UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

Form SD

Specialized Disclosure Report

_______________

Freeport-McMoRan Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-11307-01 (Commission File Number) | 74-2480931 (I.R.S. Employer Identification No.) |

|

| |

333 North Central Avenue Phoenix, AZ (Address of Principal Executive Offices) | 85004-2189 (Zip Code) |

Douglas N. Currault II

Deputy General Counsel and Secretary

(602) 366-8100

(Name and telephone number, including area code,

of the person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

| |

x | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflicts Minerals Disclosure and Report

Freeport-McMoRan Inc. (FCX) is a leading international natural resources company with revenues of $21.4 billion for the year ended December 31, 2014. FCX does not tolerate human rights transgressions. FCX’s Human Rights Policy, which is available on the FCX website at “www.fcx.com/sd/security/index.htm”, requires FCX and its contractors to conduct business in a manner consistent with the Universal Declaration of Human Rights, educate and train employees and protect any workforce member who reports suspected violations. FCX has established site-specific human rights policies and procedures consistent with its human rights policy, in-country laws and regulations, and the Voluntary Principles on Security and Human Rights.

FCX is filing this Form SD pursuant to Rule 13p-1 under the Securities Exchange Act of 1934, as amended, for the calendar year ended December 31, 2014, which requires the disclosure of certain information if any conflict minerals (as defined in Form SD) are necessary to the functionality or production of a product manufactured or contracted to be manufactured by the company during 2014.

In addition to its mining and oil and gas operations, FCX has a specialty copper products facility (Bayway) located in New Jersey that uses tin in its manufacture of trolley wire, conductor wire, and tin-coated copper wire (the Subject Products). Tin is one of the conflict minerals, as defined in Form SD. Bayway made purchases, totaling less than $600,000, of copper alloy rod (that contained tin) and tin anode for use in the manufacture of the Subject Products in 2014. Because tin is necessary to the functionality of the Subject Products, FCX conducted, in good faith, a reasonable country of origin inquiry (RCOI) reasonably designed to determine whether any of the tin used by Bayway in the manufacture of the Subject Products during 2014 originated in the Democratic Republic of Congo (DRC) or an adjoining country, which revealed that the tin may have originated in the DRC or an adjoining country. The results of FCX’s good faith RCOI and additional due diligence regarding the source and chain of custody of the tin used by Bayway during 2014 are contained in the Conflict Minerals Report, which is filed as Exhibit 1.01 hereto and is publicly available on FCX’s website, “www.fcx.com.”

Item 1.02 Exhibit

FCX’s Conflict Minerals Report for the calendar year ended December 31, 2014, is filed as Exhibit 1.01 hereto and is publicly available on the FCX’s website, “fcx.com.”

Section 2 - Exhibits

Item 2.01 Exhibits

Exhibit 1.01 - Conflict Minerals Report for the calendar year ended December 31, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

FREEPORT-MCMORAN INC.

By: /s/ Kathleen L. Quirk

Name: Kathleen L. Quirk

Title: Executive Vice President, Chief Financial Officer and Treasurer

Dated: May 29, 2015

Freeport-McMoRan Inc.

Exhibit Index

Exhibit

Number |

| | |

| | Conflict Minerals Report for the calendar year ended December 31, 2014. |

| | |

Exhibit 1.01

FREEPORT McMoRan INC.

CONFLICT MINERALS REPORT

This Conflict Minerals Report (Report) has been prepared pursuant to Rule 13p-1 under the Securities Exchange Act of 1934, as amended, for the calendar year ended December 31, 2014. This Report relates to the processes undertaken by Freeport-McMoRan Inc. (FCX) to exercise due diligence on the source and chain of custody of the tin used in its trolley wire, conductor wire, and tin-coated copper wire (the Subject Products), which were the only products manufactured or contracted to be manufactured by FCX in 2014 that contained a conflict mineral necessary to the product’s functionality or production. Terms herein have the same meanings given to them in Form SD pursuant to Rule 13p-1 under the Securities Exchange Act of 1934, as amended.

As described further below, FCX believes that the tin used in the manufacture of the Subject Products in 2014 was sourced from smelters designated as “conflict-free” by the Conflict-Free Smelter Program (CFSP), a voluntary initiative of the Electronic Industry Citizenship Coalition and the Global e-Sustainability Initiative (EICC-GeSI), which uses an independent, third-party audit to identify smelters and refiners that have systems in place to assure sourcing of only conflict-free materials. A list of smelters and refiners that meet the standards of the CFSP audit are published on the Conflict Free Sourcing Initiative website. The audit standard is developed according to global standards including the Organization for Economic Co-operation and Development’s Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (the OECD Guidance) and the United States (U.S.) Dodd-Frank Wall Street Reform and Consumer Protection Act.

