan, Australia, DRC- Congo (Kinshasa) |

|

|

|

|

| TIN |

|

Yunnan Tin Company Limited |

|

CFSI - Tin |

|

China, Canada, Brazil, Australia, Indonesia, Peru, Bolivia, Malaysia, Germany, DRC- Congo (Kinshasa), Hong Kong, Ethiopia, Belgium, Angola |

|

|

|

|

| TIN |

|

CV United Smelting |

|

CFSI - Tin |

|

China, Japan, Indonesia, Peru, Malaysia, DRC- Congo (Kinshasa) |

|

|

|

|

| TIN |

|

Empresa Metallurgica Vinto |

|

CFSI - Tin |

|

China, Canada, Brazil, Indonesia, Peru, Russia, Bolivia, Malaysia, Germany, DRC- Congo (Kinshasa) |

|

|

|

|

| TIN |

|

Metallo Chimique |

|

CFSI - Tin |

|

China, Peru, Russia, Malaysia, Thailand, DRC- Congo (Kinshasa), Belgium |

|

|

|

|

| TIN |

|

Operaciones Metalurgical S.A. |

|

CFSI - Tin |

|

China, Canada, Brazil, Japan, Indonesia, Peru, Russia, Bolivia, Malaysia, Thailand, DRC- Congo (Kinshasa) |

|

|

|

|

| TIN |

|

PT Bangka Putra Karya |

|

CFSI - Tin |

|

China, Canada, Brazil, Indonesia, Peru, Bolivia, Malaysia, DRC- Congo (Kinshasa) |

|

|

|

|

| TIN |

|

PT Bukit Timah |

|

CFSI - Tin |

|

China, Canada, Brazil, Australia, Indonesia, Peru, Russia, Bolivia, Malaysia, DRC- Congo (Kinshasa) |

|

|

|

|

| TIN |

|

PT Pelat Timah Nusantara Tbk |

|

|

|

China, Brazil, Indonesia, Bolivia, Malaysia, DRC- Congo (Kinshasa), Rwanda, Niger, Nigeria, Burundi |

|

|

|

|

|

|

|

| Metal |

|

Smelter/Refiner |

|

Certification

Status |

|

Mine Countries of Origin |

| TIN |

|

PT Stanindo Inti Perkasa |

|

CFSI - Tin |

|

China, Canada, Brazil, Australia, Indonesia, Peru, Bolivia, Malaysia, DRC- Congo (Kinshasa), Mozambique |

|

|

|

|

| TIN |

|

Thaisarco |

|

CFSI - Tin |

|

China, Canada, Brazil, Japan, Australia, Indonesia, Peru, Bolivia, Malaysia, Chile, Thailand, DRC- Congo (Kinshasa), Rwanda, Portugal, Poland, Morocco, Myanmar |

|

|

|

|

| TUNGSTEN |

|

H.C. Starck GmbH |

|

CFSI-

Progressing -

Tungsten |

|

China, Canada, Brazil, Japan, Australia, United States, Peru, Russia, Bolivia, Thailand, Germany, Rwanda, Mozambique, Ethiopia, India, Portugal, Spain, Namibia, Zimbabwe, Sierra Leone, Estonia |

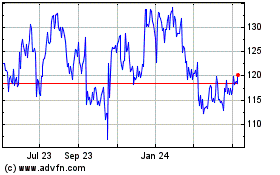

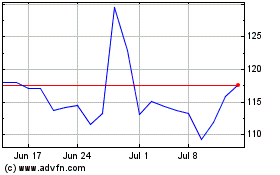

Lindsay (NYSE:LNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lindsay (NYSE:LNN)

Historical Stock Chart

From Apr 2023 to Apr 2024