FCX Product Descriptions

FCX is an international natural resource company with revenues of $21.4 billion for the calendar year ended December 31, 2014. In addition to its mining and oil and gas operations, FCX has certain operations that are considered manufacturing for purposes of Rule 13p-1. Accordingly, FCX conducted an analysis of the products at these facilities to determine if any contained conflict minerals. As a result, FCX determined that its specialty copper products facility (Bayway) uses tin in its manufacture of the Subject Products according to the specifications of its customers. Because tin is necessary to the functionality of the Subject Products, FCX conducted, in good faith, a reasonable country of origin inquiry (RCOI) described below.

Reasonable Country of Origin Inquiry

FCX has conducted a good faith RCOI that was reasonably designed, in accordance with Form SD and related guidance provided by the U.S. Securities and Exchange Commission, to determine whether any of the tin used by Bayway in the manufacture of the Subject Products during 2014 originated in the Democratic Republic of Congo (DRC) or an adjoining country. FCX does not have a direct relationship with any mines, smelters or refiners that may have direct knowledge of the source of the tin. As a result, FCX relies on communications and inquiries with its direct suppliers and publicly available data to provide information regarding the origin of the tin included in the Subject Products.

FCX identified three suppliers that had provided copper alloy rod, which contains tin, and tin anode to the Bayway operation. FCX reviewed the conflict minerals policies of two of the suppliers, which included a statement that the tin products they supply are only produced by smelters designated as conflict-free under the CFSP. The third supplier did not have a conflict minerals policy, but provided a written certification that the product delivered to FCX did not contain tin sourced from the DRC or an adjoining country. FCX also requested that each of the suppliers specifically identify the smelters that produced the tin supplied to Bayway.

| |

• | Two of the three suppliers were able to identify the specific smelters, both of which were designated as conflict-free under the CFSP. |

| |

• | One supplier was not able to identify the specific smelter(s) that produced the tin, but did provide a list of smelters that it uses for sourcing tin, all of which were designated as conflict-free under the CFSP. |

With respect to the five smelters that were identified, FCX verified that all were designated as conflict-free under the CFSP and obtained and reviewed their respective conflict minerals policies.

| |

• | Three of the five identified smelters provided affirmative statements in their conflict minerals policies that they do not purchase or process minerals that originate from the DRC or an adjoining country. |

| |

• | One of the five identified smelters did not provide an affirmative statement that the tin did not originate in the DRC or an adjoining country. |

| |

• | One of the five identified smelters stated in its policy that a portion of its tin production is sourced from Rwanda and from the southern Katanga Province of the DRC. |

Due Diligence Process

FCX determined through its RCOI that a portion of the tin used in the manufacture of the Subject Products during 2014 may have originated in the DRC or an adjoining country. Accordingly, FCX exercised due diligence on the source and chain of custody of the tin. FCX designed its due diligence measures to conform to the OECD Guidance and the related Supplement on Tin, Tantalum and Tungsten, including scaling due diligence measures to the size of FCX’s activities and supply chain relationships involving tin.

FCX’s Bayway operation does not purchase raw ore or unrefined minerals. Smelters and refiners are the consolidation points for raw ore and the OECD Guidance allocates to them the responsibility to conduct due diligence on the source and chain of custody of the origin of raw ore. As Bayway is a downstream company, the key role for FCX under the OECD Guidance is to identify the smelters in the supply chain and review the due diligence processes of those entities. FCX determined that all of the identified smelters had processes in place sufficient to be designated as conflict-free under the CFSP.

Facilities Used, Country of Origin and Mine or Location of Origin

Based on the information provided by the suppliers, FCX believes that the smelters that were or may have been used to process tin used in the manufacture of the Subject Products in 2014 consist of the following:

|

| |

Smelter Name | Country Location |

EM Vinto | Bolivia |

Malaysia Smelting Corporation | Malaysia |

Mitsubishi Materials Corporation | Japan |

PT Refined Bangka Tin | Indonesia |

PT Timah (Persero) Tbk | Indonesia |

All five of the smelters listed in the table above were designated as conflict-free under the CFSP; however, one stated in its conflict minerals policy that it does source a portion of its tin from the DRC or an adjoining country, and one did not provide an affirmative statement that its tin does not originate in the DRC or an adjoining country. The other three smelters provided affirmative statements in their conflict minerals policies that they do not purchase or process minerals that originate from the DRC or an adjoining country. Based on its RCOI and due diligence efforts, FCX has no reason to believe that any of these smelters have sourced tin that directly or indirectly financed or benefited armed groups in the DRC or an adjoining country; however, FCX does not have sufficient information to determine the countries of origin or the mine or location of origin of all of the tin used in the manufacture of the Subject Products by Bayway during 2014.

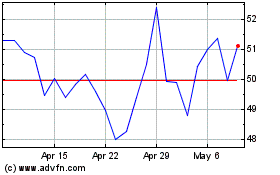

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

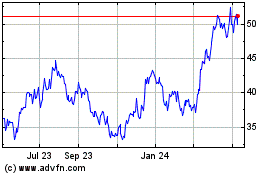

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024